CoreWeave, Inc. (CRWV) Stock Surge: Understanding Thursday's Jump

Table of Contents

Potential Factors Contributing to the CoreWeave (CRWV) Stock Surge

Several factors could have contributed to the remarkable CoreWeave (CRWV) stock surge observed on Thursday. Let's examine some key potential drivers:

Positive Earnings Report or News

A positive earnings report or significant news release often triggers a stock price increase. For CRWV, several scenarios could have played a role:

- Exceeding Earnings Expectations: If CoreWeave announced earnings that significantly exceeded analysts' expectations, it would have been a major catalyst for the CRWV stock price increase. Investors often react favorably to companies that outperform projections.

- Increased Revenue Projections: Upward revisions in revenue forecasts signal strong future growth potential, boosting investor confidence and driving up demand for the stock.

- Strategic Partnerships or Contracts: Announcing a major partnership with a significant player in the cloud computing or AI industry could have injected positivity into the market's perception of CRWV, leading to the surge.

- Analyst Upgrades: Positive ratings changes and increased price targets from respected financial analysts would have reinforced the positive sentiment surrounding CoreWeave and contributed to the CRWV stock price jump. The impact of these upgrades on investor sentiment can be substantial.

Industry Trends Favoring CoreWeave (CRWV)

The broader industry landscape also plays a significant role. The increasing demand for cloud computing and AI infrastructure creates a favorable environment for companies like CoreWeave:

- Booming Cloud Computing Market: The continued expansion of the cloud computing market provides a fertile ground for CoreWeave to grow its market share. This overall market growth often benefits companies within the sector.

- AI Infrastructure Demand: CoreWeave's specialization in providing high-performance computing infrastructure for AI applications aligns perfectly with the surging demand for AI processing power. This positions them strategically within a rapidly expanding market segment.

- Competitive Advantages: CoreWeave's unique technological advantages, sustainable infrastructure, and efficient operations could give them a competitive edge, attracting investors seeking companies with high growth potential.

- Positive Market Sentiment in Cloud Computing: Positive developments and announcements from other key players in the cloud computing sector can generate a ripple effect, boosting investor confidence in the entire industry, including CoreWeave.

Short Squeeze or Increased Investor Interest

The rapid increase in the CRWV stock price could also be attributed to a short squeeze or a sudden surge in investor interest:

- Short Squeeze: If a significant number of investors were shorting CRWV stock (betting on its price decline), a sudden positive catalyst could trigger a short squeeze, forcing short-sellers to buy back shares to limit their losses, thus driving the price up rapidly.

- Increased Trading Volume: A dramatic increase in trading volume on Thursday, alongside the price surge, might indicate a significant influx of new buyers into the CRWV stock, further fueling the upward momentum.

- Options Activity: Unusual activity in options trading (e.g., a high volume of call options purchases) could signal a strong bullish sentiment and potentially contribute to a rapid price increase.

Speculative Trading and Market Sentiment

Market sentiment and speculative trading can significantly influence short-term price movements:

- Positive Investor Sentiment: A generally positive outlook on the market or the tech sector could have positively impacted CoreWeave's stock performance, even without specific company-related news.

- Speculative Buying: Speculative buying, driven by rumors, social media trends, or general market excitement, can create upward momentum, particularly in volatile stocks.

- Market Events: Major market events, either positive or negative, can have indirect effects on individual stock prices, creating opportunities for short-term price swings.

Analyzing the Sustainability of the CoreWeave (CRWV) Stock Surge

While the Thursday surge in CRWV stock was impressive, determining its long-term sustainability requires careful consideration:

Long-Term Growth Potential

CoreWeave's long-term growth potential depends on several factors:

- Business Model Sustainability: The viability and scalability of CoreWeave's business model will determine its ability to maintain its growth trajectory.

- Future Expansion Plans: Ambitious expansion plans and the company's ability to execute them successfully are crucial for sustained growth.

- Market Competition: The level of competition within the cloud computing and AI infrastructure market will significantly impact CoreWeave's market share and future profitability.

- Technological Advancements: Staying ahead of the curve in terms of technological innovation is essential for CoreWeave to remain competitive.

Valuation and Future Price Predictions

Evaluating the sustainability of the CRWV stock surge necessitates an analysis of its valuation:

- Peer Comparison: Comparing CoreWeave's valuation metrics (e.g., price-to-earnings ratio) to those of its competitors provides insight into its relative attractiveness to investors.

- Analyst Forecasts: While analyst predictions should not be taken as gospel, they can provide a general sense of the market's expectations for future price movements.

- Risk Assessment: Identifying potential risks and challenges that could hinder CoreWeave's growth is crucial for realistic future price projections. Investors should be cautious about relying solely on short-term price fluctuations for making investment decisions.

Conclusion

The CoreWeave (CRWV) stock surge on Thursday was likely driven by a confluence of factors, including potentially positive earnings news, favorable industry trends, a possible short squeeze, and overall market sentiment. However, the sustainability of this increase remains uncertain and requires further analysis. Understanding the CoreWeave (CRWV) stock surge requires careful analysis; further research is essential before making any investment decisions regarding CRWV stock. Consult with a qualified financial advisor before making any investment decisions. For more information, refer to reputable financial news sources and CoreWeave's official investor relations website.

Featured Posts

-

Is Blake Lively Feuding With Taylor Swift And Gigi Hadid Family Rallies Around Actress

May 22, 2025

Is Blake Lively Feuding With Taylor Swift And Gigi Hadid Family Rallies Around Actress

May 22, 2025 -

Cassis Blackcurrant Growing Harvesting And Preserving Techniques

May 22, 2025

Cassis Blackcurrant Growing Harvesting And Preserving Techniques

May 22, 2025 -

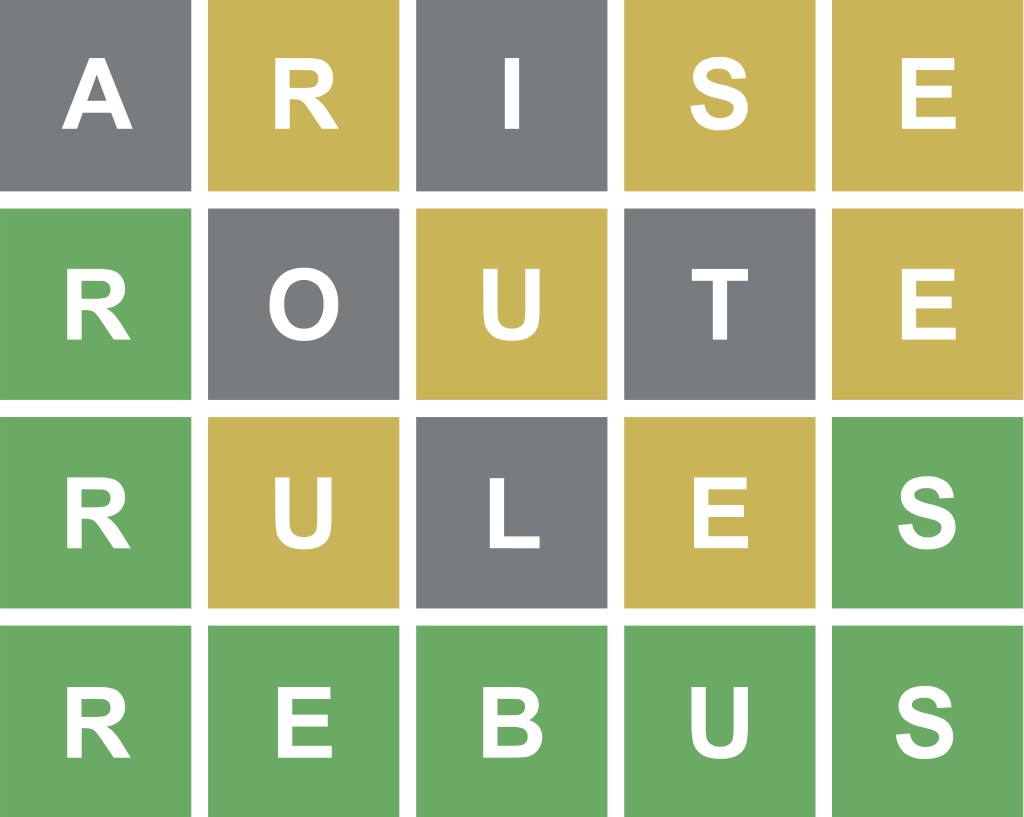

Wordle Hints And Answer Sunday April 27th 1408

May 22, 2025

Wordle Hints And Answer Sunday April 27th 1408

May 22, 2025 -

United Healths Future The Man Who Built It Faces Its Biggest Test

May 22, 2025

United Healths Future The Man Who Built It Faces Its Biggest Test

May 22, 2025 -

21 Year Old Peppa Pig Mystery Finally Solved Fans React

May 22, 2025

21 Year Old Peppa Pig Mystery Finally Solved Fans React

May 22, 2025