Despite Market Uncertainty, ETF Investments Reach Record Highs

Table of Contents

The Allure of Passive Investing in Uncertain Times

The rise of ETF investments reflects a broader shift towards passive investing strategies. In times of market uncertainty, investors are increasingly drawn to the simplicity and cost-effectiveness of ETFs.

Lower Fees and Cost-Effectiveness

One of the most significant advantages of ETFs is their lower expense ratios compared to actively managed mutual funds. These lower fees translate to greater returns over the long term, a crucial factor during periods of market downturn when even small cost savings can significantly impact investment growth.

- Average ETF expense ratios: Often range from 0.05% to 0.5%, significantly lower than the average expense ratios of actively managed mutual funds, which can reach 1% or more.

- Long-term impact of cost savings: A seemingly small difference in expense ratios can compound significantly over decades, resulting in substantially larger investment portfolios.

- Examples of popular low-cost ETFs: Vanguard Total Stock Market ETF (VTI), iShares Core S&P 500 ETF (IVV), Schwab US Dividend Equity ETF (SCHD). These examples highlight the availability of broadly diversified, low-cost options.

Diversification Strategies Made Easy

ETFs offer unparalleled ease of diversification. Investors can access a broad range of asset classes – stocks, bonds, commodities, and more – within a single investment. This inherent diversification mitigates risk, especially crucial during uncertain market periods.

- Examples of diversified ETFs: Total stock market ETFs provide exposure to a wide spectrum of US companies; global ETFs offer diversification across international markets, reducing reliance on a single economy's performance.

- Reducing portfolio volatility: Diversification through ETFs helps to cushion the impact of market downturns by reducing the overall volatility of an investment portfolio. This stability is particularly appealing during periods of heightened uncertainty.

Increased Accessibility and Technological Advancements

The accessibility of ETF investments has been significantly enhanced by technological advancements and the rise of user-friendly online platforms.

Online Brokerage Platforms

The ease of buying and selling ETFs online through various brokerage platforms has contributed immensely to their growing popularity. The process is straightforward, often requiring only a few clicks.

- Popular online brokerages and their ETF offerings: Fidelity, Schwab, TD Ameritrade, and E*TRADE all offer extensive ETF selections, making it easy for investors to find suitable options.

- The role of mobile trading apps: Mobile trading apps have further democratized ETF investing, enabling investors to manage their portfolios from anywhere, at any time.

Fractional Shares and Robo-Advisors

The introduction of fractional shares and the rise of robo-advisors have made ETF investing even more accessible to a wider range of investors, including those with smaller investment capital.

- Benefits of fractional shares for beginners: Fractional shares allow investors to buy even a small portion of a high-priced ETF, removing the barrier of needing a large initial investment.

- Robo-advisors automate ETF portfolio management: Robo-advisors utilize algorithms to build and manage diversified ETF portfolios, catering to investors seeking automated investment solutions.

ETF Performance Relative to Market Volatility

Analyzing historical data reveals that ETFs have often demonstrated relative resilience during periods of market uncertainty compared to other investment vehicles.

Historical Data and Performance Analysis

While no investment is entirely immune to market fluctuations, historical data suggests that ETFs, particularly broadly diversified ones, have generally exhibited less volatility than individual stocks during market downturns.

- Comparing ETF returns to individual stocks or mutual funds: During specific market downturns (e.g., the 2008 financial crisis), studies have shown that diversified ETFs experienced relatively smaller percentage losses than many individual stocks or actively managed funds. (Specific data and charts would be inserted here in a published article).

- Long-term historical data: Analyzing long-term ETF performance across various market cycles provides further insights into their relative stability and potential for growth.

The Role of Hedging Strategies within ETFs

Certain ETFs employ hedging strategies to mitigate risk, attracting investors looking for protection against market fluctuations.

- Examples of ETFs using hedging strategies: Inverse ETFs and short ETFs aim to profit from market declines, offering a hedge against potential losses in traditional investments. However, it's crucial to understand the inherent risks associated with these types of ETFs, as they can amplify losses during market uptrends.

- Risk management considerations: Investors should carefully assess their risk tolerance and investment objectives before considering ETFs employing hedging strategies.

Conclusion

Despite market uncertainty, ETF investments are flourishing due to their appeal as passive investment vehicles, increased accessibility through technological advancements, and the potential for superior risk-mitigation strategies offered by certain types of ETFs. The record-high ETF investments demonstrate the growing appeal of these instruments. Whether you’re a seasoned investor or just starting, understanding the benefits of ETFs is crucial to navigating market uncertainty. Start exploring the diverse range of ETFs available today to build a resilient portfolio and achieve your financial goals. Begin your journey into the world of ETF investing today and discover the potential for growth and diversification.

Featured Posts

-

U 15

May 28, 2025

U 15

May 28, 2025 -

Today In Chicago History Picassos Groundbreaking First American Solo Show

May 28, 2025

Today In Chicago History Picassos Groundbreaking First American Solo Show

May 28, 2025 -

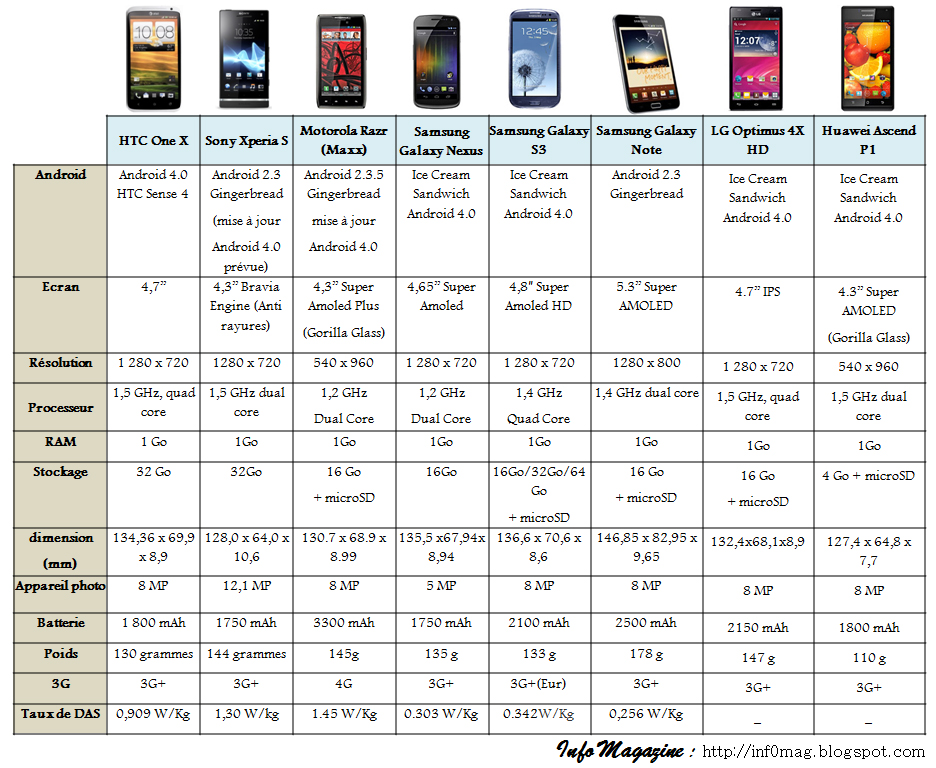

5 Smartphones Qui Tiennent Toute La Journee Comparatif 2024

May 28, 2025

5 Smartphones Qui Tiennent Toute La Journee Comparatif 2024

May 28, 2025 -

Cuaca Ekstrem Jawa Timur Hujan Deras Dan Petir Diprediksi 29 Maret 2024

May 28, 2025

Cuaca Ekstrem Jawa Timur Hujan Deras Dan Petir Diprediksi 29 Maret 2024

May 28, 2025 -

Galaxy S25 Ultra 1 To Reduction De 13 1294 90 E

May 28, 2025

Galaxy S25 Ultra 1 To Reduction De 13 1294 90 E

May 28, 2025