Dismissing Stock Market Valuation Concerns: Insights From BofA

Table of Contents

BofA's Key Arguments Against Elevated Valuations

BofA's bullish stance on the market isn't based on blind optimism. Their analysis rests on several pillars, challenging the common perception of overvaluation.

The Role of Low Interest Rates

Historically low interest rates significantly impact stock market valuation models. These low rates fundamentally alter discounted cash flow (DCF) analyses, a cornerstone of valuation.

- Lower discount rates lead to higher present values of future earnings. A lower discount rate means future earnings are worth more today, justifying higher price-to-earnings (P/E) ratios.

- Current low rates support higher valuations. The prevailing low-interest-rate environment directly supports the higher valuations observed in the market. Investors are less inclined to demand high returns from equities when they can earn little from bonds.

- Comparison to historical interest rate environments and valuation levels. Looking back at historical periods with similar interest rate environments reveals comparable, if not higher, valuations. This historical context provides a valuable perspective on current market conditions.

Technological Innovation Driving Growth

Technological advancements are a major driver of sustained corporate earnings growth, significantly impacting valuation metrics. This isn't just about short-term gains; it's about long-term structural shifts.

- Examples of innovative companies and their impact on the market. Companies at the forefront of technological innovation – think in areas like AI, cloud computing, and biotechnology – are demonstrating exceptional growth and profitability.

- Analysis of how innovation translates into higher future earnings. This innovation fuels consistent revenue growth and increased market share, leading to higher projected future earnings, which in turn justifies higher current valuations.

- Long-term growth potential despite current valuations. BofA's argument is that the long-term growth potential, fueled by technological disruption, outweighs concerns about current valuations.

Strong Corporate Earnings and Profitability

Robust corporate earnings and profit margins form another crucial part of BofA's argument against overvaluation concerns.

- Data showcasing strong earnings growth across various sectors. Across numerous sectors, companies are demonstrating strong earnings growth, a clear indicator of underlying economic health.

- Analysis of profit margins and their sustainability. Healthy profit margins suggest that companies are efficiently managing costs and generating substantial profits, supporting higher stock prices.

- Comparison to historical earnings levels. Comparing current earnings levels with historical data provides further evidence of the strength of the current market, mitigating overvaluation concerns.

Addressing Counterarguments and Potential Risks

While BofA presents a compelling case, acknowledging potential risks is crucial for a balanced perspective on stock market valuation.

Inflationary Pressures and Interest Rate Hikes

Inflation and subsequent interest rate hikes pose significant threats to current valuations.

- Discussion of potential scenarios and their impact on stock prices. Rising interest rates increase the discount rate used in valuation models, potentially leading to lower valuations. Increased inflation erodes purchasing power and can dampen consumer spending.

- BofA's assessment of the likelihood and magnitude of these risks. BofA acknowledges these risks but assesses their likelihood and potential impact as manageable, given current economic indicators.

- Strategies for mitigating these risks. Diversification, focusing on companies with strong pricing power, and holding cash reserves are suggested as strategies to mitigate these risks.

Geopolitical Uncertainties and Market Volatility

Geopolitical uncertainties and market volatility always present headwinds to market stability and valuations.

- Analysis of key geopolitical risks and their potential impact. Geopolitical events can cause significant market fluctuations, impacting stock prices and valuations.

- BofA's perspective on the market's ability to absorb shocks. BofA believes that the market has demonstrated resilience in the past, suggesting it can absorb shocks from geopolitical events.

- Strategies to navigate market volatility. BofA likely suggests strategies like dollar-cost averaging and maintaining a long-term investment horizon to navigate volatility.

BofA's Investment Recommendations and Strategies

BofA's analysis translates into specific investment recommendations and strategies.

Sector-Specific Opportunities

BofA identifies sectors particularly well-positioned for growth despite valuation concerns.

- Specific sector recommendations and rationale. Sectors likely to be highlighted may include technology, healthcare, and certain consumer staples, reflecting long-term growth potential.

- Investment strategies to capitalize on these opportunities. They might advise focusing on companies with strong earnings growth, high profit margins, and innovative technologies.

- Risk assessment for each recommended sector. A thorough risk assessment is crucial, outlining potential headwinds and mitigating strategies.

Portfolio Diversification and Risk Management

A diversified portfolio and effective risk management are crucial for navigating market uncertainties.

- Strategies for diversifying investments across sectors and asset classes. Diversification across various sectors and asset classes is key to reducing overall portfolio risk.

- Importance of considering individual risk tolerance. Investors need to consider their own risk tolerance when making investment decisions.

- Tools and techniques for effective risk management. Tools such as stop-loss orders and diversification strategies are important for risk management.

Conclusion

This article examined BofA's perspective on dismissing current stock market valuation concerns. Their arguments center around low interest rates, technological innovation driving growth, and strong corporate earnings. While acknowledging potential risks from inflation and geopolitical events, BofA's analysis suggests that current valuations may not be as overextended as many believe.

Understanding stock market valuation is crucial for making informed investment decisions. Learn more about BofA's insights and develop your own informed strategy regarding stock market valuation and related metrics. Consider consulting a financial advisor to create a personalized investment plan that addresses your specific risk tolerance and financial goals. Remember that this analysis provides insights, not financial advice. Always conduct your own research and consult with a financial professional before making any investment decisions.

Featured Posts

-

Where To Watch Newsround Bbc Two Hd Channel Guide

May 02, 2025

Where To Watch Newsround Bbc Two Hd Channel Guide

May 02, 2025 -

Saturdays Tulsa Storm Report Damage To Aid National Weather Service Tracking

May 02, 2025

Saturdays Tulsa Storm Report Damage To Aid National Weather Service Tracking

May 02, 2025 -

Daily Lotto Winning Numbers For Thursday April 17 2025

May 02, 2025

Daily Lotto Winning Numbers For Thursday April 17 2025

May 02, 2025 -

Winning Numbers Daily Lotto Friday 18th April 2025

May 02, 2025

Winning Numbers Daily Lotto Friday 18th April 2025

May 02, 2025 -

Road To Ofc U 19 Womens Championship 2025 Tongas Qualification Triumph

May 02, 2025

Road To Ofc U 19 Womens Championship 2025 Tongas Qualification Triumph

May 02, 2025

Latest Posts

-

Rupert Lowes X Posts A Dog Whistle Or A Fog Horn Will It Resonate In Uk Reform

May 02, 2025

Rupert Lowes X Posts A Dog Whistle Or A Fog Horn Will It Resonate In Uk Reform

May 02, 2025 -

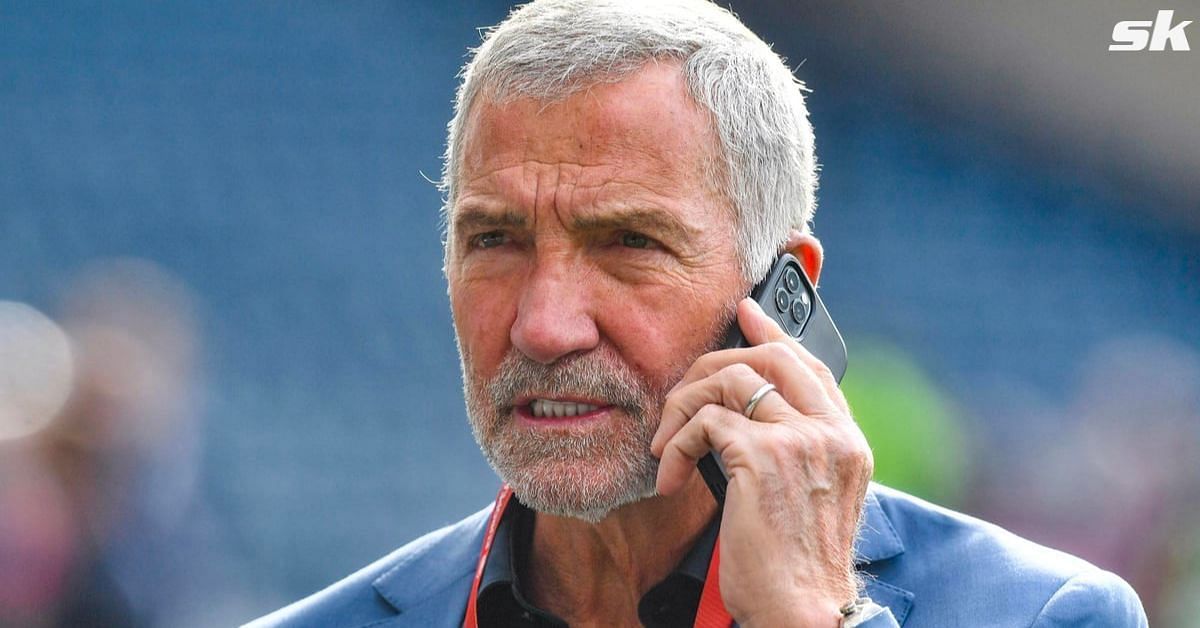

Dundee Man Jailed For Sexual Assault Graeme Sounes Sentenced

May 02, 2025

Dundee Man Jailed For Sexual Assault Graeme Sounes Sentenced

May 02, 2025 -

Guaranteed Accuracy The Chief Election Commissioner On Poll Data System Robustness

May 02, 2025

Guaranteed Accuracy The Chief Election Commissioner On Poll Data System Robustness

May 02, 2025 -

Graeme Sounes Jailed For Dundee Sex Attack

May 02, 2025

Graeme Sounes Jailed For Dundee Sex Attack

May 02, 2025 -

Reform Uk And Bullying Claims Rupert Lowe Under Police Scrutiny

May 02, 2025

Reform Uk And Bullying Claims Rupert Lowe Under Police Scrutiny

May 02, 2025