CoreWeave (CRWV) Stock Price Decrease Thursday: Factors Contributing To The Fall

Table of Contents

Main Points: Analyzing the Factors Behind the CoreWeave (CRWV) Stock Price Fall

Broad Market Sentiment and Overall Economic Uncertainty

The CoreWeave (CRWV) stock price decrease wasn't happening in isolation. The broader tech sector, and particularly growth stocks like CRWV, are highly sensitive to shifts in overall market sentiment and economic uncertainty. Negative investor sentiment towards the technology sector, fueled by concerns about inflation, rising interest rates, and a potential recession, significantly impacted the CRWV stock performance.

- Negative investor sentiment towards the broader technology sector: A general risk-off sentiment often leads investors to divest from higher-risk, growth-oriented stocks like CoreWeave.

- Rising interest rates and their impact on growth stock valuations: Higher interest rates increase the discount rate used to value future earnings, making growth stocks, which derive much of their value from future prospects, less attractive. This is a key driver of the CRWV stock decline.

- Concerns about inflation and potential recession impacting future revenue growth: Economic uncertainty creates hesitancy among investors, affecting their willingness to invest in companies like CoreWeave whose future revenue streams are less certain during periods of economic contraction.

Recent data showing a slowdown in consumer spending and a tightening labor market further amplified these concerns, contributing to the overall decline in CRWV stock.

Company-Specific News and Developments

While broader market conditions played a role, company-specific news and developments might have also contributed to the CoreWeave (CRWV) stock price decrease. It's crucial to analyze any announcements or events that could have negatively impacted investor confidence.

- Any announcements regarding financial performance, earnings reports, or revised guidance: A less-than-expected earnings report or a downward revision of future guidance could trigger a sell-off. Any news related to CoreWeave's financial health should be carefully considered.

- Potential delays in project launches or partnerships: Delays in crucial projects can signal underlying issues and negatively impact investor perception of the company's future prospects, leading to a fall in CRWV stock.

- Negative news coverage or analyst downgrades: Negative media coverage or downgrades from influential analysts can significantly influence investor sentiment and drive down the stock price.

- Competition within the cloud computing market: The cloud computing market is highly competitive. Any news about increased competition or loss of market share could contribute to the CRWV stock's decline.

A thorough review of any recent company announcements is crucial in understanding the specific factors affecting CRWV stock.

Technical Analysis and Trading Activity

Examining the technical aspects of the CoreWeave (CRWV) stock price drop offers additional insights. Analyzing trading volume, price charts, and other technical indicators can reveal patterns that contribute to the decrease.

- Analysis of trading volume on Thursday compared to previous days: An unusually high trading volume on Thursday compared to previous days might indicate a significant shift in investor sentiment and accelerate the price drop.

- Identification of potential support and resistance levels: Breaking through key support levels can trigger further declines, while encountering strong resistance can temporarily stall the fall in the CRWV stock.

- Discussion of short-selling activity: A surge in short-selling, where investors bet against the stock, can amplify downward pressure.

- Mention any significant changes in analyst ratings or price targets: Changes in analyst ratings and price targets can influence trading activity and investor sentiment, affecting the CRWV stock price.

The Role of Institutional Investors

The actions of large institutional investors, such as mutual funds and hedge funds, can significantly influence CRWV's stock price. Large sell-offs by these institutions can exacerbate downward pressure and contribute to the overall CoreWeave (CRWV) stock price decrease. Analyzing their trading activity is essential for a complete understanding of the situation.

Conclusion: Understanding the CoreWeave (CRWV) Stock Price Decrease and Future Outlook

The CoreWeave (CRWV) stock price decrease on Thursday resulted from a confluence of factors: broad market uncertainty, company-specific news (if any), and technical trading activity, all potentially amplified by the actions of institutional investors. While disentangling the exact weight of each factor requires further investigation, understanding their interplay is crucial.

The future outlook for CoreWeave (CRWV) stock remains uncertain. The company's long-term prospects will depend on its ability to navigate the challenging economic climate, execute its business strategy effectively, and maintain its competitive edge in the dynamic cloud computing market.

While this analysis provides insights into the CoreWeave (CRWV) stock price decrease, remember to conduct your own due diligence before investing in CRWV or any other stock. Understanding the factors impacting CoreWeave (CRWV) stock performance is crucial for informed investment strategies. Careful consideration of market trends, company performance, and your personal risk tolerance is essential before making any investment decisions related to CRWV stock or any other security.

Featured Posts

-

Gangsta Granny Read Aloud Tips For Parents And Educators

May 22, 2025

Gangsta Granny Read Aloud Tips For Parents And Educators

May 22, 2025 -

Liverpools Win Analysis From Arne Slot And Luis Enrique

May 22, 2025

Liverpools Win Analysis From Arne Slot And Luis Enrique

May 22, 2025 -

How To Plan A Screen Free Week For Kids

May 22, 2025

How To Plan A Screen Free Week For Kids

May 22, 2025 -

Councillors Wifes Jail Sentence For Inflammatory Tweet Appeal Awaits

May 22, 2025

Councillors Wifes Jail Sentence For Inflammatory Tweet Appeal Awaits

May 22, 2025 -

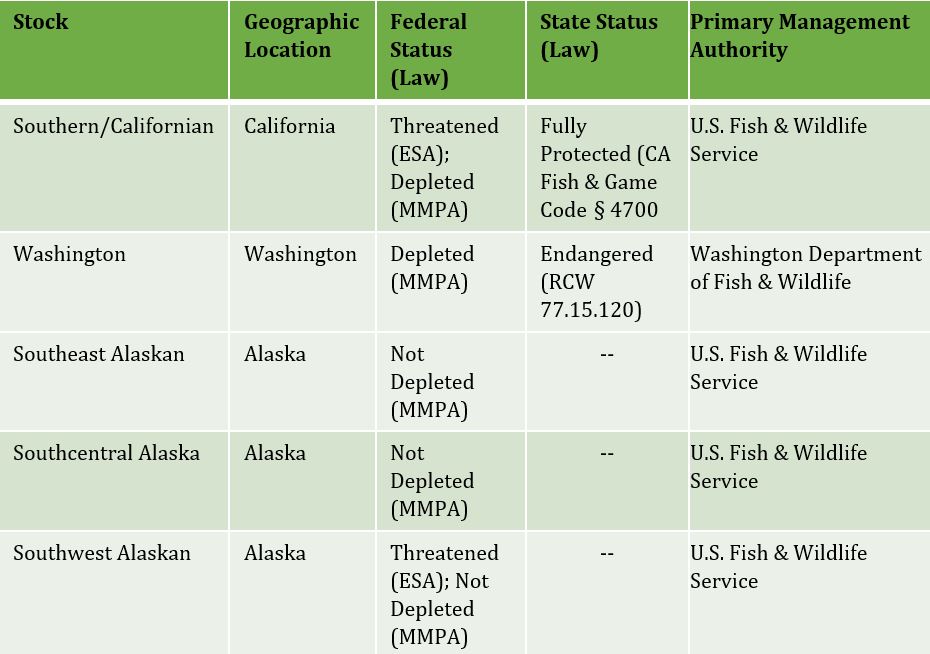

A Turning Point For Otter Management In Wyoming New Strategies And Conservation Efforts

May 22, 2025

A Turning Point For Otter Management In Wyoming New Strategies And Conservation Efforts

May 22, 2025