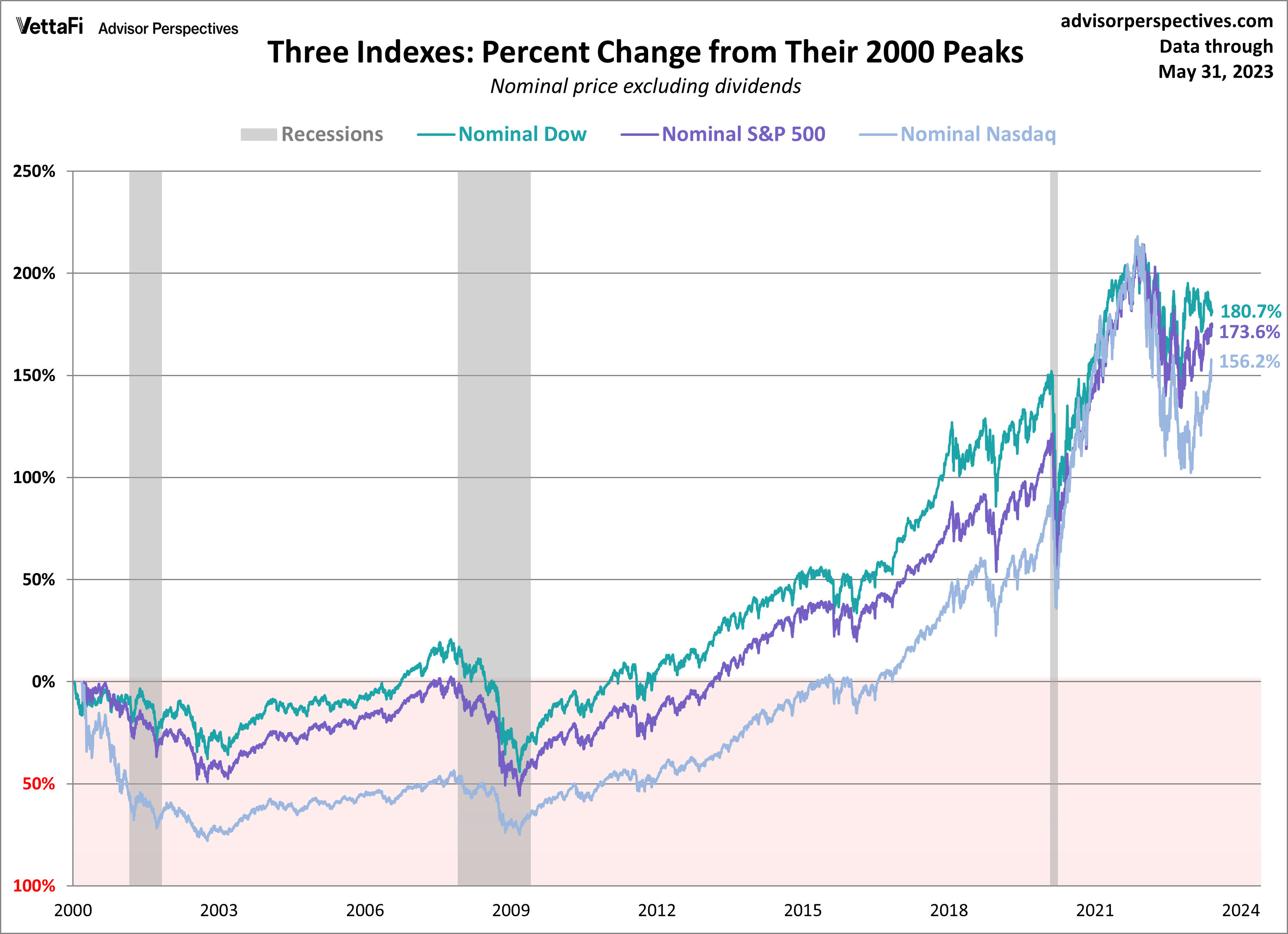

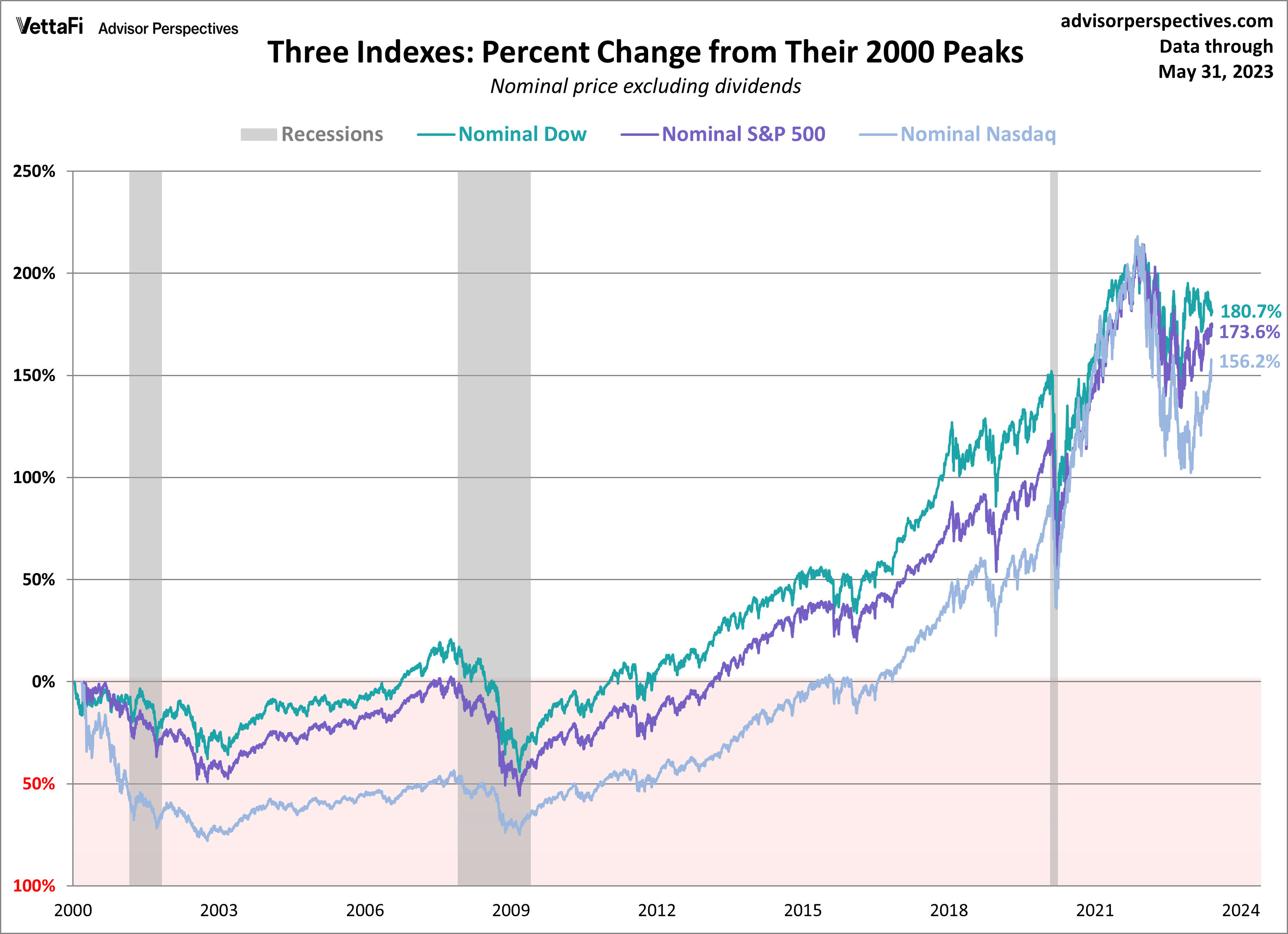

Dow Jones & S&P 500: Live Stock Market Updates (May 5)

Table of Contents

Dow Jones Performance on May 5th

Opening, High, Low, and Closing Prices:

The Dow Jones Industrial Average (DJIA) experienced a day of [Insert Actual Data for May 5th - e.g., moderate volatility]. Understanding these figures provides insight into the overall market sentiment and trading activity.

- Opening Price: [Insert Actual Opening Price]

- High: [Insert Actual High Price]

- Low: [Insert Actual Low Price]

- Closing Price: [Insert Actual Closing Price]

- Percentage Change from Previous Day's Close: [Insert Percentage Change - e.g., +0.5%]

- Volume Traded: [Insert Volume Traded]

This data indicates [Insert brief interpretation based on the data. E.g., a positive closing price suggests investor confidence].

Key Factors Influencing Dow Jones Movement:

Several factors contributed to the Dow Jones's performance on May 5th. Analyzing these influences provides a deeper understanding of the market dynamics.

- Strong Earnings Reports: Positive earnings reports from key companies like [Insert Company Example 1] and [Insert Company Example 2] boosted investor sentiment.

- Positive Economic Indicators: The release of [Insert Specific Economic Indicator, e.g., better-than-expected employment data] contributed to the positive market mood.

- Geopolitical Stability: A relatively stable geopolitical landscape eased investor concerns, allowing the market to focus on economic factors.

- Sector-Specific Performance: Strong performance in the [Insert Sector, e.g., technology] sector significantly impacted the Dow Jones's overall movement.

S&P 500 Performance on May 5th

Opening, High, Low, and Closing Prices:

The S&P 500, a broader market index than the Dow Jones, also exhibited [Insert Description of Volatility - e.g., a similar pattern of moderate fluctuations] on May 5th. Analyzing these figures helps gauge the overall health of the US stock market.

- Opening Price: [Insert Actual Opening Price]

- High: [Insert Actual High Price]

- Low: [Insert Actual Low Price]

- Closing Price: [Insert Actual Closing Price]

- Percentage Change from Previous Day's Close: [Insert Percentage Change]

- Volume Traded: [Insert Volume Traded]

These numbers suggest [Insert brief interpretation based on the data].

Key Sectors Driving S&P 500 Movement:

Analyzing sector-specific performance within the S&P 500 reveals the key drivers of the index's movement.

- Top-Performing Sectors: The [Insert Sector, e.g., energy] sector led the gains, with a percentage increase of [Insert Percentage]. This is likely due to [Insert Reason - e.g., rising oil prices].

- Bottom-Performing Sectors: The [Insert Sector, e.g., real estate] sector underperformed, registering a decline of [Insert Percentage]. This could be attributed to [Insert Reason - e.g., rising interest rates].

Correlation Between Dow Jones and S&P 500:

On May 5th, the Dow Jones and S&P 500 [Insert Description of Correlation - e.g., largely mirrored each other's movements]. This suggests a general alignment in market sentiment.

- Percentage Change Comparison: Both indices experienced [Insert Comparison - e.g., relatively similar percentage gains].

- Reasons for Correlation/Divergence: The strong correlation indicates a broad-based market response to the day's economic news and events. [Insert any discussion of divergence if applicable and reasons why].

- Market Trends: This positive correlation reinforces the overall positive market sentiment observed on May 5th.

Market Outlook and Predictions (May 5th):

Based on the day's performance and current market indicators, the short-term outlook for the Dow Jones and S&P 500 appears [Insert Description - e.g., cautiously optimistic]. However, it’s crucial to remember that market predictions are inherently uncertain.

- Potential Scenarios: The indices could continue their upward trajectory, provided positive economic data and corporate earnings persist. Conversely, negative news could lead to a correction.

- Important Factors to Watch: Keep an eye on upcoming economic reports, key company earnings announcements, and any significant geopolitical developments.

- Disclaimer: This is not financial advice; market fluctuations are unpredictable.

Conclusion:

May 5th saw the Dow Jones and S&P 500 indices exhibiting [Summarize Overall Movement - e.g., generally positive performance], driven by factors such as positive economic indicators and strong earnings reports. While both indices largely moved in tandem, understanding the nuances of sector-specific performance provides a deeper insight into market dynamics. While the short-term outlook appears promising, investors should remain vigilant and monitor key market indicators. Stay informed about future Dow Jones and S&P 500 updates for continued market analysis and insights. Follow our analysis for consistent live stock market updates on the Dow Jones and S&P 500.

Featured Posts

-

Oscar Nominee Sing Sing Debuts On Max This Week

May 06, 2025

Oscar Nominee Sing Sing Debuts On Max This Week

May 06, 2025 -

Why Tracee Ellis Ross Dates Younger Men An In Depth Look

May 06, 2025

Why Tracee Ellis Ross Dates Younger Men An In Depth Look

May 06, 2025 -

Jennifer Lopez Meryl Streep And More Celebrate Betty Gilpins Final Oh Mary Broadway Performances

May 06, 2025

Jennifer Lopez Meryl Streep And More Celebrate Betty Gilpins Final Oh Mary Broadway Performances

May 06, 2025 -

Suki Waterhouses On This Love Lyrics A Deep Dive

May 06, 2025

Suki Waterhouses On This Love Lyrics A Deep Dive

May 06, 2025 -

Patrik Shvartsenegger I Ebbi Chempion Razdevanie Dlya Kim Kardashyan

May 06, 2025

Patrik Shvartsenegger I Ebbi Chempion Razdevanie Dlya Kim Kardashyan

May 06, 2025