Did Trump Tariffs Influence The Bank Of Canada's April Interest Rate Consideration?

Table of Contents

The Bank of Canada's April [Year] interest rate decision was shrouded in uncertainty, a complex calculation influenced by a multitude of global economic factors. One particularly intriguing question remains: Did the Trump administration's tariffs play a significant role in this crucial decision? Understanding this connection is vital for Canadian businesses and the overall health of the Canadian economy. This article delves into the economic climate of that period to assess the potential influence of these tariffs.

The Economic Climate in April [Year]: A Global Perspective

April [Year] presented a mixed bag economically. Global growth rates were [Insert data on global growth rates and forecasts], showing [positive/negative/mixed] trends. Inflationary pressures varied significantly across major economies, with [mention specific examples, e.g., the Eurozone experiencing moderate inflation, while the US faced higher rates]. Geopolitical events beyond the Trump tariffs, such as [mention specific events and their economic impact, e.g., Brexit developments or tensions in the Middle East], further complicated the economic landscape. The US economy, a major trading partner for Canada, was [describe the state of the US economy at that time, e.g., experiencing robust growth but facing rising inflation].

- Global growth rates and forecasts: [Insert specific data and source].

- Inflationary pressures in major economies: [Cite specific inflation rates for key economies and their sources].

- Impact of geopolitical events (beyond tariffs): [Provide brief descriptions and their economic implications, citing reliable sources].

- State of the US economy in April [Year]: [Describe the economic indicators for the US, citing sources like the Federal Reserve].

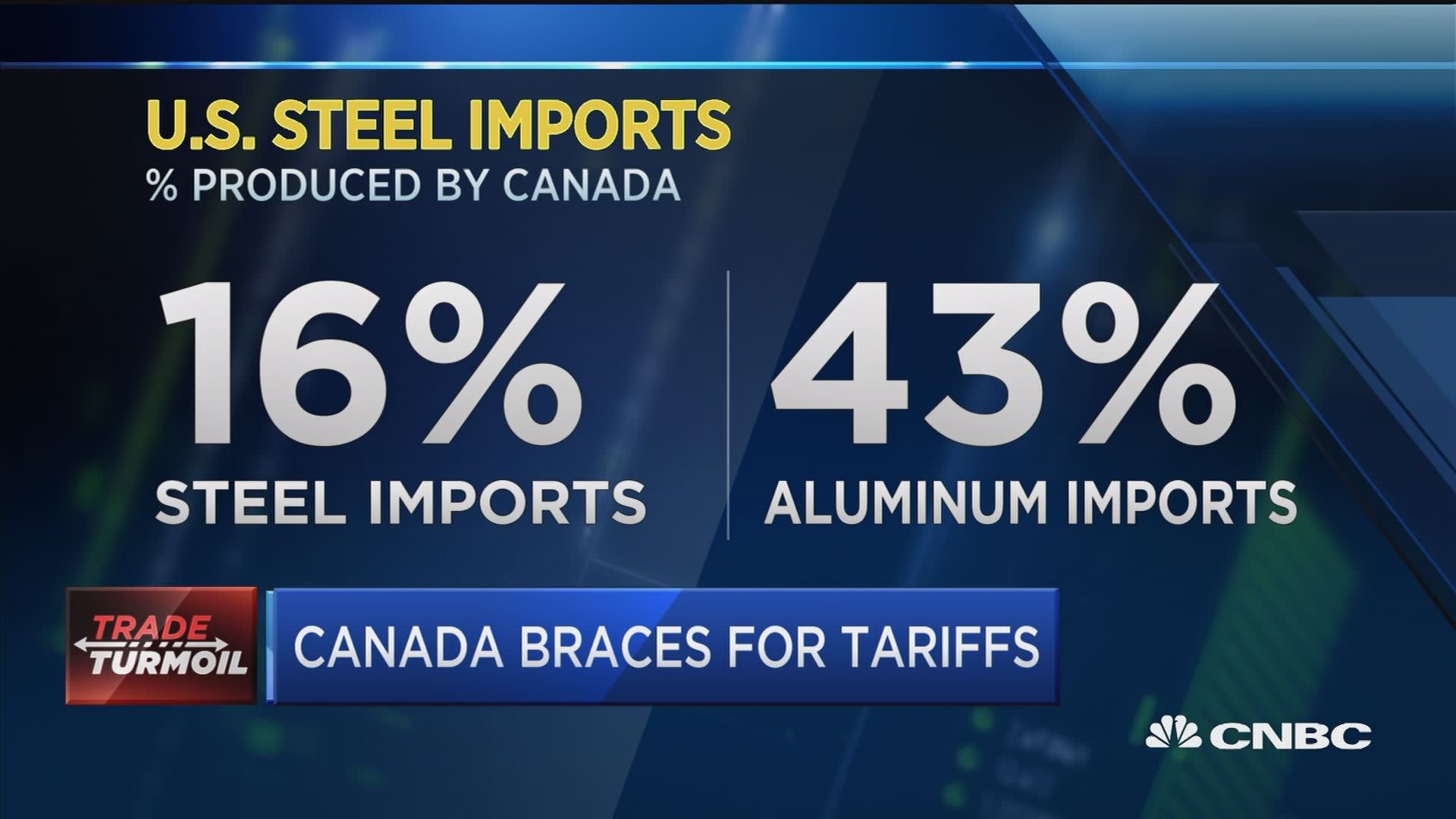

Trump Tariffs: A Detailed Overview and Their Global Impact

The Trump administration implemented a series of tariffs targeting various goods, significantly impacting global trade. These tariffs, particularly those affecting [mention specific goods impacting Canada, e.g., lumber and aluminum], had a direct bearing on the Canadian economy. The magnitude of these tariff increases varied, leading to [explain the effect, e.g., increased costs for Canadian exporters]. Canada, in turn, imposed retaliatory tariffs on certain US goods, escalating the trade conflict and disrupting established supply chains. This tit-for-tat exchange created uncertainty and volatility in the market.

- Types of goods affected: [List specific goods and their significance to the Canadian economy].

- Magnitude of tariff increases: [Provide specific percentage increases for relevant tariffs].

- Retaliatory tariffs imposed by Canada: [Detail the Canadian response to US tariffs].

- Impact on global supply chains: [Explain disruptions and their effects on businesses].

The Bank of Canada's Mandate and Decision-Making Process

The Bank of Canada's primary mandate is to maintain price stability and promote full employment. To achieve this, the Bank closely monitors key economic indicators such as inflation, unemployment rates, and GDP growth. The Bank's rate-setting process involves careful analysis of various economic data and thorough discussions among its governing council. Their communication strategy aims to ensure transparency and manage expectations in the financial markets. Beyond tariffs, the Bank also considers other factors, including domestic economic conditions and exchange rates, when making interest rate decisions.

- Key economic indicators monitored: [List and explain the significance of each indicator].

- Rate-setting process: [Describe the Bank of Canada's internal process for decision-making].

- Communication strategy: [Explain how the Bank communicates its decisions to the public].

- Other factors considered: [Mention additional factors such as domestic economic conditions and exchange rates].

Analyzing the Link: Did Tariffs Directly Influence the Rate Decision?

Determining a direct causal link between the Trump tariffs and the Bank of Canada's April [Year] interest rate decision requires careful analysis. [Insert statistical analysis or data showing any correlation between tariff impacts and key economic indicators if available. Cite your sources meticulously]. Statements from the Bank of Canada's press releases or official communications regarding tariffs and their influence [cite specific statements if available] provide valuable insight. Expert opinions from economists [cite credible economic analyses] offer further perspectives on the potential influence of tariffs, both direct and indirect. For example, the tariffs may have impacted business investment and consumer confidence, which in turn affected overall economic activity.

- Statistical analysis (if available): [Present any relevant statistical data and analysis].

- Bank of Canada statements: [Quote relevant statements from official sources].

- Expert opinions: [Summarize the perspectives of leading economists].

- Indirect effects: [Analyze potential indirect impacts on the economy].

Alternative Explanations for the Interest Rate Decision

It's crucial to acknowledge that the Bank of Canada's decision was not solely determined by the Trump tariffs. Several other factors likely played a role. Domestic economic performance, specifically [mention specific indicators], may have influenced the decision. Global economic uncertainty unrelated to tariffs, such as [mention examples], added to the complexity. Fluctuations in oil prices, a key component of the Canadian economy, also likely played a significant part.

- Domestic economic performance: [Provide details about relevant Canadian economic indicators].

- Global economic uncertainty: [Explain other global factors impacting the decision].

- Changes in oil prices: [Discuss the impact of oil price fluctuations on the Canadian economy].

Conclusion

Determining a definitive causal relationship between the Trump tariffs and the Bank of Canada's April [Year] interest rate decision proves challenging. While the tariffs undoubtedly created economic uncertainty and impacted certain sectors of the Canadian economy, the evidence of a direct, causal link remains inconclusive. Other significant economic factors, both domestic and international, played crucial roles. The Bank's decision was a multifaceted response to a complex economic landscape.

To further understand the complexities of interest rate decisions and the influence of global trade policies like the Trump tariffs, explore the Bank of Canada's website and relevant economic publications for detailed data and analysis. Investigating the impact of trade disputes on central bank policies is essential for comprehending the intricate dynamics of the global economy.

Featured Posts

-

Duizenden Limburgse Bedrijven Op De Wachtlijst Van Enexis Wat Nu

May 02, 2025

Duizenden Limburgse Bedrijven Op De Wachtlijst Van Enexis Wat Nu

May 02, 2025 -

Miss Pacific Islands 2025 A Samoan Win

May 02, 2025

Miss Pacific Islands 2025 A Samoan Win

May 02, 2025 -

Analyzing The Credibility Of Evidence Related To A Toxic Workplace Under Rupert Lowe

May 02, 2025

Analyzing The Credibility Of Evidence Related To A Toxic Workplace Under Rupert Lowe

May 02, 2025 -

Riot Fest 2025 Green Day Blink 182 And Weird Al Yankovic Headline

May 02, 2025

Riot Fest 2025 Green Day Blink 182 And Weird Al Yankovic Headline

May 02, 2025 -

Christina Aguileras New Photoshoot Is It Too Much Photoshop

May 02, 2025

Christina Aguileras New Photoshoot Is It Too Much Photoshop

May 02, 2025

Latest Posts

-

Liverpool Transfer News Frimpong Talks And Elliotts Future

May 03, 2025

Liverpool Transfer News Frimpong Talks And Elliotts Future

May 03, 2025 -

Thdhyr Khtyr Mn Jw 24 Slah Mghamratk Thdd Wdek

May 03, 2025

Thdhyr Khtyr Mn Jw 24 Slah Mghamratk Thdd Wdek

May 03, 2025 -

Jw 24 Yndhr Slah Alwde Dqyq Tjnb Almghamrat

May 03, 2025

Jw 24 Yndhr Slah Alwde Dqyq Tjnb Almghamrat

May 03, 2025 -

Rsalt Eajlt Lslah Mn Jw 24 Twqf En Almkhatrt Bwdek Alhsas

May 03, 2025

Rsalt Eajlt Lslah Mn Jw 24 Twqf En Almkhatrt Bwdek Alhsas

May 03, 2025 -

Jw 24 Thdhyr Sryh Lslah Bshan Mghamrath Alkhtyrt

May 03, 2025

Jw 24 Thdhyr Sryh Lslah Bshan Mghamrath Alkhtyrt

May 03, 2025