D-Wave Quantum (QBTS) Stock Market Performance: Explaining Monday's Sharp Decrease

Table of Contents

Monday saw a significant drop in D-Wave Quantum (QBTS) stock price, leaving many investors scrambling for answers. This sharp decrease in the share price raises crucial questions about the future of this prominent player in the burgeoning quantum computing industry. This article delves into the potential factors behind Monday's QBTS stock plunge, examining both market-wide influences and company-specific news that likely contributed to the downturn. We will analyze the situation to provide insights for navigating the volatility inherent in the quantum computing investment landscape.

Market-Wide Factors Influencing QBTS Stock Performance

Several macroeconomic and industry-wide trends may have contributed to Monday's QBTS stock price decline. Understanding these broader market forces is crucial for a complete picture.

Overall Market Sentiment

Monday's market performance was characterized by a general negative sentiment across various sectors. The overall stock market experienced a downturn, impacting not only QBTS but also other technology stocks. This negative investor sentiment stemmed from several factors, including:

- Rising Interest Rates: Continued increases in interest rates by central banks globally created a risk-averse environment, prompting investors to move away from riskier assets like technology stocks, including QBTS.

- Inflationary Concerns: Persistent inflationary pressures fueled uncertainty about economic growth, further dampening investor confidence and leading to a sell-off in many growth stocks.

- Broader Tech Sector Sell-Off: The tech sector, particularly growth-oriented companies, faced a broader sell-off as investors reassessed valuations in light of economic uncertainties. This general negativity inevitably spilled over to companies like D-Wave Quantum.

Sector-Specific Trends

The quantum computing sector, while promising, is still relatively nascent. Its susceptibility to broader market fluctuations is amplified by factors specific to the industry:

- Intense Competition: The quantum computing field is highly competitive, with multiple companies vying for market share and investment. News regarding competitors' advancements or funding rounds could indirectly influence investor perception of QBTS.

- Slower-than-Expected Adoption: The practical application of quantum computing technology is still in its early stages. Any news highlighting slower-than-anticipated adoption rates or technological hurdles could dampen investor enthusiasm for the entire sector, impacting QBTS's share price.

- Regulatory Uncertainty: The regulatory landscape for quantum computing is still evolving. Uncertainty about future regulations or potential policy changes can increase investor caution and lead to market volatility.

D-Wave Quantum (QBTS)-Specific News and Developments

Beyond market-wide trends, factors specific to D-Wave Quantum might have contributed to Monday's stock price drop. Let's explore some possibilities.

Absence of Positive Catalysts

The lack of positive news or significant developments from D-Wave Quantum itself could have disappointed investors expecting strong performance indicators. This includes:

- Missed Earnings Expectations: If D-Wave Quantum released earnings reports that fell short of analyst expectations, it could have triggered a sell-off.

- Project Delays: Any announcements regarding delays in significant projects or partnerships could also negatively impact investor confidence.

- Lack of Major Partnerships: The absence of new strategic partnerships or collaborations could signal slower-than-expected progress, discouraging investors.

Potential Negative News or Speculation

Negative speculation or unconfirmed news reports, even if ultimately unfounded, can significantly impact a company's stock price. Potential factors include:

- Rumors of Funding Challenges: Speculation about difficulties securing further funding or concerns about the company's financial health could trigger investor anxieties.

- Concerns about Market Share: Negative press or analyst reports highlighting concerns about D-Wave Quantum losing market share to competitors could contribute to a stock price decline.

- Regulatory Scrutiny: Any indication of increased regulatory scrutiny or potential legal challenges could also negatively impact investor sentiment and the QBTS share price.

Technical Analysis of QBTS Stock Chart

Analyzing the QBTS stock chart using technical indicators can provide additional insights into Monday's drop.

Chart Patterns and Indicators

Technical analysis of the QBTS stock chart revealed several concerning patterns and indicators:

- Breakdown Below Key Support Levels: The stock price might have broken below significant support levels, triggering stop-loss orders and further downward pressure.

- Negative Divergence: A negative divergence between price and indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) could have signaled weakening momentum and foreshadowed the decline.

- High Trading Volume: High trading volume accompanying the drop suggests significant selling pressure, implying a considerable number of investors exiting their positions.

Trading Volume and Liquidity

The trading volume on Monday, compared to previous days, offers clues about the intensity of the sell-off:

- Unusually High Volume: A substantially higher trading volume on Monday compared to previous days indicates significant selling pressure.

- Low Liquidity: Low liquidity in the QBTS stock could have exacerbated the price drop, as relatively few buyers were available to absorb the selling pressure.

Conclusion

Monday's sharp decrease in D-Wave Quantum (QBTS) stock price appears to be a confluence of factors. Broader market conditions, sector-specific headwinds, and potential company-specific news or the absence of positive catalysts all played a role. While determining the precise cause requires further investigation, understanding these contributing elements is essential for investors. Continuous monitoring of QBTS stock performance, including market sentiment, company announcements, and technical indicators, remains vital for making informed investment decisions. Stay informed about D-Wave Quantum's progress and future announcements to effectively navigate the volatility of the quantum computing sector and make sound decisions regarding your D-Wave Quantum (QBTS) investments.

Featured Posts

-

Family Struck By Train Two Adults Killed Childrens Fate Uncertain

May 21, 2025

Family Struck By Train Two Adults Killed Childrens Fate Uncertain

May 21, 2025 -

Stolen Antiques Antiques Roadshow Exposes Crime Leads To Arrest

May 21, 2025

Stolen Antiques Antiques Roadshow Exposes Crime Leads To Arrest

May 21, 2025 -

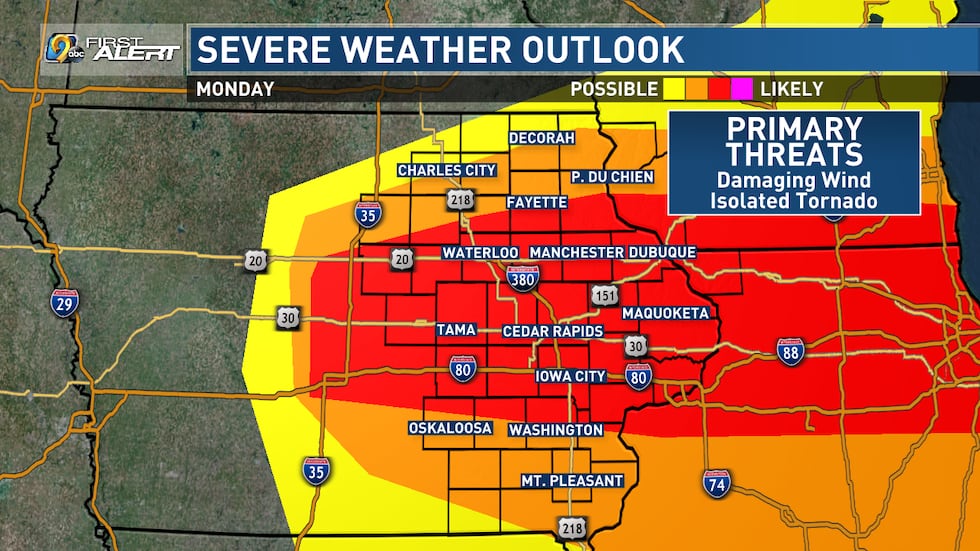

Watch Out For Damaging Winds Fast Moving Storms Explained

May 21, 2025

Watch Out For Damaging Winds Fast Moving Storms Explained

May 21, 2025 -

Is Gangsta Granny Suitable For Young Readers A Parents Guide

May 21, 2025

Is Gangsta Granny Suitable For Young Readers A Parents Guide

May 21, 2025 -

Trans Australia Run World Record Attempt Underway

May 21, 2025

Trans Australia Run World Record Attempt Underway

May 21, 2025