CoreWeave (CRWV) Stock Price Spike: Analysis And Potential Factors

Table of Contents

Analyzing the CoreWeave (CRWV) Stock Price Surge: Key Drivers

The dramatic rise in the CoreWeave stock price isn't a random event; several key factors have contributed to this surge. Let's analyze the major drivers fueling this impressive growth in the CRWV stock.

Increased Demand for AI-Related Services

The burgeoning field of artificial intelligence (AI) and machine learning (ML) is a primary driver of the CoreWeave (CRWV) stock price spike. CoreWeave's specialized infrastructure, built for high-performance computing, is perfectly positioned to capitalize on the exploding demand for AI processing power.

- Examples of AI applications fueled by CoreWeave's services: Large language models, generative AI image creation, complex scientific simulations.

- Statistics on market growth in AI infrastructure: The market for AI infrastructure is projected to grow exponentially in the coming years, with various market research firms predicting triple-digit percentage growth.

- CoreWeave's competitive advantage: CoreWeave's focus on providing scalable, cost-effective GPU-powered cloud infrastructure gives it a significant edge in this competitive landscape. Their innovative approach to utilizing repurposed gaming hardware is particularly noteworthy.

Strategic Partnerships and Collaborations

Strategic partnerships are playing a crucial role in driving the CoreWeave (CRWV) stock price higher. These collaborations expand CoreWeave's reach and solidify its position within the industry.

- Key partnerships: [Insert details of any significant partnerships here, including links to official press releases]. For example, partnerships with major software companies providing AI tools or with large enterprises requiring significant compute power could be mentioned.

- Synergistic effects of these collaborations: These alliances not only provide access to new markets but also enhance CoreWeave's technological capabilities and brand reputation.

- Relevant news articles or press releases: [Insert links to relevant news articles or press releases here].

Positive Financial Performance and Future Outlook

CoreWeave's recent financial performance has significantly contributed to investor confidence and the subsequent CRWV stock price increase.

- Significant financial data points: Focus on key metrics like revenue growth, profitability, and customer acquisition costs from recent financial reports. Include quantifiable data whenever possible.

- Expert opinions and analyst predictions: Mention positive ratings and price targets from reputable financial analysts.

- Positive guidance from company management: Include any positive statements made by CoreWeave's management regarding future growth prospects and financial projections.

Assessing the Risks and Uncertainties Associated with CRWV Stock

While the outlook for CoreWeave is currently positive, it's crucial to acknowledge the inherent risks and uncertainties associated with investing in CRWV stock.

Volatility in the Tech Sector

The technology sector is known for its volatility. Macroeconomic factors and shifts in investor sentiment can significantly impact CoreWeave's stock price.

- Examples of past tech stock volatility: Reference past examples of significant price swings in the technology sector.

- Discussion of macroeconomic factors: Mention macroeconomic factors like interest rate hikes, inflation, and potential recessions that could negatively impact the tech industry and CRWV stock.

- Mention potential market corrections: Highlight the risk of market corrections impacting the CoreWeave stock price.

Competition and Market Saturation

The cloud computing market is highly competitive. While CoreWeave enjoys a strong position, the risk of competition and market saturation cannot be ignored.

- List major competitors: Name key competitors in the cloud computing space, such as AWS, Azure, and GCP.

- Assess CoreWeave's market share and competitive strengths/weaknesses: Analyze CoreWeave's market share and identify its competitive advantages and disadvantages.

- Discuss potential market saturation risks: Discuss the possibility of market saturation hindering CoreWeave's future growth.

Regulatory and Legal Considerations

Regulatory changes and legal challenges could impact CoreWeave's operations and profitability.

- Mention relevant regulations or potential legal challenges: Discuss potential regulations related to data privacy, security, or antitrust concerns that might affect CoreWeave.

- Assess the likelihood and potential impact of these risks: Analyze the probability and potential impact of these risks on the CRWV stock price.

Conclusion: Investing in CoreWeave (CRWV) – A Balanced Perspective

The CoreWeave (CRWV) stock price spike is a result of a confluence of factors, primarily the soaring demand for AI-related services and strategic partnerships. However, the inherent volatility of the tech sector, competition, and potential regulatory hurdles must be considered.

Key Takeaways:

- Strong growth potential driven by AI and ML.

- Strategic partnerships expanding market reach.

- Significant risks associated with tech stock volatility and competition.

Understanding the dynamics of the CoreWeave (CRWV) stock price spike is crucial for informed investment decisions. Do your research and invest wisely. Remember to conduct thorough due diligence before investing in any stock, including CRWV, and consider consulting with a financial advisor.

Featured Posts

-

Five Escapees Still Missing As New Orleans Sheriff Ends Reelection Run

May 22, 2025

Five Escapees Still Missing As New Orleans Sheriff Ends Reelection Run

May 22, 2025 -

The Goldbergs Behind The Scenes Of The Hit Sitcom

May 22, 2025

The Goldbergs Behind The Scenes Of The Hit Sitcom

May 22, 2025 -

Israeli Embassy Confirms Identities Of Couple Killed In Dc Shooting

May 22, 2025

Israeli Embassy Confirms Identities Of Couple Killed In Dc Shooting

May 22, 2025 -

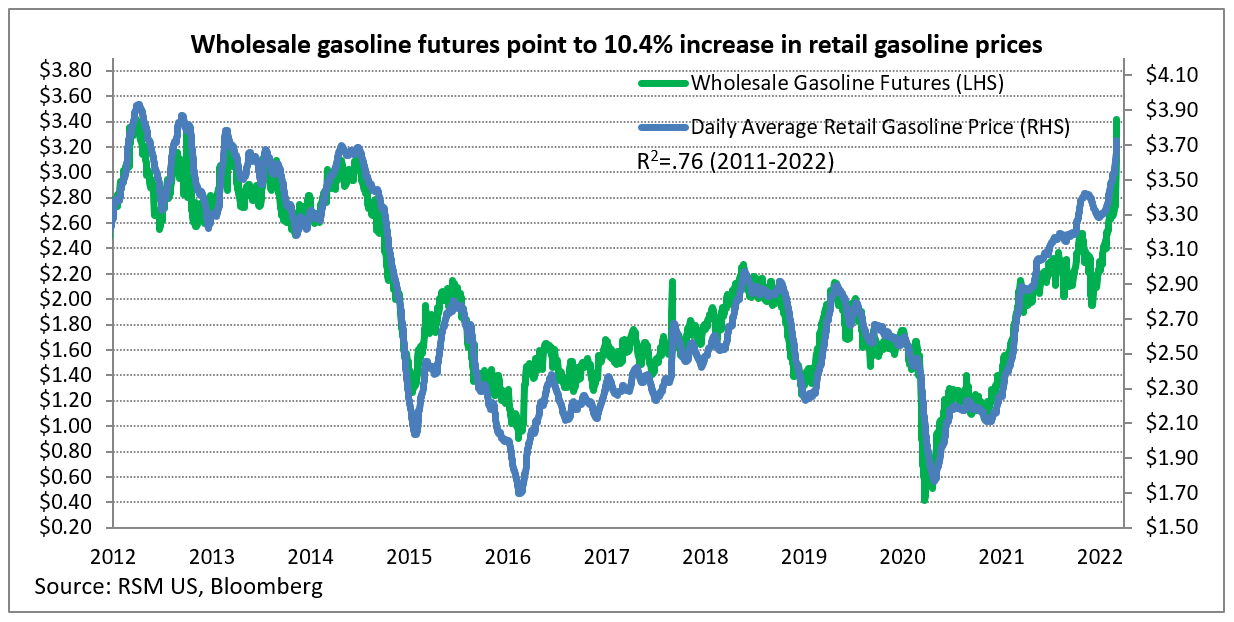

Average Gas Price Increase A 20 Cent Jump

May 22, 2025

Average Gas Price Increase A 20 Cent Jump

May 22, 2025 -

Bolidul De Milioane De Euro Al Fratilor Tate O Aparitie Spectaculoasa In Centrul Bucurestiului

May 22, 2025

Bolidul De Milioane De Euro Al Fratilor Tate O Aparitie Spectaculoasa In Centrul Bucurestiului

May 22, 2025