Copper Market Outlook: China's Role In Shaping Prices

Table of Contents

China's Massive Copper Consumption and its Impact

China's massive infrastructure projects, booming construction sector, and rapid industrial growth have made it the world's largest consumer of copper. This voracious appetite directly impacts global copper prices. The correlation between China's economic activity and copper demand is undeniable, making understanding China copper consumption paramount for accurate copper price forecasts.

-

Increased Chinese demand drives up prices: As China's economy expands, so does its demand for copper. This increased demand outstrips supply, leading to higher copper prices globally. The construction boom alone accounts for a significant portion of this increased demand.

-

Correlation between China's economic growth and copper price increases: Historically, periods of robust Chinese economic growth are strongly correlated with increases in copper prices. A slowdown in the Chinese economy, conversely, often leads to lower copper prices. Analyzing China's GDP growth is therefore a vital component of copper price prediction models.

-

Impact of government policies on Chinese copper demand: Government policies, such as infrastructure spending initiatives (like the Belt and Road Initiative) and support for renewable energy projects (driving demand for copper in electric vehicles and wind turbines), significantly influence copper demand in China. These policies are major drivers of the China copper market and subsequently global prices.

-

Role of Chinese electric vehicle (EV) manufacturing in boosting copper consumption: The rapid expansion of China's electric vehicle (EV) sector significantly boosts copper consumption. EV batteries and related components require substantial amounts of copper, further solidifying China's position as a key driver of global copper demand. This makes understanding the EV market in China crucial for copper market analysis.

China's Role in Global Copper Supply

While China is a significant copper producer, its role extends beyond domestic output. Its influence on global supply chains, import/export activities, and refined copper production significantly shapes market dynamics. Analyzing China's role in the supply side is equally critical to understanding the copper market outlook.

-

China's copper production capacity and its contribution to the global supply: China is a major copper producer, contributing significantly to the global supply. However, its production capacity is not unlimited, and fluctuations in domestic production can have ripple effects on global prices. Monitoring Chinese copper mine output is therefore a vital element of any copper market analysis.

-

China's import and export of copper concentrates and refined copper: China is a major importer of copper concentrates (partially processed copper ore) and a significant exporter of refined copper. These import/export activities influence global copper supply and price dynamics. Understanding these flows is essential for assessing the overall global supply of refined copper.

-

Impact of Chinese government regulations on copper mining and production: Government regulations concerning environmental protection and mining practices in China can impact domestic copper production. These regulations often have downstream effects on global copper supply and prices.

-

Role of Chinese smelters in the global copper market: China houses many large copper smelters, playing a key role in the refining process. Their operational capacity and efficiency have a direct impact on the global supply of refined copper, influencing price dynamics.

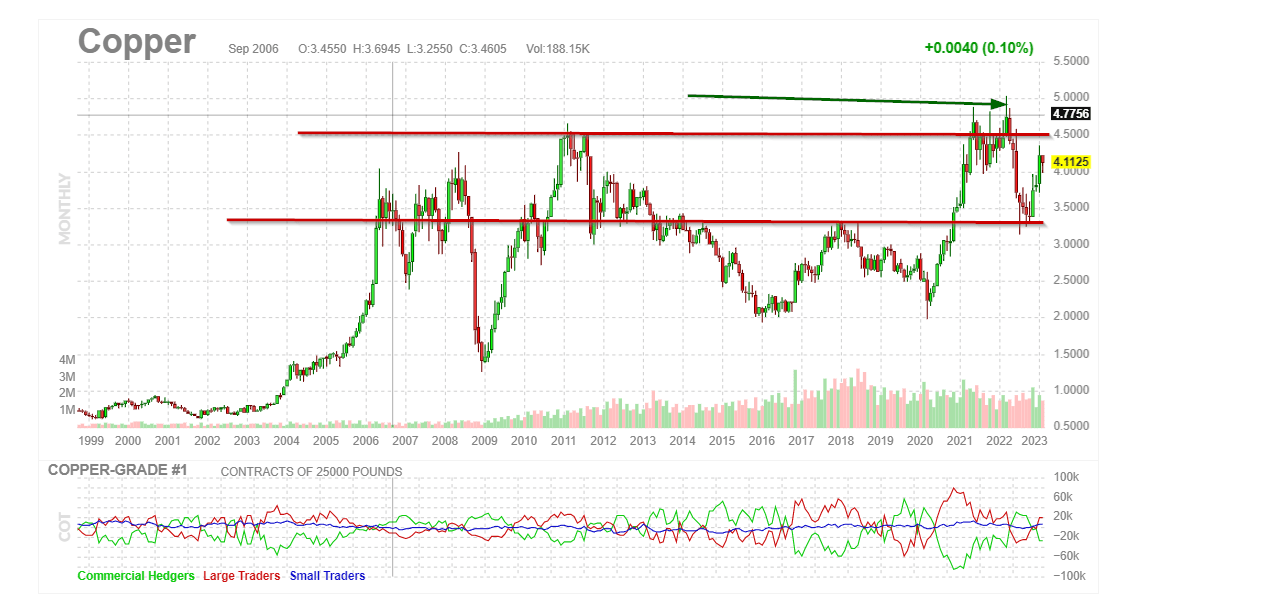

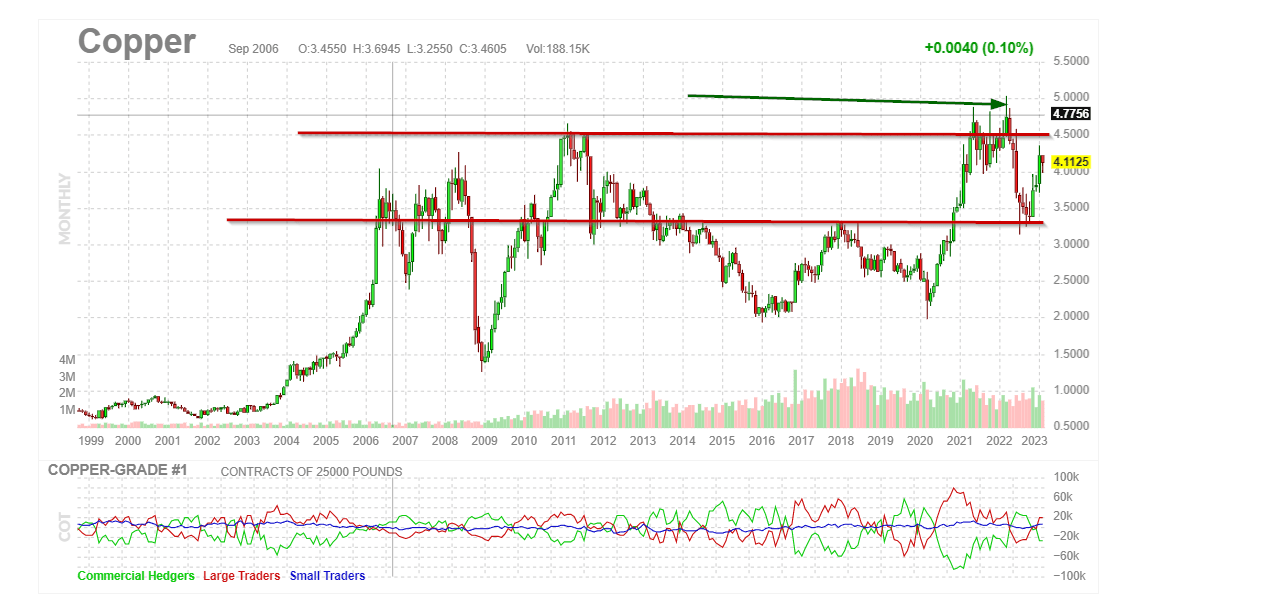

Forecasting Copper Prices: The China Factor

Predicting future copper prices is inherently challenging, but understanding China's economic policies, infrastructure plans, and industrial output is crucial for any accurate forecast. The China copper outlook is therefore a central factor in any comprehensive copper price prediction model.

-

Impact of China's economic growth forecasts on copper demand projections: Forecasts for China's economic growth directly impact projections for copper demand. Strong growth typically translates to higher copper demand and prices, while slower growth indicates potentially lower prices.

-

Potential disruptions in the Chinese copper supply chain and their impact on prices: Disruptions to China's copper supply chain, whether due to logistical bottlenecks, environmental regulations, or geopolitical factors, can have a significant impact on global copper prices. Analyzing potential vulnerabilities within the Chinese supply chain is crucial for accurate copper price forecasting.

-

Copper price forecast scenarios based on different assumptions about China's role: Different assumptions regarding China's economic growth, policy changes, and infrastructure development lead to varying copper price forecast scenarios. Developing multiple scenarios allows for a more nuanced understanding of potential price outcomes.

-

Influence of geopolitical factors and trade relations on the China-copper market nexus: Geopolitical factors and trade relations involving China can influence the copper market. Trade disputes or sanctions can disrupt supply chains and impact copper prices.

Conclusion

China's influence on the copper market is undeniable. Its massive consumption, involvement in global supply chains, and economic policies are key drivers of copper price fluctuations. Understanding China's role is critical for navigating the complexities of the global copper market. The future of copper prices is inextricably linked to the future of the China copper market.

Call to Action: Stay informed about the latest developments in the copper market and China's impact on copper prices. Monitor our future analyses for insights into the copper market outlook and make informed decisions about your investments and business strategies related to copper. Learn more about the crucial relationship between China and the global copper market. Understanding the China copper market is vital for success in this dynamic sector.

Featured Posts

-

Kato Rules Out Using Us Treasury Sales For Trade Deals

May 06, 2025

Kato Rules Out Using Us Treasury Sales For Trade Deals

May 06, 2025 -

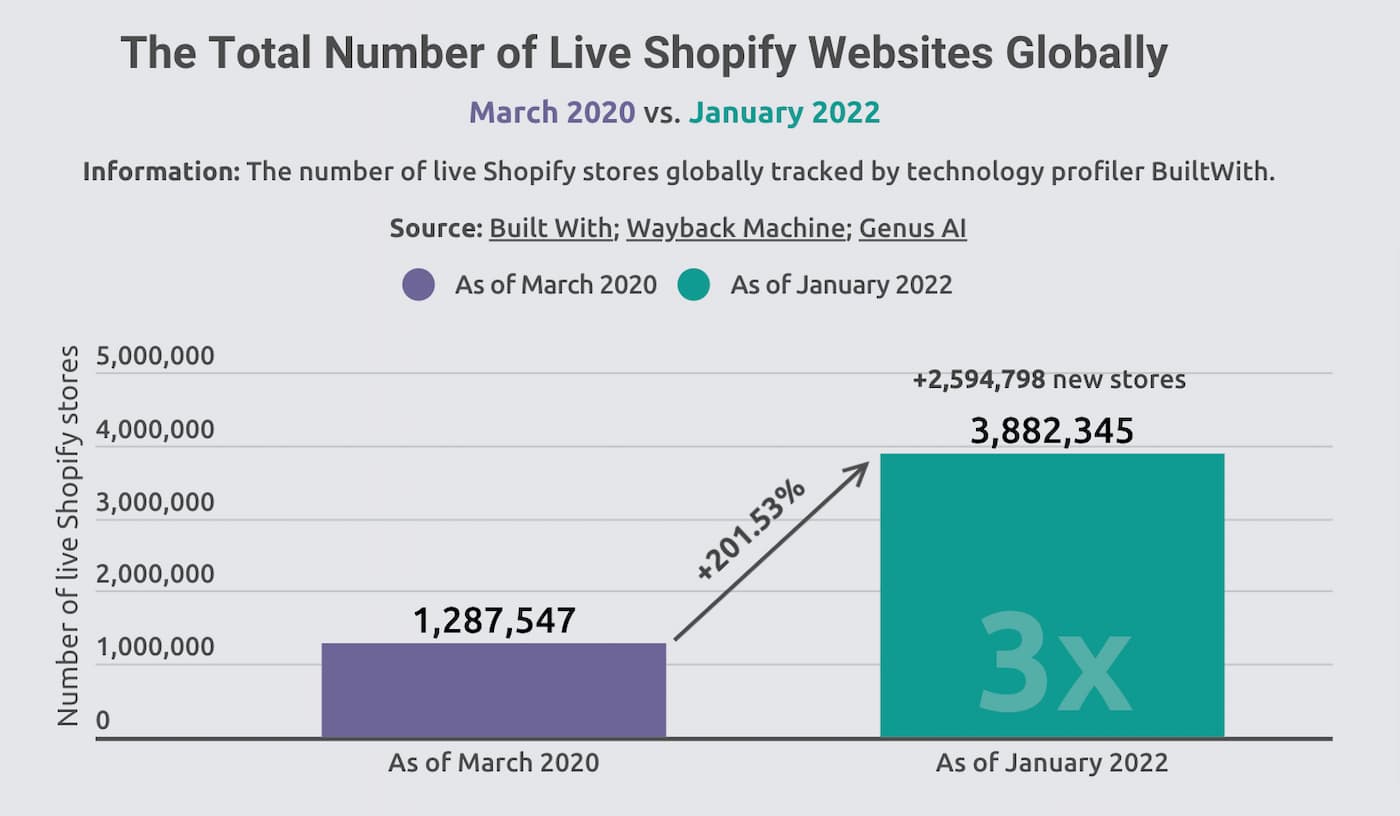

Shopify Developers Annual Revenue Share Changes Under New Lifetime Program

May 06, 2025

Shopify Developers Annual Revenue Share Changes Under New Lifetime Program

May 06, 2025 -

Finding The Best Cheap Products A Buyer S Guide

May 06, 2025

Finding The Best Cheap Products A Buyer S Guide

May 06, 2025 -

Understanding Greg Abel Berkshire Hathaways Future Ceo

May 06, 2025

Understanding Greg Abel Berkshire Hathaways Future Ceo

May 06, 2025 -

Tracee Ellis Ross On Dating Grief Growth And Choosing Herself

May 06, 2025

Tracee Ellis Ross On Dating Grief Growth And Choosing Herself

May 06, 2025