Dismissing Stock Market Valuation Worries: Insights From BofA

Table of Contents

BofA's Key Arguments Against High Valuation Concerns

BofA's assessment counters the narrative of an overvalued market by focusing on several key factors. Their analysis suggests that current valuations, while seemingly high, are justifiable given the prevailing economic environment and long-term growth prospects.

The Role of Low Interest Rates

Historically low interest rates significantly impact stock market valuations. In a low interest rate environment, the discount rate used to calculate the present value of future earnings is lower. This means that future earnings are worth more today, justifying higher price-to-earnings (P/E) ratios.

- BofA's reasoning: Their reports highlight the inverse relationship between interest rates and stock valuations, citing historical data to support this correlation.

- Data points: While specific numbers would require referencing BofA's reports directly, their analysis likely points to a demonstrably lower discount rate compared to previous periods of higher interest rates.

- Impact on Present Value: A lower discount rate increases the present value of future cash flows. Imagine receiving $100 in a year. If interest rates are high (say, 10%), that $100 is worth less today (approximately $90.91). But if interest rates are near zero, the present value is much closer to $100. This principle applies to a company's future earnings, justifying higher valuations in a low-interest-rate environment.

Strong Corporate Earnings Growth Projections

BofA's analysis isn't solely based on low interest rates. They also predict robust corporate earnings growth in the coming years, further supporting their view on valuations. This expected growth in profitability and revenue will help to offset seemingly high valuation multiples.

- Earnings Growth Projections: BofA's analysts likely forecast strong earnings per share (EPS) growth across various sectors, driven by factors like economic recovery and technological innovation.

- Data Points: Their projections would likely include specific growth rates for different sectors, potentially highlighting those poised for exceptional growth.

- Offsetting High Multiples: Strong earnings growth can naturally lead to higher stock prices, even if the P/E ratio remains elevated. A higher numerator (earnings) can justify a seemingly high denominator (price).

Technological Innovation and Disruption

BofA acknowledges the significant role of technological innovation in shaping long-term growth. They likely emphasize the potential of disruptive technologies to create new markets and drive sustained growth for companies positioned to benefit from these advancements.

- Examples of Growth Sectors: Sectors like artificial intelligence, cloud computing, and renewable energy are likely highlighted as key drivers of future growth, justifying premium valuations for companies in these areas.

- Future-Proof Businesses: BofA's analysis probably focuses on identifying companies with strong competitive advantages and sustainable business models, which can withstand market fluctuations and continue to grow even in uncertain times.

- Justifying Premium Valuations: The potential for exponential growth in these innovative sectors warrants higher valuation multiples compared to more traditional, slower-growing industries.

Addressing Counterarguments and Potential Risks

While BofA presents a largely positive outlook, acknowledging potential risks is crucial for a balanced assessment. Their analysis likely incorporates considerations for factors that could impact valuations negatively.

Inflationary Pressures

Inflation is a significant concern for investors. Rising inflation could lead to interest rate hikes by central banks, potentially impacting stock valuations negatively.

- BofA's Inflation Outlook: Their analysts likely offer a perspective on the likely trajectory of inflation, considering factors such as supply chain dynamics and monetary policy.

- Impact of Interest Rate Hikes: They likely model the potential impact of interest rate increases on discount rates and therefore on stock valuations.

- Mitigating Inflation Risk: BofA might suggest investing in sectors less vulnerable to inflation, such as consumer staples or certain types of real estate, to hedge against potential negative impacts.

Geopolitical Uncertainty

Geopolitical events can introduce significant uncertainty into the market. Supply chain disruptions, international conflicts, and other geopolitical risks can impact corporate earnings and investor sentiment.

- Geopolitical Factors Considered: BofA's analysis likely incorporates an assessment of various geopolitical factors and their potential impact on global markets and specific companies.

- Assessing Market Volatility: Their analysis probably includes models for assessing the potential for market corrections or volatility stemming from geopolitical events.

- Incorporating Risks Without Negating Positive Outlook: BofA’s overall positive assessment likely acknowledges these risks but emphasizes that they don't necessarily invalidate the positive long-term growth outlook they’ve identified.

Conclusion: Navigating Stock Market Valuation Worries Based on BofA's Insights

BofA's analysis provides valuable insights into current stock market valuations. While acknowledging potential risks like inflation and geopolitical uncertainty, their arguments emphasize the role of low interest rates, strong earnings growth projections, and technological innovation in supporting current valuations. Don't let valuation worries paralyze your investment strategy. Learn more about BofA's insights on stock market valuations and make informed decisions. Consider exploring their full reports for a more comprehensive understanding of their assessment and its implications for your investment approach.

Featured Posts

-

Vivienne Westwood Presents The First Ever Westwood Bridal Show

Apr 26, 2025

Vivienne Westwood Presents The First Ever Westwood Bridal Show

Apr 26, 2025 -

Nyt Spelling Bee Solution For February 26th Puzzle 360 Complete Guide

Apr 26, 2025

Nyt Spelling Bee Solution For February 26th Puzzle 360 Complete Guide

Apr 26, 2025 -

Steun Voor Koninklijke Familie Stijgt Naar 59 Eerste Toename In Jaren

Apr 26, 2025

Steun Voor Koninklijke Familie Stijgt Naar 59 Eerste Toename In Jaren

Apr 26, 2025 -

Will Thaksins Influence Lead To A New Era Of Us Thai Trade Agreements

Apr 26, 2025

Will Thaksins Influence Lead To A New Era Of Us Thai Trade Agreements

Apr 26, 2025 -

Jak Usetrit Na Velikonocich Prakticke Rady V Dobe Zdrazovani

Apr 26, 2025

Jak Usetrit Na Velikonocich Prakticke Rady V Dobe Zdrazovani

Apr 26, 2025

Latest Posts

-

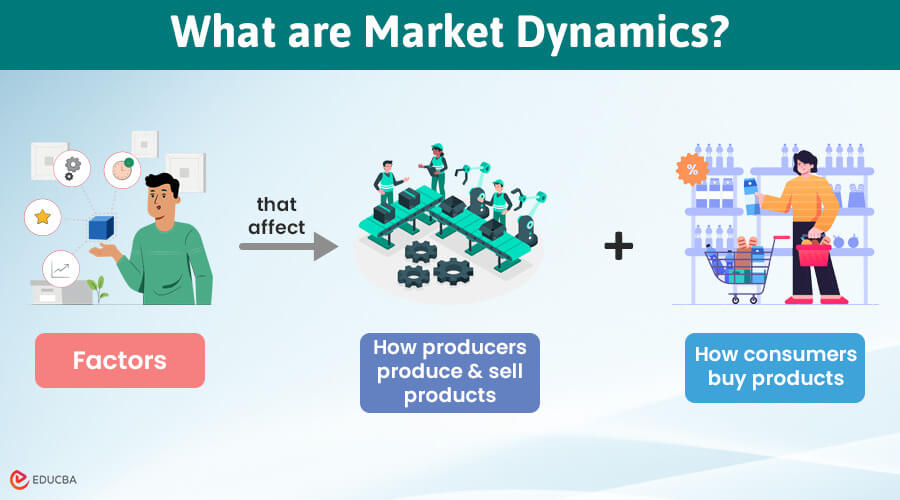

Bmw And Porsche In China Understanding Market Dynamics And Future Strategies

Apr 26, 2025

Bmw And Porsche In China Understanding Market Dynamics And Future Strategies

Apr 26, 2025 -

Premium Car Sales In China Bmw And Porsches Strategies And Results

Apr 26, 2025

Premium Car Sales In China Bmw And Porsches Strategies And Results

Apr 26, 2025 -

Gambling On Calamity The Case Of The Los Angeles Wildfires

Apr 26, 2025

Gambling On Calamity The Case Of The Los Angeles Wildfires

Apr 26, 2025 -

Los Angeles Wildfires The Growing Market For Disaster Betting

Apr 26, 2025

Los Angeles Wildfires The Growing Market For Disaster Betting

Apr 26, 2025 -

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 26, 2025

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 26, 2025