CoreWeave (CRWV) And OpenAI: A Deep Dive Based On Jim Cramer's Analysis

Table of Contents

Jim Cramer's Stance on CoreWeave (CRWV)

Jim Cramer, a prominent figure in financial media, has frequently discussed CoreWeave (CRWV) on his various platforms. While specific quotes and recommendations may change over time (always refer to the most up-to-date information), a common thread in his analysis usually centers on CoreWeave's position within the rapidly expanding AI infrastructure market. He often considers several key factors:

- Financial Performance: Cramer's analysis likely involves scrutinizing CoreWeave's revenue growth, profitability, and overall financial health. He'll likely look at metrics such as revenue growth, operating margins, and debt levels.

- Market Position: CoreWeave's market share, competitive advantages, and potential for future market penetration are essential elements of Cramer's assessment. He'll likely consider its position relative to competitors like Google Cloud, AWS, and Microsoft Azure.

- Technological Advancements: Given CoreWeave's focus on providing high-performance computing resources for AI, Cramer's assessment likely takes into account the company's technological capabilities and its ability to adapt to the ever-evolving AI landscape.

Key Takeaways from Cramer's Analysis:

- (Insert summary of positive aspects highlighted by Cramer, citing specific examples if possible).

- (Insert summary of potential risks mentioned by Cramer, citing specific examples if possible).

- (Insert summary of overall sentiment expressed by Cramer – bullish, bearish, or neutral).

CoreWeave's (CRWV) Relationship with OpenAI

CoreWeave's relationship with OpenAI is a significant driver of its growth potential. CoreWeave provides OpenAI with crucial cloud computing infrastructure, specifically high-performance GPUs crucial for training and running large language models (LLMs) like ChatGPT. This involves:

- Specific Services: Providing dedicated, high-performance computing clusters optimized for AI workloads, including GPU instances and specialized networking infrastructure.

- Potential Benefits for CoreWeave: The OpenAI partnership provides CoreWeave with high-profile clientele, strengthening its brand recognition and providing a substantial revenue stream. It also validates CoreWeave's technology and expertise within the AI industry.

- Risks Associated with Reliance on OpenAI: Over-reliance on a single client, even as prominent as OpenAI, poses a risk. Should the OpenAI relationship falter, CoreWeave's financial performance could be negatively impacted.

CoreWeave's (CRWV) Business Model and Competitive Landscape

CoreWeave operates on a cloud computing infrastructure-as-a-service (IaaS) model, specializing in high-performance computing tailored for AI and machine learning workloads. Its key differentiators include:

- Key Differentiators: Focus on optimized GPU infrastructure, specialized networking, and strong customer support.

- Major Competitors: Major players like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure are key competitors.

- Market Share and Growth Potential: CoreWeave is a rapidly growing player in a high-growth market, with significant potential for expansion as demand for AI infrastructure continues to increase.

Financial Analysis of CoreWeave (CRWV)

(Note: This section requires accessing and analyzing CoreWeave's financial statements from reputable sources like SEC filings. Remember to avoid giving financial advice. The following is a template):

Analyzing CoreWeave's financial performance requires reviewing its financial statements. Investors should look at:

- Key Financial Metrics and Trends: Revenue growth, operating margins, net income, debt levels, and cash flow are vital indicators of the company's financial health.

- Growth Prospects Based on Financial Data: Analyze historical trends to project future growth. Consider factors like market demand and competitive pressures.

- Potential Risks Based on Financial Analysis: High debt levels, negative cash flow, or declining profitability are potential red flags.

Investing in CoreWeave (CRWV): Risks and Rewards

Investing in CoreWeave (CRWV) presents both significant opportunities and substantial risks. The company operates in a high-growth market, but it's also a relatively young company with inherent uncertainties:

- Potential High-Growth Scenarios: Continued partnerships with major players like OpenAI, successful expansion into new markets, and technological advancements could drive substantial growth.

- Potential Downsides and Risks: Increased competition, economic downturns, regulatory changes, and dependence on a few key clients are potential downsides.

- Importance of Diversification: Remember to always diversify your investment portfolio to mitigate risk.

CoreWeave (CRWV) and OpenAI: A Final Verdict

CoreWeave (CRWV) presents a compelling investment opportunity within the burgeoning AI infrastructure market. Its relationship with OpenAI is a major strength, providing a substantial revenue stream and validating its technology. However, investors must carefully weigh the potential rewards against the risks inherent in investing in a young, rapidly growing company within a volatile market. Jim Cramer's commentary offers valuable insight, but it should be considered alongside independent research and analysis.

This analysis is not financial advice. Thorough due diligence is crucial before making any investment decisions. Continue your research on CoreWeave (CRWV) and OpenAI, consulting financial professionals for personalized advice before investing in CRWV or any similar high-growth stock. Remember to always diversify your portfolio to minimize risk. Consider seeking advice from a qualified financial advisor before making any investment decisions related to CoreWeave (CRWV).

Featured Posts

-

Hai Lo Vuong Nho Tren Usb C Tim Hieu Cong Dung Thuc Te

May 22, 2025

Hai Lo Vuong Nho Tren Usb C Tim Hieu Cong Dung Thuc Te

May 22, 2025 -

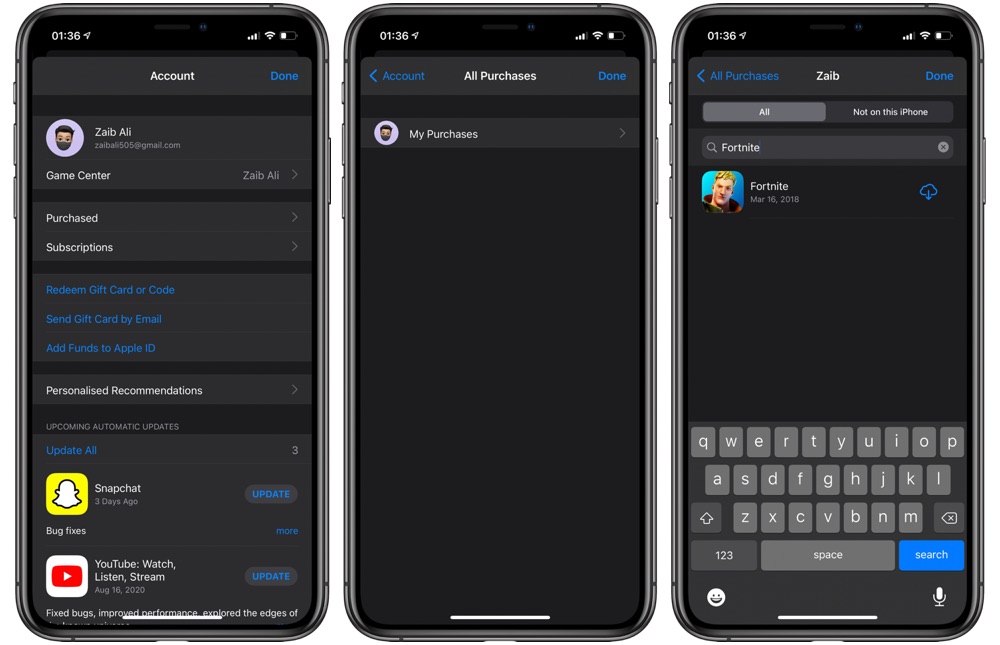

Us I Phone Users Can Now Download Fortnite Again

May 22, 2025

Us I Phone Users Can Now Download Fortnite Again

May 22, 2025 -

New Yorks Downtown The New Hotspot For The Ultra Wealthy

May 22, 2025

New Yorks Downtown The New Hotspot For The Ultra Wealthy

May 22, 2025 -

Dropout Kings Lose Lead Singer Adam Ramey Fans Mourn The Loss

May 22, 2025

Dropout Kings Lose Lead Singer Adam Ramey Fans Mourn The Loss

May 22, 2025 -

Musics Reach Defining The Sound Perimeter

May 22, 2025

Musics Reach Defining The Sound Perimeter

May 22, 2025