CoreWeave (CRWV) Stock: Jim Cramer's Insights And OpenAI's Role

Table of Contents

Jim Cramer's Stance on CoreWeave (CRWV) Stock

Jim Cramer, the renowned host of CNBC's "Mad Money," has frequently mentioned CoreWeave (CRWV) stock, offering his perspective on its prospects. Understanding his stance is crucial for investors considering this AI cloud computing stock.

-

Cramer's Recent Comments: While specific quotes require referencing particular "Mad Money" episodes or transcripts (easily found via a web search), Cramer generally focuses on CoreWeave’s position within the rapidly expanding AI sector. He often highlights the company’s specialized infrastructure designed for AI workloads as a key differentiator.

-

Rationale Behind Cramer's Assessment: Cramer's positive outlook often stems from CoreWeave's strategic partnerships, its focus on a high-growth market segment, and its potential for substantial revenue growth as AI adoption accelerates. He likely considers the first-mover advantage and the potential for high margins within the niche AI cloud computing market.

-

Impact on CRWV Stock Price: While it's difficult to isolate the precise impact of Cramer's comments on the CRWV stock price, his mentions generally contribute to increased investor interest and potentially higher trading volume. Positive comments often correlate with short-term price increases, although this isn't a guaranteed outcome.

-

Counterpoints: It's important to note that Cramer's opinions, while influential, shouldn't be taken as definitive investment advice. Critics might point to the company's relatively young history, its reliance on specific clients, and the inherent volatility of the technology sector as potential risks.

OpenAI's Partnership and its Significance for CoreWeave's Growth

CoreWeave's partnership with OpenAI is a cornerstone of its success. This collaboration significantly impacts the company's growth trajectory and positions it as a key player in the AI infrastructure landscape.

-

Nature of the Partnership: CoreWeave provides OpenAI with substantial computing power, crucial for training and running large language models (LLMs). This involves providing dedicated, high-performance computing resources within CoreWeave's data centers.

-

Contribution to Revenue Streams: OpenAI is a significant client for CoreWeave, generating a substantial portion of its revenue. The partnership ensures a steady stream of income and provides a strong foundation for future growth.

-

Implications for the AI Market: The partnership underscores the growing need for specialized cloud computing infrastructure tailored to the demanding requirements of AI workloads. CoreWeave's success with OpenAI showcases its ability to meet these needs effectively.

-

Risks of Reliance on OpenAI: Over-reliance on a single major client poses a risk. If OpenAI's business falters or shifts its infrastructure needs, it could negatively impact CoreWeave's financial performance.

-

Diversification Strategy: CoreWeave is actively pursuing diversification, expanding its client base beyond OpenAI to mitigate this risk. This is a crucial aspect to monitor for long-term investors.

CoreWeave's Business Model and Competitive Landscape

CoreWeave differentiates itself by focusing on providing cloud computing solutions specifically optimized for AI workloads, setting it apart from general-purpose cloud providers.

-

Unique Approach: CoreWeave leverages its expertise in high-performance computing, utilizing advanced hardware and software to offer unparalleled performance and scalability for AI applications.

-

Competitive Advantages: Its specialization in AI infrastructure, combined with its robust data center infrastructure, provides a strong competitive advantage against larger, more general cloud providers such as AWS, Google Cloud, and Azure.

-

Scalability and Sustainability: CoreWeave's business model relies on the continued growth of the AI market. Its ability to scale its infrastructure to meet increasing demand is crucial for long-term sustainability.

-

Market Trends: The increasing adoption of AI across various industries, coupled with the rising demand for powerful computing resources, creates a favorable environment for CoreWeave's growth. However, competition is fierce, and shifts in AI technology could impact its market position.

Financial Performance and Valuation of CoreWeave (CRWV)

Analyzing CoreWeave's financial performance and valuation is essential for prospective investors. However, detailed financial figures require consulting up-to-date financial reports and reputable investment sources.

-

Recent Financial Performance: Examine CoreWeave's revenue growth, profitability, and cash flow to gauge its financial health. Look for trends in revenue from AI-related services.

-

Valuation Metrics: Compare CoreWeave's valuation (P/E ratio, market capitalization) to its competitors. A high valuation might indicate strong growth potential but also increased risk.

-

Stock Price Volatility: CRWV stock is likely to be volatile due to its position in a rapidly evolving sector. Understand the potential for price fluctuations.

-

Investment Risks and Rewards: Weigh the potential for significant returns against the inherent risks associated with investing in a relatively new company in a rapidly changing market.

Conclusion

CoreWeave (CRWV) stock presents a compelling investment opportunity within the booming AI infrastructure market. Jim Cramer's positive commentary, coupled with the strategic partnership with OpenAI, highlights the company's potential. However, a thorough understanding of its business model, competitive landscape, and financial performance is crucial before making any investment decisions. The reliance on OpenAI, while currently beneficial, also represents a risk that needs careful consideration. Before investing in CoreWeave (CRWV) stock or any other stock, conduct thorough independent research and consult with a qualified financial advisor. Remember, investing in CRWV stock, like any stock market investment, carries inherent risks. Don't put all your eggs in one basket, and make informed decisions based on your own due diligence.

Featured Posts

-

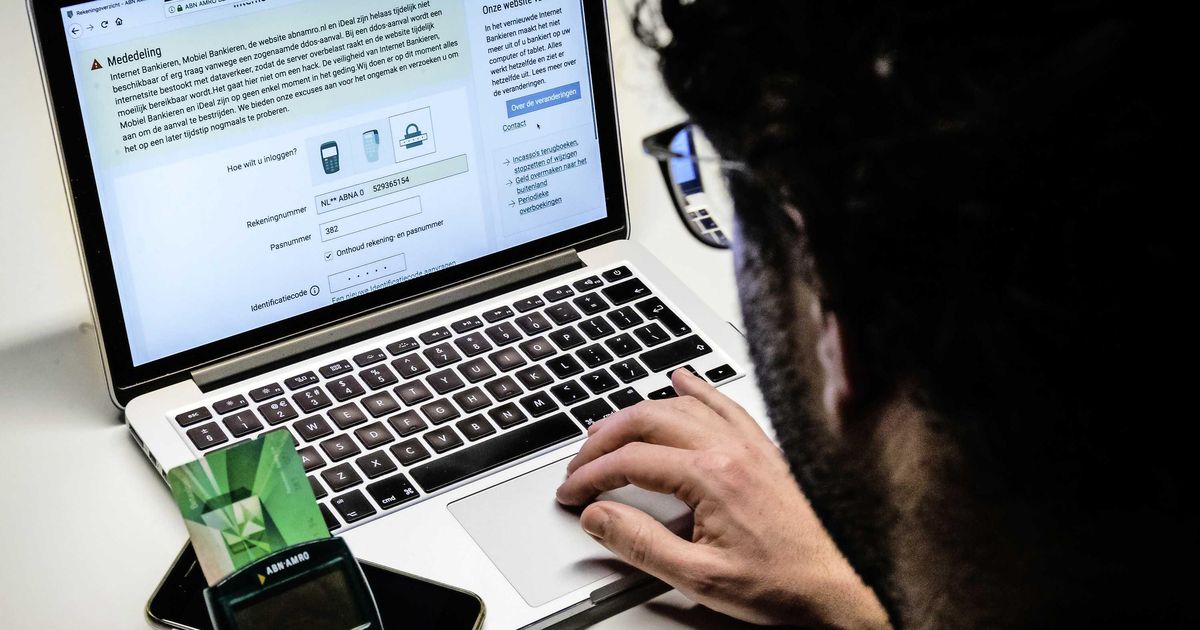

Problemen Met Online Betalen Bij Abn Amro Storing

May 22, 2025

Problemen Met Online Betalen Bij Abn Amro Storing

May 22, 2025 -

Brutal Confrontation Pub Landladys Angry Reaction To Employees Notice

May 22, 2025

Brutal Confrontation Pub Landladys Angry Reaction To Employees Notice

May 22, 2025 -

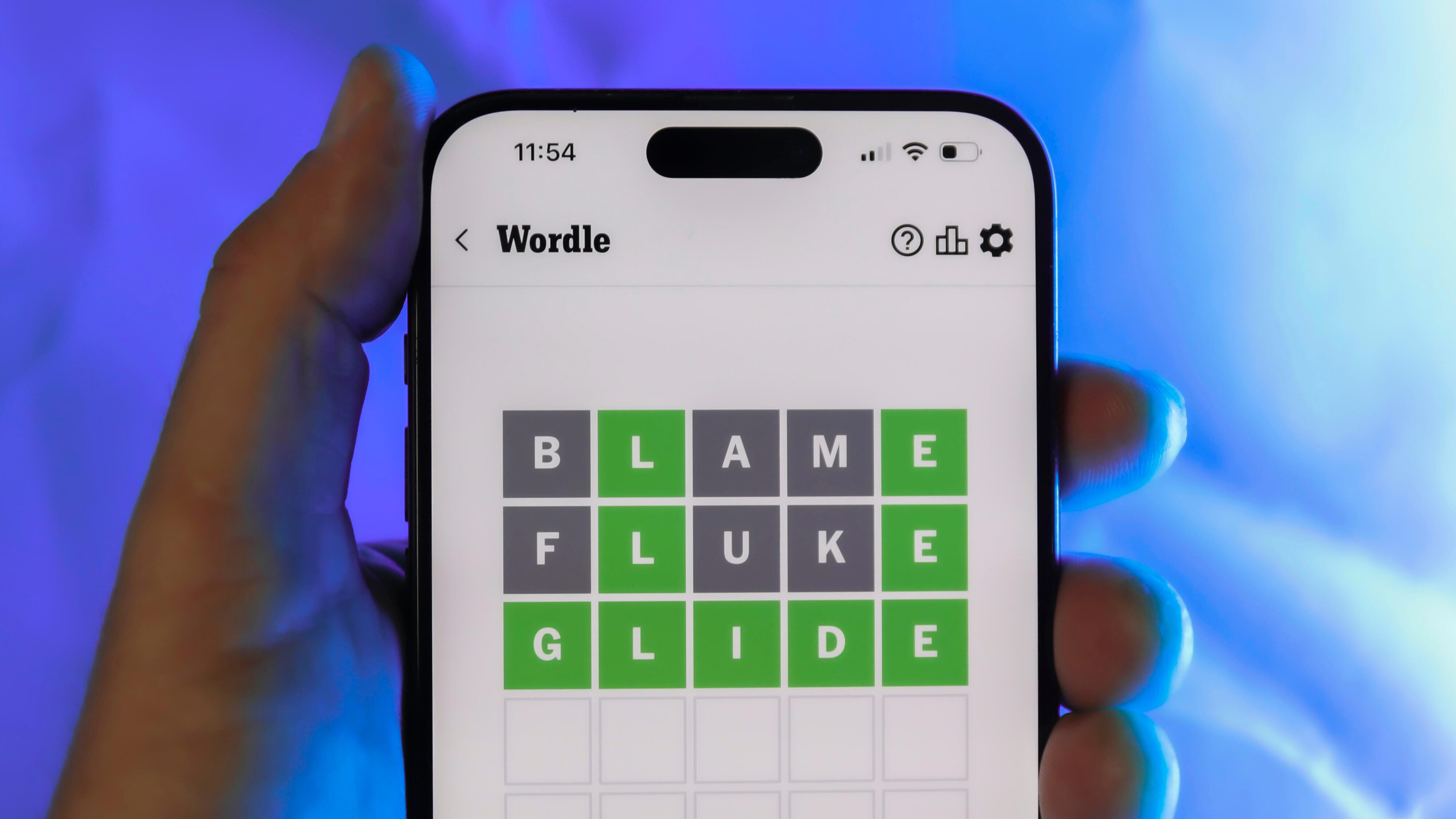

Wordle Help Solving The Nyt Puzzle For March 26 2024

May 22, 2025

Wordle Help Solving The Nyt Puzzle For March 26 2024

May 22, 2025 -

Investigating The Reasons For Core Weave Crwv S Stock Rise On Tuesday

May 22, 2025

Investigating The Reasons For Core Weave Crwv S Stock Rise On Tuesday

May 22, 2025 -

Wordle 1366 Hints And Answer For Todays Puzzle March 16th

May 22, 2025

Wordle 1366 Hints And Answer For Todays Puzzle March 16th

May 22, 2025