D-Wave Quantum (QBTS) Stock's Sudden Drop On Monday: Factors And Implications

Table of Contents

Potential Factors Contributing to the D-Wave Quantum (QBTS) Stock Drop

Several factors likely contributed to the significant decline in D-Wave Quantum (QBTS) stock on Monday. Understanding these factors is crucial for assessing the current situation and predicting future performance.

Market Sentiment and Overall Tech Sector Downturn

The broader market conditions played a significant role. Monday saw a general downturn in the tech sector, impacting many technology stocks regardless of their specific performance. This negative market sentiment likely influenced D-Wave Quantum (QBTS) stock, dragging it down along with other tech companies.

- Impact of broader economic concerns on investor sentiment: Widespread economic anxieties, such as inflation fears or interest rate hikes, often lead investors to sell off riskier assets, including tech stocks like QBTS.

- Correlation between QBTS and other tech stocks: D-Wave Quantum (QBTS) stock often moves in tandem with other tech companies, making it susceptible to general market trends. A negative correlation with the NASDAQ Composite or other technology indices would support this theory.

- Mention any related news impacting the tech sector: Any major news events affecting the technology industry as a whole – for example, new regulatory announcements or disappointing earnings reports from major tech firms – would have likely contributed to the overall negative sentiment and impacted D-Wave Quantum (QBTS) stock.

Lack of Recent Positive News or Announcements

The absence of recent positive news or announcements from D-Wave Quantum could also have contributed to the stock's decline. Investors often react negatively when companies fail to deliver anticipated positive updates.

- Absence of significant contract wins or technological breakthroughs: Lack of major contract wins or announcements of significant technological advancements can disappoint investors expecting continued growth and innovation from D-Wave.

- Potential delays in product development or deployment: Any delays in the development or deployment of new quantum computing products could signal to investors that the company is falling behind its competitors.

- Comparison with competitor performance: If competitors in the quantum computing industry announced significant progress or breakthroughs while D-Wave remained relatively quiet, this could negatively impact investor sentiment towards QBTS.

Analyst Ratings and Price Target Adjustments

Changes in analyst ratings and price targets for D-Wave Quantum (QBTS) stock might have triggered the downward trend. Negative revisions or downgrades often impact investor confidence.

- Summary of recent analyst reports and their recommendations: A review of recent analyst reports will reveal whether there were any significant changes in ratings or price target adjustments prior to the stock drop.

- Impact of price target adjustments on investor confidence: Lowered price targets can signal to investors that analysts are less optimistic about the stock's future performance.

- Mention specific analysts and their views: Referencing specific analysts and their views on D-Wave Quantum (QBTS) stock adds credibility and detail to the analysis.

Short Selling and Increased Volatility

Short selling and increased trading volume can exacerbate stock price declines. A surge in short selling activity could have put significant downward pressure on D-Wave Quantum (QBTS) stock.

- Short interest data and its implications: Analyzing short interest data provides insights into the extent of short selling activity and its potential influence on the stock price.

- Analysis of trading volume on Monday compared to previous days: A significant increase in trading volume on Monday compared to previous days suggests increased activity and potential for greater volatility.

- Impact of increased volatility on investor behavior: High volatility can make investors more likely to sell, further driving down the stock price.

Implications of the D-Wave Quantum (QBTS) Stock Drop

The sudden drop in D-Wave Quantum (QBTS) stock carries significant implications for investors and the quantum computing sector.

Impact on Investor Confidence

The sharp decline likely shook investor confidence in D-Wave Quantum and the overall quantum computing sector. Such volatility can deter potential investors and cause existing shareholders to question the company's long-term prospects.

Future Outlook for D-Wave Quantum (QBTS) Stock

Predicting the future of D-Wave Quantum (QBTS) stock is challenging. The stock's future performance will depend on various factors, including the company's ability to deliver on its technological promises, secure significant contracts, and navigate the competitive landscape. Technical analysis, such as examining chart patterns and support/resistance levels, might provide some insights.

Opportunities and Risks for Long-Term Investors

While the recent drop presents risks, it could also offer opportunities for long-term investors with a high-risk tolerance. Careful evaluation of the company's fundamentals, technological progress, and competitive positioning is crucial before making any investment decisions. Understanding the risks associated with investing in a volatile, emerging technology company is paramount.

Conclusion

The significant drop in D-Wave Quantum (QBTS) stock on Monday resulted from an interplay of factors, including general market sentiment, the lack of positive company news, analyst actions, and increased market volatility. The implications are significant, affecting investor confidence and potentially altering the trajectory of the company. While the recent drop in D-Wave Quantum (QBTS) stock is concerning, understanding the underlying factors is crucial for informed investment decisions. Continue monitoring D-Wave Quantum (QBTS) stock news and market trends to make sound judgments regarding your investments in this emerging technology. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions related to D-Wave Quantum (QBTS) stock or other high-risk investments.

Featured Posts

-

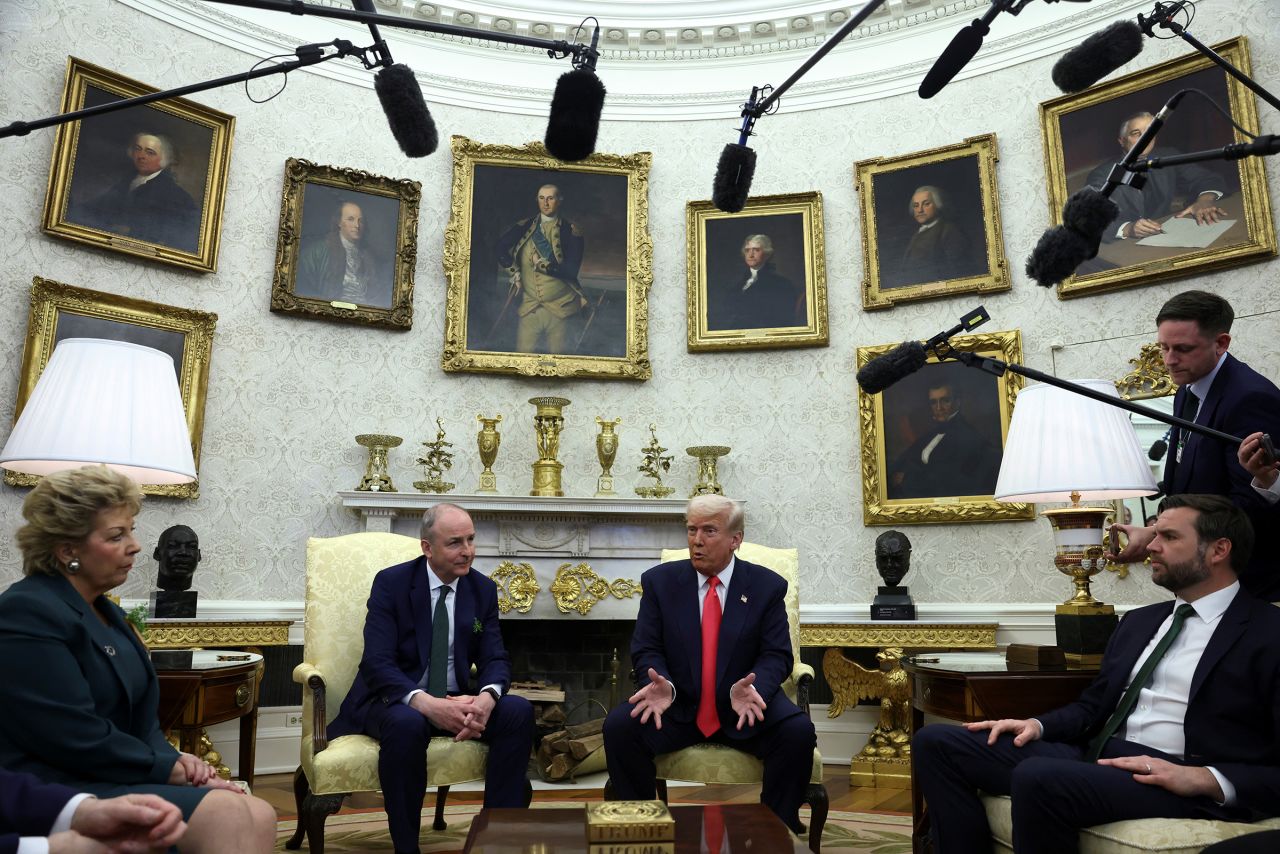

White House Humor Unforgettable Moments With Trump The Irish Pm And Jd Vance

May 21, 2025

White House Humor Unforgettable Moments With Trump The Irish Pm And Jd Vance

May 21, 2025 -

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League 10 Tahun Terakhir

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League 10 Tahun Terakhir

May 21, 2025 -

Pivdenniy Mist Oglyad Protsesu Remontu Ta Zaluchenikh Koshtiv

May 21, 2025

Pivdenniy Mist Oglyad Protsesu Remontu Ta Zaluchenikh Koshtiv

May 21, 2025 -

Resilience Turning Challenges Into Opportunities For Growth In Mental Health

May 21, 2025

Resilience Turning Challenges Into Opportunities For Growth In Mental Health

May 21, 2025 -

Freepoint Eco Systems Announces Ing Project Finance Facility

May 21, 2025

Freepoint Eco Systems Announces Ing Project Finance Facility

May 21, 2025