D-Wave Quantum (QBTS): Analyzing The Stock's Decline On Monday

Table of Contents

Market-Wide Influences on QBTS Stock Performance

Several market-wide factors likely contributed to the QBTS stock decline on Monday. Understanding these broader influences is crucial for a comprehensive analysis.

Overall Market Sentiment

Monday's market performance played a role in QBTS's drop. The overall market sentiment was negatively impacted by several factors.

- Nasdaq Performance: The Nasdaq Composite, a key technology index, experienced a [insert percentage]% decline on Monday, reflecting a broader sell-off in the technology sector. This general negative sentiment often spills over into individual tech stocks, including those in the emerging quantum computing field.

- Economic Anxieties: [Mention specific macroeconomic news, e.g., inflation concerns, interest rate hikes, or geopolitical instability] contributed to a risk-off environment, causing investors to move away from higher-risk investments like QBTS stock. Uncertainty in the broader economy often leads to reduced investment in speculative sectors.

This general market negativity likely exacerbated the decline in QBTS stock, creating a downward pressure independent of company-specific news.

Investor Sentiment Towards Quantum Computing Stocks

Investor sentiment towards quantum computing stocks, while generally optimistic long-term, can be quite volatile in the short-term.

- Risk Aversion: The quantum computing sector is still relatively nascent, making it susceptible to shifts in investor risk appetite. A general increase in risk aversion across markets often leads to investors moving capital away from more speculative investments, such as quantum computing stocks.

- Recent Funding Rounds: While recent funding rounds in the quantum computing sector have been positive overall, any news of slower than expected progress or reduced investment in certain companies could negatively impact investor sentiment across the board, impacting the price of QBTS stock. Investors closely monitor funding announcements and the overall investment climate.

D-Wave Quantum (QBTS)-Specific News and Developments

Beyond market-wide influences, company-specific news and developments also played a role in the QBTS stock decline.

Recent Company Announcements

Any negative news surrounding D-Wave Quantum around the time of the stock decline would significantly contribute to the downturn.

- [Insert Specific Announcement, e.g., Delayed Product Launch]: If D-Wave Quantum announced a delay in a significant product launch or a setback in research and development, this would likely negatively impact investor confidence and lead to a stock price decrease. [Link to news article if available].

- [Insert Specific Announcement, e.g., Lower than Expected Earnings]: If the company released financial reports showing lower-than-expected earnings or revenue, this would undoubtedly trigger selling pressure, contributing to the QBTS stock decline. Investors react strongly to financial performance updates.

Analyst Ratings and Price Targets

Changes in analyst ratings and price targets can significantly impact a stock's price.

- Downgrades: If prominent analysts downgraded their ratings or lowered their price targets for QBTS, this would likely influence investor sentiment negatively and contribute to selling pressure. [Mention specific analysts and their rating changes if available].

- Consensus Estimate Changes: A shift in the consensus estimate for QBTS's future performance, reflecting a less optimistic outlook, would also contribute to a price decline. Investors closely watch the consensus opinion of financial analysts.

Technical Analysis of QBTS Stock Chart

A technical analysis of the QBTS stock chart offers further insights into Monday's decline.

Chart Patterns and Indicators

Analyzing chart patterns can reveal clues about price movements.

- Support and Resistance Levels: A break below a key support level could signal increased selling pressure. Examining the chart for any significant breaches of support or resistance levels on Monday will help explain the sudden drop in QBTS stock. [Include chart image if possible].

- Moving Averages: The relationship between the QBTS stock price and its moving averages (e.g., 50-day, 200-day) can provide insights into the trend and potential reversals. A crossing below a key moving average can be a bearish signal.

Trading Volume and Volatility

Trading volume and volatility provide additional context to the price movement.

- High Trading Volume: An unusually high trading volume on Monday suggests significant selling pressure. High volume during a price drop confirms the strength of the downward movement.

- Increased Volatility: Increased volatility, reflecting larger price swings, points to heightened uncertainty and investor anxiety surrounding QBTS stock. This instability contributes to the overall decline.

Conclusion

The D-Wave Quantum (QBTS) stock decline on Monday was likely a result of a confluence of factors. Broader market negativity, affecting the technology sector and fueled by economic anxieties, combined with potentially negative company-specific news and a bearish technical outlook, all contributed to the price drop. Understanding the interplay between market-wide influences and D-Wave Quantum-specific developments is critical for interpreting the stock's performance. While investing in D-Wave Quantum (QBTS) carries inherent risks, remaining informed about developments in the quantum computing sector and continuously monitoring the QBTS stock is essential. Conduct thorough research before making any investment decisions related to QBTS stock or other quantum computing stocks. Remember that this analysis is for informational purposes only and not financial advice.

Featured Posts

-

Reddits Viral Kidnapping Hoax The Sydney Sweeney Movie Connection

May 21, 2025

Reddits Viral Kidnapping Hoax The Sydney Sweeney Movie Connection

May 21, 2025 -

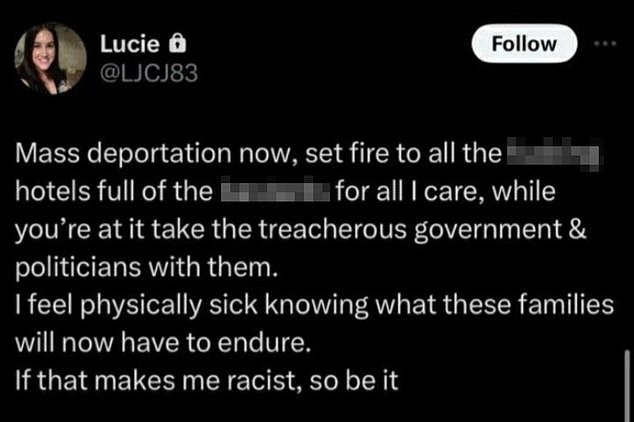

Southport Case Highlights Dangers Of Online Racial Hatred Tory Councillors Wife Jailed

May 21, 2025

Southport Case Highlights Dangers Of Online Racial Hatred Tory Councillors Wife Jailed

May 21, 2025 -

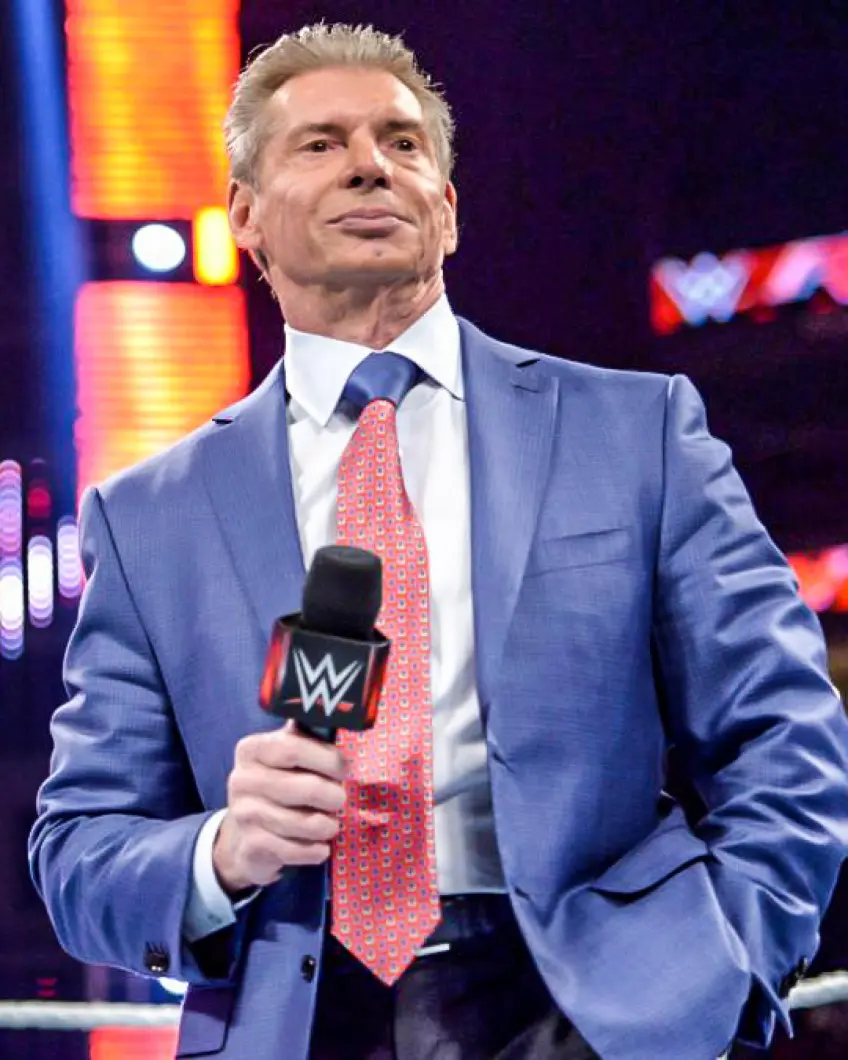

Wwe Backstage Buzz Hinchcliffes Reportedly Unsuccessful Appearance

May 21, 2025

Wwe Backstage Buzz Hinchcliffes Reportedly Unsuccessful Appearance

May 21, 2025 -

Abn Amro En Transferz Samenwerking Voor Een Innovatief Digitaal Platform

May 21, 2025

Abn Amro En Transferz Samenwerking Voor Een Innovatief Digitaal Platform

May 21, 2025 -

Louths Young Food Hero From Startup To Business Consultant

May 21, 2025

Louths Young Food Hero From Startup To Business Consultant

May 21, 2025