CoreWeave (CRWV) Stock Surge: Reasons Behind Last Week's Rise

Table of Contents

The Booming AI Market Fuels CoreWeave's Growth

CoreWeave's specialization in providing high-performance computing infrastructure perfectly aligns with the exploding demand for AI processing power. The rise of generative AI, large language models (LLMs), and machine learning algorithms necessitates vast computational resources, a niche CoreWeave is expertly filling. The company leverages powerful GPUs (graphics processing units) to deliver the high-performance computing necessary for training and deploying these complex AI models. This is crucial, as the training of sophisticated AI models requires massive datasets and significant processing power, making CoreWeave's services highly sought after.

- Increased demand for GPU-powered cloud computing services: The AI revolution is driving unprecedented demand for cloud infrastructure capable of handling complex AI workloads. CoreWeave is well-positioned to capitalize on this explosive growth.

- Strategic partnerships with leading AI companies: Collaborations with major players in the AI industry provide CoreWeave with access to cutting-edge technology and a wider client base, fueling further expansion and growth. These partnerships often lead to dedicated infrastructure and optimized solutions for specific AI applications.

- CoreWeave's ability to scale its infrastructure to meet growing demand: The company's scalable infrastructure is a key differentiator. They can rapidly adapt to the fluctuating needs of their clients, ensuring uninterrupted service even during periods of peak demand. This scalability is essential for handling the unpredictable nature of AI workloads.

- Focus on sustainable and efficient data center operations: In an increasingly environmentally conscious world, CoreWeave’s commitment to sustainable practices is a significant advantage, appealing to environmentally responsible investors and clients. Efficient data center operations also translate to cost savings, improving profitability.

Strong Financial Performance and Positive Investor Sentiment

Positive financial performance indicators often translate to increased investor confidence and a subsequent rise in stock prices. For CoreWeave, strong revenue growth, coupled with potentially improving profit margins, has likely contributed to the recent surge. Speculation about future earnings and market share also plays a significant role in driving investor sentiment.

- Analysis of recent financial reports and earnings calls: Reviewing CoreWeave's recent financial disclosures reveals key performance indicators (KPIs) like revenue growth, net income, and operating margins, which often influence investor decisions.

- Positive analyst ratings and price target increases: Positive analyst ratings and upward revisions of price targets signal confidence in CoreWeave's future prospects, encouraging further investment.

- Increased institutional investment in CRWV: Large institutional investors often conduct thorough due diligence before making significant investments. An increase in institutional holdings suggests a positive outlook on the company's long-term value.

- Overall positive market sentiment towards the company's future prospects: The overall market sentiment, influenced by factors like industry trends and macroeconomic conditions, can significantly affect investor perception and stock valuation.

Strategic Partnerships and Technological Advancements

Strategic partnerships and technological innovation are crucial for maintaining a competitive advantage in the rapidly evolving cloud computing and AI landscape. CoreWeave's ability to forge strong alliances and continuously improve its technology has likely contributed to its recent stock price increase.

- Details on any new partnerships or collaborations announced: New partnerships can expand CoreWeave's reach, access new technologies, and open doors to lucrative opportunities, boosting investor confidence.

- Discussion of any significant technological upgrades or innovations: Continuous technological advancements are essential for staying ahead of the competition. Any notable improvements in CoreWeave's infrastructure or service offerings are likely to attract investors.

- Analysis of CoreWeave's competitive landscape and market share: Understanding CoreWeave's position relative to its competitors provides valuable insight into its growth potential and overall market dominance.

- Potential for future strategic alliances to boost growth: The potential for future collaborations and partnerships with other key players in the AI and cloud computing industry could further enhance CoreWeave's market position and future growth trajectory.

Conclusion

The recent surge in CoreWeave (CRWV) stock price can be attributed to a confluence of factors, including the booming AI market, strong financial performance, positive investor sentiment, and strategic partnerships. The company's strategic positioning within the rapidly growing cloud computing and artificial intelligence sectors makes it a compelling investment opportunity.

Understanding the drivers behind CoreWeave's stock surge is crucial for investors seeking exposure to the AI and cloud computing markets. Further research into CoreWeave (CRWV) and its long-term growth potential is recommended to make informed investment decisions regarding this promising growth stock. Stay informed about CoreWeave's progress and future developments to capitalize on future opportunities in this dynamic sector. Consider adding CoreWeave (CRWV) to your portfolio of AI-related investments to potentially benefit from the continued growth of the artificial intelligence industry.

Featured Posts

-

Migrant Hotel Fire Tory Councillors Wife Says Remarks Not Intended To Incite Violence

May 22, 2025

Migrant Hotel Fire Tory Councillors Wife Says Remarks Not Intended To Incite Violence

May 22, 2025 -

Analysis The Chicago Sun Times Ai Reporting Failures

May 22, 2025

Analysis The Chicago Sun Times Ai Reporting Failures

May 22, 2025 -

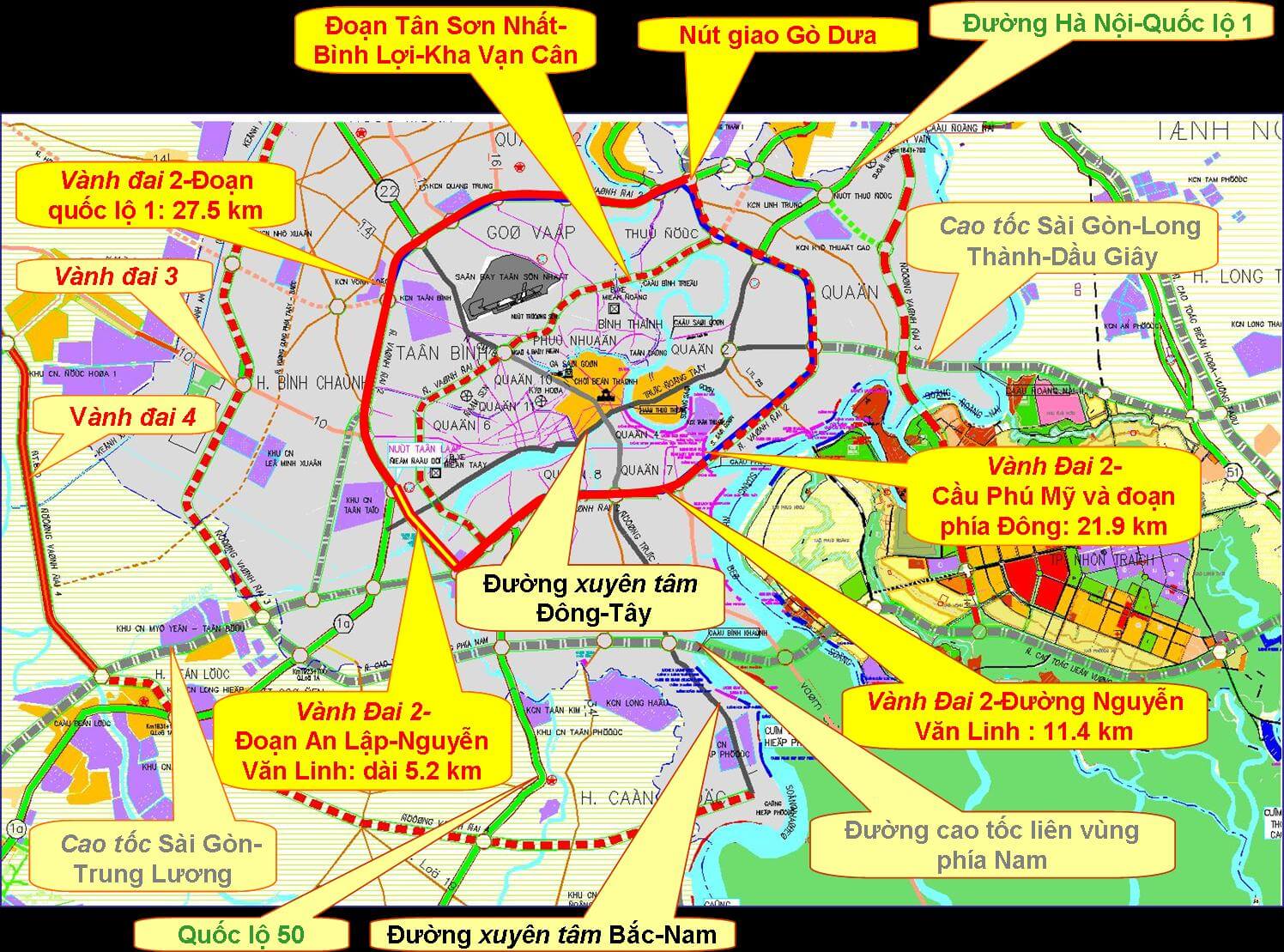

Cau Va Duong Lien Tinh Binh Duong Tay Ninh

May 22, 2025

Cau Va Duong Lien Tinh Binh Duong Tay Ninh

May 22, 2025 -

Ea Fc 24 Fut Birthday Player Tier List Best Cards To Use

May 22, 2025

Ea Fc 24 Fut Birthday Player Tier List Best Cards To Use

May 22, 2025 -

Swiss Foreign Minister Cassis Condemns Pahalgam Terror Attack Full Statement

May 22, 2025

Swiss Foreign Minister Cassis Condemns Pahalgam Terror Attack Full Statement

May 22, 2025