Cryptocurrency's Resilience: A Winning Strategy Amidst Trade Wars

Table of Contents

Decentralization as a Shield Against Trade Wars

One of the key reasons behind cryptocurrency's resilience is its inherent decentralization. Unlike traditional financial systems that are often subject to government control and regulations, cryptocurrencies operate on a distributed ledger technology (DLT), typically a blockchain. This decentralized architecture offers several advantages:

- No single point of failure: Unlike centralized systems vulnerable to single points of failure, a cryptocurrency network is resilient to attacks and disruptions. If one node goes down, the network continues to function.

- Resistant to government control and sanctions: Because cryptocurrencies aren't tied to any single nation or entity, they are less susceptible to government control and sanctions imposed during trade wars. Transactions can often bypass traditional banking systems impacted by such restrictions. This characteristic offers a degree of freedom not available with traditional financial instruments.

- Global accessibility, unaffected by national borders: Cryptocurrency transactions transcend geographical boundaries. This global accessibility makes it a valuable tool for international trade and investment, even when traditional cross-border payments are restricted. For example, businesses facing trade sanctions could potentially utilize cryptocurrencies to facilitate transactions.

Low Correlation with Traditional Markets

A significant advantage of cryptocurrency is its generally low correlation with traditional asset classes such as stocks and bonds. This lack of correlation offers substantial diversification benefits for investors.

- Diversification benefits: Reduce portfolio risk by adding crypto: Including cryptocurrencies in a diversified portfolio can help mitigate the overall risk, especially during periods of market volatility. When traditional markets decline, cryptocurrencies may not necessarily follow suit, offering a potential buffer against losses.

- Hedge against inflation and currency devaluation: Cryptocurrencies can act as a hedge against inflation and currency devaluation. Their limited supply and decentralized nature can protect their value against inflationary pressures affecting fiat currencies.

- Potential for growth even when traditional markets are down: Historical data shows instances where cryptocurrency markets have performed independently of traditional markets, demonstrating their potential for growth even during economic downturns. While volatility remains a factor, this decoupling presents a compelling investment case.

While definitive data on correlation constantly shifts, numerous studies and observations suggest a relatively weak correlation between major cryptocurrencies and traditional market indices. Further research in this area is ongoing and will help investors better understand this dynamic relationship.

Growth Potential Despite Economic Uncertainty

Despite trade war anxieties and global economic headwinds, the cryptocurrency market continues to show remarkable growth potential. This is driven by several key factors:

- Growing institutional investment in crypto: Large financial institutions are increasingly exploring and investing in cryptocurrencies, lending credibility and stability to the market.

- Development of new crypto technologies (e.g., DeFi, NFTs): The constant evolution of blockchain technology, including decentralized finance (DeFi) and non-fungible tokens (NFTs), fuels innovation and expands the potential use cases for cryptocurrencies.

- Increased regulatory clarity in some jurisdictions: Growing regulatory clarity in certain regions is attracting more institutional investors and fostering a more stable and mature market environment.

Examples like the continued success of Ethereum's DeFi ecosystem and the burgeoning NFT market highlight the robust growth within the crypto space, demonstrating that economic uncertainty doesn't always halt innovation and adoption.

Risks and Considerations

It's crucial to acknowledge that investing in cryptocurrencies involves inherent risks. The market is highly volatile, and prices can fluctuate dramatically in short periods.

- Price fluctuations: The price of cryptocurrencies can be highly unpredictable, leading to significant potential gains or losses.

- Regulatory uncertainty in some regions: Regulatory frameworks surrounding cryptocurrencies are still evolving globally, creating uncertainty in some jurisdictions.

- Security risks (e.g., hacking, scams): Investors must be aware of potential security risks, such as hacking of exchanges or scams targeting unsuspecting users.

Thorough research, careful risk assessment, and a diversified investment strategy are crucial before engaging with the cryptocurrency market. Never invest more than you can afford to lose.

Cryptocurrency's Resilience – A Long-Term Strategy

In conclusion, cryptocurrency's resilience stems from its decentralized nature, low correlation with traditional markets, and strong growth potential. Its ability to function independently of traditional financial systems makes it a compelling diversification tool and a potential hedge against the risks associated with trade wars and other geopolitical events. While risks exist, the long-term potential of cryptocurrency is undeniable. Explore the resilience of cryptocurrency and discover the benefits of cryptocurrency during trade wars. Invest in cryptocurrency for long-term growth and consider its role in a well-diversified investment portfolio. Learn more about effective cryptocurrency investment strategies today.

Featured Posts

-

Investigacao Em Andamento Mulher Se Passando Por Madeleine Mc Cann Presa Na Inglaterra

May 09, 2025

Investigacao Em Andamento Mulher Se Passando Por Madeleine Mc Cann Presa Na Inglaterra

May 09, 2025 -

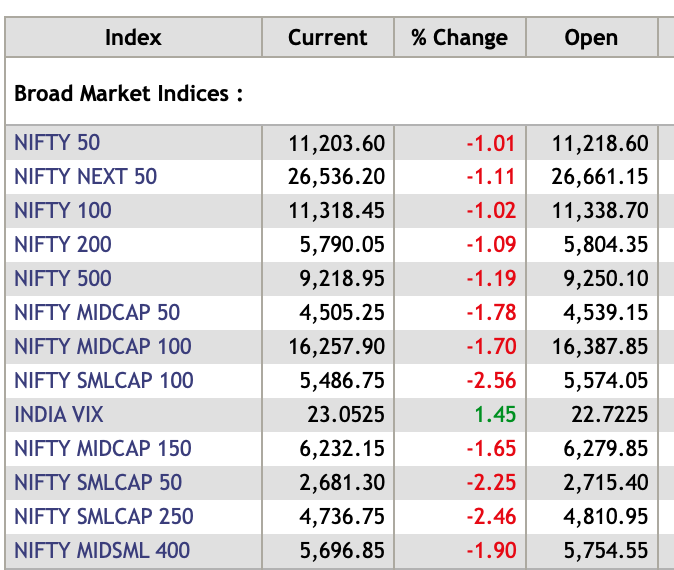

Indian Stock Market Today Sensex Nifty End Higher

May 09, 2025

Indian Stock Market Today Sensex Nifty End Higher

May 09, 2025 -

Analyzing Colin Cowherds Commentary On Jayson Tatum

May 09, 2025

Analyzing Colin Cowherds Commentary On Jayson Tatum

May 09, 2025 -

Dakota Johnsons Family Supports Her At Materialist Premiere

May 09, 2025

Dakota Johnsons Family Supports Her At Materialist Premiere

May 09, 2025 -

I Meiosi Ton Xionoptoseon Sta Imalaia Mia Analysi

May 09, 2025

I Meiosi Ton Xionoptoseon Sta Imalaia Mia Analysi

May 09, 2025