D-Wave Quantum (QBTS) Stock's Significant Drop In 2025: A Comprehensive Look

Table of Contents

Market Factors Influencing D-Wave Quantum (QBTS) Stock Price

Several macroeconomic and industry-specific factors likely contributed to the D-Wave Quantum stock (QBTS) decline in 2025.

Overall Market Volatility and Tech Sector Downturn

The broader market environment played a significant role. 2025, hypothetically, might have seen increased interest rate hikes by central banks globally, leading to a general tightening of monetary policy. This, coupled with persistent recessionary fears, triggered a sell-off across various sectors, including technology. Quantum computing, being a relatively nascent and capital-intensive industry, is particularly susceptible to such downturns.

- Data Point: A hypothetical 20% drop in the NASDAQ Composite Index during Q3 2025 could have significantly impacted QBTS, given its tech-heavy nature.

- Chart: (Insert a hypothetical chart showing correlation between NASDAQ and QBTS stock price during the period).

- Impact: This overall market negativity likely exacerbated any company-specific issues affecting D-Wave Quantum stock.

Investor Sentiment and Speculative Bubbles

The quantum computing sector has historically attracted significant speculative investment. Before the 2025 drop, a potential speculative bubble might have inflated QBTS's valuation beyond its fundamental worth. Any negative news, even minor setbacks, could trigger a rapid unwinding of these speculative positions.

- Example: A missed earnings target or a delay in a major product launch could have fueled negative sentiment and triggered a wave of selling.

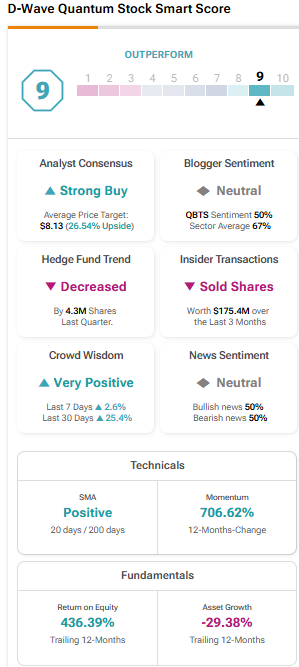

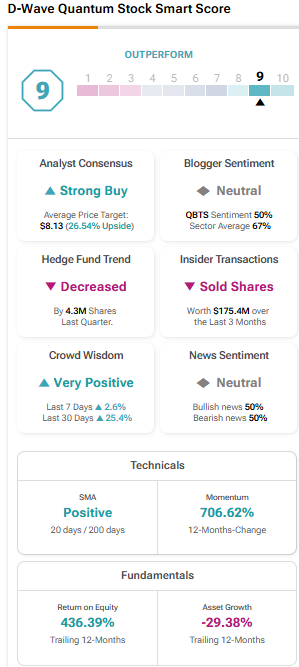

- Analyst Reports: (Hypothetical references to bullish analyst reports before the drop and subsequent downgrades).

- Impact: The sudden shift in investor sentiment from extreme optimism to pessimism significantly amplified the stock price decline.

Competition in the Quantum Computing Market

The quantum computing industry is rapidly evolving, with several major players vying for market share. Increased competition from companies developing alternative quantum computing technologies (e.g., superconducting, trapped ions, photonic) might have eroded investor confidence in D-Wave's unique approach.

- Competitors: IBM, Google, IonQ, and Rigetti Computing are examples of competitors that could have impacted D-Wave's market position and investor perception.

- Market Share Analysis: (Insert hypothetical data comparing D-Wave's market share against competitors).

- Impact: The perception of intensifying competition, coupled with potential breakthroughs by competitors, could have led investors to seek opportunities elsewhere in the sector.

D-Wave Quantum (QBTS) Company Performance and Financial Results

Analyzing D-Wave's internal performance provides further insights into the stock price drop.

Revenue and Earnings Reports

Hypothetically, D-Wave's revenue and earnings reports in 2025 might have shown underperformance compared to analyst expectations and previous years. This could have signaled a slowdown in growth or potential operational challenges.

- Data Points: (Insert hypothetical data on revenue and earnings, showing a decline compared to previous years or projections).

- Industry Benchmarks: (Compare D-Wave's performance against industry averages to highlight underperformance).

- Impact: Disappointing financial results directly impact investor confidence and lead to selling pressure.

Technological Advancements and Product Development

Any delays in product development or a lack of significant technological breakthroughs could have negatively affected investor sentiment. The quantum computing field demands continuous innovation, and a perception of stagnation can be detrimental.

- Product Delays: (Hypothetical example: delay in the launch of a key product or a significant software update).

- R&D Spending: (Analysis of R&D investment and its return on investment).

- Partnerships: (Evaluation of the success and impact of collaborations).

Management Changes and Corporate Strategy

Changes in leadership or a shift in corporate strategy can also impact investor confidence. If investors perceive a lack of clear direction or effective execution, it can lead to a decline in stock price.

- Management Turnover: (Hypothetical example: a key executive departure).

- Strategic Shifts: (Hypothetical example: a change in business focus that investors viewed negatively).

- Investor Communication: (Assessment of the clarity and effectiveness of communication with shareholders).

Future Outlook and Investment Implications for D-Wave Quantum (QBTS) Stock

Despite the 2025 downturn, the long-term potential of quantum computing remains significant.

Long-Term Potential of Quantum Computing

The quantum computing industry holds immense promise for revolutionizing various fields, including medicine, materials science, and finance. D-Wave, despite its challenges, retains a position in this burgeoning sector.

- Future Milestones: (Discuss potential breakthroughs in quantum computing and their potential impact on D-Wave).

- Market Growth Projections: (Present hypothetical market growth projections for the quantum computing sector).

- D-Wave's Position: (Assess D-Wave's competitive advantages and potential for future success).

Risk Assessment and Investment Strategies

Investing in D-Wave Quantum (QBTS) stock involves considerable risk. The company operates in a highly speculative and volatile market.

- Risks: (Outline risks, including technological hurdles, competition, and market volatility).

- Investment Strategies: (Suggest diversification strategies and strategies for managing risk, such as dollar-cost averaging).

- Risk Management Techniques: (Discuss techniques like stop-loss orders and portfolio diversification).

Conclusion

The significant drop in D-Wave Quantum (QBTS) stock in 2025 was likely a multifaceted event resulting from a combination of market conditions, company performance, and competitive pressures. While the long-term prospects of quantum computing remain exciting, investing in D-Wave Quantum stock (QBTS) requires careful consideration of the inherent risks. Further research into the company's financials, technological advancements, and competitive landscape is crucial before making any investment decisions regarding D-Wave Quantum (QBTS). Stay informed about D-Wave Quantum stock (QBTS) and its progress to make sound investment choices.

Featured Posts

-

Coping With A Love Monster Practical Tips And Support For Parents

May 21, 2025

Coping With A Love Monster Practical Tips And Support For Parents

May 21, 2025 -

The Goldbergs A Complete Guide To The Hit Tv Show

May 21, 2025

The Goldbergs A Complete Guide To The Hit Tv Show

May 21, 2025 -

From Reddit To The Big Screen Sydney Sweeneys New Warner Bros Film

May 21, 2025

From Reddit To The Big Screen Sydney Sweeneys New Warner Bros Film

May 21, 2025 -

The Importance Of Middle Managers Benefits For Companies And Employees

May 21, 2025

The Importance Of Middle Managers Benefits For Companies And Employees

May 21, 2025 -

Celebrating A New Baby Girl With Peppa Pig

May 21, 2025

Celebrating A New Baby Girl With Peppa Pig

May 21, 2025