D-Wave Quantum (QBTS) Stock: A Quantum Leap Or A Risky Investment?

Table of Contents

Understanding D-Wave Quantum's Technology and Business Model

D-Wave's unique approach to quantum computing relies on quantum annealing, a method designed to solve complex optimization problems. Unlike gate-based quantum computers aiming for universal computation, D-Wave focuses on specific types of problems where its technology excels.

-

Quantum Annealing: This process uses quantum mechanics to find the lowest energy state of a system, representing the optimal solution to a given problem. This is particularly beneficial for tackling optimization challenges in logistics, finance, materials science, and artificial intelligence.

-

Target Market: D-Wave primarily targets businesses facing complex optimization problems that are intractable for classical computers. This includes companies seeking to improve supply chain efficiency, optimize financial portfolios, or design new materials with enhanced properties.

-

Revenue Streams: D-Wave generates revenue through the sale of its quantum computing systems (like the D-Wave Advantage system) and its cloud-based platform, the Leap quantum cloud service. Subscription-based access to their quantum computers allows businesses to experiment with and leverage quantum computing power without the massive upfront investment of owning a system.

-

Future Growth Potential: D-Wave's future growth hinges on expanding its customer base, developing more powerful quantum annealing systems, and broadening its software and application ecosystem. The integration of quantum annealing with classical computing – hybrid quantum-classical computing – offers a significant pathway for near-term applications and revenue generation.

Analyzing D-Wave Quantum's Financial Performance and Market Position

Analyzing D-Wave's financial performance requires careful consideration of its stage of development. While revenue is growing, profitability remains a challenge, typical of a company operating in a nascent industry.

-

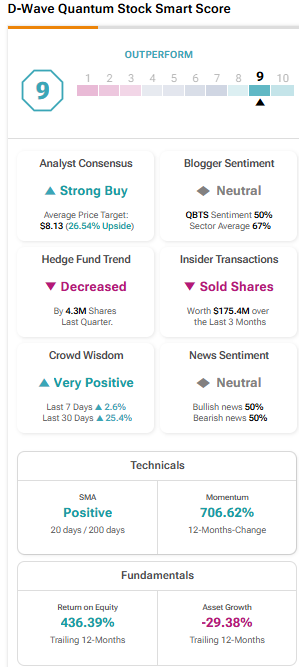

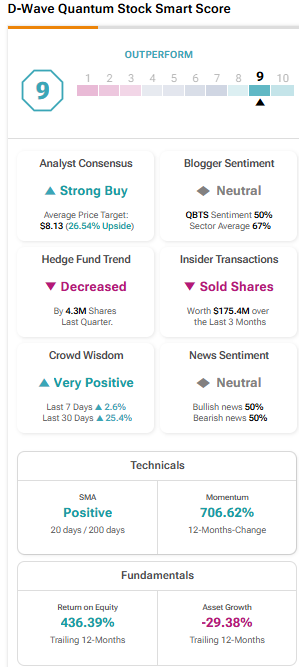

QBTS Stock Price & Market Cap: Tracking the QBTS stock price and market capitalization provides an indication of investor sentiment and overall valuation. This needs to be viewed in context with the overall quantum computing market size and the company's position within it.

-

Revenue Growth: Examining D-Wave's revenue growth trajectory provides insights into market acceptance and the effectiveness of its business model. Growth in cloud subscriptions and system sales is key to assessing its financial health.

-

Competitor Analysis: D-Wave faces competition from other quantum computing companies like IBM, Google, and IonQ, each with their distinct approaches and strengths. A comprehensive competitor analysis is crucial for understanding D-Wave's competitive advantages and disadvantages.

-

Profitability: At this stage, focusing on revenue growth and market share is more important than immediate profitability. However, a path towards sustainable profitability needs to be clearly defined in D-Wave's long-term strategy.

Assessing the Risks and Rewards of Investing in QBTS Stock

Investing in QBTS stock is inherently speculative, carrying both substantial risks and potential rewards.

-

Potential Risks:

- Technological Challenges: Advancements in quantum computing are unpredictable. D-Wave might face technological hurdles in improving its quantum annealing technology or scaling it to tackle even more complex problems.

- Competition: Intense competition from established tech giants and emerging startups could limit D-Wave's market share and growth potential.

- Market Volatility: The stock market can be unpredictable, particularly for stocks of companies in nascent industries. QBTS stock price can fluctuate significantly based on market sentiment and news related to the quantum computing field.

- Regulatory Uncertainty: Government regulations regarding quantum computing could impact D-Wave's operations and growth prospects.

-

Potential Rewards:

- Early Investment: Investing early in a potentially transformative technology like quantum computing could yield significant returns if D-Wave achieves widespread adoption of its technology.

- Long-Term Growth: The long-term growth potential for the quantum computing market is enormous, making D-Wave a potentially valuable investment in a high-growth sector.

-

Investment Strategy: Diversification and appropriate risk tolerance are essential when considering an investment in QBTS. Don't put all your eggs in one basket, especially in a high-risk, high-reward investment like this.

Factors Influencing the Future of D-Wave Quantum (QBTS) Stock

Several factors will significantly influence the future trajectory of D-Wave Quantum and its stock price.

-

Quantum Computing Technology Advancements: Breakthroughs in quantum annealing technology, as well as the development of hybrid quantum-classical algorithms, are crucial for D-Wave's success.

-

Government Policy & Funding: Government funding and regulatory frameworks supporting the development and adoption of quantum computing technologies will play a vital role in shaping the industry's landscape.

-

Industry Adoption: Increased adoption of quantum computing solutions across various sectors will be a major driver of D-Wave's growth. Success in demonstrating real-world applications will be essential.

-

Strategic Partnerships & Collaborations: Partnerships with leading technology companies and research institutions can accelerate D-Wave's technological development and market penetration.

Conclusion: Is D-Wave Quantum (QBTS) Stock Right for You?

Investing in D-Wave Quantum (QBTS) presents a high-risk, high-reward opportunity. While the potential for long-term growth in the quantum computing market is significant, several challenges and risks need careful consideration. Before investing in QBTS stock, it is crucial to thoroughly understand the company's business model, financial performance, and the competitive landscape. Conduct thorough due diligence, consult with a financial advisor, and only invest what you can afford to lose. Remember, this is a quantum leap into a largely unproven technology, so proceed with caution and a well-informed investment strategy. Further research into D-Wave's publications and financial reports is recommended before making any investment decisions. [Link to D-Wave's Investor Relations page] [Link to relevant financial news sources]. Is D-Wave Quantum the right investment for you? Only you can answer that after careful consideration of the potential for a quantum leap, alongside the significant inherent risks.

Featured Posts

-

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal Awaiting Decision

May 21, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal Awaiting Decision

May 21, 2025 -

Benjamin Kaellman Huuhkajien Uusi Taehti Maalivire Ja Kasvu Kentillae Ja Niiden Ulkopuolella

May 21, 2025

Benjamin Kaellman Huuhkajien Uusi Taehti Maalivire Ja Kasvu Kentillae Ja Niiden Ulkopuolella

May 21, 2025 -

The Heartwarming Story Behind Peppa Pigs New Baby Sisters Name

May 21, 2025

The Heartwarming Story Behind Peppa Pigs New Baby Sisters Name

May 21, 2025 -

One Child Missing Another Injured Train Kills Two Adults On Railroad Bridge

May 21, 2025

One Child Missing Another Injured Train Kills Two Adults On Railroad Bridge

May 21, 2025 -

Vanja Mijatovic O Razvodu Nije Me Ostavio Zbog Kilograma

May 21, 2025

Vanja Mijatovic O Razvodu Nije Me Ostavio Zbog Kilograma

May 21, 2025