D-Wave Quantum (QBTS) Stock Performance Thursday: Factors Contributing To The Decrease

Table of Contents

Market Sentiment and Overall Tech Sector Performance

The performance of QBTS stock is intrinsically linked to broader market trends and the overall health of the technology sector. Negative investor sentiment towards the tech sector as a whole significantly impacts growth stocks like D-Wave Quantum. Several factors contributed to this negative sentiment on Thursday.

- Negative investor sentiment towards the tech sector: A general bearish feeling surrounding technology stocks can drag down even promising companies like D-Wave Quantum. This is often driven by macroeconomic factors.

- Impact of interest rate hikes on growth stocks: Increased interest rates typically lead to a decrease in investment in growth stocks, as investors seek safer, higher-yielding options. This is particularly true for companies that haven't yet reached profitability.

- General market volatility affecting QBTS: Overall market volatility, stemming from geopolitical events or economic uncertainty, can amplify the impact of negative news, leading to greater price swings in stocks like QBTS.

- Comparison to performance of other quantum computing stocks: The performance of D-Wave Quantum relative to its competitors in the quantum computing space also influences investor sentiment. A comparatively poor showing can lead to further selling pressure. Analyzing the performance of these competitors is crucial for a comprehensive D-Wave Quantum stock analysis.

Lack of Significant Catalysts and News

The absence of positive news or significant catalysts is another contributing factor to Thursday's QBTS stock price drop. Investor confidence often hinges on positive developments within a company. The lack of substantial advancements or partnerships can lead to a decline in share price.

- Absence of major product launches or partnerships: Without announcements of new products or lucrative partnerships, investors may become hesitant, leading to selling pressure.

- Limited progress in key performance indicators: A lack of visible progress in crucial metrics, such as customer acquisition or technological advancements, can dampen investor enthusiasm.

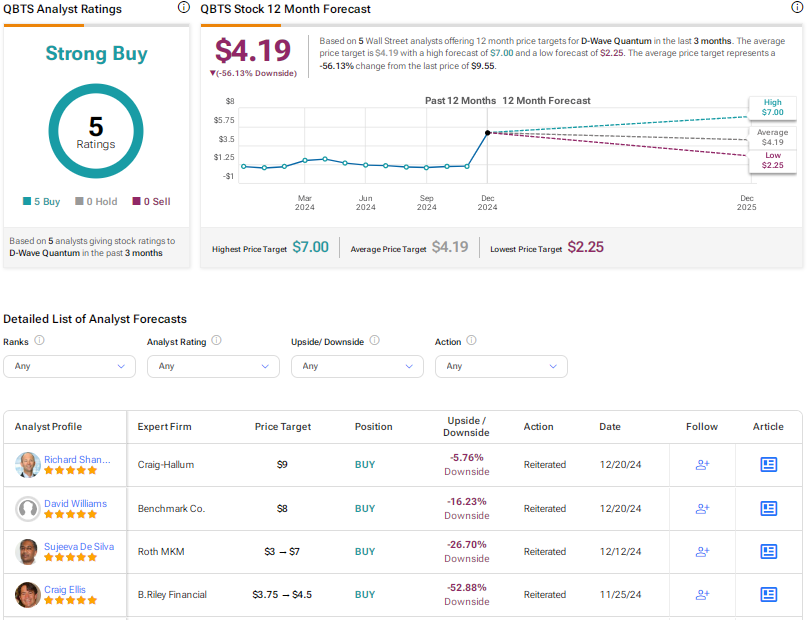

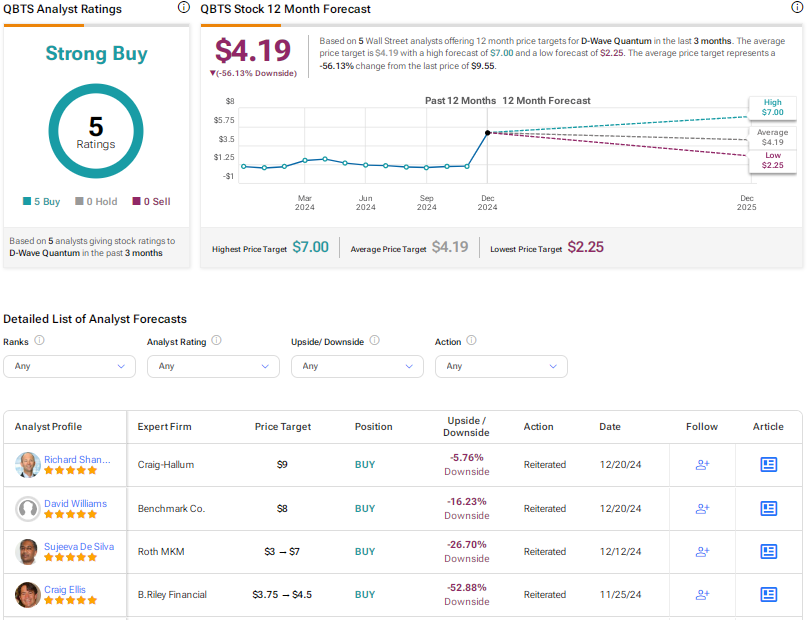

- Negative press coverage or analyst downgrades (if any): Negative news coverage or downgrades from financial analysts can significantly impact investor perception and lead to a sell-off.

- Comparison to competitors' announcements and progress: When competitors announce significant breakthroughs or partnerships, the lack of similar news from D-Wave Quantum can further exacerbate the negative sentiment and contribute to the QBTS stock price drop.

Profitability and Financial Performance Concerns

D-Wave Quantum's financial health plays a pivotal role in shaping investor confidence. Concerns about profitability, revenue growth, or cash flow can trigger significant price declines.

- Recent financial reports and key metrics (revenue, expenses, losses): Analyzing D-Wave Quantum's recent financial reports, focusing on revenue, expenses, and profitability, is crucial to understanding the current financial situation. This provides context for the QBTS stock price drop.

- Concerns about long-term financial sustainability: Investors are keenly interested in a company's long-term financial prospects. Concerns about the sustainability of D-Wave Quantum's business model can lead to decreased investment.

- Analyst expectations versus actual performance: Comparing D-Wave Quantum's actual financial performance with analyst expectations offers valuable insights. A significant miss on expectations can trigger a sell-off.

- Comparison to industry benchmarks for profitability: Assessing D-Wave Quantum's profitability relative to its competitors within the quantum computing industry helps to understand whether its financial performance is lagging.

Technical Analysis of QBTS Stock Chart

Examining the technical aspects of Thursday's QBTS stock chart provides further insights into the price decline. Technical analysis helps understand the price action and investor sentiment based on chart patterns and indicators.

- Analysis of price charts and candlestick patterns: Analyzing candlestick patterns can reveal information about the strength and direction of the price movement. Bearish candlestick patterns could indicate a strong downward pressure.

- Volume analysis to gauge investor sentiment: High trading volume during the price drop can suggest strong selling pressure, while low volume might indicate a less significant event.

- Identification of key support and resistance levels: Identifying key support and resistance levels helps understand where the price may find temporary stability or experience further declines. A break below a key support level can signal further downside.

- Technical indicators that suggest bearish momentum: Technical indicators, like moving averages or Relative Strength Index (RSI), can provide confirmation of bearish momentum and help predict future price movements.

Conclusion: Understanding D-Wave Quantum (QBTS) Stock Performance and Future Outlook

Thursday's decline in D-Wave Quantum (QBTS) stock price was likely a result of a combination of factors: negative market sentiment impacting the tech sector, a lack of positive news or catalysts from D-Wave Quantum itself, concerns about financial performance, and bearish signals revealed through technical analysis of the QBTS stock chart. Understanding these factors is crucial for making informed investment decisions. While the short-term outlook may be uncertain, continued monitoring of D-Wave Quantum’s progress, financial reports, and market conditions is vital. To make well-informed investment decisions regarding D-Wave Quantum (QBTS) stock, continue monitoring QBTS stock performance, stay updated on news and analysis, and conduct further research using terms like "D-Wave Quantum investment strategy" or "QBTS long-term prospects."

Featured Posts

-

Kaellmanin Nousu Kenttaesuoritus Ja Kehitys Huuhkajissa

May 21, 2025

Kaellmanin Nousu Kenttaesuoritus Ja Kehitys Huuhkajissa

May 21, 2025 -

O Giakoymakis Kai I Kroyz Azoyl Ston Teliko Toy Champions League Mia Istoriki Prokrisi

May 21, 2025

O Giakoymakis Kai I Kroyz Azoyl Ston Teliko Toy Champions League Mia Istoriki Prokrisi

May 21, 2025 -

Improving Llm Siri Apples Challenges And Solutions

May 21, 2025

Improving Llm Siri Apples Challenges And Solutions

May 21, 2025 -

Man Achieves Fastest Australia Crossing On Foot

May 21, 2025

Man Achieves Fastest Australia Crossing On Foot

May 21, 2025 -

Borussia Dortmund Triumphs Beier Scores A Brace Against Mainz

May 21, 2025

Borussia Dortmund Triumphs Beier Scores A Brace Against Mainz

May 21, 2025