Dismissing Stock Market Valuation Concerns: BofA's Rationale

Table of Contents

BofA's Bullish Outlook on Corporate Earnings Growth

BofA's primary justification for a less pessimistic view on current valuations centers on their bullish outlook for corporate earnings growth. They project robust earnings expansion in the coming years, arguing that this growth will ultimately justify current, seemingly high, valuation multiples. This strong earnings growth outlook is a key component in their strategy for dismissing stock market valuation concerns.

- Specific growth projections: While precise numbers vary depending on the specific report and timeframe, BofA consistently projects above-average earnings growth across various sectors. They often cite double-digit percentage increases for certain sectors, outpacing historical averages.

- Sectors driving the growth: Key growth drivers often identified include technology, healthcare, and certain consumer discretionary sectors benefiting from sustained economic recovery. These sectors show strong potential for continued corporate profitability.

- Supporting data/evidence: BofA typically supports their projections with detailed analysis of macroeconomic trends, industry-specific data, and company-specific financial forecasts. They frequently reference factors like improving consumer confidence, sustained technological innovation, and increased business investment.

The Role of Low Interest Rates in Justifying Higher Valuations

A crucial element of BofA's argument revolves around the relationship between interest rates and stock valuations. They contend that the persistent low-interest-rate environment supports higher price-to-earnings (P/E) ratios. Understanding this dynamic is vital when considering dismissing stock market valuation concerns.

- Inverse relationship: Lower interest rates decrease the discount rate used in valuation models, leading to higher present values for future earnings. This makes stocks, with their potential for future growth, relatively more attractive compared to bonds yielding low returns.

- Historical comparison: BofA often draws parallels to historical periods with similarly low interest rates, highlighting that current P/E ratios are not unprecedented in such environments. Analyzing historical P/E ratios offers valuable context when assessing current market conditions.

- Monetary policy impact: The continued influence of accommodative monetary policy, with central banks maintaining low interest rates, is seen by BofA as a factor supporting higher stock valuations and mitigating some of the concerns surrounding valuation multiples.

Addressing the Risks: BofA's Acknowledgment of Valuation Challenges

It's crucial to understand that BofA doesn't entirely dismiss the risks associated with high valuations. Instead, they acknowledge potential challenges and outline strategies for managing them. This nuanced approach is key to understanding their complete rationale for dismissing some stock market valuation concerns, but not all.

- Specific risks identified: BofA typically identifies risks such as inflation, geopolitical uncertainty, and potential shifts in monetary policy as factors that could impact stock valuations. These are important considerations when constructing and managing an investment portfolio.

- Risk mitigation strategies: They recommend diversified portfolios, careful stock selection based on fundamental analysis, and potentially incorporating defensive assets to mitigate these risks. A balanced investment approach is crucial in any market environment.

- Potential downsides and likelihood: BofA typically provides a probabilistic assessment of potential downsides, acknowledging the possibility of market corrections or slower-than-expected growth, but suggesting these scenarios are not their base-case expectations.

Alternative Investment Strategies within a High-Valuation Environment

Given the current market landscape, BofA often suggests alternative investment strategies to help investors navigate the potential complexities of high valuations. These are not presented as alternatives to stock investing outright, but rather as tools for diversification and risk management.

- Specific strategies: These may include sector rotation, focusing on undervalued sectors or those with strong growth potential, and increased diversification across asset classes (e.g., adding bonds or real estate). These strategies aid in mitigating specific risks associated with elevated stock market valuations.

- Reasons behind recommendations: These recommendations are often based on BofA's assessments of relative valuations across different sectors and asset classes, as well as predictions for future economic growth and its impact on different market segments.

- Potential benefits and drawbacks: BofA typically analyses the potential benefits and drawbacks of each strategy, helping investors make informed decisions based on their individual risk tolerance and investment objectives. Understanding the trade-offs is crucial for successful investment.

Conclusion

BofA's rationale for dismissing – or at least tempering concerns about – current stock market valuations rests on their projections of robust corporate earnings growth, the influence of low interest rates on valuation multiples, and a proactive approach to identifying and mitigating potential risks. They acknowledge the existence of risks, like inflation and geopolitical uncertainty, but suggest that the positive factors outweigh the negatives in their current assessment. It's important to note that this is just one perspective, and other analysts may hold differing views. Understanding BofA's rationale for dismissing stock market valuation concerns is crucial for making informed investment decisions. Continue your research to form your own perspective on current market conditions and carefully evaluate stock market valuation concerns based on your individual investment goals and risk tolerance.

Featured Posts

-

Russias Military Buildup Keeping Europe On High Alert

Apr 29, 2025

Russias Military Buildup Keeping Europe On High Alert

Apr 29, 2025 -

Alberto Ardila Olivares Garantia De Gol

Apr 29, 2025

Alberto Ardila Olivares Garantia De Gol

Apr 29, 2025 -

University Shooting In North Carolina One Dead Six Injured

Apr 29, 2025

University Shooting In North Carolina One Dead Six Injured

Apr 29, 2025 -

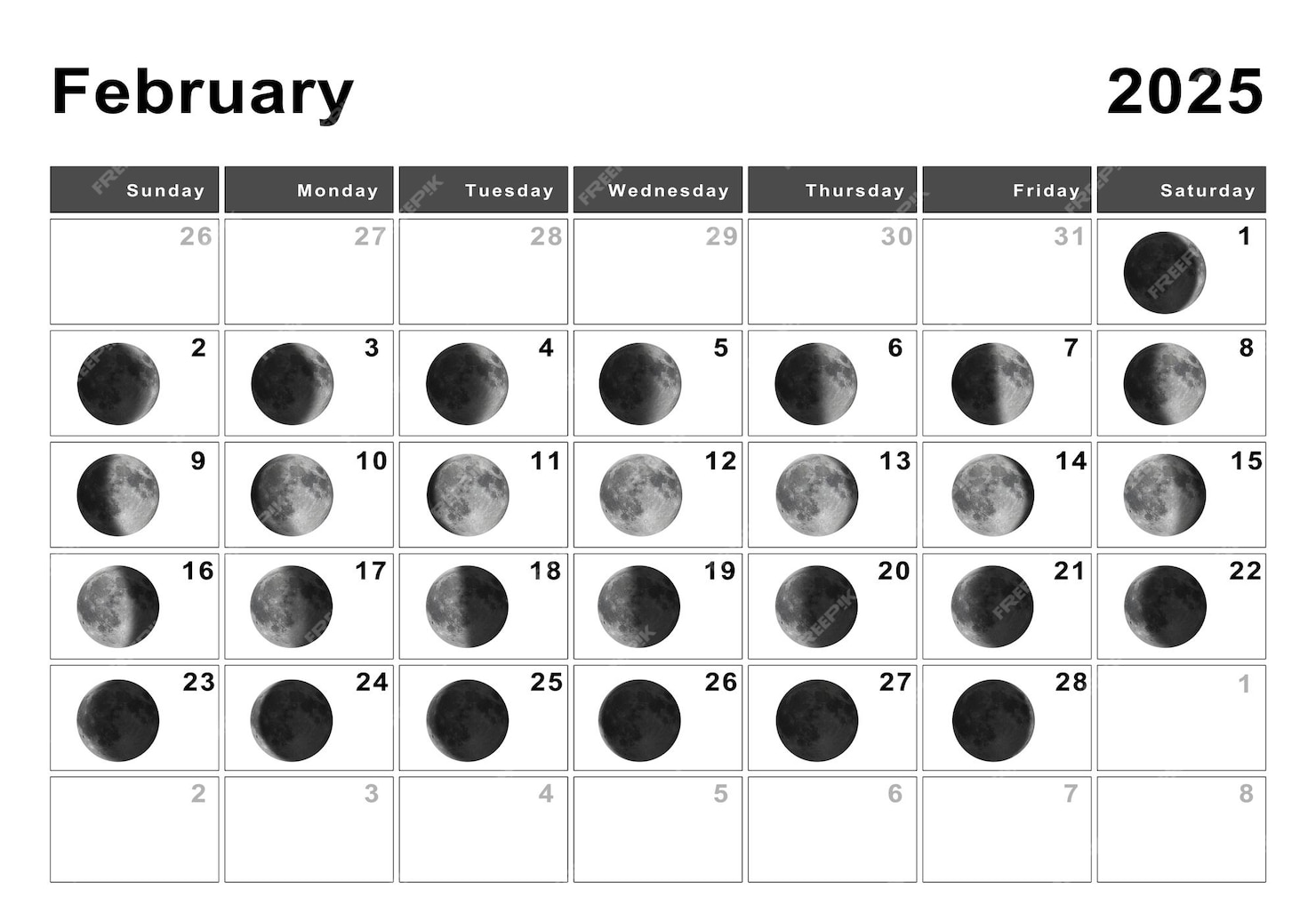

Your Open Thread February 16 2025

Apr 29, 2025

Your Open Thread February 16 2025

Apr 29, 2025 -

Zuckerberg And Trump A New Era For Tech And Politics

Apr 29, 2025

Zuckerberg And Trump A New Era For Tech And Politics

Apr 29, 2025

Latest Posts

-

Why Older Adults Are Choosing You Tube For Entertainment

Apr 29, 2025

Why Older Adults Are Choosing You Tube For Entertainment

Apr 29, 2025 -

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025 -

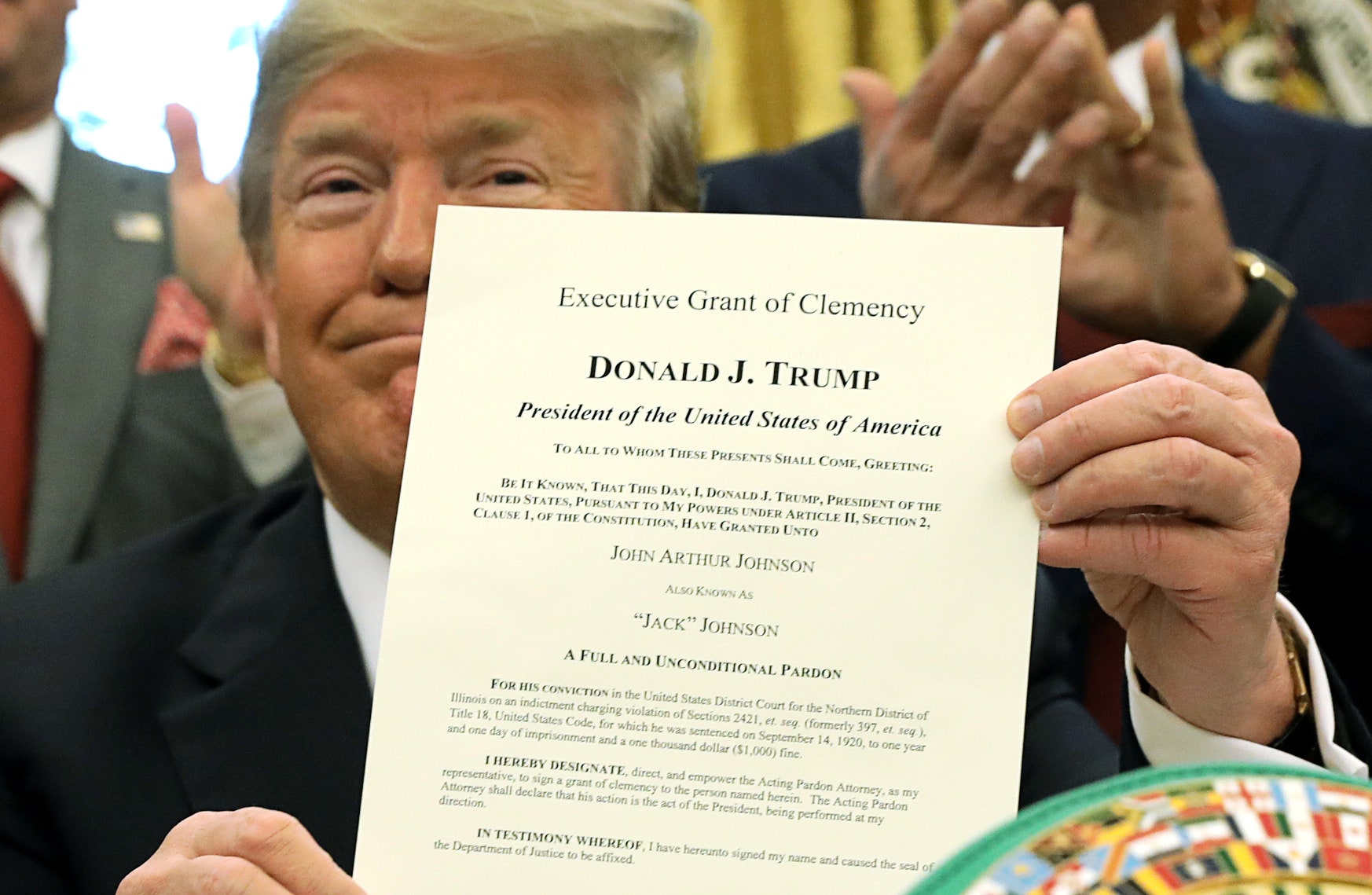

Full Pardon For Rose Trumps Decision And Its Fallout

Apr 29, 2025

Full Pardon For Rose Trumps Decision And Its Fallout

Apr 29, 2025 -

Rose Pardon Will Trump Grant Executive Clemency

Apr 29, 2025

Rose Pardon Will Trump Grant Executive Clemency

Apr 29, 2025 -

Will Trump Pardon Rose A Complete Analysis

Apr 29, 2025

Will Trump Pardon Rose A Complete Analysis

Apr 29, 2025