Delaying ECB Rate Cuts: Economists Sound The Alarm

Table of Contents

Rising Inflation and Persistent Price Pressures

Inflation in the Eurozone continues to outpace the ECB's target of 2%. Factors driving this persistent inflation are multifaceted and interconnected. Soaring energy prices, exacerbated by the ongoing geopolitical situation, remain a significant contributor. Supply chain disruptions, though easing somewhat, continue to put upward pressure on prices. Furthermore, robust wage growth, while positive for workers, is adding fuel to the inflationary fire. The potential for a sustained inflationary spiral is a major concern fueling the debate around delaying ECB rate cuts.

- Inflation figures: Eurozone inflation hit X% in [Month, Year], with individual countries like Germany and France experiencing even higher rates.

- Core inflation vs. headline inflation: Core inflation, which excludes volatile elements like energy and food, remains elevated, indicating underlying price pressures.

- Geopolitical impact: The war in Ukraine has significantly impacted energy prices and supply chains, directly contributing to higher inflation.

Concerns over Wage-Price Spiral

A wage-price spiral, a self-reinforcing cycle where rising wages lead to higher prices, which in turn lead to further wage demands, is a significant threat. The ECB is acutely aware of this risk and the potential consequences of delaying rate cuts if a spiral takes hold. If wages continue to rise rapidly to keep pace with inflation, it will become very difficult to tame rising prices. This is a key element in discussions surrounding delaying ECB rate cuts.

- Wage growth data: Wage growth in several Eurozone countries has outpaced inflation in recent months, adding to inflationary pressures.

- Wage growth and inflation relationship: The correlation between wage growth and inflation is strengthening, raising concerns about a wage-price spiral.

- Preventing a wage-price spiral: The ECB may need to implement more aggressive measures to curb wage growth and prevent a self-perpetuating cycle.

Economic Growth Slowdown and Recession Risks

Delaying ECB rate cuts, while potentially helpful in fighting inflation in the short-term, risks further dampening economic growth. Higher interest rates increase borrowing costs for businesses and consumers, impacting investment and consumption. This could push the Eurozone into a recession, exacerbating existing economic challenges. The potential for a prolonged period of slow growth is a serious consideration in the debate surrounding delaying ECB rate cuts.

- GDP growth forecasts: Forecasts for Eurozone GDP growth have been revised downwards, reflecting the impact of higher interest rates and economic uncertainty.

- Impact on investment and consumption: Increased borrowing costs are discouraging investment and reducing consumer spending, impacting overall economic activity.

- Mitigation strategies: Fiscal policy measures, such as targeted government spending, could help mitigate the negative impact of higher interest rates on economic growth.

Alternative Policy Options and Their Implications

The ECB isn't limited to simply delaying rate cuts. Alternative policy options exist, each with its own advantages and disadvantages. Targeted measures focused on specific inflationary pressures, such as energy subsidies, could be implemented. Strategic communication by the ECB, aimed at managing market expectations, might also help to influence inflation expectations. Finally, unconventional monetary policy tools, used sparingly in the past, remain an option, though they carry their own risks. Considering these alternatives to simply delaying ECB rate cuts is crucial for responsible monetary policy.

- Targeted measures: Subsidies for energy-intensive industries or tax breaks for businesses could alleviate inflationary pressures without broad interest rate hikes.

- Communication strategies: Clear communication from the ECB regarding its inflation targets and policy intentions can help to manage market expectations.

- Unconventional monetary policy: Quantitative easing or negative interest rates are possibilities, but they come with potential risks and limitations.

The International Context and Global Economic Uncertainty

The Eurozone economy is not an island; it is deeply intertwined with global markets. The actions of other central banks, particularly the US Federal Reserve, have a significant impact on the ECB's decision-making. Global supply chain disruptions and geopolitical risks also contribute to uncertainty. These external factors significantly complicate the ECB's task and further complicate the decision to delay ECB rate cuts.

- US monetary policy impact: The US Federal Reserve's interest rate hikes influence capital flows and exchange rates, affecting the Eurozone economy.

- Global supply chain disruptions: Ongoing supply chain issues continue to contribute to inflationary pressures in the Eurozone.

- Geopolitical risks: Geopolitical instability can impact energy prices, trade flows, and investor confidence, adding to uncertainty.

Conclusion: The Urgency of Addressing Delaying ECB Rate Cuts

The potential for delaying ECB rate cuts presents a complex challenge for the Eurozone economy. High inflation, the risk of a wage-price spiral, potential economic slowdown, and global uncertainty all create a challenging environment. While fighting inflation is paramount, the economic consequences of overly aggressive action must also be considered. The ECB needs to carefully weigh these competing risks and implement a monetary policy that balances inflation control with the need to avoid a deep recession. Stay informed about upcoming ECB decisions and their potential impact on your finances and investments. The potential consequences of inaction regarding delaying ECB rate cuts are severe, demanding proactive and informed engagement. Subscribe to our newsletter for updates on the latest economic developments and deeper analysis of the ECB’s policy decisions.

Featured Posts

-

4 Recetas Para Sobrevivir A Un Apagon Ricas Y Faciles De Preparar

May 31, 2025

4 Recetas Para Sobrevivir A Un Apagon Ricas Y Faciles De Preparar

May 31, 2025 -

Le Combat Pour Les Droits Du Vivant L Exemple De L Etoile De Mer

May 31, 2025

Le Combat Pour Les Droits Du Vivant L Exemple De L Etoile De Mer

May 31, 2025 -

Tariff Truce Sustaining Us China Trade Across The Pacific

May 31, 2025

Tariff Truce Sustaining Us China Trade Across The Pacific

May 31, 2025 -

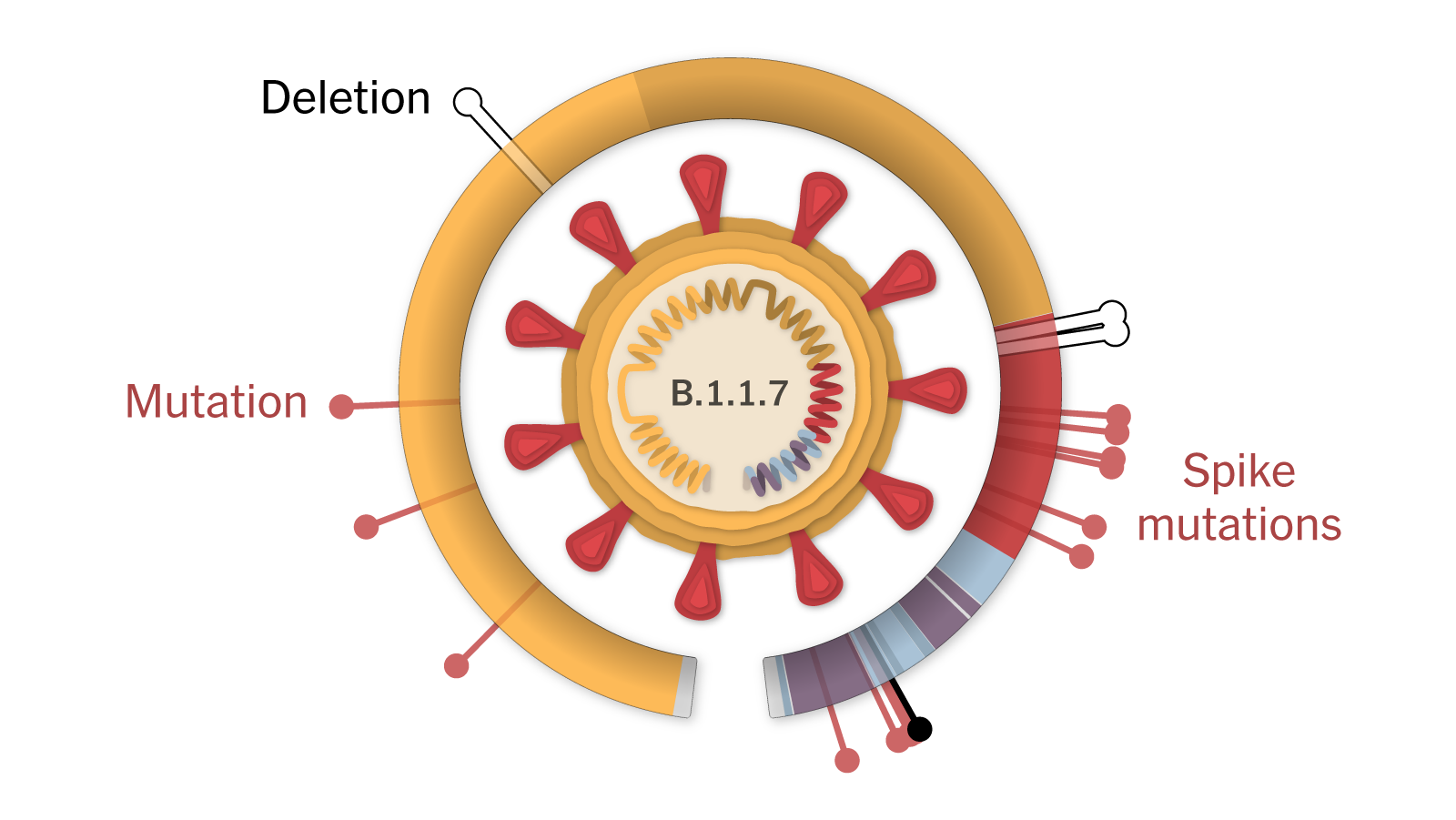

Rising Covid 19 Cases A New Variant Emerges Who Reports

May 31, 2025

Rising Covid 19 Cases A New Variant Emerges Who Reports

May 31, 2025 -

Banksy Print Sales Soar 22 777 000 In A Single Year

May 31, 2025

Banksy Print Sales Soar 22 777 000 In A Single Year

May 31, 2025