D-Wave Quantum (QBTS) Stock Plunges: Kerrisdale Capital's Valuation Concerns

Table of Contents

Kerrisdale Capital's Report: A Deep Dive into D-Wave's Valuation

Kerrisdale Capital's report, released on [Insert Date of Report], delivered a scathing assessment of D-Wave Quantum's valuation, arguing that the company's stock price is significantly inflated. The report meticulously dissected D-Wave's financial performance, market position, and future projections, presenting a compelling case for its bearish outlook. Key criticisms centered on:

-

Overstated Revenue Projections: Kerrisdale challenged D-Wave's optimistic revenue forecasts, arguing they were based on unrealistic assumptions about market adoption and sales growth in the quantum computing sector. Specific figures from the report should be cited here (e.g., "Kerrisdale estimates D-Wave's projected revenue for 2025 to be overstated by X%").

-

Unrealistic Market Share Assumptions: The report questioned D-Wave's projected market share in the nascent quantum computing industry, highlighting the intense competition from other major players. This section should compare D-Wave's market share projections with those of competitors like IBM, Google, and Rigetti.

-

High Operating Losses and Unsustainable Burn Rate: Kerrisdale pointed to D-Wave's substantial operating losses and high cash burn rate, arguing that the company's current business model is unsustainable in the long term without significant revenue growth. Include specific data on operating losses and cash burn rate here.

-

Comparison to Other Quantum Computing Companies: The report likely benchmarked D-Wave's performance and valuation against its competitors. This section needs to elaborate on those comparisons and include details on why Kerrisdale believes D-Wave is overvalued in comparison.

D-Wave Quantum's Response and Counterarguments

D-Wave Quantum responded to Kerrisdale Capital's report with a press release and various statements [Insert Links to Responses]. Their defense primarily focused on:

-

Explanation of Revenue Model and Future Projections: D-Wave likely defended its revenue projections, emphasizing the long-term potential of the quantum computing market and the growing demand for its technology. This section should detail D-Wave's explanation and justification.

-

Highlighting Partnerships and Strategic Collaborations: The company likely highlighted its strategic partnerships and collaborations with major companies in various industries, aiming to demonstrate the validation of its technology and market potential. List and explain the significance of these partnerships.

-

Addressing Concerns about Technological Advancements: D-Wave likely countered criticism about its technology, emphasizing ongoing research and development efforts, and showcasing any recent technological advancements or breakthroughs. Specific examples are needed here.

-

Emphasizing Long-Term Growth Potential in the Quantum Computing Market: D-Wave’s response likely focused on the long-term growth potential of the quantum computing market, suggesting that Kerrisdale's short-term focus overlooks its long-term prospects.

Market Reaction and Investor Sentiment

The release of Kerrisdale Capital's report triggered a significant negative market reaction.

-

Significant Drop in Stock Price: The QBTS stock price experienced a substantial drop following the report's publication. Quantify the percentage drop.

-

Increased Trading Volume: The report likely led to increased trading volume in QBTS stock as investors reacted to the news. Include data on trading volume changes.

-

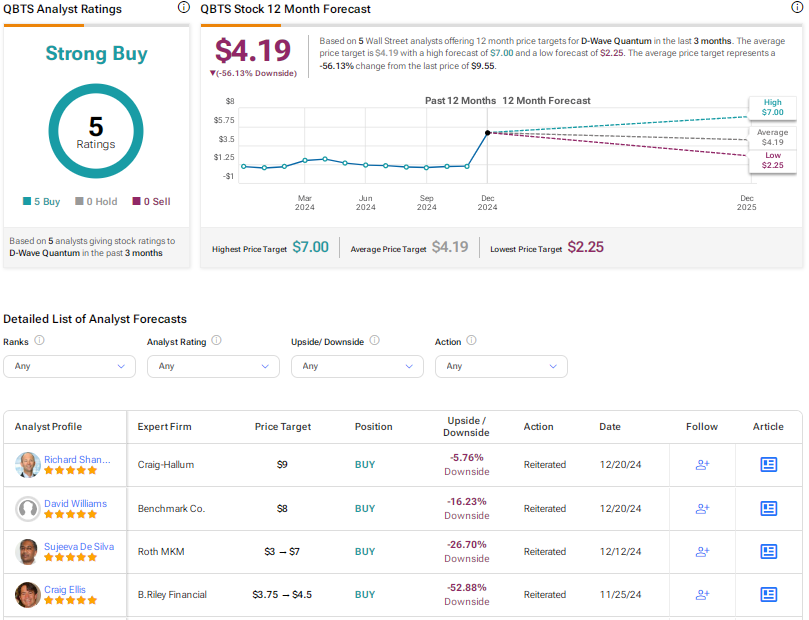

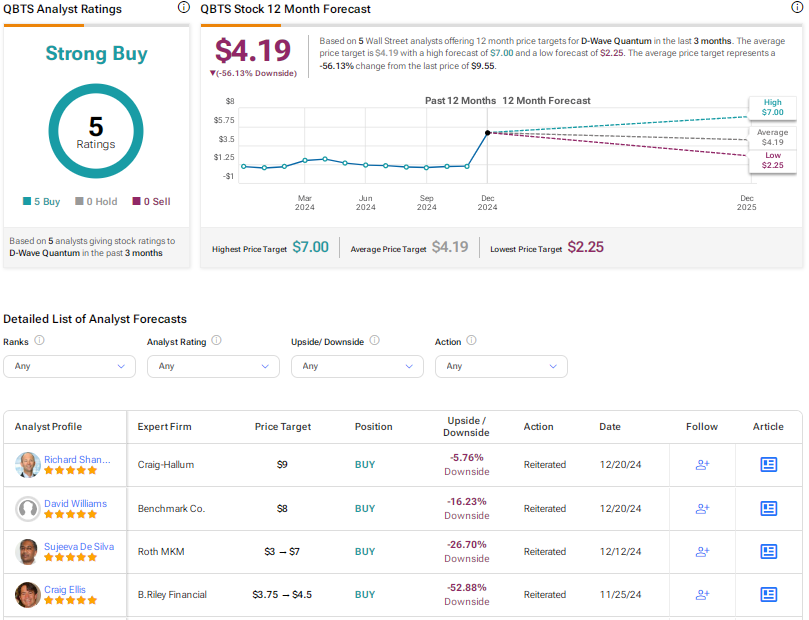

Changes in Analyst Ratings and Price Targets: This section should detail how analyst ratings and price targets for QBTS stock changed after the report.

-

Impact on Investor Confidence: The report's impact on investor confidence in D-Wave Quantum is crucial. Discuss the overall sentiment shift.

-

Other News Affecting QBTS Stock Price: Were there any other concurrent news events impacting the QBTS stock price? Mention these here for context.

The Future of D-Wave Quantum and the Quantum Computing Industry

The D-Wave Quantum situation has broad implications for the quantum computing industry. The future prospects of D-Wave Quantum remain uncertain.

-

Technological Hurdles and Breakthroughs: Discuss the ongoing technological challenges in the quantum computing field and the potential for future breakthroughs.

-

Market Adoption Rates and Potential Applications: Analyze the current market adoption rates for quantum computing technologies and potential applications in various industries.

-

Competition from Other Quantum Computing Companies: Discuss the competitive landscape and the impact of competitors on D-Wave's future prospects.

-

Long-Term Growth Potential in the Quantum Computing Sector: Offer a balanced assessment of the long-term growth potential for the quantum computing sector despite the current uncertainties.

Conclusion: Assessing the Impact of Kerrisdale Capital's Report on D-Wave Quantum (QBTS) Stock

Kerrisdale Capital's report on D-Wave Quantum (QBTS) has undoubtedly shaken investor confidence. The report raised serious concerns about D-Wave's valuation, revenue projections, and long-term sustainability. While D-Wave has responded with counterarguments, the market's reaction highlights the significant uncertainty surrounding the company's future. Understanding the intricacies of the D-Wave Quantum (QBTS) situation requires thorough due diligence. Conduct your own research before making any investment decisions related to D-Wave Quantum (QBTS) stock. Stay informed about future developments in the quantum computing market and the performance of D-Wave Quantum (QBTS) stock.

Featured Posts

-

Impact Of The Wintry Mix Rain And Snow Advisory

May 20, 2025

Impact Of The Wintry Mix Rain And Snow Advisory

May 20, 2025 -

Manchester Uniteds Fa Cup Victory Rashfords Brace Sinks Aston Villa

May 20, 2025

Manchester Uniteds Fa Cup Victory Rashfords Brace Sinks Aston Villa

May 20, 2025 -

Railroad Bridge Accident Two Adults Dead One Child Missing Another Injured

May 20, 2025

Railroad Bridge Accident Two Adults Dead One Child Missing Another Injured

May 20, 2025 -

Maybanks Role In 545 Million Economic Zone Investment

May 20, 2025

Maybanks Role In 545 Million Economic Zone Investment

May 20, 2025 -

Protect Your Rights Big Bear Ai Bbai Investors Urged To Contact Gross Law Firm

May 20, 2025

Protect Your Rights Big Bear Ai Bbai Investors Urged To Contact Gross Law Firm

May 20, 2025

Latest Posts

-

Efimeries Giatron Stin Patra Savvatokyriako 10 11 Maioy

May 20, 2025

Efimeries Giatron Stin Patra Savvatokyriako 10 11 Maioy

May 20, 2025 -

Giakoymakis I Megali Proklisi Apo Tin Los Antzeles

May 20, 2025

Giakoymakis I Megali Proklisi Apo Tin Los Antzeles

May 20, 2025 -

Efimereyontes Giatroi Patras 10 And 11 Maioy Odigos Eyresis

May 20, 2025

Efimereyontes Giatroi Patras 10 And 11 Maioy Odigos Eyresis

May 20, 2025 -

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025 -

Wwes Tony Hinchcliffe Segment A Look At The Backstage Fallout

May 20, 2025

Wwes Tony Hinchcliffe Segment A Look At The Backstage Fallout

May 20, 2025