DAX Surge: Will A Wall Street Rebound Dampen The Celebrations?

Table of Contents

Factors Contributing to the Recent DAX Surge

Several key factors have contributed to the recent impressive DAX surge. Understanding these elements is crucial for assessing the index's future performance and the potential impact of external events.

Strong German Economic Data

Recent positive economic indicators from Germany have played a pivotal role in boosting investor confidence and driving the DAX surge. Robust industrial production figures, exceeding expectations in several key sectors, signal a healthy manufacturing base. Furthermore, consumer confidence indicators have also shown improvement, suggesting increased spending and economic activity.

- PMI Figures: The Purchasing Managers' Index (PMI) for manufacturing and services has consistently remained above the 50-mark, indicating expansion in these critical sectors. Strong PMI readings often precede positive stock market performance.

- Unemployment Rates: Low and stable unemployment rates demonstrate a healthy labor market, further fueling economic optimism and supporting the DAX's upward trend.

- Inflation Trends: While inflation remains a concern globally, signs of easing inflationary pressures in Germany, compared to other major economies, have also contributed to the positive sentiment.

Global Economic Optimism (Cautious)

While global economic uncertainties persist, including geopolitical risks and ongoing interest rate adjustments by central banks, there are signs of easing inflation and improving supply chains. This cautious optimism has positively impacted investor sentiment, indirectly supporting the DAX's rise.

- Easing Inflation: Although inflation remains elevated in many countries, the signs of slowing price increases in some key economies have encouraged investors, reducing fears of aggressive monetary tightening.

- Supply Chain Improvements: Easing supply chain disruptions have helped reduce production bottlenecks and boosted business confidence, supporting positive market sentiment.

- Geopolitical Risks: While geopolitical events always pose a risk, recent developments in some regions haven't led to major disruptions in global markets, allowing for some level of optimism to persist.

Performance of Specific DAX Companies

The impressive performance of several key DAX companies has significantly contributed to the overall index surge. Strong earnings reports and positive growth outlooks from companies in key sectors have boosted investor confidence.

- Automotive Sector: Leading German automotive manufacturers have reported strong sales figures, driven by increased demand and successful product launches. This sector's positive performance has directly impacted the DAX.

- Technology Sector: German technology companies have shown robust growth, with innovations in software, renewable energy, and industrial technology contributing to their success and boosting the DAX.

- Individual Company Success Stories: Specific examples of companies like [insert example company names and their positive contributions] highlight the diversified strength driving the DAX surge.

The Potential Impact of a Wall Street Rebound

While the DAX has enjoyed a surge, the potential for a Wall Street rebound introduces an element of uncertainty. The relationship between these markets and the potential for diverging economic paths are crucial considerations.

Correlation between DAX and Wall Street

The DAX and major US indices like the S&P 500 and Dow Jones exhibit a historical correlation. Global market interconnectedness means a Wall Street rebound could have significant spillover effects on the DAX. However, the strength of this correlation can vary depending on various factors.

- Global Market Sentiment: A strong Wall Street rebound might signal renewed global confidence, potentially further bolstering the DAX.

- Sectoral Differences: A Wall Street rebound driven primarily by specific sectors might have a limited impact on the DAX, depending on the sector's representation in both markets.

- Economic Divergence: If the rebound is solely based on US-specific economic factors, its impact on the DAX could be muted.

Divergent Economic Factors

The possibility of diverging economic paths between the US and Europe must be considered. While the US might experience a rebound driven by specific factors, Europe, and consequently the DAX, might follow a different trajectory.

- Monetary Policy Differences: Different monetary policy approaches by the Federal Reserve and the European Central Bank could lead to diverging economic performances.

- Energy Prices: Europe's dependence on energy imports, particularly from Russia, might lead to different economic outcomes compared to the US.

- Geopolitical Factors: Geopolitical events impacting Europe disproportionately can also cause divergence in economic performance.

Investor Sentiment and Market Volatility

Investor sentiment and market volatility play a critical role in determining the DAX's reaction to a Wall Street rebound. A sudden shift in sentiment could lead to significant market fluctuations.

- Risk Appetite: If a Wall Street rebound leads to increased risk appetite, investors might shift funds towards higher-growth opportunities, potentially benefiting the DAX.

- Profit-Taking: Conversely, a Wall Street rebound could trigger profit-taking in the DAX, leading to a temporary correction.

- Market Volatility: Increased market volatility following a Wall Street rebound could lead to uncertainty and cautious investment strategies.

Conclusion

The recent DAX surge is a multifaceted event influenced by strong German economic data, cautious global optimism, and the robust performance of key DAX companies. However, a potential Wall Street rebound introduces complexity. The correlation between the DAX and Wall Street, coupled with potentially diverging economic factors and investor sentiment, will significantly influence whether the DAX celebrations continue or are dampened.

Call to Action: Stay informed about the latest developments impacting the DAX surge and the global market. Monitor key economic indicators, analyze the interplay between European and US markets, and understand the potential impact of a Wall Street rebound to make informed investment decisions regarding the DAX and its future trajectory. Understanding the nuances of the DAX surge is crucial for navigating the ever-changing landscape of the global financial markets.

Featured Posts

-

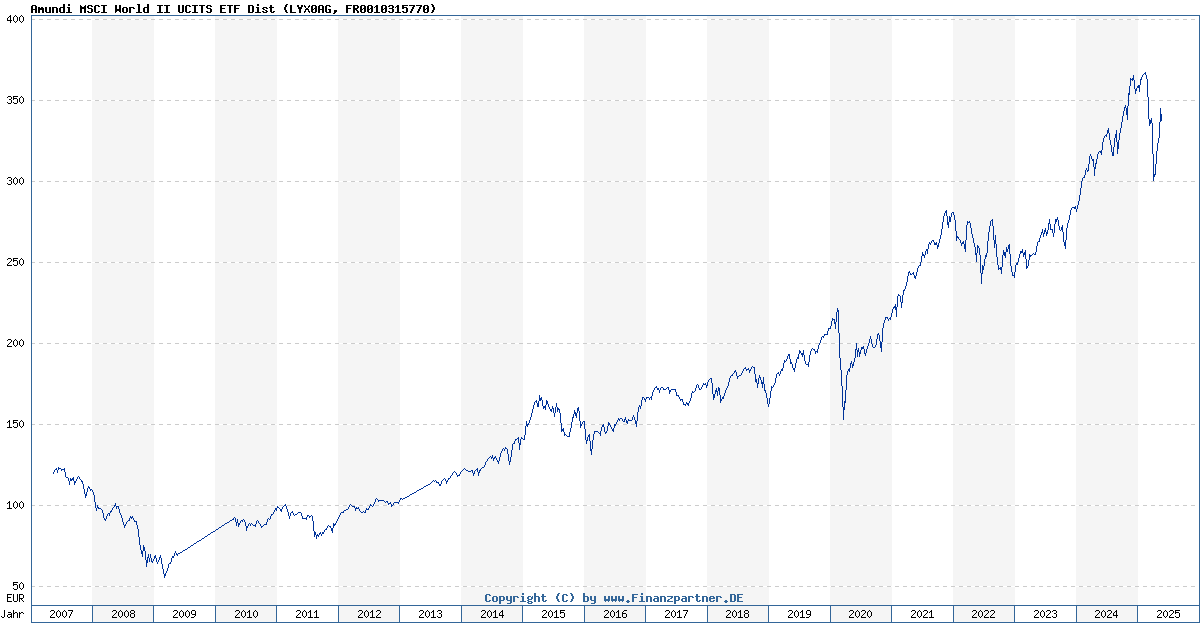

Amundi Msci World Ex Us Ucits Etf Acc Net Asset Value Explained

May 25, 2025

Amundi Msci World Ex Us Ucits Etf Acc Net Asset Value Explained

May 25, 2025 -

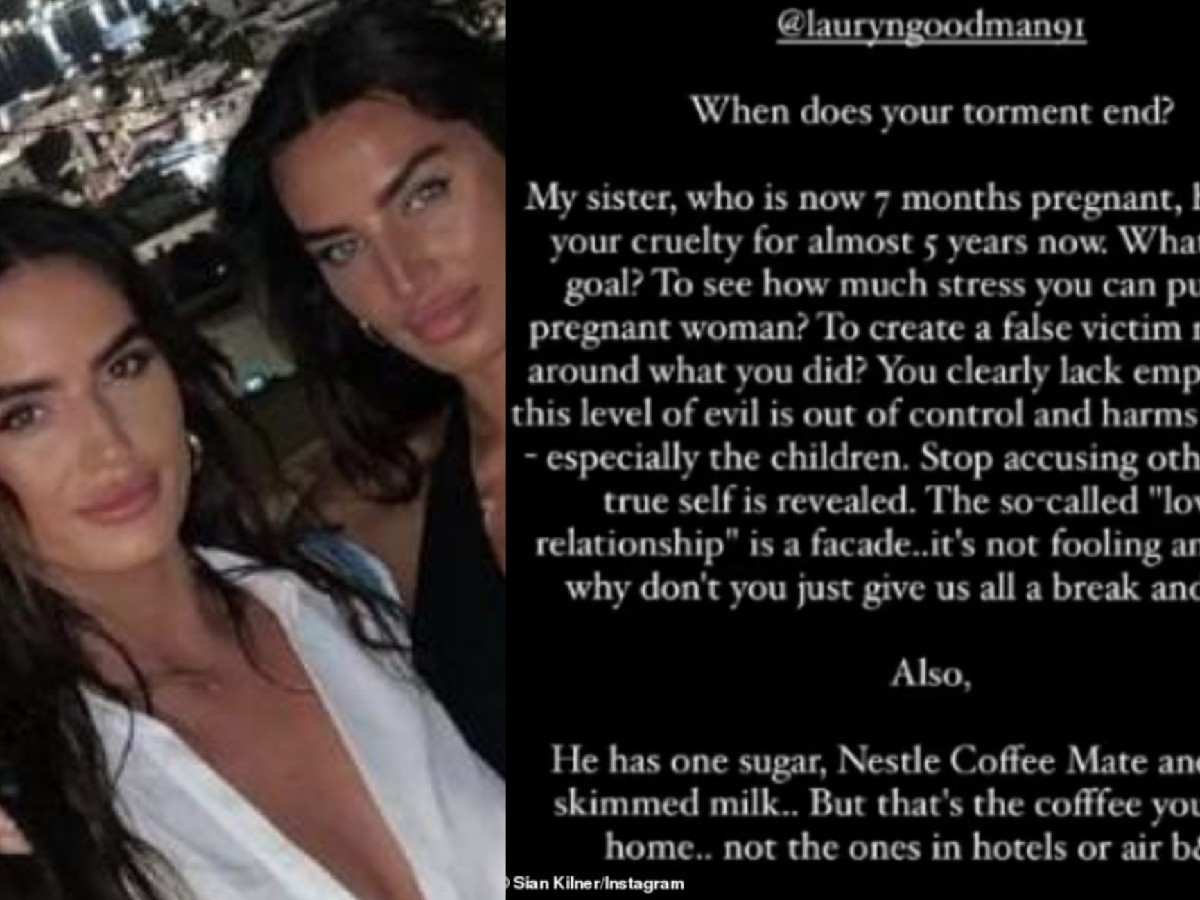

Models Night Out Turns Sour Annie Kilners Poisoning Allegations Against Kyle Walker

May 25, 2025

Models Night Out Turns Sour Annie Kilners Poisoning Allegations Against Kyle Walker

May 25, 2025 -

French Pms Dissenting Voice On Macrons Leadership

May 25, 2025

French Pms Dissenting Voice On Macrons Leadership

May 25, 2025 -

Bardellas Path To The French Presidency A Contender Emerges

May 25, 2025

Bardellas Path To The French Presidency A Contender Emerges

May 25, 2025 -

Fastest Ferraris Comparing 10 Production Models At Fiorano

May 25, 2025

Fastest Ferraris Comparing 10 Production Models At Fiorano

May 25, 2025

Latest Posts

-

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025