D-Wave Quantum (QBTS) Stock Crash: Understanding Monday's Sharp Decline

Table of Contents

Analyzing the Immediate Triggers of the QBTS Stock Decline

Several factors likely converged to cause the sharp decline in QBTS stock on Monday. Understanding these immediate triggers is crucial for assessing the situation's severity and potential long-term implications.

News and Press Releases

Negative news or announcements can significantly impact stock prices. While specific information surrounding Monday's QBTS crash may require further investigation, potential factors could include:

- Disappointing Earnings Report: A less-than-expected earnings report, showing lower-than-projected revenue or increased losses, could have spooked investors. Links to financial reports would be crucial here to support this analysis. (Insert link to hypothetical D-Wave earnings report if available)

- Project Delays: Delays in significant project milestones or the rollout of new quantum computing technologies could signal challenges in D-Wave's development timeline, impacting investor confidence. (Insert link to relevant news articles about potential delays if available).

- Negative Analyst Ratings: Downgrades from influential financial analysts could contribute to a sell-off as investors adjust their expectations and portfolio allocations. (Insert link to hypothetical analyst reports if available).

Market Sentiment and Overall Market Conditions

The broader market context is essential. Monday's QBTS stock decline may not be solely attributable to D-Wave-specific news.

- Tech Stock Sell-Off: A general sell-off in the technology sector, perhaps triggered by broader economic concerns or interest rate hikes, could have negatively impacted QBTS, as it's a technology stock. References to the performance of relevant indices like the NASDAQ Composite on that day would be valuable here. (Insert data on NASDAQ performance on the relevant Monday).

- Investor Sentiment: Overall investor sentiment towards growth stocks, particularly in the relatively nascent quantum computing sector, could have played a role. A shift towards risk aversion could lead to a sell-off in higher-risk investments like QBTS.

Short Selling and Trading Activity

Increased short selling or unusual trading activity can exacerbate downward price pressure.

- Short Interest Data: Analyzing data on short interest in QBTS could reveal whether a significant portion of the stock was shorted, potentially contributing to the sell-off. (Insert data on short interest if available).

- Unusual Trading Volume: A surge in trading volume beyond typical levels might indicate significant selling pressure from investors. (Insert data on trading volume if available).

- Options Activity: Unusual activity in options markets could also suggest speculative trading that amplified the price decline. (Insert data on options activity if available).

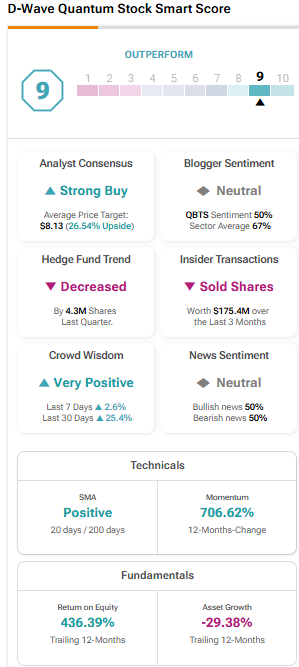

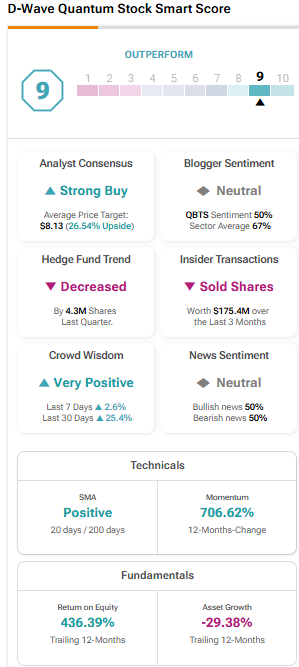

Long-Term Factors Contributing to QBTS Stock Volatility

Understanding the long-term factors affecting D-Wave Quantum's stock performance is crucial for assessing its investment potential.

Competition in the Quantum Computing Sector

D-Wave faces stiff competition in the quantum computing space from major players like IBM, Google, and IonQ.

- Technological Advancements: The rapid pace of technological advancements in quantum computing means that maintaining a competitive edge requires continuous innovation and significant investment.

- Market Share: D-Wave's market share relative to competitors, especially in specific applications of quantum computing, is a critical factor influencing investor perception.

- Funding Levels: The amount of funding secured by D-Wave compared to its rivals reflects investor confidence and market positioning.

Investor Expectations and the Hype Cycle

The quantum computing sector is prone to hype cycles, with periods of intense investor enthusiasm followed by corrections.

- Overvaluation: D-Wave's stock price might have become overvalued during periods of heightened market optimism, making it vulnerable to corrections.

- Hype vs. Reality: A mismatch between investor expectations about the speed of technological progress and D-Wave's actual achievements can lead to price volatility.

Financial Performance and Business Model

D-Wave's financial performance and the viability of its business model are critical long-term considerations.

- Revenue and Profitability: Consistent revenue growth and the path to profitability are crucial factors for sustained investor confidence. (Insert relevant financial figures if available).

- Cash Flow: Strong positive cash flow indicates a financially healthy company capable of weathering market downturns. (Insert relevant financial figures if available).

- Scalability: The scalability of D-Wave's technology and business model determines its potential for long-term growth.

Conclusion: Navigating the Future of D-Wave Quantum (QBTS) Stock

The QBTS stock crash on Monday was likely a result of a confluence of factors, including short-term market triggers like negative news and broader market trends, as well as longer-term concerns about competition, investor expectations, and the company's financial performance. Investing in volatile stocks like QBTS requires careful consideration of both immediate events and underlying business fundamentals. Investors need to approach D-Wave Quantum and similar quantum computing stocks with caution, conducting thorough due diligence before making any investment decisions. Understanding the complexities of the D-Wave Quantum (QBTS) stock requires continuous monitoring of the market. Stay informed and make well-researched investment choices.

Featured Posts

-

Rtl Groups Streaming Business Progress Towards Profitability

May 20, 2025

Rtl Groups Streaming Business Progress Towards Profitability

May 20, 2025 -

Rusenje Daytonskog Sporazuma Sta Gubi Politicko Sarajevo

May 20, 2025

Rusenje Daytonskog Sporazuma Sta Gubi Politicko Sarajevo

May 20, 2025 -

Man Utd Joins Arsenal In Pursuit Of Matheus Cunha

May 20, 2025

Man Utd Joins Arsenal In Pursuit Of Matheus Cunha

May 20, 2025 -

Broadcast Networks Abc Cbs And Nbc Face Criticism For Censoring New Mexico Gop Arson Attack Coverage

May 20, 2025

Broadcast Networks Abc Cbs And Nbc Face Criticism For Censoring New Mexico Gop Arson Attack Coverage

May 20, 2025 -

Wireless Headphones A Comprehensive Guide To The Latest Enhancements

May 20, 2025

Wireless Headphones A Comprehensive Guide To The Latest Enhancements

May 20, 2025

Latest Posts

-

Roxanne Perez And Rhea Ripley Qualify For The 2025 Money In The Bank Ladder Match

May 20, 2025

Roxanne Perez And Rhea Ripley Qualify For The 2025 Money In The Bank Ladder Match

May 20, 2025 -

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025 -

2025 Money In The Bank Perez And Ripley Earn Their Place In The Ladder Match

May 20, 2025

2025 Money In The Bank Perez And Ripley Earn Their Place In The Ladder Match

May 20, 2025 -

Rhea Ripley And Roxanne Perez 2025 Money In The Bank Ladder Match Qualifiers

May 20, 2025

Rhea Ripley And Roxanne Perez 2025 Money In The Bank Ladder Match Qualifiers

May 20, 2025 -

Avauskokoonpano Julkistettu Kamara Ja Pukki Vaihtopenkillae

May 20, 2025

Avauskokoonpano Julkistettu Kamara Ja Pukki Vaihtopenkillae

May 20, 2025