Dogecoin's Price Volatility: The Impact Of Elon Musk's Recent Activities

Table of Contents

Elon Musk's Tweets and Their Immediate Effect on Dogecoin's Price

Elon Musk's tweets have become infamous for their immediate and often dramatic effect on Dogecoin's price. His pronouncements, both positive and negative, directly influence the buying and selling pressure, leading to significant price fluctuations. This power stems from his massive social media following and the perception of him as a key figurehead within the cryptocurrency community. The psychological impact is immense; his words create a ripple effect, driving both FOMO (fear of missing out) and fear-based selling.

- Example 1: On [Insert Date], Musk tweeted "[Insert Tweet Content – something positive about Doge]", causing a rapid price surge of approximately [Insert Percentage]% within [Insert Timeframe].

- Example 2: Conversely, on [Insert Date], a seemingly innocuous tweet [Insert Tweet Content – something negative or neutral about Doge] resulted in a price drop of around [Insert Percentage]% in a similar timeframe.

This demonstrates the potent, almost instantaneous impact of Elon Musk Dogecoin tweets on market sentiment and subsequent price movements. The potential for market manipulation, however unintentional, through such pronouncements is a major concern for regulators and investors alike. The sheer volume of social media chatter triggered by his actions further amplifies the effect.

Musk's Business Ventures and Their Indirect Influence on Dogecoin

Beyond his tweets, Elon Musk's various business ventures exert a significant, albeit often more subtle, influence on Dogecoin's price. Tesla's previous acceptance of Bitcoin, for example, sent ripples throughout the cryptocurrency market, highlighting the potential for mainstream adoption. Should Tesla ever decide to accept Dogecoin for payments, it could lead to a massive surge in its value.

- Tesla's Bitcoin experiment: Tesla's brief acceptance of Bitcoin as a payment method significantly boosted Bitcoin's price, demonstrating the potential market impact of large corporations adopting cryptocurrencies.

- SpaceX and Dogecoin merchandise: Speculation surrounds the possibility of SpaceX using Dogecoin for merchandise or services. Such a move would likely increase Dogecoin's legitimacy and appeal, leading to a significant price increase.

- Other ventures: While less direct, the overall perception of Elon Musk's success and innovation can indirectly bolster investor confidence in Dogecoin, influencing its valuation.

The Role of Social Media and Speculation in Amplifying Volatility

Social media plays a crucial role in amplifying the impact of Elon Musk's actions on Dogecoin's price. Platforms like Twitter, Reddit, and others provide fertile ground for speculation and the rapid spread of information – and misinformation. Online communities dedicated to Dogecoin often react instantaneously to Musk’s pronouncements, further exacerbating price volatility.

- Meme culture and social trends: Dogecoin's very origins lie in internet memes, and its price often reflects the ebb and flow of online trends and memes.

- FOMO and impulsive trading: The fear of missing out (FOMO) is a significant driver of impulsive trading decisions, particularly in volatile markets like Dogecoin’s. This amplifies price fluctuations significantly.

- Responsible investing: It's vital for investors to approach the Dogecoin market with caution, conducting thorough research and avoiding emotional, impulsive trades.

Conclusion

In summary, the strong correlation between Elon Musk's activities and Dogecoin's price volatility is undeniable. His tweets alone can trigger substantial price swings, while his business ventures hold the potential for even more significant impacts on Dogecoin's future. Investing in volatile cryptocurrencies like Dogecoin carries considerable risk, especially when influenced by external factors beyond the control of the market itself. Understanding Dogecoin's price volatility and the significant impact of Elon Musk's influence is crucial for navigating this unpredictable market. Conduct thorough research and make responsible investment decisions before engaging in the Dogecoin market. Stay informed about Elon Musk's activities and carefully assess the inherent risks associated with this volatile cryptocurrency.

Featured Posts

-

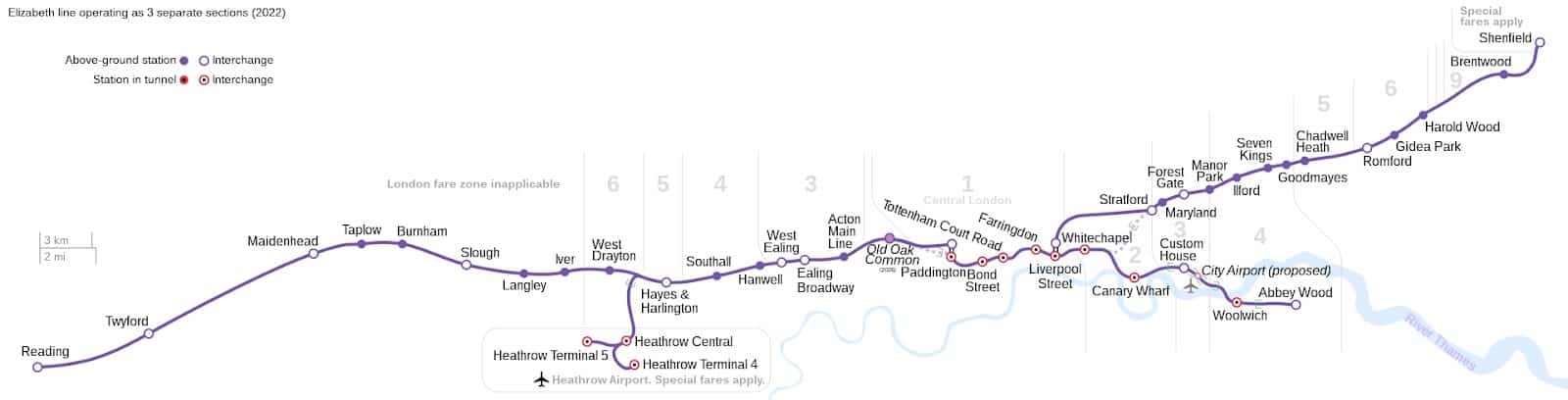

Navigating The Elizabeth Line A Guide For Wheelchair Users

May 09, 2025

Navigating The Elizabeth Line A Guide For Wheelchair Users

May 09, 2025 -

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025 -

Indias Rise In Global Power Outpacing Traditional Powers

May 09, 2025

Indias Rise In Global Power Outpacing Traditional Powers

May 09, 2025 -

Edmonton Oilers Projected To Win Against Los Angeles Kings Betting Analysis

May 09, 2025

Edmonton Oilers Projected To Win Against Los Angeles Kings Betting Analysis

May 09, 2025 -

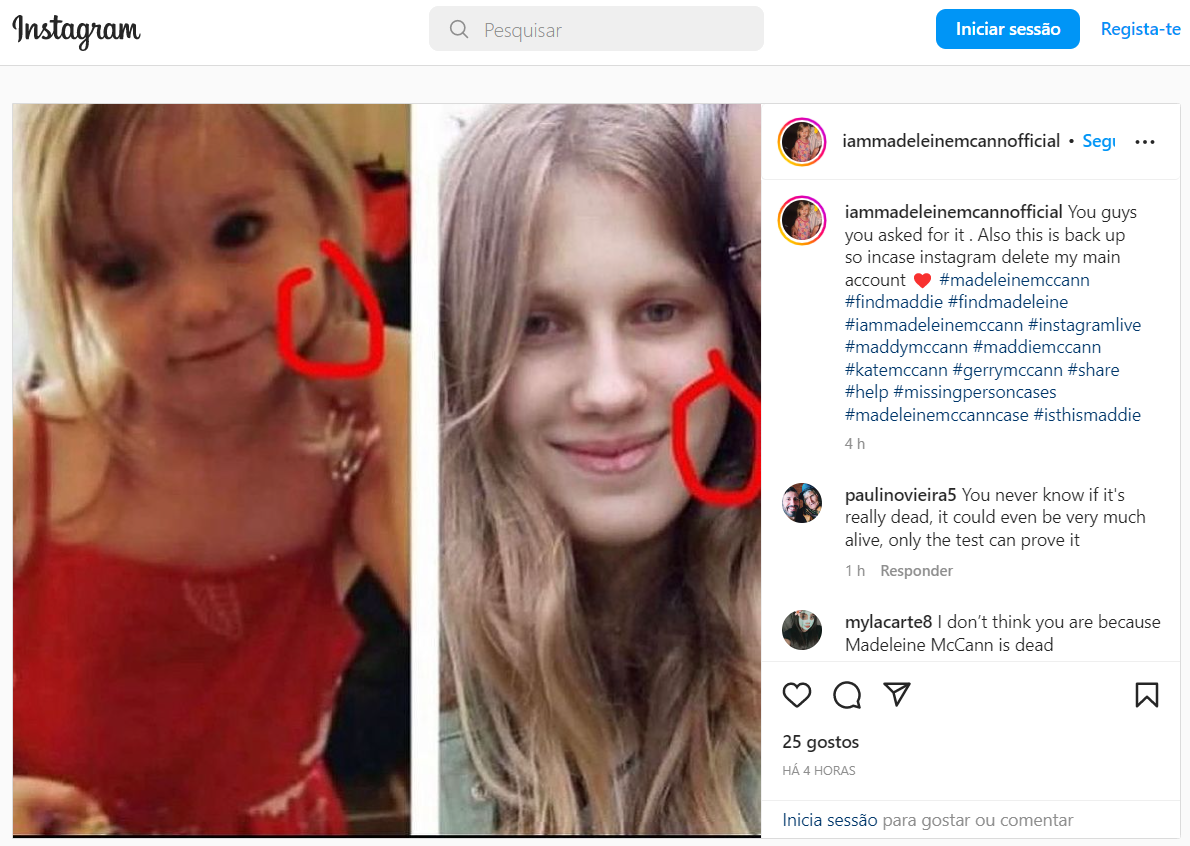

Investigacao Polonesa Detida Apos Alegar Ser Maddie Mc Cann

May 09, 2025

Investigacao Polonesa Detida Apos Alegar Ser Maddie Mc Cann

May 09, 2025