David Rosenberg: Was The Bank Of Canada Too Timid?

Table of Contents

Canada's economic landscape is currently navigating a complex terrain. Inflation remains a persistent concern, prompting ongoing debates about the effectiveness of the Bank of Canada's monetary policy. Central to this discussion is renowned economist David Rosenberg, whose outspoken criticisms of the Bank of Canada's approach to interest rate hikes have ignited a firestorm of debate. This article delves into the core question: Was the Bank of Canada too timid in raising interest rates?

Rosenberg's Critique of the Bank of Canada's Monetary Policy

The Argument for More Aggressive Rate Hikes

David Rosenberg has consistently argued that the Bank of Canada's incremental increases in interest rates have been insufficient to curb inflation effectively. He contends that a more aggressive and swift approach was necessary to preempt a more entrenched inflationary spiral. Rosenberg’s arguments often center around the belief that the Bank was behind the curve, failing to anticipate the persistence and strength of inflationary pressures.

-

Examples of his cited evidence: Rosenberg points to lagging inflation indicators that remained stubbornly high, even as the Bank of Canada began raising rates. He also highlights persistent wage growth as a sign that inflationary pressures were becoming embedded in the economy. Furthermore, he often points to other global inflation trends as reasons why the Bank of Canada should have been more proactive.

-

Specific policy recommendations: Rosenberg has likely advocated for steeper and more frequent interest rate hikes, possibly even a more proactive approach with a more aggressive target rate. His suggested timeline may have differed substantially from what the Bank implemented.

The Potential Consequences of a More Cautious Approach

Rosenberg implies that the Bank of Canada's gradual approach carries several potential risks. He suggests that by not acting decisively enough, the central bank risked allowing inflation to become more entrenched, making it harder to control in the long run.

-

Increased inflation: A more prolonged period of high inflation could erode purchasing power and destabilize the economy.

-

Prolonged economic uncertainty: The uncertainty surrounding inflation can lead to decreased investment and consumer spending, impacting economic growth.

-

Potential damage to the Canadian dollar: Persistently high inflation can weaken the Canadian dollar relative to other currencies.

-

Impact on different sectors of the Canadian economy: The housing market, particularly sensitive to interest rate changes, could experience a more significant correction if rates had risen more sharply earlier.

Counterarguments and Alternative Perspectives

Defending the Bank of Canada's Approach

Critics of Rosenberg’s stance argue that the Bank of Canada’s more gradual approach was a prudent strategy, given the inherent complexities of predicting economic outcomes and the risks associated with overly aggressive monetary tightening.

-

Potential risks of overly aggressive rate hikes: A rapid increase in interest rates could trigger a recession, leading to job losses and widespread economic hardship.

-

Lagging indicators and the complexities of predicting economic outcomes: Economic data often lags, making it challenging to assess the true impact of monetary policy in real-time.

Alternative Economic Forecasts and Analyses

Several economists and institutions offer perspectives that differ from Rosenberg's. Some argue that the Bank of Canada's approach was appropriate, given the uncertainties surrounding the global economic outlook and the potential for unforeseen shocks.

-

Mention specific economists or institutions with differing viewpoints: [Insert links to reputable sources and specific economists with differing opinions].

-

Highlight the range of opinions and the uncertainties involved in economic prediction: Economic forecasting is inherently uncertain, and different models and assumptions can lead to widely varying conclusions.

The Current Economic Situation in Canada and the Impact of Interest Rates

Analyzing the Current Inflation Rate and Economic Growth

[Insert current data on Canadian inflation rate, GDP growth, unemployment rate, etc. Cite reliable sources]. This section should provide an up-to-date snapshot of the Canadian economy and assess how well the Bank of Canada's policies are currently performing in light of its inflation targets.

-

Key economic indicators and their current values: [Insert specific data points]

-

Assessment of the effectiveness of the Bank of Canada's policy to date: [Analyze the current situation in relation to the Bank's stated goals].

The Future Outlook and Predictions

Based on the available data and analysis, what is the likely trajectory of the Canadian economy? Will inflation continue to decline? What are the potential risks? What future actions might the Bank of Canada take?

-

Predictions for inflation, economic growth, and potential risks: [Present reasoned predictions, supported by evidence]

-

Likely future actions of the Bank of Canada: [Speculate on the Bank's likely future policy adjustments, based on the current economic situation].

Conclusion

David Rosenberg's critique of the Bank of Canada's interest rate policy has sparked a vital debate about the effectiveness of Canada's monetary policy response to inflation. While Rosenberg advocates for a more aggressive approach, others highlight the potential risks of overly rapid rate hikes. The current economic situation in Canada is characterized by [summarize current economic situation]. The future trajectory of the economy remains uncertain, dependent on various factors including global economic conditions and the Bank of Canada's future policy decisions.

Was the Bank of Canada truly too timid? Share your thoughts on the effectiveness of Canada's monetary policy in the comments below. For further reading on the Bank of Canada and Canadian economic policy, please refer to [insert links to relevant resources].

Featured Posts

-

Diamond Johnson From Norfolk State To Minnesota Lynx Wnba Camp

Apr 29, 2025

Diamond Johnson From Norfolk State To Minnesota Lynx Wnba Camp

Apr 29, 2025 -

La Fires Fuel Landlord Price Gouging Controversy A Selling Sunset Stars Perspective

Apr 29, 2025

La Fires Fuel Landlord Price Gouging Controversy A Selling Sunset Stars Perspective

Apr 29, 2025 -

V Mware Costs To Skyrocket 1 050 At And Ts Concerns Over Broadcoms Price Hike

Apr 29, 2025

V Mware Costs To Skyrocket 1 050 At And Ts Concerns Over Broadcoms Price Hike

Apr 29, 2025 -

One Plus 13 R Vs Pixel 7a In Depth Comparison And Review

Apr 29, 2025

One Plus 13 R Vs Pixel 7a In Depth Comparison And Review

Apr 29, 2025 -

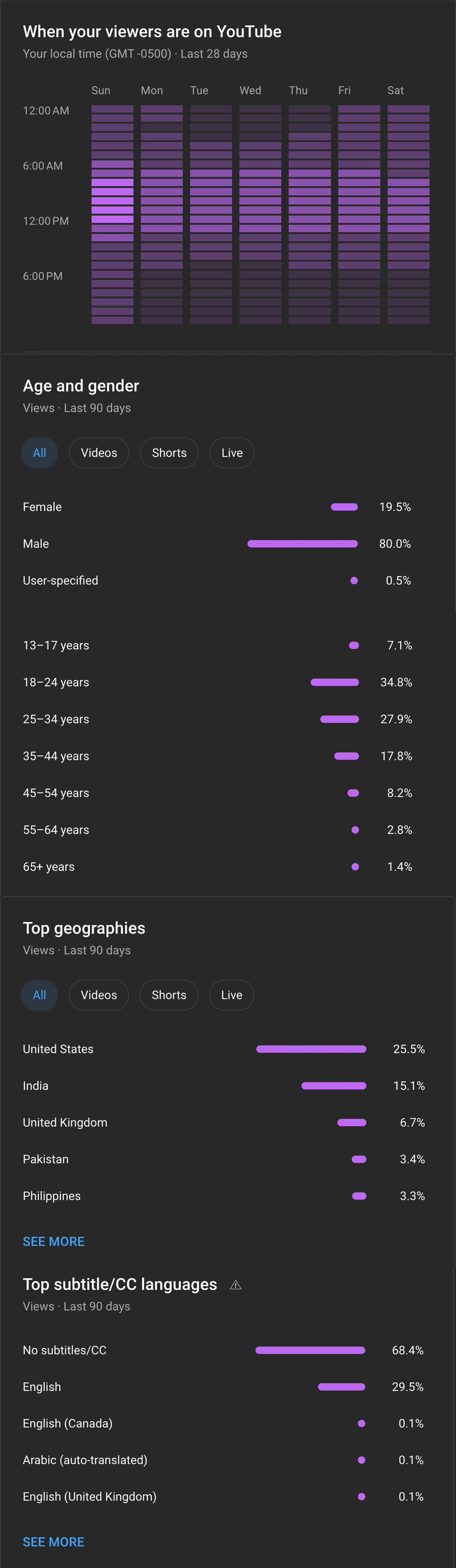

Why Older Viewers Are Choosing You Tube For Entertainment

Apr 29, 2025

Why Older Viewers Are Choosing You Tube For Entertainment

Apr 29, 2025

Latest Posts

-

Will Trump Pardon Rose A Complete Analysis

Apr 29, 2025

Will Trump Pardon Rose A Complete Analysis

Apr 29, 2025 -

Trump To Issue Full Pardon For Rose Latest Updates

Apr 29, 2025

Trump To Issue Full Pardon For Rose Latest Updates

Apr 29, 2025 -

You Tubes Growing Appeal To Older Viewers Nostalgia And Accessibility

Apr 29, 2025

You Tubes Growing Appeal To Older Viewers Nostalgia And Accessibility

Apr 29, 2025 -

How You Tube Caters To The Preferences Of Older Viewers

Apr 29, 2025

How You Tube Caters To The Preferences Of Older Viewers

Apr 29, 2025 -

You Tube A Platform For Classic Tv Shows And Older Viewers

Apr 29, 2025

You Tube A Platform For Classic Tv Shows And Older Viewers

Apr 29, 2025