Deutsche Bank And FinaXai Partner On Tokenized Funds Servicing

Table of Contents

The Potential of Tokenized Funds

The partnership between Deutsche Bank and finaXai highlights the transformative potential of tokenized funds. By leveraging blockchain technology, the traditional fund servicing model is poised for a significant upgrade, offering several key advantages:

Enhanced Efficiency

Tokenization streamlines various aspects of fund administration, leading to significant improvements in efficiency:

- Streamlined Processes: Fund administration tasks, such as record-keeping, reporting, and settlements, become significantly faster and more efficient. This automation reduces operational costs and minimizes time delays, allowing for quicker turnaround times on transactions.

- Automated Workflows: Blockchain's inherent automation capabilities eliminate manual intervention in many processes, reducing human error and boosting overall productivity. This includes automated reconciliation of transactions and the generation of reports.

- Improved Scalability: The decentralized nature of blockchain enables the seamless handling of vastly increased transaction volumes. This scalability is crucial for managing the growth of tokenized funds and adapting to future market demands.

Increased Transparency

Tokenized funds offer unparalleled transparency throughout the fund lifecycle:

- Real-time Visibility: Investors and fund managers gain real-time access to fund performance data and asset holdings. This transparency fosters trust and enables more informed decision-making.

- Enhanced Auditability and Compliance: The immutable nature of blockchain records provides a comprehensive audit trail, simplifying compliance processes and reducing the risk of discrepancies. This increased transparency makes regulatory oversight more efficient.

- Reduced Counterparty Risk: The decentralized nature of blockchain minimizes reliance on intermediaries, thus mitigating counterparty risk and fostering greater trust within the ecosystem.

Enhanced Security

Blockchain technology significantly bolsters the security of tokenized funds:

- Improved Security Against Fraud and Cyberattacks: Cryptographic techniques inherent in blockchain technology provide robust protection against fraudulent activities and cyberattacks. This enhanced security safeguards both fund assets and investor information.

- Minimized Risks Associated with Human Error: Automation minimizes the risk of human error, a frequent source of inaccuracies and potential losses in traditional fund management.

- Greater Data Integrity and Protection Against Unauthorized Access: Blockchain's inherent security features ensure the integrity of data and protect against unauthorized access, enhancing overall data protection.

The Role of Deutsche Bank and finaXai

This innovative partnership leverages the unique strengths of both Deutsche Bank and finaXai:

Deutsche Bank's Contribution

Deutsche Bank brings its extensive expertise and global reach to the table:

- Extensive Experience in Funds Servicing: Deutsche Bank's deep understanding of funds servicing allows for seamless integration of tokenization into existing processes.

- Regulatory Expertise and Market Access: The bank's regulatory expertise ensures compliance and provides valuable market access, facilitating wider adoption of the solution.

- Infrastructure Integration: Deutsche Bank's integration of the tokenized funds solution into its existing infrastructure makes the transition smoother for clients.

finaXai's Expertise

finaXai provides the cutting-edge blockchain technology and platform:

- Blockchain Technology and Tokenization Platform: finaXai contributes its robust and secure blockchain platform specifically designed for tokenizing funds.

- Secure and Scalable Infrastructure: The platform provides the scalable infrastructure needed to handle the growing demands of tokenized funds.

- Regulatory Compliance: finaXai ensures the solution complies with all relevant regulations and standards.

Implications for the Financial Industry

The Deutsche Bank and finaXai partnership has far-reaching implications for the financial industry:

Wider Adoption of Blockchain

This partnership is expected to accelerate the adoption of blockchain technology within the financial services sector:

- Catalysing Broader Adoption: The success of this initiative is likely to encourage other financial institutions to explore similar solutions.

- Increased Interest from Other Financial Institutions: The demonstrable benefits of tokenized funds are likely to generate significant interest from other players in the financial services industry.

- Potential for Similar Partnerships: This partnership may serve as a model for similar collaborations in other areas of finance.

Improved Investor Experience

Tokenized funds are poised to deliver a significantly improved investor experience:

- Faster and More Transparent Access to Fund Information: Investors gain quick and easy access to comprehensive, real-time information.

- Improved Liquidity and Reduced Friction in Trading Tokenized Assets: Trading tokenized assets becomes smoother and more efficient.

- Enhanced Investor Confidence: The transparency and security offered by blockchain technology will significantly boost investor confidence.

Conclusion

The partnership between Deutsche Bank and finaXai in developing tokenized funds servicing represents a pivotal moment in the evolution of the financial industry. By leveraging blockchain technology, this collaboration promises to deliver significant improvements in efficiency, transparency, and security for fund management. This innovative approach to funds servicing opens doors to broader adoption of blockchain within the financial landscape, ultimately benefiting both investors and financial institutions. Learn more about the future of tokenized funds and how this partnership is shaping the industry. Explore the potential of funds servicing with blockchain today!

Featured Posts

-

French Open Opponents Dealing With Hostile Crowds And Unconventional Tactics

May 30, 2025

French Open Opponents Dealing With Hostile Crowds And Unconventional Tactics

May 30, 2025 -

Ruben Amorim Casts Doubt On Manchester United Player

May 30, 2025

Ruben Amorim Casts Doubt On Manchester United Player

May 30, 2025 -

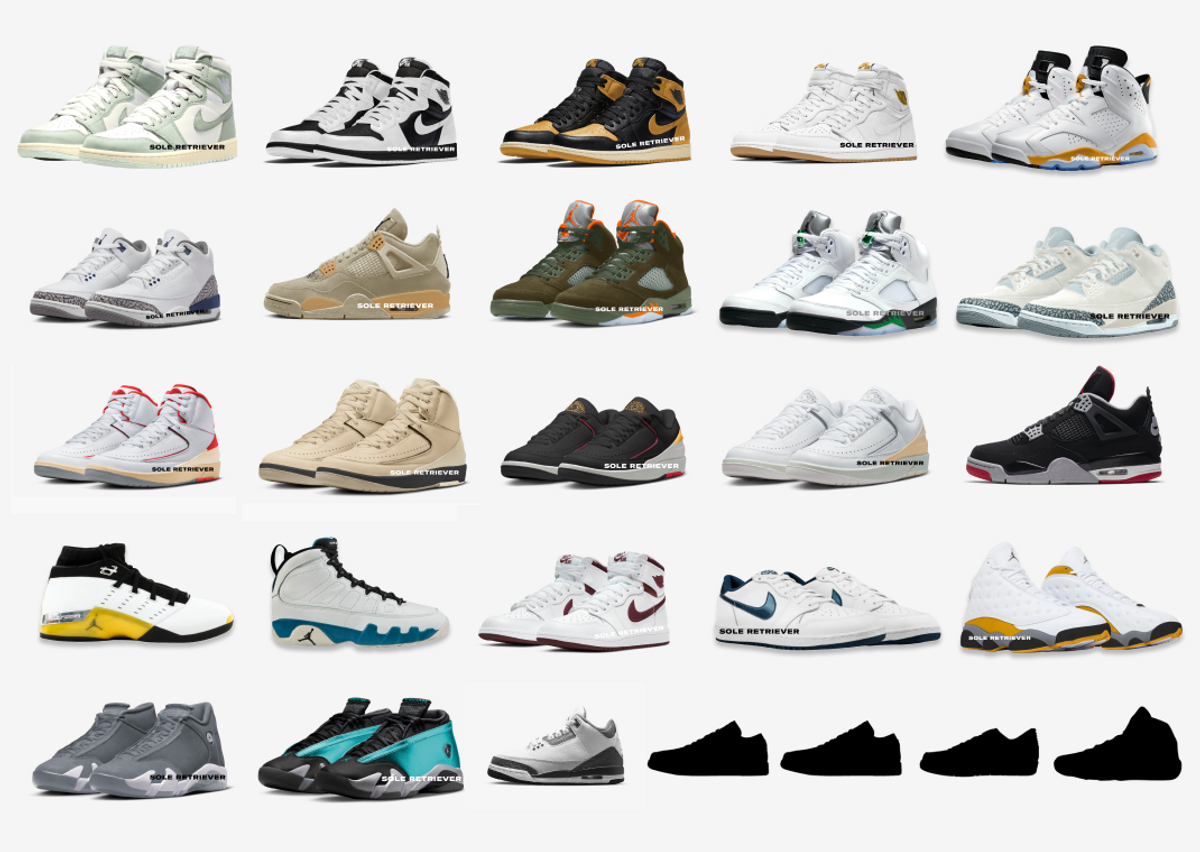

Air Jordans Launching In June 2025 A Detailed Overview

May 30, 2025

Air Jordans Launching In June 2025 A Detailed Overview

May 30, 2025 -

Analysis 311 Deaths In England Linked To Extreme Heat

May 30, 2025

Analysis 311 Deaths In England Linked To Extreme Heat

May 30, 2025 -

Innovative Materials For A Cooler Urban India Addressing Climate Change

May 30, 2025

Innovative Materials For A Cooler Urban India Addressing Climate Change

May 30, 2025