D-Wave Quantum (QBTS): Stock Performance Following Valuation Criticism

Table of Contents

The Valuation Controversy Surrounding D-Wave Quantum (QBTS)

The valuation of D-Wave Quantum has been a subject of considerable debate. Criticisms haven't centered solely on one aspect; instead, they've encompassed various concerns relating to revenue projections, market capitalization, and the inherent technological hurdles faced by the company. Several analyst reports and news articles have highlighted these issues, raising questions about the sustainability of D-Wave's current valuation.

Key arguments against D-Wave's current valuation include:

- High market cap compared to revenue: D-Wave's market capitalization has been significantly high relative to its current revenue streams, leading some to question whether the stock is overvalued.

- Uncertainty regarding future market adoption of annealing quantum computers: The long-term market viability of annealing quantum computers, D-Wave's primary technology, remains uncertain. This uncertainty contributes to the valuation debate.

- Competition from other quantum computing companies: The quantum computing landscape is increasingly competitive, with numerous companies pursuing different technological approaches. This intense competition poses a risk to D-Wave's market share and, consequently, its valuation. Keywords: D-Wave valuation, QBTS valuation, quantum computing investment, market capitalization, revenue projections.

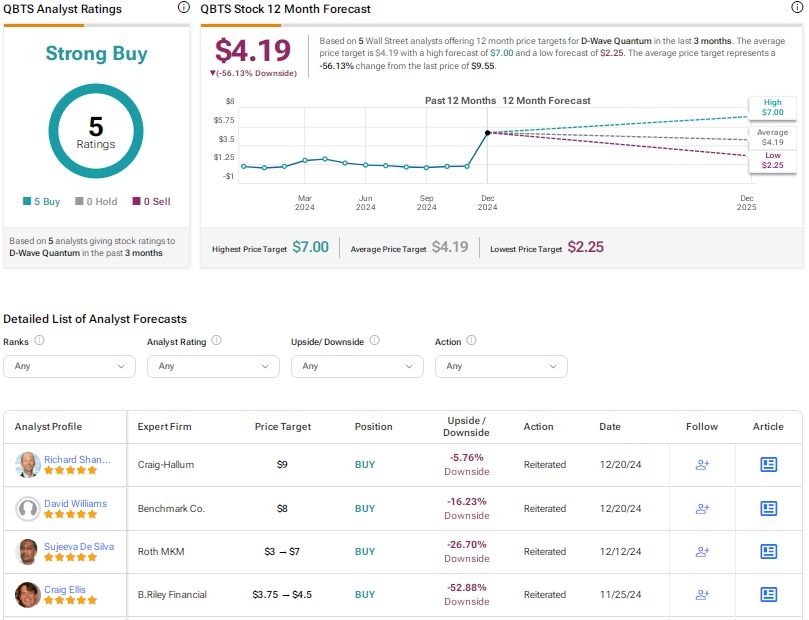

Analyzing QBTS Stock Performance in the Aftermath of Criticism

Since the emergence of these valuation criticisms, QBTS stock has experienced considerable fluctuation. (Insert chart/graph of QBTS stock performance here). These price swings reflect the dynamic interplay of news events and overall market sentiment. For instance, positive news regarding new partnerships or technological breakthroughs has often resulted in short-term price increases, while negative news or renewed valuation concerns have led to declines.

Key performance metrics since the criticisms emerged include:

- Stock price highs and lows: Tracking these reveals the extent of the volatility.

- Trading volume changes: Increased trading volume often indicates heightened investor interest, both positive and negative.

- Impact on investor confidence: This can be gauged through sentiment analysis of news articles, social media, and investor forums. Keywords: QBTS stock price, stock chart, market sentiment, investor confidence, trading volume.

Factors Influencing QBTS Stock Performance Beyond Valuation Concerns

While valuation concerns are significant, they aren't the sole determinant of QBTS stock performance. Several other factors play a crucial role:

- New product announcements or partnerships: Successful product launches or strategic partnerships can significantly boost investor confidence and the stock price.

- Government regulations or funding: Government policies and funding initiatives can have a substantial impact on the quantum computing industry as a whole, indirectly influencing D-Wave's prospects.

- Overall market trends (e.g., tech sector performance): Broader market trends in the technology sector can influence QBTS stock, irrespective of company-specific news.

- Competitor actions: The actions and achievements of competing quantum computing companies can influence investor perception of D-Wave's competitive position. Keywords: Quantum computing market, industry trends, partnerships, government funding, competition.

Future Outlook for D-Wave Quantum (QBTS) and Investment Implications

Predicting the future of D-Wave Quantum (QBTS) requires a balanced perspective, acknowledging both risks and opportunities. While valuation concerns remain valid, the potential for significant growth in the quantum computing market is undeniable.

Potential scenarios for future price movements include:

- Successful product launches leading to increased revenue: Successful product adoption could significantly improve D-Wave's financial outlook and boost its stock price.

- Further criticism leading to decreased valuation: Continued negative press or further valuation concerns could lead to further stock price declines.

- Market adoption of annealing quantum computers: Widespread adoption of annealing quantum computers would represent a major catalyst for D-Wave's growth and stock price appreciation. Keywords: Future outlook, investment opportunities, risks, quantum computing future, market adoption.

Conclusion: Assessing the Future of D-Wave Quantum (QBTS) Stock

D-Wave Quantum's stock performance is intricately linked to its valuation, but broader market trends and company-specific developments play crucial roles. While the valuation controversy presents a legitimate concern, the long-term potential of quantum computing cannot be ignored. Before investing in D-Wave Quantum (QBTS), thorough research is essential. Stay updated on the latest news, developments in the quantum computing market, and financial analysis to make informed investment decisions. Remember to consult with a financial advisor before making any investment choices. Conduct your own due diligence before investing in D-Wave Quantum (QBTS) and stay informed about the latest developments in the quantum computing sector. [Link to relevant financial news resource].

Featured Posts

-

Kahnawake Casino Lawsuit 220 Million Claim Against Mohawk Council And Grand Chief

May 21, 2025

Kahnawake Casino Lawsuit 220 Million Claim Against Mohawk Council And Grand Chief

May 21, 2025 -

The History And Production Of Cassis Blackcurrant

May 21, 2025

The History And Production Of Cassis Blackcurrant

May 21, 2025 -

Mondays Market Drop Analyzing The D Wave Quantum Qbts Stock Fall

May 21, 2025

Mondays Market Drop Analyzing The D Wave Quantum Qbts Stock Fall

May 21, 2025 -

Revenirea Fratilor Tate In Romania Imagini Spectaculoase Din Centrul Bucurestiului

May 21, 2025

Revenirea Fratilor Tate In Romania Imagini Spectaculoase Din Centrul Bucurestiului

May 21, 2025 -

Protomagia Sto Oropedio Evdomos Idees Gia Ekdromi

May 21, 2025

Protomagia Sto Oropedio Evdomos Idees Gia Ekdromi

May 21, 2025