Deutsche Bank And IBM: A Partnership Driving Digital Innovation

Table of Contents

Enhanced Cybersecurity through IBM's Expertise

Keyword: Deutsche Bank Cybersecurity IBM

Deutsche Bank, handling vast amounts of sensitive client data and facing ever-evolving cyber threats, relies heavily on robust cybersecurity measures. The partnership with IBM provides access to leading-edge solutions, significantly strengthening its defenses. This collaboration ensures that Deutsche Bank remains at the forefront of cybersecurity in the financial industry.

- Implementation of advanced threat detection and response systems: IBM's QRadar and other advanced security information and event management (SIEM) tools provide real-time threat detection and rapid response capabilities, minimizing the impact of potential breaches.

- Utilizing AI-powered security analytics for proactive threat mitigation: AI-driven security analytics help identify and neutralize threats before they can cause damage, enhancing proactive security measures. Machine learning algorithms constantly adapt to new threats, providing a more robust and resilient security posture.

- Strengthening data encryption and access control mechanisms: Implementing strong encryption protocols and granular access control measures ensures that only authorized personnel can access sensitive data, minimizing the risk of data breaches.

- Regular security audits and vulnerability assessments: Proactive vulnerability assessments and regular security audits help identify and address potential weaknesses in the system, strengthening overall security posture.

The Impact of Enhanced Security on Client Trust

Improved cybersecurity is paramount for maintaining client trust. By leveraging IBM's expertise, Deutsche Bank demonstrates a commitment to protecting client data, strengthening its reputation and fostering greater confidence among its clientele. This enhanced security is a key differentiator in the competitive financial landscape.

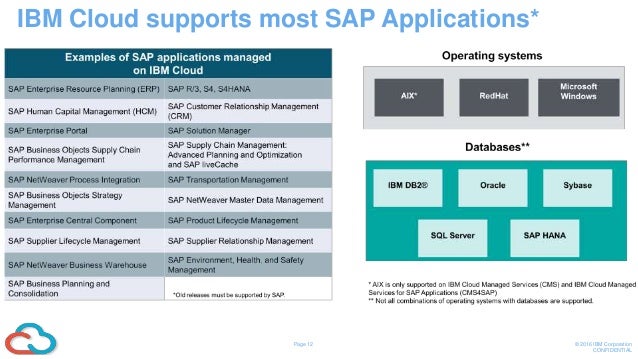

Accelerated Cloud Migration with IBM Hybrid Cloud Solutions

Keyword: Deutsche Bank IBM Cloud Migration

The Deutsche Bank IBM partnership facilitates a strategic migration to a hybrid cloud environment. This approach combines the benefits of on-premises infrastructure with the scalability and flexibility of the cloud, optimizing operations and reducing costs.

- Seamless integration of on-premises infrastructure with cloud services: IBM's hybrid cloud solutions ensure a smooth transition, minimizing disruption to existing operations while enabling a gradual shift to the cloud.

- Improved agility and faster deployment of new applications: The cloud environment enables faster deployment of new applications and services, providing Deutsche Bank with greater agility to respond to market demands and client needs.

- Enhanced data management and analytics capabilities: Cloud-based data management solutions provide improved data accessibility, scalability, and analytical capabilities, enabling better decision-making.

- Optimization of IT infrastructure costs: Consolidating and optimizing IT infrastructure through cloud migration leads to significant cost savings in the long run.

Benefits of Hybrid Cloud for Financial Services

Hybrid cloud offers significant advantages to financial institutions. It allows for maintaining control over sensitive data while benefiting from the scalability and cost-effectiveness of the cloud, striking a balance between security and innovation. This is particularly crucial for the financial services industry which demands both high security and high availability.

AI-Driven Innovation in Financial Services

Keyword: Deutsche Bank IBM AI

The collaboration between Deutsche Bank and IBM is spearheading AI-driven innovation across various financial services. This partnership is leveraging the power of AI to enhance operational efficiency, improve risk management, and personalize customer experiences.

- Development of AI-powered fraud detection systems: AI algorithms analyze vast datasets to identify and prevent fraudulent activities, significantly reducing financial losses.

- Utilizing machine learning for algorithmic trading and portfolio optimization: Machine learning models analyze market data and optimize investment strategies, leading to improved returns and risk management.

- Implementation of AI-driven chatbots for enhanced customer support: AI-powered chatbots provide 24/7 customer support, answering queries efficiently and improving customer satisfaction.

- Application of AI in regulatory compliance: AI assists in navigating complex regulatory landscapes, ensuring compliance and minimizing risks.

Transforming Customer Experience with AI

The integration of AI-powered solutions is transforming the customer experience at Deutsche Bank. AI-driven chatbots provide instant support, personalized recommendations, and seamless interactions, enhancing customer satisfaction and loyalty.

Sustainable Business Practices through Technological Collaboration

Keyword: Deutsche Bank IBM Sustainability

The Deutsche Bank IBM partnership is committed to sustainable business practices. This collaboration leverages technology to reduce environmental impact and promote responsible business operations.

- Development of solutions to reduce carbon footprint: Through optimized IT infrastructure and data-driven insights, the partnership helps minimize Deutsche Bank’s environmental footprint.

- Utilizing data analytics to optimize energy consumption: Data analytics help identify areas for energy efficiency improvements, reducing overall energy consumption and carbon emissions.

- Implementation of sustainable technologies across operations: The partnership promotes the adoption of sustainable technologies throughout Deutsche Bank's operations, minimizing waste and maximizing resource efficiency.

- Promoting responsible AI development: The partnership emphasizes responsible AI development, ensuring ethical and transparent use of AI technologies.

The Role of Technology in Achieving Sustainability Goals

Technology plays a critical role in achieving sustainability goals. By leveraging data analytics, AI, and efficient IT infrastructure, Deutsche Bank, in partnership with IBM, is actively contributing to a more sustainable future.

Conclusion

The Deutsche Bank IBM partnership exemplifies the transformative power of technological collaboration within the financial sector. Their joint efforts in enhancing cybersecurity, accelerating cloud migration, driving AI-powered innovation, and promoting sustainable business practices are reshaping the future of finance. This powerful alliance demonstrates a commitment to modernization, efficiency, and responsible growth.

Call to Action: Learn more about the transformative impact of the Deutsche Bank IBM partnership and how this collaboration is shaping the future of finance. Explore the innovative solutions they are developing together. Discover the power of the Deutsche Bank and IBM partnership for a more secure, efficient, and sustainable future.

Featured Posts

-

Worth The Wait Post Credit Scenes In Marvel And Sinner Explained

May 30, 2025

Worth The Wait Post Credit Scenes In Marvel And Sinner Explained

May 30, 2025 -

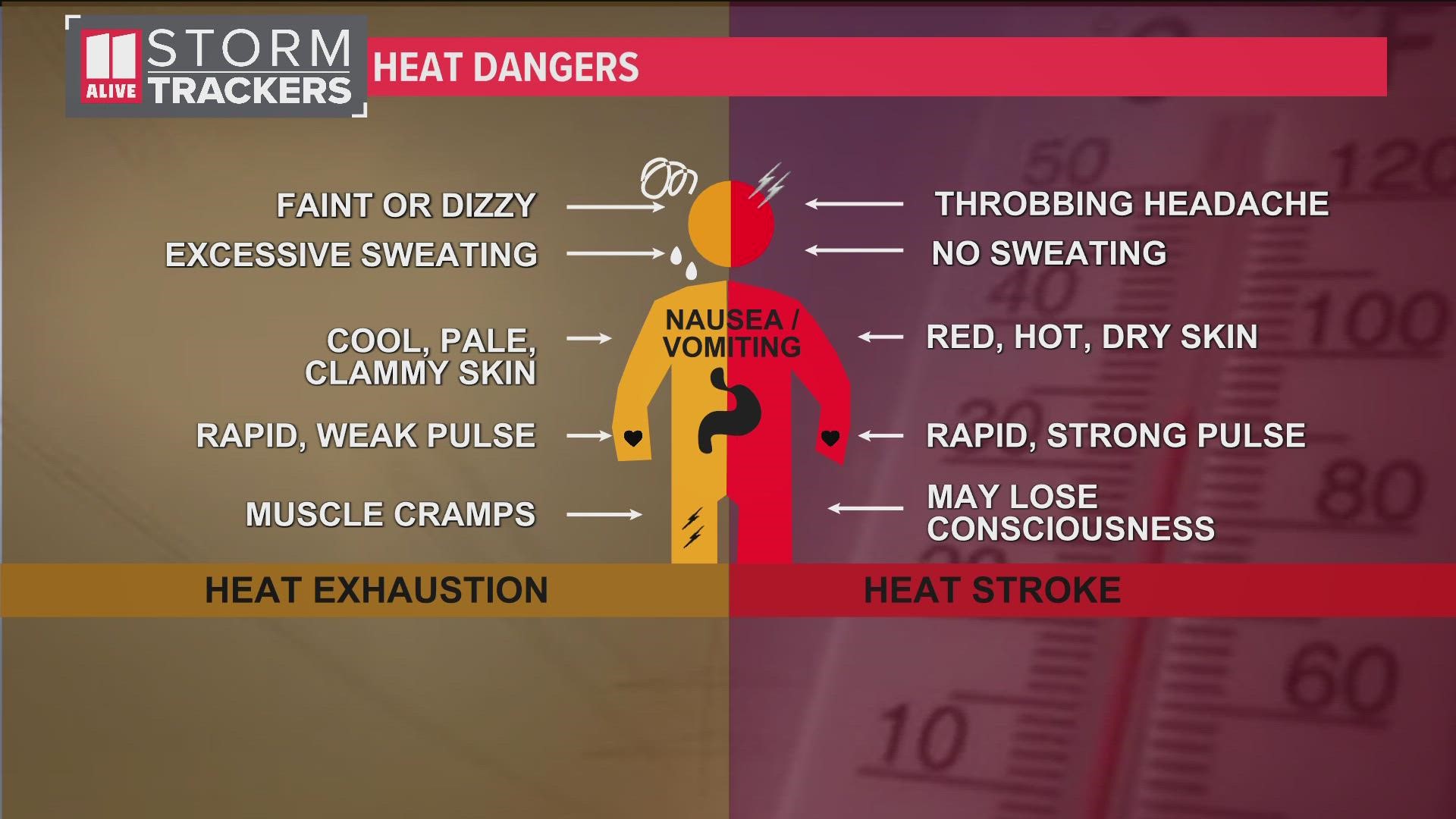

Why Your Forecast Might Not Include An Excessive Heat Warning

May 30, 2025

Why Your Forecast Might Not Include An Excessive Heat Warning

May 30, 2025 -

Amanda Holdens Dog Care Practices Spark Outrage On Heart Radio

May 30, 2025

Amanda Holdens Dog Care Practices Spark Outrage On Heart Radio

May 30, 2025 -

Recent Measles Outbreak Identifying High Risk Areas In The U S

May 30, 2025

Recent Measles Outbreak Identifying High Risk Areas In The U S

May 30, 2025 -

Donald Trump I Wolodymyr Zelenski Szczegoly Rozmow

May 30, 2025

Donald Trump I Wolodymyr Zelenski Szczegoly Rozmow

May 30, 2025