D-Wave Quantum (QBTS) Stock Jump: Analyzing Monday's Price Increase

Table of Contents

Monday saw a significant and unexpected jump in D-Wave Quantum (QBTS) stock price, leaving many investors wondering about the reasons behind this surge. This article delves into the potential factors contributing to this exciting development, examining market trends, recent company news, and the broader implications for those interested in quantum computing stocks. We'll analyze the reasons behind this increase and provide insights into what this might mean for the future of QBTS and the burgeoning quantum computing sector.

Analyzing the QBTS Stock Price Increase

Several factors likely contributed to the QBTS stock price increase on Monday. Let's break down the key elements:

Market Sentiment and Investor Interest

The quantum computing sector is experiencing a wave of optimism, significantly impacting QBTS. This positive sentiment stems from several sources:

- Increased media coverage of quantum computing advancements: Recent breakthroughs in quantum computing are generating significant media attention, increasing public awareness and investor interest in the field. This heightened visibility translates into increased demand for quantum computing stocks, including QBTS.

- Growing institutional investor interest in the sector: Major investment firms are increasingly allocating capital to quantum computing, recognizing its transformative potential across various industries. This institutional backing provides stability and fuels further investment in the sector.

- Positive analyst reports and price target adjustments: Favorable analyst reports and upward revisions of price targets for QBTS and other quantum computing companies signal growing confidence in the sector's future prospects. These reports often influence investment decisions.

- Potential impact of competitor's news and advancements: While seemingly counterintuitive, positive news from competitors can sometimes benefit the entire sector, including QBTS. Increased overall attention and investment in quantum computing can lift all boats, albeit to varying degrees.

Recent D-Wave Quantum News and Announcements

While specific news directly causing Monday's jump may not be publicly available immediately, it's crucial to consider potential company-related factors:

- New contract wins or significant partnerships: Securing large contracts with major corporations or forming strategic partnerships with influential players in related industries could significantly boost investor confidence and drive up the stock price.

- Successful product launches or technological breakthroughs: Announcing the successful launch of a new product or a major technological breakthrough in D-Wave's quantum computing technology would undoubtedly be a positive catalyst for the stock price.

- Announcements regarding future development plans or strategic initiatives: Positive updates regarding the company's future roadmap, such as significant investments in R&D or expansion into new market segments, can signal growth potential and attract investors.

- Impact of any regulatory approvals or changes: Favorable regulatory decisions or changes in policy that benefit the quantum computing industry could have a positive ripple effect on QBTS's stock price.

Broader Market Trends and Macroeconomic Factors

It's important to consider the broader economic context when analyzing QBTS's stock performance:

- Overall stock market performance on Monday: A generally positive day in the overall stock market can contribute to a rising tide that lifts all boats, including QBTS.

- Performance of other technology stocks and quantum computing competitors: The performance of similar technology stocks and competing quantum computing companies can influence investor sentiment and investment flows within the sector.

- Impact of interest rate changes or economic forecasts: Changes in interest rates or economic forecasts can significantly impact investor behavior, affecting the overall market and sector-specific stocks like QBTS.

- Influence of geopolitical events: Major geopolitical events can create market uncertainty and volatility, impacting investor decisions across all sectors, including quantum computing.

Understanding the Risks and Opportunities in QBTS

Investing in QBTS, like any investment in early-stage technology, comes with both significant risks and considerable opportunities.

Volatility in the Quantum Computing Sector

The quantum computing sector is inherently volatile:

- Risks associated with technological challenges and development delays: Developing quantum computing technology is complex and challenging. Delays in achieving milestones or encountering unforeseen technological hurdles can significantly impact the stock price.

- Competition from larger established technology companies: D-Wave faces competition from larger tech companies with substantial resources invested in quantum computing research and development. This competition creates uncertainty and potential market share challenges.

- Uncertainty regarding long-term market adoption and profitability: The long-term market adoption of quantum computing technology and the ultimate profitability of companies in the sector remain uncertain.

Potential for Future Growth and Returns

Despite the risks, the potential rewards for investing in QBTS are substantial:

- Market projections for the quantum computing industry: Market research projects significant growth in the quantum computing industry over the coming years, suggesting substantial potential for QBTS to capitalize on this growth.

- D-Wave's competitive advantages and unique technology: D-Wave possesses unique technology and expertise in the quantum computing field, giving it a competitive edge in the market.

- Potential for significant returns on investment if the company meets expectations: If D-Wave successfully executes its business plan and achieves its technological goals, investors could see significant returns on their investment.

- Risk/Reward analysis for QBTS investors: A thorough risk/reward assessment is crucial before investing in QBTS. Consider your risk tolerance and investment goals before making any decisions.

Conclusion

This analysis explored the various factors potentially contributing to the recent increase in D-Wave Quantum (QBTS) stock price, including positive market sentiment, potential company-specific news, and broader economic conditions. While the quantum computing sector offers substantial long-term potential, investors should carefully weigh the associated risks and volatility inherent in early-stage technology investments.

Understanding the complexities behind Monday's QBTS stock jump is crucial for informed investment decisions. Further research into D-Wave Quantum's technology, market position, and future prospects is essential before investing in QBTS or other quantum computing stocks. Stay informed about future developments in D-Wave Quantum and the broader quantum computing industry to make well-informed decisions regarding your D-Wave Quantum (QBTS) investment.

Featured Posts

-

Winter Weather Advisory Understanding School Delays And Closures

May 20, 2025

Winter Weather Advisory Understanding School Delays And Closures

May 20, 2025 -

Hmrc Savings Debt A Guide For Thousands Of Unknowing Taxpayers

May 20, 2025

Hmrc Savings Debt A Guide For Thousands Of Unknowing Taxpayers

May 20, 2025 -

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025 -

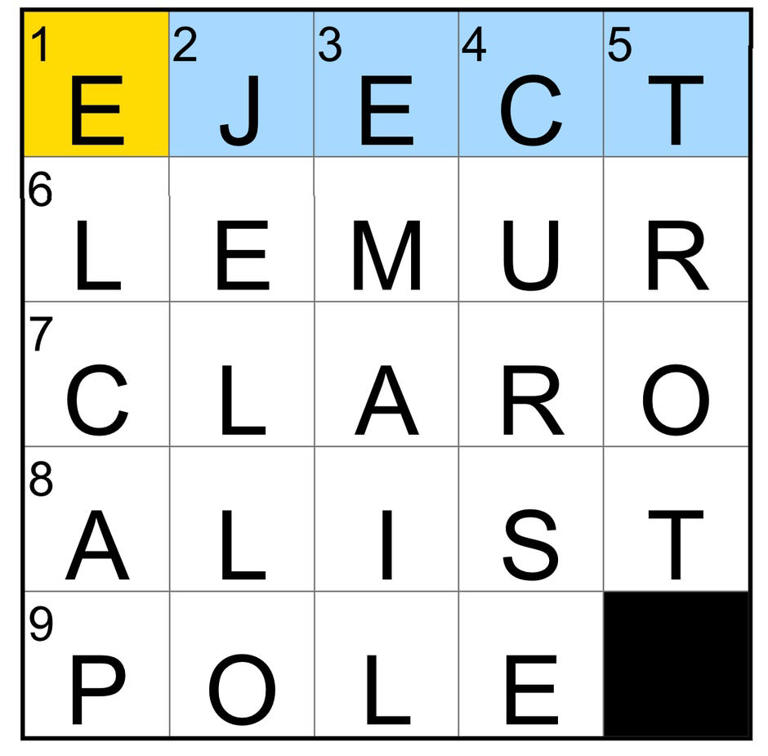

Nyt Mini Crossword April 18 2025 Complete Solutions And Clues

May 20, 2025

Nyt Mini Crossword April 18 2025 Complete Solutions And Clues

May 20, 2025 -

Is There A Bbc Agatha Christie Deepfake An Investigation

May 20, 2025

Is There A Bbc Agatha Christie Deepfake An Investigation

May 20, 2025

Latest Posts

-

Sandylands U Tv Schedule Where To Watch

May 21, 2025

Sandylands U Tv Schedule Where To Watch

May 21, 2025 -

Find Sandylands U On Tv A Comprehensive Guide

May 21, 2025

Find Sandylands U On Tv A Comprehensive Guide

May 21, 2025 -

Sandylands U Tv Listings And Showtimes

May 21, 2025

Sandylands U Tv Listings And Showtimes

May 21, 2025 -

Stan Approves David Walliams Fantasy Novel Adaptation Fing

May 21, 2025

Stan Approves David Walliams Fantasy Novel Adaptation Fing

May 21, 2025 -

David Walliams Fing Stans New Fantasy Production

May 21, 2025

David Walliams Fing Stans New Fantasy Production

May 21, 2025