CoreWeave Inc. (CRWV) Stock: Deciphering Tuesday's Price Movement

Table of Contents

Analyzing CoreWeave's (CRWV) Recent Performance

Pre-Tuesday Market Sentiment

The tech sector, and specifically the cloud computing space, experienced a period of moderate uncertainty leading up to Tuesday. While overall market indices showed relatively stable performance, some headwinds existed.

- Analyst Ratings: Several analysts maintained a "hold" rating on CRWV, while others issued slightly more optimistic outlooks, reflecting the inherent volatility of the nascent AI infrastructure market.

- Price Target Changes: No significant price target changes were reported immediately before Tuesday's trading, suggesting that the day's volatility wasn't anticipated by major financial institutions.

- Competitor Activity: Increased activity from competitors in the AI cloud computing space, particularly in areas overlapping CoreWeave’s services, might have contributed to the overall market nervousness.

- Pre-Tuesday Data: CoreWeave's stock price closed at [Insert actual closing price from Monday] on Monday, with a trading volume of [Insert actual volume]. This provides a baseline for evaluating Tuesday's price movements.

Factors Influencing Tuesday's CRWV Stock Price

Several factors likely contributed to the significant price swings in CRWV stock on Tuesday. Pinpointing the exact cause is difficult, but a combination of elements likely played a role.

- News Releases: Any news releases from CoreWeave or related companies in the AI infrastructure space could have influenced investor sentiment and trading activity. The absence of major negative news, however, suggests other factors were at play.

- Industry Trends: Continued rapid growth in the adoption of AI and the increasing demand for specialized cloud computing infrastructure likely played a positive role. The market’s sensitivity to even minor shifts in these trends can significantly impact stock prices.

- Broader Economic Factors: Broader economic conditions, such as interest rate hikes or concerns about inflation, could have indirectly affected investor risk appetite, leading to increased volatility in tech stocks like CRWV.

- Short Squeezes or Market Manipulations: While difficult to definitively prove, the possibility of short squeezes or other market manipulations cannot be entirely ruled out. Sharp price movements sometimes indicate underlying speculative activity.

Technical Analysis of CRWV Stock Chart

A technical analysis of CRWV's stock chart on Tuesday reveals [Insert specific technical details, e.g., a break below a key support level, increased trading volume around a particular price point, candlestick patterns suggesting a reversal].

- Support and Resistance Levels: [Identify and explain the relevance of support and resistance levels observed in the chart].

- Trading Volume Changes: [Analyze changes in trading volume during periods of price fluctuations. High volume during price drops might indicate a strong selling pressure.]

- Candlestick Patterns: [Discuss the implications of any prominent candlestick patterns observed on the chart, linking them to potential short-term price direction.]

- Technical Indicators: [Mention any relevant technical indicators, such as RSI, MACD, or moving averages, and explain their signals].

CoreWeave's (CRWV) Long-Term Growth Prospects

Despite Tuesday's volatility, CoreWeave's long-term growth prospects remain promising due to its position in the rapidly expanding AI infrastructure market.

The AI Infrastructure Market Opportunity

The market for AI infrastructure is experiencing explosive growth. CoreWeave is well-positioned to capitalize on this opportunity.

- Competitive Advantages: CoreWeave’s competitive advantages include [mention specific advantages like superior technology, strategic partnerships, or cost-effectiveness].

- Technological Innovations: CoreWeave’s continuous investment in technological innovation, particularly in areas such as [mention specific technologies], helps it maintain a competitive edge.

- Strategic Partnerships: Partnerships with major players in the tech industry enhance CoreWeave’s market reach and credibility.

The global AI infrastructure market is projected to reach [Insert market size projection from a credible source] by [Insert year]. This provides a substantial growth opportunity for CoreWeave.

CoreWeave's Business Model and Financials

CoreWeave’s business model, focused on providing high-performance cloud computing services optimized for AI workloads, is well-suited to the current market demand.

- Revenue Growth: CoreWeave’s recent revenue growth indicates a strong market acceptance of its offerings. [Insert data on revenue growth if available].

- Profitability: While still in its early stages, CoreWeave's profitability trajectory will be a key factor to watch. [Discuss profitability trends if available.]

- Debt Levels: CoreWeave's debt levels need to be monitored to assess its financial stability. [Discuss debt levels and their implications].

These financial metrics help investors assess the sustainability of CoreWeave's business model and growth prospects.

Risks and Challenges Facing CoreWeave

Despite its potential, CoreWeave faces several risks and challenges.

- Competition: Intense competition from established cloud providers and emerging startups presents a significant challenge.

- Economic Downturns: Economic downturns could negatively impact the demand for cloud computing services, affecting CoreWeave's revenue.

- Technological Disruptions: Rapid technological advancements could render existing infrastructure obsolete, requiring substantial investments in upgrades.

- Regulatory Changes: Changes in regulations impacting data privacy and security could impact CoreWeave's operations.

Understanding these potential risks is critical for making informed investment decisions in CRWV stock.

Conclusion

Tuesday's price fluctuations in CoreWeave Inc. (CRWV) stock highlight the volatility inherent in the tech sector and the AI infrastructure market. While short-term price movements can be influenced by various factors, including market sentiment and speculative trading, CoreWeave's long-term growth prospects remain promising given the increasing demand for AI-focused cloud computing solutions. Understanding both the short-term volatility and long-term potential is crucial for making informed investment decisions. Remember to conduct thorough due diligence, analyze CoreWeave's financial reports and industry trends, and consider the inherent risks before investing in CRWV stock. Careful analysis of CRWV stock and the broader AI infrastructure market will allow you to navigate future price fluctuations more effectively and potentially capitalize on this exciting growth area.

Featured Posts

-

Music World Mourns Dropout Kings Lose Vocalist Adam Ramey

May 22, 2025

Music World Mourns Dropout Kings Lose Vocalist Adam Ramey

May 22, 2025 -

Partnership Promotes Safety Bear Spray Giveaways And Training

May 22, 2025

Partnership Promotes Safety Bear Spray Giveaways And Training

May 22, 2025 -

Volunteer For Wyomings Guided Fishing Advisory Board

May 22, 2025

Volunteer For Wyomings Guided Fishing Advisory Board

May 22, 2025 -

2025 Emmy Awards Analyzing The Lead Actress In A Limited Series Nominees

May 22, 2025

2025 Emmy Awards Analyzing The Lead Actress In A Limited Series Nominees

May 22, 2025 -

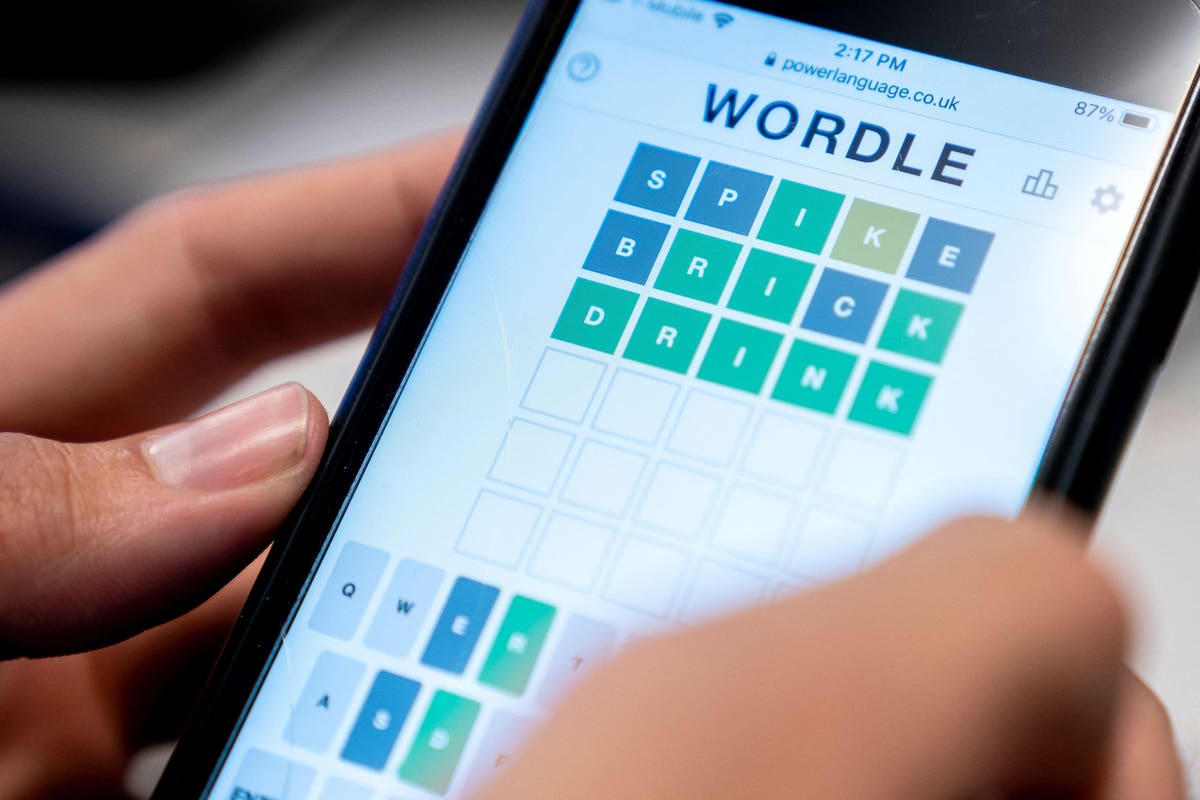

Solve Wordle 363 March 13th Hints Clues And Answer

May 22, 2025

Solve Wordle 363 March 13th Hints Clues And Answer

May 22, 2025