Desjardins Forecasts Three Additional Bank Of Canada Interest Rate Cuts

Table of Contents

Desjardins' Reasoning Behind the Forecast

Desjardins' prediction of three further interest rate cuts is rooted in a careful analysis of several key economic indicators. Their forecast isn't a guess; it's built upon a solid foundation of data and economic modeling. The key factors influencing their prediction include:

-

Inflation Rates and Their Projected Trajectory: While inflation has shown signs of cooling, Desjardins believes the current rate is still stubbornly high. Their models suggest a slower-than-expected decline, necessitating further monetary easing to reach the Bank of Canada's target. Persistent inflationary pressures remain a major concern.

-

Unemployment Figures and Their Potential Impact on Economic Growth: While unemployment remains relatively low, Desjardins' analysis indicates a potential softening in the labor market. A slowdown in job creation could dampen economic growth and contribute to the need for interest rate cuts to stimulate activity. This economic slowdown is a significant factor in their forecast.

-

Global Economic Uncertainty and its Influence on the Canadian Market: The global economic landscape is riddled with uncertainties, from geopolitical tensions to supply chain disruptions. These external factors exert pressure on the Canadian economy, making further interest rate cuts a precautionary measure to mitigate risks and bolster domestic growth.

-

Analysis of Recent Bank of Canada Statements and Communications: Desjardins has meticulously analyzed recent statements and communications from the Bank of Canada. They interpret these communications as suggesting a willingness to continue easing monetary policy if economic conditions warrant it. The Bank's own cautious tone supports Desjardins' predictions.

Potential Impact of Three Additional Interest Rate Cuts

The predicted three interest rate cuts could significantly influence various sectors of the Canadian economy.

Impact on Mortgages and Borrowing

Lower interest rates directly translate to lower mortgage rates. This would make homeownership more affordable for many Canadians and potentially reinvigorate the housing market, which has experienced a slowdown. Reduced borrowing costs also extend to personal loans, credit card interest, and other forms of consumer debt, potentially boosting consumer spending and stimulating economic activity. Lower mortgage rates and decreased borrowing costs are key consequences of these potential cuts.

Impact on the Canadian Economy

While stimulating, the impact on the Canadian economy is complex. Lower interest rates could encourage investment, spur economic growth, and increase job creation. However, there's a risk of inadvertently fueling inflation if the cuts are too significant. Finding the right balance between stimulating growth and controlling inflation is a delicate act for policymakers. This involves careful monitoring of GDP growth and inflationary risks.

Impact on the Canadian Dollar

Lower interest rates typically reduce the attractiveness of the Canadian dollar (CAD) to foreign investors seeking higher returns. This could lead to a weakening of the CAD exchange rate against other currencies. Currency fluctuations resulting from interest rate cuts could impact both importers and exporters, adding another layer of complexity to the economic outlook. Fluctuations in the CAD exchange rate, and potential effects on foreign investment, should be carefully considered.

Alternative Scenarios and Market Reactions

It’s crucial to acknowledge that the economic future is rarely predictable. Unforeseen events, such as unexpected geopolitical instability or a sudden surge in inflation, could alter the trajectory of interest rates. Desjardins' forecast represents a considered prediction based on current data; however, alternative scenarios must be considered.

Market reactions to Desjardins' forecast will likely be mixed. Some may view the prediction as positive, anticipating a boost to economic activity and consumer spending. Others might express concern about potential inflationary risks or a further weakening of the Canadian dollar. Market volatility is expected following such pronouncements. It's important to compare this forecast with those of other financial institutions to gain a broader perspective on the potential outcomes and risk assessment.

Conclusion

Desjardins' forecast of three additional Bank of Canada interest rate cuts presents a significant development for the Canadian economic landscape. The predicted decrease in mortgage rates and borrowing costs could benefit consumers and potentially stimulate the housing market and consumer spending. However, potential inflationary risks and the impact on the Canadian dollar warrant careful consideration. The economic impact will be complex and multifaceted. Staying informed about the latest developments regarding Desjardins' interest rate predictions and the Bank of Canada's monetary policy is crucial for making informed financial decisions. Keep up-to-date on Desjardins' interest rate outlook and Bank of Canada rate cuts by following their reports and subscribing to reputable financial news sources for the latest Canadian interest rate forecasts.

Featured Posts

-

Escape To The Country Finding Your Perfect Country Home

May 24, 2025

Escape To The Country Finding Your Perfect Country Home

May 24, 2025 -

Couples Fight Over Joe Jonas His Unexpected Reaction

May 24, 2025

Couples Fight Over Joe Jonas His Unexpected Reaction

May 24, 2025 -

Under 1 Million Your Escape To The Country Awaits

May 24, 2025

Under 1 Million Your Escape To The Country Awaits

May 24, 2025 -

The Last Rodeo Neal Mc Donoughs Intense Bull Riding Challenge

May 24, 2025

The Last Rodeo Neal Mc Donoughs Intense Bull Riding Challenge

May 24, 2025 -

Nintendos Cease And Desist Ryujinx Emulators Unexpected Closure

May 24, 2025

Nintendos Cease And Desist Ryujinx Emulators Unexpected Closure

May 24, 2025

Latest Posts

-

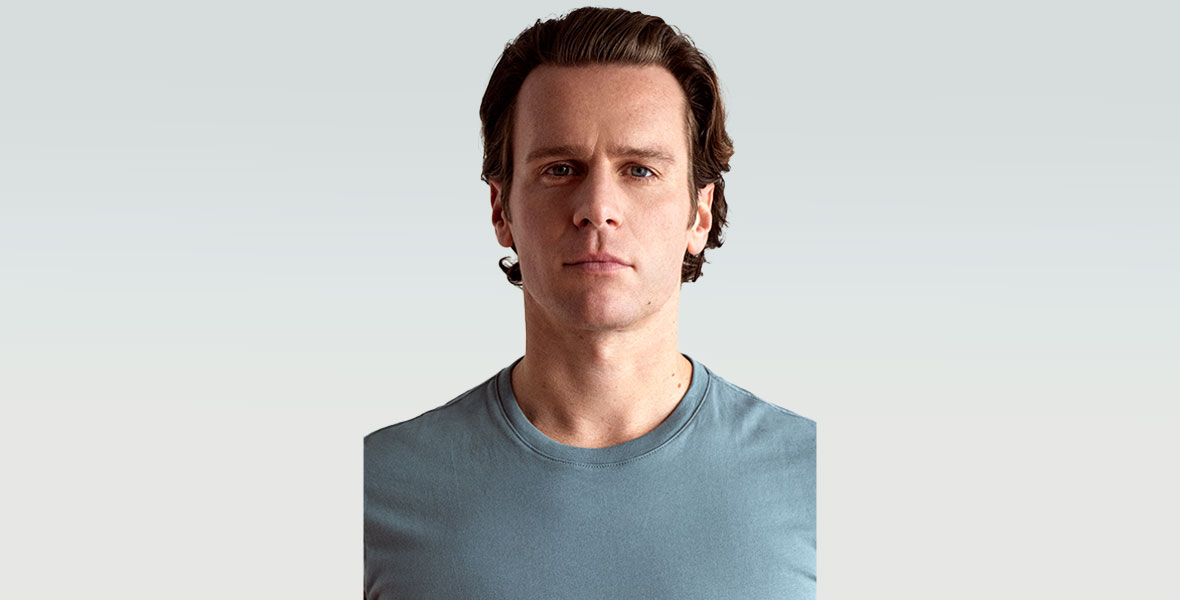

A Look Into Jonathan Groffs Past And His Relationship With Asexuality

May 24, 2025

A Look Into Jonathan Groffs Past And His Relationship With Asexuality

May 24, 2025 -

Jonathan Groff And Asexuality A Personal Reflection

May 24, 2025

Jonathan Groff And Asexuality A Personal Reflection

May 24, 2025 -

Understanding Jonathan Groffs Journey With Asexuality

May 24, 2025

Understanding Jonathan Groffs Journey With Asexuality

May 24, 2025 -

Jonathan Groff A Candid Conversation About Asexuality

May 24, 2025

Jonathan Groff A Candid Conversation About Asexuality

May 24, 2025 -

Actor Jonathan Groff On His Experience With Asexuality

May 24, 2025

Actor Jonathan Groff On His Experience With Asexuality

May 24, 2025