D-Wave Quantum (QBTS) Stock Performance: Explaining Thursday's Decrease

Table of Contents

Market Sentiment and Overall Tech Stock Performance

The performance of D-Wave Quantum (QBTS) stock is inextricably linked to the overall market sentiment, especially within the technology sector. Nascent industries like quantum computing are particularly susceptible to broader economic shifts. The volatility of QBTS reflects this sensitivity.

-

Correlation between QBTS and broader tech indices (e.g., Nasdaq): A strong negative correlation often exists between QBTS and broader tech indices like the Nasdaq. When the Nasdaq experiences a downturn, due to factors such as rising interest rates or geopolitical uncertainty, QBTS often sees a more pronounced drop, reflecting its status as a higher-risk growth stock.

-

Influence of interest rate hikes and inflation concerns on growth stocks: Interest rate hikes by central banks typically lead to decreased investor appetite for growth stocks. Companies like D-Wave Quantum, which are not yet profitable and rely heavily on future growth projections, are disproportionately affected by these shifts, as investors seek safer, higher-yield investments.

-

Investor risk aversion and its effect on speculative investments like QBTS: During periods of heightened economic uncertainty, investors often become more risk-averse. This leads them to divest from speculative investments, like those in the quantum computing sector, in favor of more established and less volatile assets. The resulting sell-off can significantly impact the price of QBTS stock.

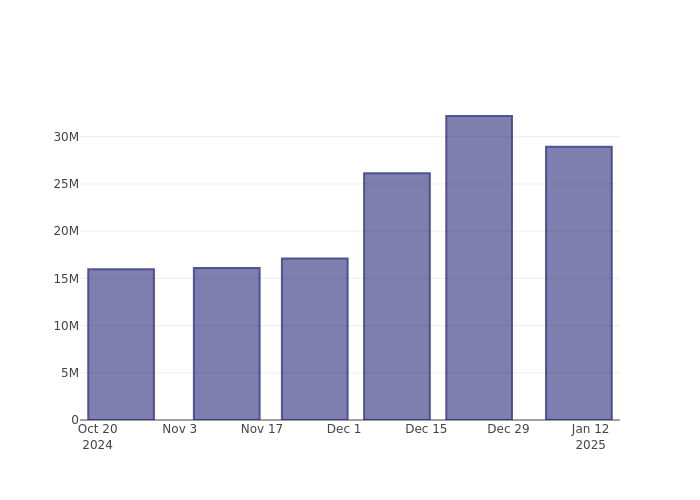

[Insert relevant chart here showing the correlation between QBTS and a major tech index like the Nasdaq over a specific period.]

D-Wave Quantum (QBTS) Specific News and Developments

Company-specific news plays a significant role in shaping investor sentiment and, consequently, the QBTS stock price. Negative news can trigger sell-offs, while positive announcements can boost investor confidence. Let's examine potential factors:

-

Any announcements regarding financial performance (earnings reports, revised guidance): Disappointing earnings reports or a downward revision of future financial guidance can significantly impact investor confidence. Any indication of slower-than-expected revenue growth or increased operating losses could trigger a sell-off.

-

New partnerships or contract wins/losses: Securing significant partnerships with major corporations or winning large contracts can positively impact QBTS stock. Conversely, the loss of key partnerships or failure to secure anticipated contracts can negatively affect investor sentiment.

-

Developments related to product launches or technological breakthroughs (or lack thereof): Successful product launches or significant technological advancements can generate considerable excitement and drive up the stock price. Conversely, a lack of notable progress or delays in development can lead to investor disappointment.

-

Any negative press coverage or analyst downgrades: Negative news coverage or downgrades from financial analysts can significantly impact investor confidence, leading to a decrease in the stock price. Negative sentiment can quickly spread through the market, exacerbating the price drop.

Competition and the Quantum Computing Market Landscape

The quantum computing industry is highly competitive, with several major players vying for market share. This competitive landscape significantly influences D-Wave Quantum’s performance.

-

Mention key competitors (IBM, Google, IonQ, etc.) and their recent activities: Companies like IBM, Google, and IonQ are actively developing their own quantum computing technologies and expanding their market presence. Any significant advancements by these competitors could put pressure on D-Wave Quantum's market share and stock price.

-

Analyze potential market share implications for D-Wave Quantum: D-Wave Quantum's market share is constantly being challenged by the advancements of its competitors. Any perceived loss of market share or reduced competitive advantage could negatively impact investor sentiment and the QBTS stock price.

-

Discuss advancements in competing quantum computing technologies: The rapid pace of innovation in quantum computing means that competitors constantly introduce new and improved technologies. These advancements can make D-Wave Quantum's technology seem less attractive, potentially impacting its stock price.

Analyzing the Risk Profile of Investing in QBTS

Investing in D-Wave Quantum (QBTS) carries significant risk. The company operates in a nascent technology sector with inherent uncertainties.

-

Highlight the inherent volatility and risk associated with investing in a company in the early stages of a rapidly developing technology sector: Early-stage technology companies are inherently volatile. QBTS stock price is likely to fluctuate significantly in response to market sentiment, company news, and technological advancements.

-

Discuss the speculative nature of the quantum computing market: The quantum computing market is still largely speculative. The long-term viability of the technology and its market potential remain uncertain.

-

Mention the importance of long-term investment strategies and risk tolerance: Investing in QBTS requires a long-term perspective and a high tolerance for risk. Short-term fluctuations should be expected, and investors should only allocate capital that they are comfortable potentially losing.

Conclusion

Thursday's decrease in D-Wave Quantum (QBTS) stock price can be attributed to a combination of factors. These include broader negative market sentiment impacting tech stocks, potentially disappointing company-specific news, and the intense competition within the burgeoning quantum computing sector. The inherent volatility and speculative nature of the quantum computing market further contribute to the risk associated with QBTS stock.

Call to Action: While Thursday's drop in D-Wave Quantum (QBTS) stock presents challenges, understanding the factors influencing its performance is crucial for informed investment decisions. Continue researching D-Wave Quantum (QBTS) stock and the broader quantum computing market to make well-informed choices about your investment strategy. Stay updated on the latest news and developments affecting D-Wave Quantum (QBTS) stock to navigate its volatility effectively. Careful consideration of the risks and potential rewards is paramount before investing in D-Wave Quantum (QBTS) stock.

Featured Posts

-

Mondays D Wave Quantum Qbts Stock Increase A Detailed Look

May 20, 2025

Mondays D Wave Quantum Qbts Stock Increase A Detailed Look

May 20, 2025 -

Fremantle Reports 5 6 Q1 Revenue Decline Analysis Of Budgetary Impacts

May 20, 2025

Fremantle Reports 5 6 Q1 Revenue Decline Analysis Of Budgetary Impacts

May 20, 2025 -

Dzhennifer Lourens Vdruge Stala Mamoyu Pidtverdzhennya Ta Podrobitsi

May 20, 2025

Dzhennifer Lourens Vdruge Stala Mamoyu Pidtverdzhennya Ta Podrobitsi

May 20, 2025 -

Analyzing The Friday Increase In D Wave Quantum Inc Qbts Share Price

May 20, 2025

Analyzing The Friday Increase In D Wave Quantum Inc Qbts Share Price

May 20, 2025 -

Atkinsrealis Assistance Juridique Et Conseil En Droit D Affaires

May 20, 2025

Atkinsrealis Assistance Juridique Et Conseil En Droit D Affaires

May 20, 2025

Latest Posts

-

United Kingdom Tory Wifes Imprisonment Confirmed For Anti Migrant Outburst

May 21, 2025

United Kingdom Tory Wifes Imprisonment Confirmed For Anti Migrant Outburst

May 21, 2025 -

Tigers 8 6 Win Over Rockies A Deeper Look

May 21, 2025

Tigers 8 6 Win Over Rockies A Deeper Look

May 21, 2025 -

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 21, 2025

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 21, 2025 -

Delay In Appeal Ex Tory Councillors Wife And The Racial Hate Tweet

May 21, 2025

Delay In Appeal Ex Tory Councillors Wife And The Racial Hate Tweet

May 21, 2025 -

Update Appeal In Racial Hatred Tweet Case Against Ex Tory Councillors Wife

May 21, 2025

Update Appeal In Racial Hatred Tweet Case Against Ex Tory Councillors Wife

May 21, 2025