Disaster Capitalism And Betting: Examining The Los Angeles Wildfires

Table of Contents

The Role of Insurance Companies in Post-Wildfire Los Angeles

Following a devastating wildfire, the role of insurance companies becomes paramount. However, their actions often exacerbate the suffering of those already affected.

Inflated Premiums and Inadequate Coverage

Insurance companies frequently raise premiums in areas affected by wildfires, making insurance unaffordable for many residents. This leaves communities already reeling from loss vulnerable to further financial hardship. Many victims also face difficulties in securing adequate payouts. Claims are often denied based on technicalities or disputes over the extent of the damage. This is further compounded by the influence of lobbying and regulatory capture, which often favors the interests of insurance companies over policyholders.

- Insurance fraud investigations frequently follow major wildfires, sometimes hindering legitimate claims.

- Wildfire insurance claims often involve complex assessments and lengthy processing times.

- Los Angeles property insurance costs are among the highest in the nation, placing an added burden on residents.

Profiting from Rebuilding

The substantial insurance payouts following wildfires fuel the rebuilding industry, often benefiting specific contractors and companies. This can lead to inflated costs and, in some cases, substandard construction, leaving residents vulnerable to further damage in future events.

- Post-wildfire reconstruction contracts often go to pre-selected firms, limiting competition and driving up prices.

- Disaster relief funding is sometimes diverted to projects that benefit private interests rather than directly aiding those affected.

- Scrutiny of construction contracts after major wildfires is crucial to ensuring fairness and quality.

Speculative Land Purchases and Real Estate After Wildfires

Wildfires, tragically, create opportunities for real estate speculation. The devastation can temporarily depress property values, allowing investors to acquire land cheaply.

Depressed Property Values and Opportunistic Buying

The immediate aftermath of a wildfire leaves property values significantly diminished. This allows opportunistic investors to purchase land at bargain prices, often leaving long-term residents unable to afford to return.

- Real estate speculation following natural disasters raises ethical questions about profit motives versus community recovery.

- Land investment in areas affected by wildfires requires careful consideration of the environmental and social consequences.

- Property values after wildfires fluctuate significantly, depending on the extent of damage and the speed of rebuilding efforts.

Gentrification and Displacement

Rebuilding efforts, often funded by large-scale investments, can inadvertently trigger gentrification, displacing long-term residents who can no longer afford the rising costs of living. This can fracture community cohesion and exacerbate existing inequalities.

- Affordable housing crisis is often worsened by post-wildfire rebuilding, as new construction frequently targets higher-income residents.

- Community displacement occurs when long-term residents are unable to compete with higher-paying newcomers.

- Post-disaster gentrification is a growing concern in many disaster-prone areas, including Los Angeles.

The "Betting" Aspect: Financial Instruments and Wildfire Risk

The financial sector plays a significant role in managing wildfire risk, but this involves a complex interplay of risk mitigation and profit-seeking.

Derivatives and Catastrophe Bonds

Financial instruments like catastrophe bonds and derivatives are used to hedge against wildfire risk. However, the focus on profit can sometimes overshadow the actual mitigation of risk for affected communities.

- Catastrophe bonds allow investors to profit from events like wildfires while simultaneously providing insurance payouts to affected parties.

- Financial derivatives can be used to speculate on the severity and frequency of wildfires, potentially exacerbating the impact.

- The potential for wildfire risk assessment to become overly focused on financial gain rather than community safety is a pressing concern.

Predictive Modeling and Data Exploitation

Predictive modeling and data analytics are increasingly used to assess wildfire risk. However, the use of sensitive data for profit carries significant ethical implications, including the potential for algorithmic bias and discriminatory practices.

- Data analytics can identify high-risk areas, but this information is often used to set insurance premiums, potentially disadvantaging vulnerable communities.

- Wildfire prediction models are becoming more sophisticated, but their accuracy and equity remain subject to debate.

- The risk of algorithmic bias in wildfire prediction models warrants careful attention and oversight to avoid exacerbating existing inequalities.

Conclusion: Addressing Disaster Capitalism in the Face of Los Angeles Wildfires

The analysis presented here demonstrates how Disaster Capitalism intertwines with the devastating reality of Los Angeles wildfires. Insurance companies profit from inflated premiums and rebuilding efforts, real estate investors exploit depressed property values, and financial instruments transform wildfire risk into a commodity. The ethical considerations are profound. We must critically examine how these systems operate and advocate for stronger regulations to protect vulnerable communities. We need transparent, equitable disaster relief funding, affordable housing initiatives, and increased accountability for those who profit from these tragedies. The exploitation inherent in Disaster Capitalism must be addressed to ensure ethical and effective disaster recovery and rebuilding practices in Los Angeles and beyond. Addressing Disaster Capitalism and its influence on the Los Angeles Wildfires is crucial for building more resilient and equitable communities.

Featured Posts

-

Political Fallout Analyzing Newsoms Actions Against Democrats

Apr 26, 2025

Political Fallout Analyzing Newsoms Actions Against Democrats

Apr 26, 2025 -

Mission Impossible 7 Final Reckoning Official Trailer Analysis

Apr 26, 2025

Mission Impossible 7 Final Reckoning Official Trailer Analysis

Apr 26, 2025 -

Espn Analyst Details Deion Sanders Shedeur Sanders Nfl Draft Projection

Apr 26, 2025

Espn Analyst Details Deion Sanders Shedeur Sanders Nfl Draft Projection

Apr 26, 2025 -

Decade Long Halt Ends Construction Resumes On Worlds Tallest Abandoned Building

Apr 26, 2025

Decade Long Halt Ends Construction Resumes On Worlds Tallest Abandoned Building

Apr 26, 2025 -

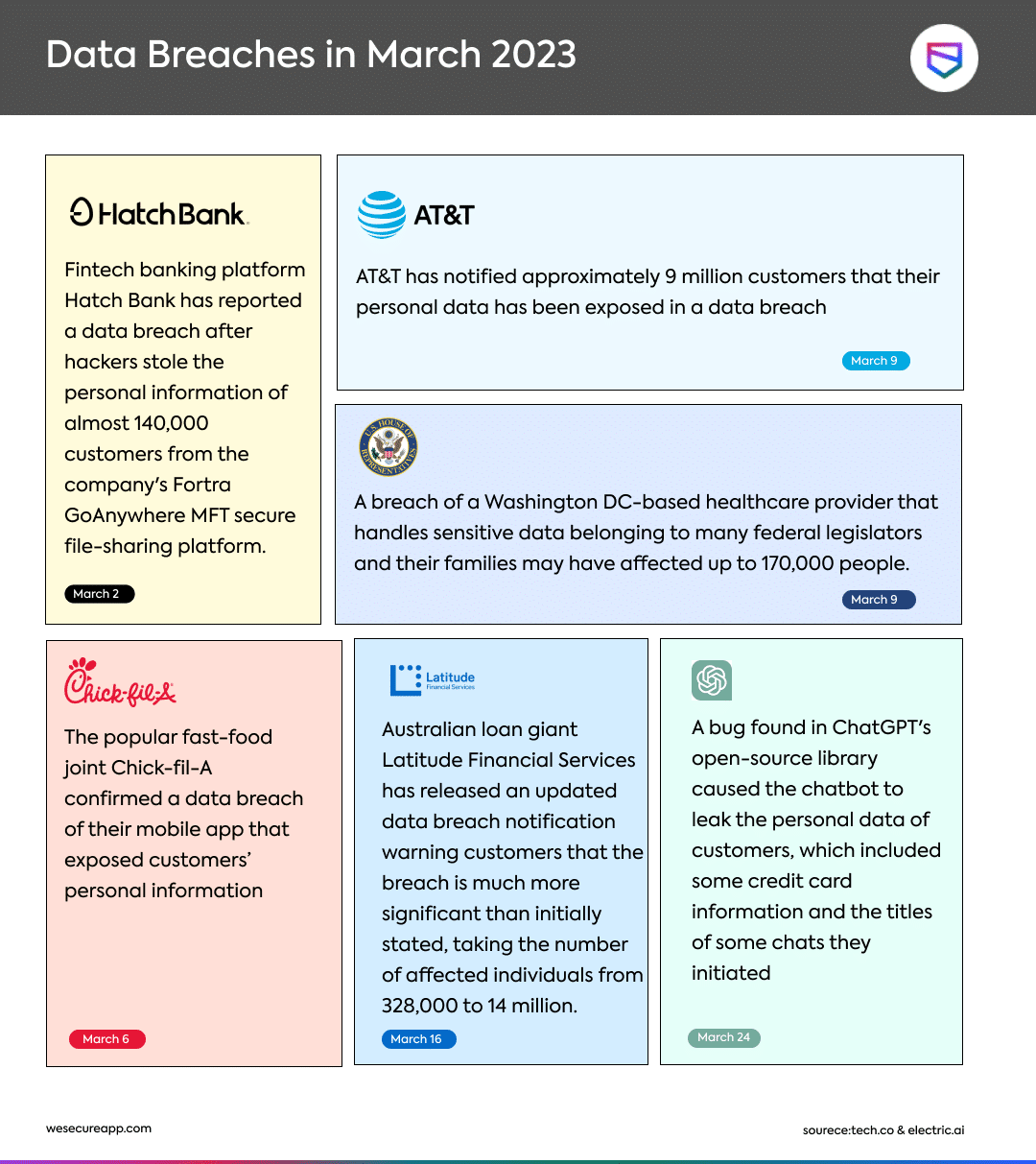

16 Million Fine For T Mobile Details Of Three Years Of Data Security Issues

Apr 26, 2025

16 Million Fine For T Mobile Details Of Three Years Of Data Security Issues

Apr 26, 2025

Latest Posts

-

Ariana Grandes Hair And Tattoo Transformation Expert Opinion And Analysis

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation Expert Opinion And Analysis

Apr 27, 2025 -

Exploring Ariana Grandes New Look A Professional Assessment Of Her Tattoos And Hairstyle

Apr 27, 2025

Exploring Ariana Grandes New Look A Professional Assessment Of Her Tattoos And Hairstyle

Apr 27, 2025 -

Understanding Ariana Grandes Latest Transformation A Professionals View

Apr 27, 2025

Understanding Ariana Grandes Latest Transformation A Professionals View

Apr 27, 2025 -

Professional Commentary Ariana Grandes Bold Hair And Tattoo Changes

Apr 27, 2025

Professional Commentary Ariana Grandes Bold Hair And Tattoo Changes

Apr 27, 2025 -

Ariana Grandes Style Evolution Professional Analysis Of Her New Look

Apr 27, 2025

Ariana Grandes Style Evolution Professional Analysis Of Her New Look

Apr 27, 2025