CoreWeave's IPO: $40 Listing Price Falls Short Of Initial Estimates

Table of Contents

Lower-Than-Expected Valuation: Reasons for the Disappointment

The CoreWeave IPO's underwhelming performance can be attributed to a confluence of factors affecting both the broader market and the company's specific circumstances.

Investor Concerns Regarding the Current Market Climate

The current economic landscape presents significant headwinds for new IPOs.

- Economic Uncertainty: The prevailing economic uncertainty, characterized by high inflation and interest rates, has made investors significantly more risk-averse. This caution translates into a decreased appetite for potentially volatile investments like newly public companies.

- Tech Sector Downturn: The broader tech sector downturn, impacting even established players, has further dampened investor enthusiasm for new entrants. This general negativity spills over into valuations for even promising companies.

- Increased Competition: The fiercely competitive cloud computing market, with established giants like AWS, Azure, and Google Cloud, presents a formidable challenge. Investors are carefully scrutinizing CoreWeave's competitive advantage and its ability to carve out a substantial market share.

Company Performance and Growth Projections

While CoreWeave demonstrates impressive growth, certain aspects might have fueled investor apprehension.

- Sustainability of Growth: While current growth figures are compelling, investors are keen to understand the sustainability of this rapid expansion. Questions around the long-term viability of the growth trajectory might have influenced the pricing.

- Financial Performance Scrutiny: A detailed examination of CoreWeave’s financial performance and future projections might have revealed potential risks or limitations not initially apparent in the pre-IPO hype.

- Client and Technology Concentration: Reliance on a limited number of clients or specific technologies can be perceived as a risk factor, potentially reducing investor confidence.

Pricing Strategy and Market Demand

The final pricing likely reflects a combination of factors related to the IPO process itself.

- Overly Optimistic Initial Range: The initial price range might have been overly optimistic, requiring downward revision to reflect the actual market demand.

- Lower-Than-Anticipated Demand: Lower-than-anticipated demand during the book-building process likely played a significant role in forcing a reduction in the offering price.

- Benchmarking Against Competitors: Comparisons to similar IPOs in the cloud computing sector, and their respective performance, could have influenced the final CoreWeave IPO pricing.

Impact of the Lower Listing Price on CoreWeave's Future

The lower-than-expected listing price has significant implications for CoreWeave's future plans and strategies.

Funding and Expansion Plans

The reduced IPO proceeds will likely necessitate adjustments to CoreWeave's ambitious expansion plans.

- Funding Constraints: The company might need to explore alternative funding avenues, such as private equity or debt financing, to supplement its capital and achieve its growth targets.

- Slower Expansion: This could lead to a slower pace of innovation, product development, and market penetration compared to their initial roadmap.

- Strategic Prioritization: CoreWeave might need to prioritize its investments, focusing on the most promising areas of growth.

Investor Confidence and Long-Term Growth

The lower listing price could create short-term challenges related to investor confidence.

- Short-Term Negative Sentiment: The underwhelming IPO could negatively impact investor confidence in the short term, leading to increased volatility.

- Demonstrating Profitability: CoreWeave will need to demonstrate long-term growth and profitability to restore investor trust and attract future investment.

- Execution is Key: The successful execution of its business strategy, focusing on delivering value and achieving milestones, will be critical for attracting further investments.

Competition and Market Share

The reduced capital could affect CoreWeave's competitive position in the market.

- Competitive Pressure: The lower capital could potentially limit CoreWeave's ability to compete aggressively against established players with deep pockets.

- Resource Optimization: The company will need to optimize its resources and technologies to maximize its market share and minimize expenses.

- Strategic Market Adjustments: A strategic shift in market focus might be necessary to enhance the company’s competitiveness and maximize its chances of success.

Analyzing Investor Sentiment and Future Outlook for CoreWeave Stock

Analyzing investor sentiment and the future outlook for CoreWeave stock requires a careful consideration of both short-term and long-term factors.

Short-Term Volatility

The immediate aftermath of the IPO is likely to witness considerable price volatility.

- Initial Price Fluctuations: Expect fluctuations in the stock price in the short term as investors digest the IPO outcome and assess its implications.

- Buying Opportunities: Some long-term investors might view the initial lower price as a potential buying opportunity.

- Market Monitoring: Closely monitoring market reactions, analyst reports, and news related to the CoreWeave IPO is crucial.

Long-Term Potential

Despite the initial setback, CoreWeave operates in a high-growth sector with significant long-term potential.

- Sector Growth: The cloud computing sector continues to grow exponentially, presenting significant opportunities for expansion and market penetration.

- Technological Advantage: CoreWeave's technology and expertise position it well for future growth if it can effectively navigate the challenges.

- Long-Term Viability: Long-term performance will depend heavily on the company's capacity to execute its business strategy and adapt to the evolving dynamics of the cloud computing market.

Conclusion

The CoreWeave IPO, with its $40 listing price falling short of expectations, presents a mixed bag. While the lower valuation raises concerns about investor sentiment and the company's future path, CoreWeave remains a player in a rapidly expanding market with substantial long-term potential. Success will depend on navigating the current challenges, making strategic decisions, and delivering on its promises. Staying informed about the CoreWeave IPO's development is vital for making informed investment choices. Understanding the implications of this CoreWeave IPO, and its long-term effects on the wider cloud computing sector, is critical for investors and industry watchers alike.

Featured Posts

-

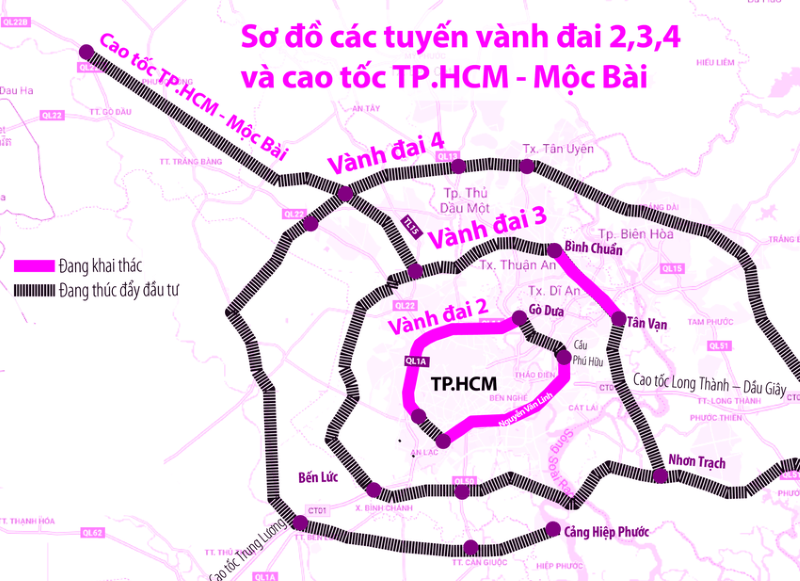

Cau Va Duong Cao Toc Binh Duong Tay Ninh Ban Do And Huong Dan

May 22, 2025

Cau Va Duong Cao Toc Binh Duong Tay Ninh Ban Do And Huong Dan

May 22, 2025 -

Appeal Pending Ex Tory Councillors Wife And Racial Hatred Tweet

May 22, 2025

Appeal Pending Ex Tory Councillors Wife And Racial Hatred Tweet

May 22, 2025 -

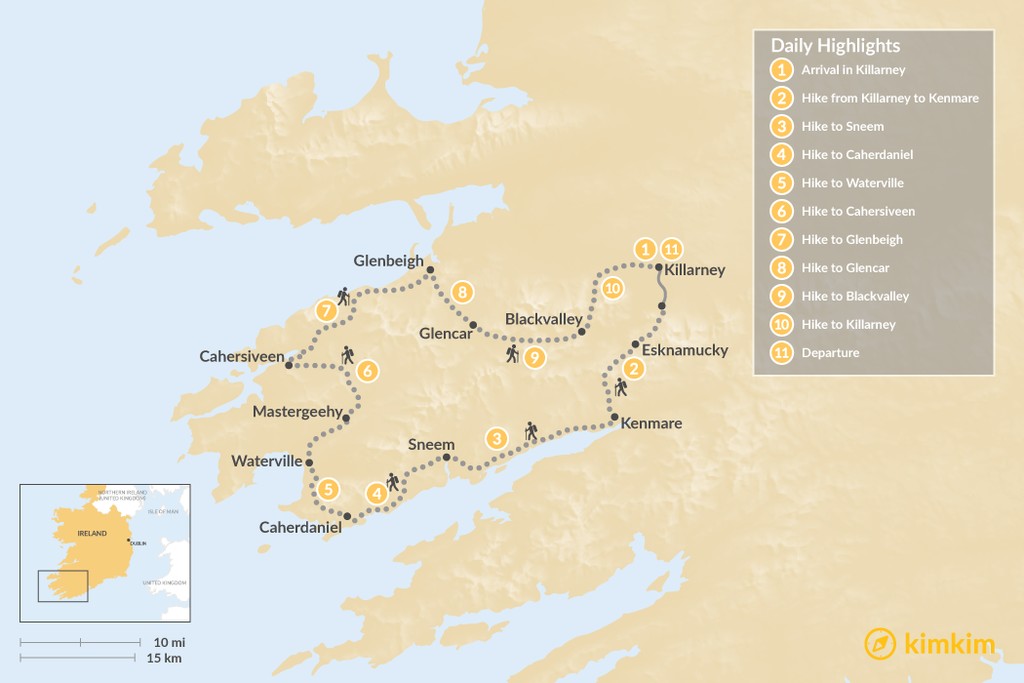

Self Guided Hike Provence France Mountains To Mediterranean

May 22, 2025

Self Guided Hike Provence France Mountains To Mediterranean

May 22, 2025 -

Could This Be The Year The Trans Australia Run Record Is Broken

May 22, 2025

Could This Be The Year The Trans Australia Run Record Is Broken

May 22, 2025 -

Recuperacion Y Rendimiento El Plan De Javier Baez Para El Exito

May 22, 2025

Recuperacion Y Rendimiento El Plan De Javier Baez Para El Exito

May 22, 2025