Corporate Earnings: A Current Boom And Potential Future Slowdown

Table of Contents

The Current Boom in Corporate Earnings: Factors Contributing to Growth

Several factors have contributed to the impressive growth in corporate earnings we've witnessed recently. Understanding these drivers is crucial for predicting future trends.

Strong Consumer Spending: Fueling the Engine of Growth

Increased consumer confidence and spending power are significantly boosting corporate revenue across various sectors.

- Increased disposable income: Following the pandemic, many households saw an increase in savings, leading to higher spending capacity.

- Pent-up demand post-pandemic: Restrictions eased, unleashing pent-up demand for travel, entertainment, and experiences.

- Robust job market: A strong job market with low unemployment rates translates to higher disposable income and increased consumer confidence.

This surge in consumer spending has particularly benefited sectors like retail, hospitality, and entertainment. Retailers report strong sales figures, driven by both online and in-store shopping. The hospitality industry is experiencing a revival, with increased travel and tourism contributing to higher revenues. Similarly, the entertainment sector is seeing a resurgence, with movie theaters, concert venues, and sporting events attracting large crowds.

Supply Chain Improvements: Smoother Operations, Higher Profits

The easing of supply chain bottlenecks, a major challenge in recent years, has significantly improved corporate efficiency and profitability.

- Reduced shipping costs: Reduced congestion in ports and improved logistics have led to lower shipping costs.

- Increased availability of raw materials: Improved supply chain management has increased the availability of essential raw materials, reducing production delays.

- Improved production capacity: Companies have been able to ramp up production to meet the increased demand, leading to higher output and greater profitability.

The impact of these improvements is substantial. Companies are experiencing higher production rates, reduced inventory costs, and ultimately, increased profit margins. This positive trend has contributed greatly to the current boom in corporate earnings.

Strategic Pricing and Increased Profit Margins: Navigating Inflationary Pressures

Despite inflationary pressures, many companies have successfully implemented strategic pricing and cost-cutting measures to maintain profitability.

- Effective cost-cutting measures: Companies have streamlined operations, reduced waste, and optimized their supply chains to control costs.

- Strategic pricing adjustments: Companies have carefully adjusted their pricing strategies to balance increased input costs with maintaining consumer demand.

- Increased efficiency: Improvements in operational efficiency have allowed companies to absorb some of the increased costs without significantly impacting profit margins.

Inflation remains a significant factor, impacting pricing strategies across various sectors. Companies have had to make tough decisions about passing increased costs onto consumers while also remaining competitive. The successful navigation of these challenges has been a key contributor to the overall strong earnings performance.

Potential Headwinds: Factors Indicating a Future Slowdown

While the current corporate earnings picture is positive, several headwinds could lead to a slowdown in the future.

Inflationary Pressures: Eroding Consumer Spending Power

Persistent inflation poses a significant threat to consumer spending and corporate earnings.

- Rising interest rates: Central banks are raising interest rates to combat inflation, which increases borrowing costs for consumers and businesses.

- Increased energy costs: High energy prices are driving up production costs for businesses and reducing disposable income for consumers.

- Wage stagnation for some segments: Wage growth hasn't kept pace with inflation for some segments of the population, impacting their purchasing power.

Inflation's impact on consumer behavior is a major concern. As prices rise, consumers may reduce spending on discretionary items, impacting corporate revenue. This could lead to a decrease in demand and eventually, a slowdown in corporate earnings growth.

Geopolitical Uncertainty: Disrupting Global Business

Geopolitical instability can severely disrupt supply chains and negatively impact business confidence, creating uncertainty for businesses.

- The war in Ukraine: The ongoing conflict has created significant disruptions to energy markets and global supply chains.

- Trade tensions: Trade disputes and protectionist policies can create uncertainty and increase costs for businesses.

- Global political instability: Political instability in various regions of the world can lead to disruptions in supply chains and decreased investment.

These geopolitical events have a ripple effect across the global economy, impacting everything from raw material prices to shipping costs. This uncertainty makes it difficult for businesses to plan for the future and can lead to decreased investment and slower economic growth.

Rising Interest Rates: Increasing Borrowing Costs

Higher interest rates significantly increase borrowing costs for businesses, potentially hindering investment and expansion.

- Increased debt servicing costs: Higher interest rates increase the cost of servicing existing debt, reducing profitability.

- Reduced capital expenditures: Businesses may postpone or cancel investments due to higher borrowing costs, hindering growth.

- Decreased profitability: The combination of higher costs and reduced investment can lead to a decrease in overall profitability.

The impact of rising interest rates on business investment is substantial. Businesses may become more cautious, delaying expansion plans and reducing capital expenditures. This can negatively impact economic growth and corporate earnings in the long run.

Analyzing Key Indicators for Future Earnings Predictions

Several key economic indicators provide valuable insights into future corporate earnings trends.

GDP Growth: A Leading Indicator of Economic Health

GDP growth is a strong indicator of overall economic activity and has a direct correlation with corporate earnings. Strong GDP growth generally translates to higher corporate earnings, and vice versa.

Consumer Confidence Index: Gauging Consumer Sentiment

The Consumer Confidence Index measures consumer sentiment and spending intentions. High consumer confidence usually signals strong consumer spending and positive corporate earnings growth.

Inflation Rate: Monitoring Pricing Pressures

The inflation rate directly impacts corporate profit margins. High inflation can erode profit margins if companies cannot pass increased costs onto consumers.

Unemployment Rate: Assessing Consumer Spending Power

The unemployment rate is a significant factor influencing consumer spending. Low unemployment rates usually translate to higher consumer spending and stronger corporate earnings.

Conclusion

The current boom in corporate earnings is a positive sign for the economy, driven by strong consumer spending and improved supply chains. However, significant headwinds, including persistent inflation, geopolitical uncertainty, and rising interest rates, pose a considerable threat to continued growth. Careful monitoring of key economic indicators, such as GDP growth, consumer confidence, and inflation rates, is crucial for predicting future corporate earnings trends. Understanding these factors allows for informed investment decisions and strategic business planning. Stay informed on the latest developments in corporate earnings to make the best decisions for your investments and business strategies. Continue to monitor future corporate earnings reports for a clearer picture of the economic landscape.

Featured Posts

-

Elections Municipales Metz 2026 L Avenir Politique De Laurent Jacobelli

May 30, 2025

Elections Municipales Metz 2026 L Avenir Politique De Laurent Jacobelli

May 30, 2025 -

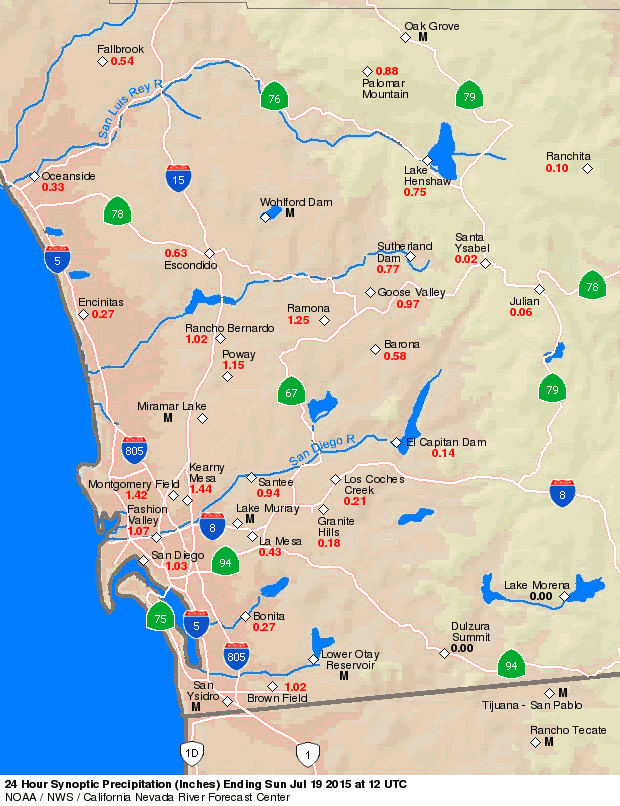

Cbs 8 Com Your Source For San Diego Rain Totals

May 30, 2025

Cbs 8 Com Your Source For San Diego Rain Totals

May 30, 2025 -

Borges Defeats Ruud At French Open After Knee Problem

May 30, 2025

Borges Defeats Ruud At French Open After Knee Problem

May 30, 2025 -

Trump Contra Ticketmaster La Nueva Orden Ejecutiva Para Controlar La Reventa De Boletos

May 30, 2025

Trump Contra Ticketmaster La Nueva Orden Ejecutiva Para Controlar La Reventa De Boletos

May 30, 2025 -

Ufc Veteran Advocates For Jon Joness 29 Million Demand

May 30, 2025

Ufc Veteran Advocates For Jon Joness 29 Million Demand

May 30, 2025