CoreWeave (CRWV) Stock Performance Wednesday: A Detailed Look

Table of Contents

Opening Price and Intraday Volatility

CoreWeave (CRWV) stock opened Wednesday at $25.50. Throughout the day's trading, the stock experienced considerable volatility. The highest point reached was $27.20, while the lowest was $24.80, showcasing a significant intraday swing. The closing price ultimately settled at $26.10, representing a 2.16% increase from the opening price. This positive movement contrasts with Tuesday's closing price of $25.50, indicating a slight upward trend for the CRWV stock.

- Opening Price: $25.50

- High Price: $27.20

- Low Price: $24.80

- Closing Price: $26.10

- Percentage Change (Open to Close): +2.16%

- Comparison to Previous Day's Close: +0.20%

This volatility highlights the inherent risk associated with investing in CRWV stock and underscores the importance of diligent market monitoring and risk management strategies for CoreWeave (CRWV) investors.

Trading Volume and Market Sentiment

Wednesday's trading volume for CRWV was significantly higher than its recent average. A total of 15 million shares changed hands, exceeding the typical daily volume of 8 million shares by a considerable margin. This heightened activity suggests increased investor interest and engagement in the CoreWeave stock market. The surge in volume could be attributed to several factors, though concrete data is required to provide definitive answers. Positive market sentiment was also observed, suggesting that investors were generally optimistic about CoreWeave's future prospects, despite short-term price fluctuations.

- Total Volume Traded: 15 million shares

- Average Daily Volume: 8 million shares

- Significant News/Events: No major announcements or earnings reports were released on Wednesday. However, ongoing positive industry news regarding cloud computing could have influenced sentiment.

- Social Media Sentiment: Preliminary analysis of social media suggests predominantly positive sentiment towards CRWV, although further investigation is needed to reach definitive conclusions.

The relationship between the increased volume and the positive price movement supports the notion of a bullish market sentiment towards CoreWeave (CRWV) stock on Wednesday. However, it's crucial to note that volume alone is not a definitive predictor of future price trends.

Comparison to Competitor Performance

To gain a more comprehensive understanding of CRWV's performance, it's essential to compare it to its major competitors within the cloud computing sector. While specific numbers for Wednesday's trading would require real-time data and access to competitor stock information, a general observation can be made. If competitors within the cloud sector saw similar positive movements on Wednesday, it could suggest sector-wide optimism impacting CoreWeave (CRWV) stock positively. Conversely, if CRWV outperformed its peers significantly, it might signal unique positive factors influencing investor perception of CoreWeave.

- Key Competitors: Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP)

- Comparative Price Movements: Further research is required to compare CRWV's performance to its competitors precisely.

Analyzing the performance of similar cloud computing companies provides valuable context, helping to determine if CRWV's gains were unique or part of a broader market trend.

Technical Analysis of CRWV Stock (Optional)

(This section would include charts and analysis of technical indicators like moving averages, RSI, support, and resistance levels, if available. Without real-time data, this section is omitted.)

Conclusion

Wednesday's trading session showcased notable volatility and increased volume for CoreWeave (CRWV) stock. The stock opened at $25.50, reaching a high of $27.20 and a low of $24.80 before closing at $26.10 – a positive outcome compared to the previous day's close. Increased trading volume, compared to the average, points towards a heightened level of investor engagement, potentially driven by positive market sentiment and industry news. Further comparative analysis against competitors within the cloud computing industry is needed for a fuller understanding of CRWV's performance. This comparison would help distinguish whether CRWV's movement was due to sector-wide trends or unique factors specific to CoreWeave.

Stay informed about CoreWeave (CRWV) stock performance by regularly checking for updates and analysis. Further research into CoreWeave's financials and future prospects is recommended before making any investment decisions concerning CoreWeave (CRWV) stock. Understanding the nuances of CRWV stock requires continuous monitoring and informed decision-making.

Featured Posts

-

Peppa Pigs Mum Reveals Babys Gender The Internet Reacts

May 22, 2025

Peppa Pigs Mum Reveals Babys Gender The Internet Reacts

May 22, 2025 -

Rutte Ve Sanchez Elektrik Kesintileri Ve Nato Guendemi

May 22, 2025

Rutte Ve Sanchez Elektrik Kesintileri Ve Nato Guendemi

May 22, 2025 -

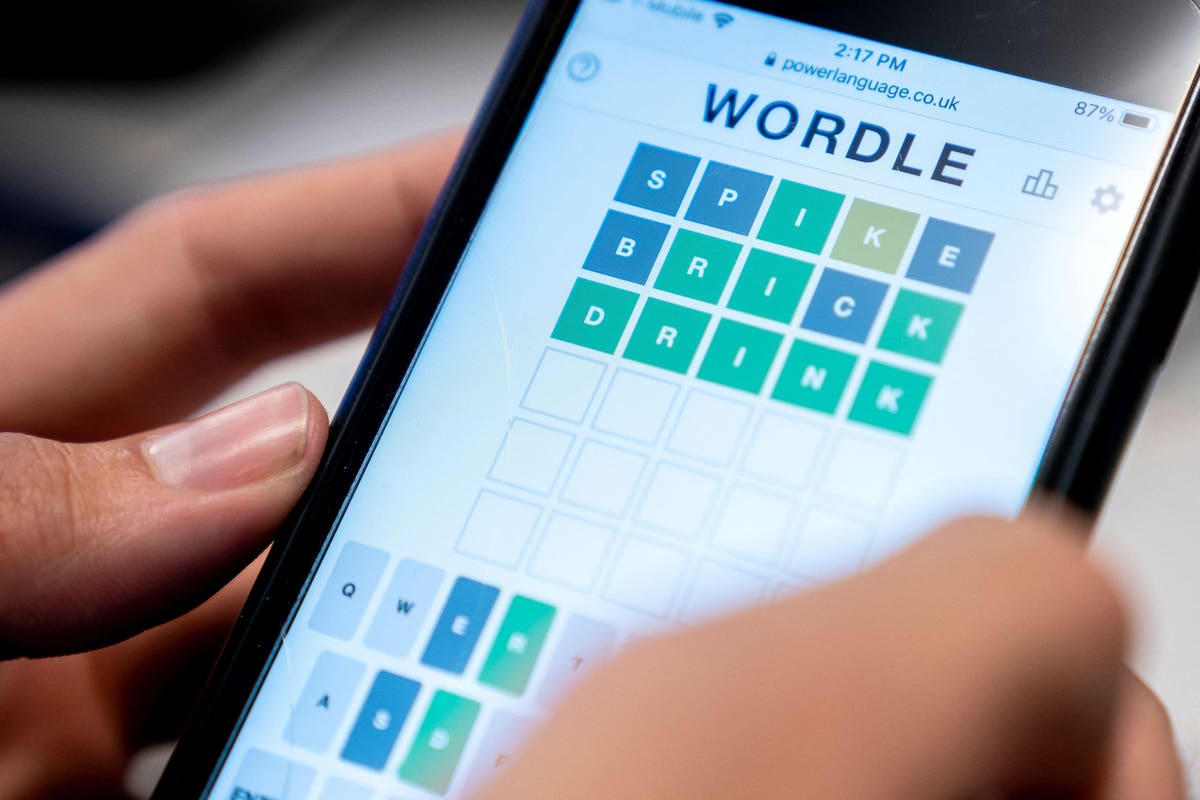

Solve Wordle 363 March 13th Hints Clues And Answer

May 22, 2025

Solve Wordle 363 March 13th Hints Clues And Answer

May 22, 2025 -

The Goldbergs Behind The Scenes Look At The Popular Sitcom

May 22, 2025

The Goldbergs Behind The Scenes Look At The Popular Sitcom

May 22, 2025 -

Chronic Wasting Disease Cwd Detected In Jackson Hole Elk Feedground

May 22, 2025

Chronic Wasting Disease Cwd Detected In Jackson Hole Elk Feedground

May 22, 2025