D-Wave Quantum (QBTS) Stock Decline Explained: Thursday's Market Activity

Table of Contents

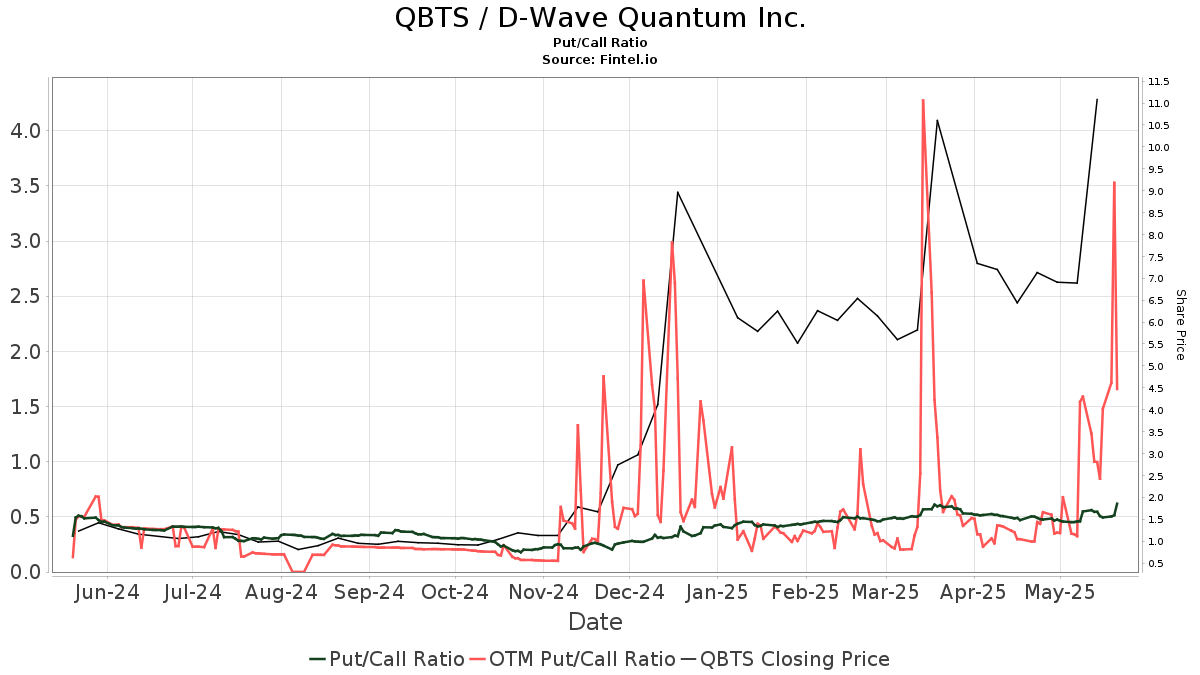

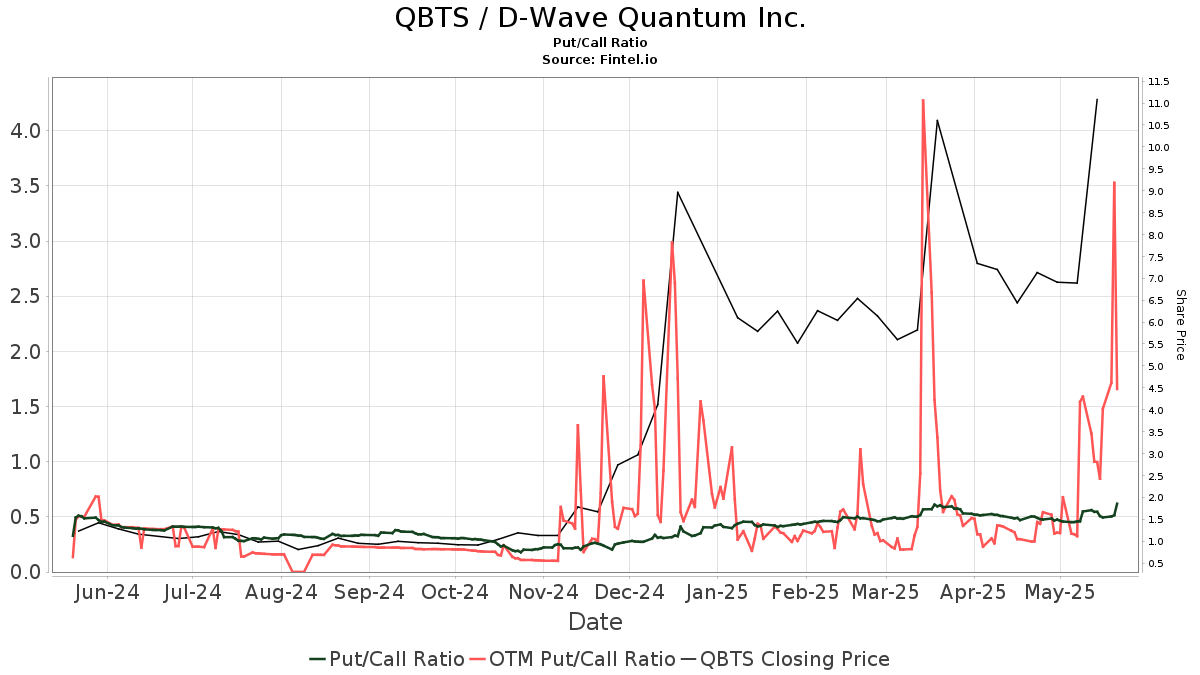

Impact of Recent Earnings Reports on QBTS Stock Price: The recent D-Wave Quantum earnings report, released [Insert Date], likely played a significant role in Thursday's QBTS stock decline. Investors closely scrutinize financial performance, and any deviation from expectations can trigger market reactions. Analyzing the QBTS financial performance reveals some key areas of concern.

- Revenue figures fell short of analyst expectations. [Insert specific numbers and percentage shortfall]. This shortfall indicates weaker-than-anticipated demand for D-Wave's quantum computing solutions, raising concerns about the company's growth trajectory and revenue projections. The disparity between projected and actual QBTS revenue impacted investor confidence.

- Increased operating losses were reported. [Insert specific numbers and comparison to previous periods]. The widening operating losses underscore the challenges D-Wave faces in balancing research and development investments with profitability. This negative aspect of D-Wave Quantum earnings likely contributed to the negative investor sentiment.

- Negative or cautious future guidance impacted investor confidence. [Quote from the earnings report highlighting cautious outlook]. A less-than-optimistic outlook on future QBTS revenue and profitability further fueled the sell-off, as investors reacted to the uncertainty surrounding the company's financial future. The combination of these factors related to D-Wave Quantum earnings significantly impacted the QBTS stock price.

Broader Market Trends and Their Influence on QBTS: It's crucial to consider the broader market context when analyzing the QBTS stock decline. Thursday's market activity wasn't isolated to D-Wave Quantum; broader trends likely amplified the negative impact.

- Overall market sell-off due to macroeconomic factors. [Mention specific macroeconomic factors, e.g., rising interest rates, inflation concerns]. A general market downturn can negatively impact even fundamentally strong companies, particularly high-growth tech stocks like QBTS.

- Sector-specific decline in quantum computing stocks. [Mention any overall weakness in the quantum computing sector on Thursday]. If the entire sector experienced a downturn, it would exacerbate the negative pressure on QBTS stock, irrespective of its individual performance.

- Increased investor risk aversion affecting high-growth tech stocks like QBTS. During periods of market volatility, investors often shift towards safer investments, leading to sell-offs in riskier, high-growth sectors like quantum computing. This increased investor risk aversion likely played a role in the QBTS stock decline.

Analyst Ratings and Price Target Revisions for D-Wave Quantum: Analyst opinions significantly influence investor sentiment and trading activity. Any changes in analyst ratings or price targets around Thursday's decline warrant examination.

- Key investment banks lowered their price targets for QBTS stock. [Mention specific banks and the degree of the price target reduction]. Lowered price targets reflect analysts' revised expectations for future QBTS stock performance, further contributing to selling pressure.

- Negative analyst reports citing concerns about the company's future prospects. [Summarize key concerns raised by analysts]. Negative reports, highlighting concerns about competition, technology development, or financial sustainability, can significantly impact investor confidence.

- Changes in overall analyst consensus contributed to the selling pressure. A shift in the overall analyst consensus towards a more negative view of D-Wave Quantum further amplified the downward pressure on QBTS stock. The negative sentiment among analysts likely led to a cascade effect, pushing the QBTS stock price lower.

Specific News or Events Affecting QBTS Stock: [If applicable, detail any specific news or events, such as a competitor's announcement, a regulatory change impacting the quantum computing industry, or a significant contract loss. Analyze the event's impact and its likely contribution to the QBTS stock decline. Include bullet points detailing the event and its repercussions.]

Conclusion: The decline in D-Wave Quantum (QBTS) stock on Thursday was likely a confluence of factors. Disappointing D-Wave Quantum earnings, featuring lower-than-expected QBTS revenue and increased operating losses, coupled with broader market trends and negative analyst sentiment, all contributed to the sell-off. Specific news events [if any] further exacerbated the negative pressure on the QBTS stock price. Understanding these intertwined factors is crucial for navigating the volatility surrounding D-Wave Quantum (QBTS) stock. Stay informed about the future performance of D-Wave Quantum (QBTS) stock by regularly checking for updates and news related to QBTS financial performance and market trends. Understanding these factors is crucial for making informed decisions about investing in D-Wave Quantum (QBTS).

Featured Posts

-

L Alfa Romeo Junior 1 2 Turbo Speciale Sous La Loupe De Le Matin Auto

May 21, 2025

L Alfa Romeo Junior 1 2 Turbo Speciale Sous La Loupe De Le Matin Auto

May 21, 2025 -

Vybz Kartel Speaks Out Prison Life Freedom Family And New Music

May 21, 2025

Vybz Kartel Speaks Out Prison Life Freedom Family And New Music

May 21, 2025 -

500 000 Bribery Scheme Leads To 30 Year Sentence For Retired Navy Admiral

May 21, 2025

500 000 Bribery Scheme Leads To 30 Year Sentence For Retired Navy Admiral

May 21, 2025 -

Watch Peppa Pig Online A Complete Guide To Free Streaming

May 21, 2025

Watch Peppa Pig Online A Complete Guide To Free Streaming

May 21, 2025 -

Is Love Monster A Good Book For Your Child A Comprehensive Review

May 21, 2025

Is Love Monster A Good Book For Your Child A Comprehensive Review

May 21, 2025