David Rosenberg: Canadian Labour Data And The Call For Rate Relief

Table of Contents

Rosenberg's Analysis of Recent Canadian Labour Market Data

David Rosenberg's perspective on the Canadian economy is heavily influenced by his interpretation of recent labour market data. His analysis considers several key indicators to form his overall assessment and recommendations.

Employment Numbers and Their Significance

The latest employment figures from Statistics Canada paint a mixed picture. While job creation has remained relatively robust in certain sectors, the overall picture suggests a potential slowdown.

- Unemployment Rate: [Insert latest unemployment rate from Statistics Canada]. While this figure might seem positive on the surface, Rosenberg argues that [insert Rosenberg's interpretation of the unemployment rate, e.g., it masks underlying weakness in the job market].

- Job Creation: [Insert latest job creation figures from Statistics Canada, broken down by sector if possible]. Rosenberg highlights [insert specific sectors where job creation is weakening, according to his analysis].

- Participation Rate: [Insert latest participation rate from Statistics Canada]. A declining participation rate suggests [insert Rosenberg's interpretation, e.g., potential discouragement among job seekers, reflecting a weakening economy].

Rosenberg's interpretation of these numbers differs from the Bank of Canada's, who may be focusing on [mention a different perspective the BoC may have]. This divergence is crucial in understanding the differing calls for monetary policy.

Wage Growth and Inflationary Pressures

Wage growth is a key factor in the inflation debate. While some wage increases are necessary to keep pace with the cost of living, excessive wage growth can fuel inflationary pressures.

- Wage Growth Statistics: [Insert wage growth statistics from Statistics Canada, broken down by sector]. Rosenberg's analysis focuses on the [mention specific sectors showing concerning wage growth, according to his perspective].

- Relationship to Inflation: Rosenberg argues that current wage growth rates [insert his argument on whether it's contributing to or mitigating inflation]. This assessment informs his view on the need for rate relief.

- Rosenberg's Viewpoint: He contends that the Bank of Canada needs to consider the impact of continued rate hikes on wage growth and the broader economy.

Industry-Specific Trends

Examining industry-specific trends provides a more nuanced understanding of the Canadian labour market.

- Key Sectors: Rosenberg points to the [mention specific sectors, e.g., housing construction, manufacturing, tech] sectors as exhibiting significant changes that reflect broader economic trends.

- Sectoral Performance: [Insert data points about performance in key sectors]. The decline in [mention specific sectors and the implications according to Rosenberg's analysis] is a significant concern.

- Implications for Outlook: These sector-specific trends, according to Rosenberg, indicate [explain the overall economic implications according to his analysis].

Rosenberg's Arguments for Rate Relief

David Rosenberg's calls for rate relief are based on a compelling set of arguments.

The Case for Lower Interest Rates

Rosenberg advocates for lower interest rates to stimulate economic activity. His key arguments include:

- Slowing Economic Growth: He believes the current interest rate policy is stifling economic growth, potentially leading to a recession.

- Impact on Consumer Spending: Higher interest rates reduce consumer spending, creating a negative feedback loop.

- Housing Market Downturn: Rosenberg points to the already struggling housing market and warns that further rate hikes could worsen the situation.

Potential Risks of Continued Rate Hikes

Rosenberg strongly warns against the risks associated with continued rate hikes.

- Deepened Recession: He fears that persistent high interest rates will push the economy into a deeper and more prolonged recession.

- Increased Unemployment: Continued rate hikes could lead to significant job losses.

- Further Housing Market Decline: The housing market is already sensitive to interest rate changes. Further increases risk a more significant collapse.

Counterarguments and Alternative Perspectives

While Rosenberg's arguments are persuasive, it's crucial to consider alternative viewpoints.

Differing Views on the Economy

Other economists hold differing perspectives. Some believe that inflation remains a more pressing concern than economic growth and advocate for maintaining or even increasing interest rates. [Mention specific economists and their opposing viewpoints].

Potential Risks of Rate Cuts

Lowering interest rates also carries risks. The primary concern is that it could reignite inflationary pressures if not managed carefully. This could lead to a period of [explain the potential negative consequences].

Conclusion: David Rosenberg, Canadian Labour Data, and the Path Forward for Interest Rates

David Rosenberg's analysis of Canadian labour data presents a compelling case for rate relief. His arguments, while concerning, must be considered alongside the risks of lowering interest rates. The debate around the optimal interest rate policy for Canada is ongoing and complex, highlighting the need for careful monitoring of key economic indicators. Stay informed on David Rosenberg's analysis of Canadian labour data and the ongoing discussion surrounding interest rate policy to gain a comprehensive understanding of the Canadian economic outlook and the potential impact on your financial well-being. Learn more about the impact of interest rates on the Canadian economy and follow the discussion on rate relief.

Featured Posts

-

Get To Know Jacob Alon A Promising Talent

May 31, 2025

Get To Know Jacob Alon A Promising Talent

May 31, 2025 -

Padel Court Proposal For Bannatyne Health Club Essex

May 31, 2025

Padel Court Proposal For Bannatyne Health Club Essex

May 31, 2025 -

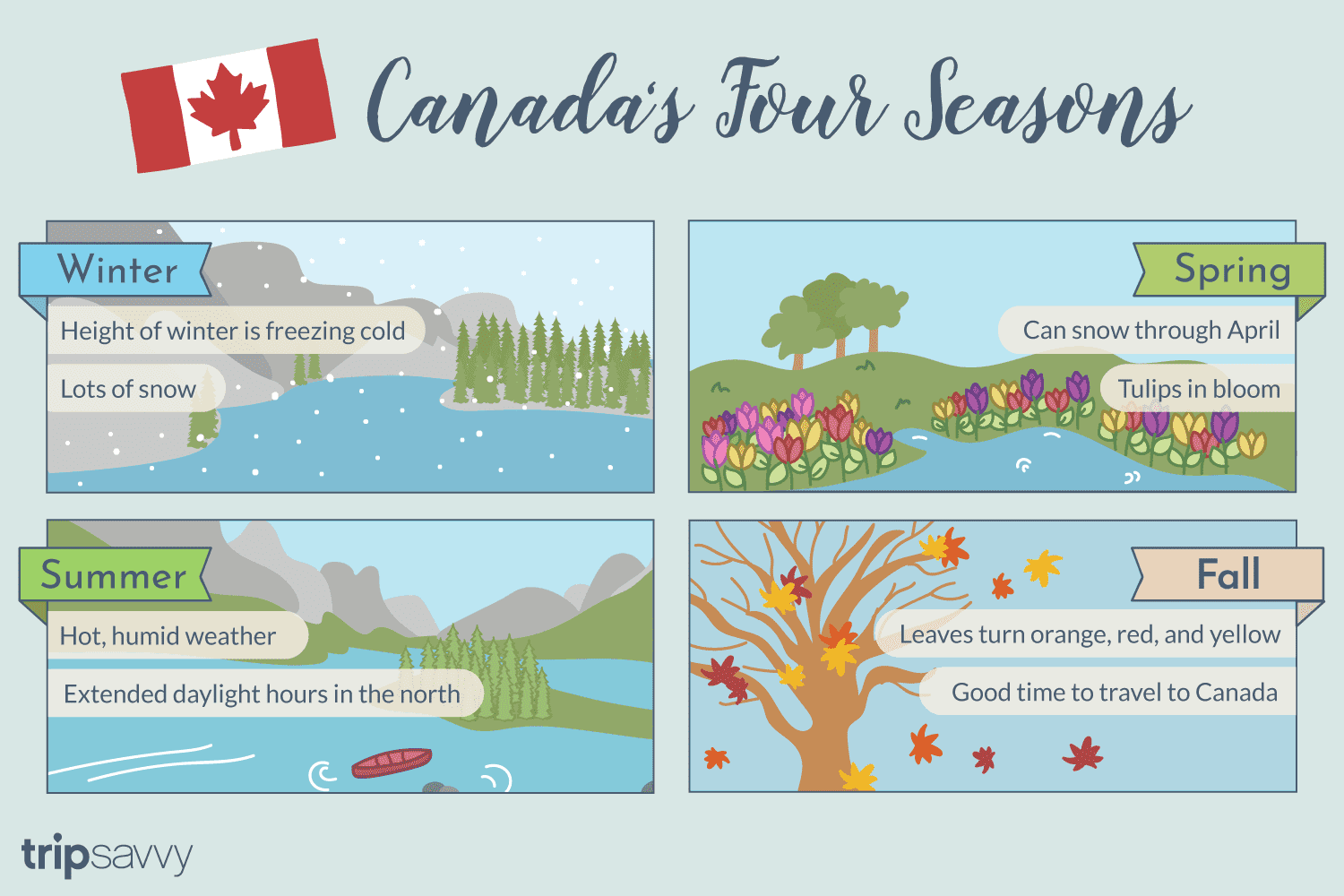

Early Start To Fire Season In Canada And Minnesota What You Need To Know

May 31, 2025

Early Start To Fire Season In Canada And Minnesota What You Need To Know

May 31, 2025 -

Post Dragons Den Success Entrepreneur Announces 40 Profit Rise

May 31, 2025

Post Dragons Den Success Entrepreneur Announces 40 Profit Rise

May 31, 2025 -

The Good Life Finding Fulfillment And Purpose

May 31, 2025

The Good Life Finding Fulfillment And Purpose

May 31, 2025