Deutsche Bank Targets Global Investors In Saudi Arabia

Table of Contents

Saudi Arabia's Attractive Investment Landscape

Saudi Vision 2030 is the driving force behind Saudi Arabia's economic transformation, creating a highly attractive investment landscape for global players. The plan aims to diversify the economy beyond oil, fostering growth in various sectors and opening doors for significant investment opportunities. This diversification strategy, coupled with massive infrastructure projects and privatization initiatives, is attracting substantial foreign direct investment (FDI).

-

Massive infrastructure projects under Vision 2030: Projects like NEOM, the Red Sea Project, and Qiddiya are not only transforming the Saudi landscape but also creating numerous opportunities for investors in construction, engineering, and related industries. These mega-projects require significant capital investment, presenting lucrative opportunities for global investors.

-

Privatization of state-owned assets creating new investment opportunities: The Saudi government's privatization program is opening up previously inaccessible sectors to private investment. This includes opportunities in utilities, transportation, and other key industries, offering high growth potential.

-

Growth in sectors like tourism, technology, and renewable energy: Saudi Arabia is actively developing its tourism sector, creating opportunities in hospitality, leisure, and entertainment. The technology sector is also experiencing rapid growth, with increased investment in digital infrastructure and innovation hubs. The kingdom's commitment to renewable energy presents further investment potential in solar and wind power projects.

-

Increased foreign direct investment (FDI) inflows: The reforms under Vision 2030 have resulted in a significant increase in FDI, demonstrating global confidence in the Saudi economy's future.

-

The impact of the Saudi Aramco IPO on the global investment landscape: The successful IPO of Saudi Aramco showcased the kingdom's commitment to transparency and its ability to attract significant global investment. This event also boosted investor confidence in the Saudi market and paved the way for more significant IPOs in the future. The real estate investment market is also booming thanks to increased domestic demand and an influx of foreign investment. Private equity firms are also actively seeking opportunities in the rapidly expanding Saudi market.

Deutsche Bank's Services for Global Investors in Saudi Arabia

Deutsche Bank offers a comprehensive suite of financial services tailored to meet the needs of global investors in Saudi Arabia. The bank's expertise spans various areas, allowing it to provide holistic solutions to its clients. Their services are designed to help investors navigate the complexities of the Saudi market and effectively capitalize on its growth potential.

-

Investment banking services for large-scale projects: Deutsche Bank provides advisory services, underwriting, and financing for major infrastructure projects and other large-scale investments in Saudi Arabia.

-

Wealth management solutions for high-net-worth individuals: The bank offers tailored wealth management solutions designed to meet the specific needs of high-net-worth individuals seeking investment opportunities in the Saudi market. This includes sophisticated investment strategies and portfolio management services.

-

Expertise in navigating the Saudi regulatory environment: Deutsche Bank possesses in-depth knowledge of the Saudi regulatory framework, allowing it to guide investors through the complexities of the local legal and regulatory landscape.

-

Dedicated teams focusing on Saudi Arabian investment opportunities: The bank has dedicated teams with specialized expertise in the Saudi market, providing clients with localized support and insights.

-

Access to a network of local partners and industry experts: Deutsche Bank leverages its extensive network of local partners and industry experts to provide clients with invaluable connections and market intelligence. This includes expertise in Islamic finance and Sharia-compliant investments, catering to a significant segment of the Saudi market.

Focus on Specific Investment Sectors

Deutsche Bank identifies significant growth potential in several key sectors within Saudi Arabia:

-

Real estate Saudi Arabia: The booming real estate market, driven by population growth and infrastructure development, presents significant opportunities for investors. Deutsche Bank offers services to help investors navigate this dynamic sector, from identifying promising projects to managing risk.

-

Renewable energy investment Saudi Arabia: With a strong commitment to diversifying its energy sources, Saudi Arabia's renewable energy sector is rapidly expanding. Deutsche Bank provides advisory and financing solutions for investors looking to participate in this growth.

-

Technology investment Saudi Arabia: Saudi Arabia's Vision 2030 prioritizes technological advancement, making it an attractive destination for tech investments. Deutsche Bank offers expertise in this area, assisting investors in identifying and capitalizing on opportunities in fintech, digital transformation, and other related fields.

-

Tourism investment Saudi Arabia: The kingdom is aggressively developing its tourism sector, with significant investments in infrastructure and marketing. Deutsche Bank provides services to investors seeking opportunities in hospitality, leisure, and related industries.

Competition and Deutsche Bank's Competitive Advantage

The Saudi Arabian financial services market is competitive, with several international banks vying for market share. However, Deutsche Bank’s competitive advantage lies in its global network, deep expertise, and strong understanding of the local market.

-

Mention key competitors in the Saudi market: While specific competitors aren't named here for brevity, the competitive landscape includes other major international banks operating in the region.

-

Explain Deutsche Bank's strengths, such as global network, expertise, and local market knowledge: Deutsche Bank's extensive global network provides access to a wider pool of investors and resources. Their deep expertise in various sectors and their dedicated Saudi Arabia teams give them a significant advantage. Understanding local customs and regulations are also vital for success in the Saudi market.

-

Highlight any partnerships or strategic alliances that strengthen their position: Potential partnerships or strategic alliances with local Saudi firms would further enhance Deutsche Bank's position and provide access to local market knowledge.

Conclusion

Deutsche Bank's strategic focus on global investors in Saudi Arabia capitalizes on the kingdom's transformative Vision 2030 plan and offers a range of financial services tailored to the unique opportunities and challenges of this rapidly growing market. The bank’s expertise, combined with its strong global network and understanding of the local landscape, positions it for significant success in facilitating foreign investment in the Kingdom. Its focus on key sectors like real estate, renewable energy, technology, and tourism further strengthens its competitive advantage.

Call to Action: Are you a global investor looking to capitalize on the exciting investment opportunities in Saudi Arabia? Contact Deutsche Bank today to explore how we can help you navigate this dynamic market and achieve your investment goals. Learn more about Deutsche Bank’s services for global investors in Saudi Arabia by visiting [link to relevant Deutsche Bank page].

Featured Posts

-

Odigos Tiletheasis Gia To Savvato 15 3

May 30, 2025

Odigos Tiletheasis Gia To Savvato 15 3

May 30, 2025 -

Jacobelli Rn Marine Le Pen Ni Au Dessus Ni En Dessous De La Loi

May 30, 2025

Jacobelli Rn Marine Le Pen Ni Au Dessus Ni En Dessous De La Loi

May 30, 2025 -

Gare Du Nord Trafic Fortement Perturbe Suite A La Decouverte D Une Bombe Datant De La Seconde Guerre Mondiale

May 30, 2025

Gare Du Nord Trafic Fortement Perturbe Suite A La Decouverte D Une Bombe Datant De La Seconde Guerre Mondiale

May 30, 2025 -

Role Models No Place Like Home Tour New Paris And London Dates Added

May 30, 2025

Role Models No Place Like Home Tour New Paris And London Dates Added

May 30, 2025 -

French Open Opponents Navigating The Challenges Of A Passionate Crowd

May 30, 2025

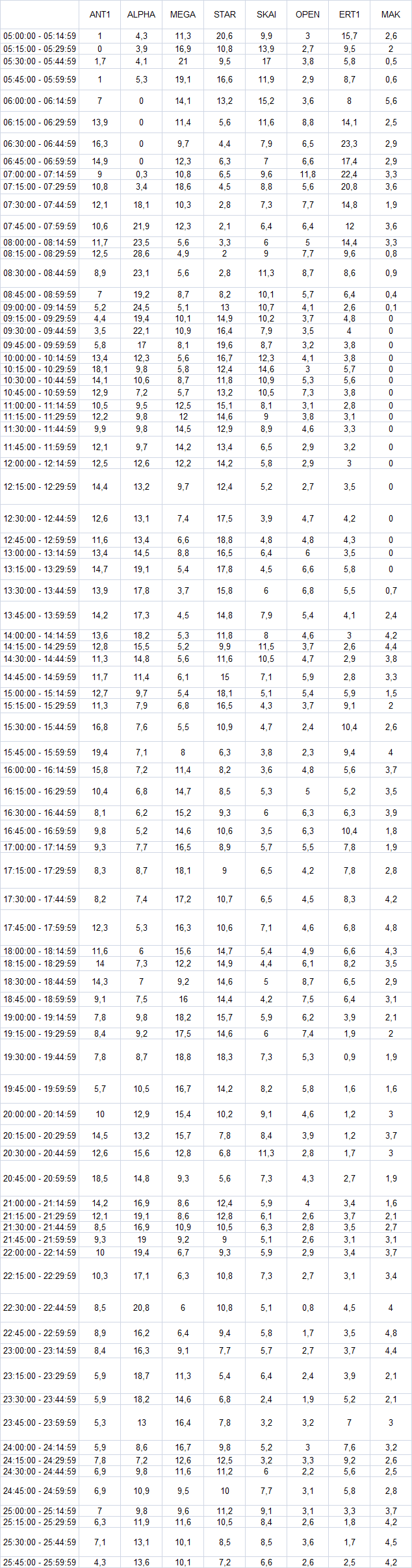

French Open Opponents Navigating The Challenges Of A Passionate Crowd

May 30, 2025