D-Wave Quantum (QBTS): Analyzing The Significant Stock Drop In 2025

Table of Contents

Macroeconomic Factors Influencing the D-Wave Quantum Stock Drop

The D-Wave Quantum stock drop in 2025 wasn't solely due to company-specific issues; macroeconomic factors played a significant role. Understanding the broader economic landscape is key to interpreting the QBTS performance.

Broader Market Corrections

The overall market climate in 2025 significantly impacted high-growth tech stocks like QBTS. Several factors contributed to a broader market correction:

- Nasdaq Decline: The Nasdaq Composite, a benchmark for technology stocks, experienced a substantial downturn in 2025. This broader market trend negatively impacted many tech companies, including D-Wave Quantum. Data from [Source: reputable financial index site] showed a [Percentage]% decline in the Nasdaq, correlating with a similar downward trend in QBTS.

- Interest Rate Hikes: Aggressive interest rate hikes by central banks to combat inflation increased borrowing costs for companies and reduced investor appetite for riskier assets, including growth stocks like those in the quantum computing sector.

- Inflation Concerns: High inflation eroded investor confidence and led to a reassessment of valuations across various sectors, impacting the D-Wave Quantum stock price.

Investor Sentiment and Risk Aversion

Shifting investor sentiment played a crucial role in the D-Wave Quantum stock drop. The increased risk aversion observed in 2025 led to a flight to safety, with investors moving capital into more conservative investments.

- Reduced Risk Tolerance: Investors became less tolerant of risk, favoring established, less volatile companies over high-growth, speculative ventures like D-Wave Quantum.

- Alternative Investments: The attractiveness of alternative investments, perceived as safer havens during economic uncertainty, diverted investment capital away from QBTS and other similar companies.

- Market Volatility: The increased market volatility made investors hesitant to hold onto stocks perceived as high-risk, further contributing to the selling pressure on QBTS.

D-Wave Quantum's Company-Specific Challenges Contributing to the Stock Drop

While macroeconomic conditions contributed to the overall market downturn, several company-specific challenges exacerbated the D-Wave Quantum stock drop.

Revenue Growth and Profitability Concerns

D-Wave Quantum's financial performance in 2025 fell short of investor expectations, impacting its stock price.

- Revenue Shortfalls: The company's revenue figures for 2025 were [hypothetical data, e.g., lower than projected by X%], failing to meet anticipated growth targets. This shortfall signaled concerns about the company's ability to scale its operations and generate substantial revenue.

- Lack of Profitability: D-Wave Quantum, like many companies in the nascent quantum computing industry, remained unprofitable in 2025. The continued absence of profitability raised concerns about the company's long-term sustainability.

- Comparison to Previous Years: Compared to previous years, the revenue growth rate experienced a significant decline, further eroding investor confidence.

Competition in the Quantum Computing Market

The quantum computing market is highly competitive, with several major players vying for market share. D-Wave Quantum's position within this competitive landscape played a significant role in its stock decline.

- IBM and Google's Advancements: Competitors such as IBM and Google made significant advancements in their quantum computing technologies throughout 2025, increasing the competitive pressure on D-Wave Quantum.

- Market Share Erosion: The advancements of competitors potentially led to a perception of market share erosion for D-Wave Quantum, negatively influencing investor sentiment.

- Technological Differentiation: D-Wave's unique approach to quantum computing (annealing) faced challenges in demonstrating a clear advantage over competitors using gate-based models.

Technological Hurdles and Development Delays

D-Wave Quantum faced several technological hurdles and potential development delays in 2025 that negatively impacted its stock price.

- Scaling Challenges: Scaling quantum computing technology to achieve greater computational power proved more difficult than anticipated. Challenges in scaling up qubit numbers and maintaining coherence impacted development timelines.

- Quantum Advantage: D-Wave struggled to demonstrate a clear “quantum advantage” – outperforming classical computers on commercially relevant problems – hindering its ability to attract customers and investors.

- Missed Milestones: Potential missed milestones in research and development further fueled negative sentiment among investors already concerned about the company's progress.

Conclusion

The significant D-Wave Quantum (QBTS) stock drop in 2025 was a complex event resulting from a confluence of macroeconomic factors and company-specific challenges. While broader market corrections and investor sentiment played a role, D-Wave's financial performance, competitive landscape, and technological hurdles contributed significantly to the decline. Understanding these factors is crucial for investors considering future investments in the quantum computing sector and specifically, in D-Wave Quantum. Further research into D-Wave's strategic initiatives and technological breakthroughs will be critical to assessing the long-term viability of QBTS. Stay informed about future developments and carefully analyze the D-Wave Quantum stock before making any investment decisions. Monitoring the D-Wave Quantum stock price and understanding the factors influencing its performance remain vital for navigating this dynamic sector.

Featured Posts

-

Postman Pro Tips Hidden Features You Never Knew Existed

May 20, 2025

Postman Pro Tips Hidden Features You Never Knew Existed

May 20, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Jaettaevaet Seuransa Puolassa

May 20, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Jaettaevaet Seuransa Puolassa

May 20, 2025 -

Historic Burnham And Highbridge Photographs Now Accessible

May 20, 2025

Historic Burnham And Highbridge Photographs Now Accessible

May 20, 2025 -

The Ultimate Guide To Solo Travel Planning

May 20, 2025

The Ultimate Guide To Solo Travel Planning

May 20, 2025 -

Railroad Bridge Accident Two Adults Dead One Child Missing Another Injured

May 20, 2025

Railroad Bridge Accident Two Adults Dead One Child Missing Another Injured

May 20, 2025

Latest Posts

-

Peppa Pigs Mummy A Memorable Gender Reveal Party In London

May 21, 2025

Peppa Pigs Mummy A Memorable Gender Reveal Party In London

May 21, 2025 -

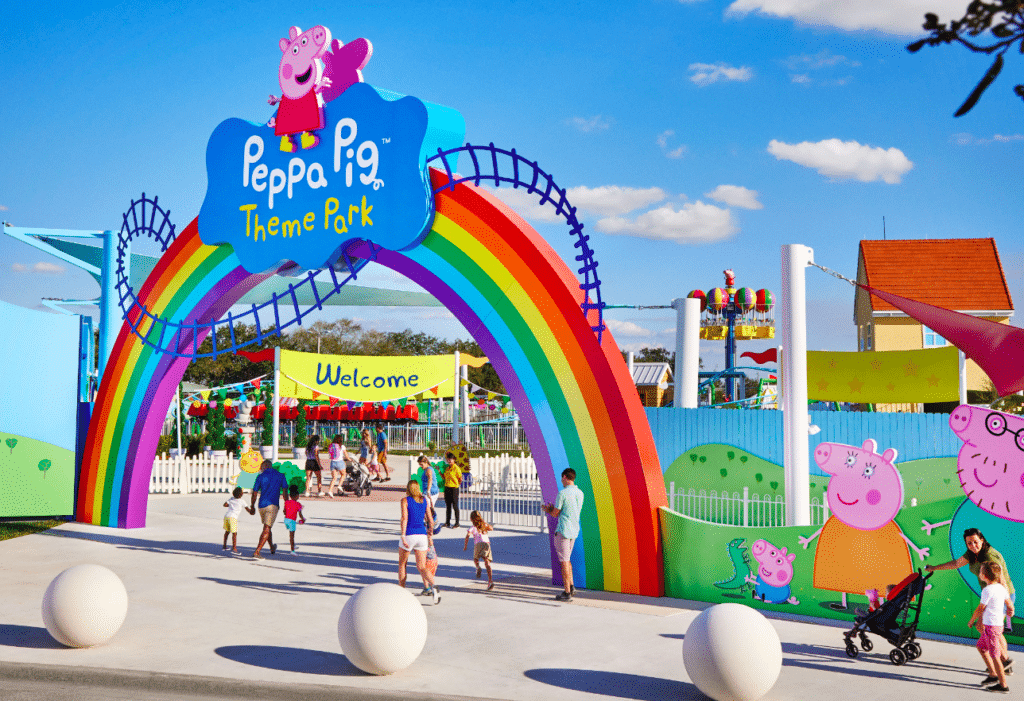

Planning Your Trip To The New Peppa Pig Theme Park In Texas

May 21, 2025

Planning Your Trip To The New Peppa Pig Theme Park In Texas

May 21, 2025 -

Celebrating A New Baby Girl With Peppa Pig

May 21, 2025

Celebrating A New Baby Girl With Peppa Pig

May 21, 2025 -

Mummy Pig Hosts Lavish Gender Reveal At Iconic London Location

May 21, 2025

Mummy Pig Hosts Lavish Gender Reveal At Iconic London Location

May 21, 2025 -

New Peppa Pig Theme Park A Guide For Texas Families

May 21, 2025

New Peppa Pig Theme Park A Guide For Texas Families

May 21, 2025