Dow Jones Steady Climb: Strong PMI Numbers Offer Support

Table of Contents

Strong PMI Numbers Fuel Dow Jones Growth

The Purchasing Managers' Index (PMI) is a crucial economic indicator that tracks the activity levels of purchasing managers within the manufacturing and services sectors. A PMI above 50 generally signifies expansion, while a reading below 50 suggests contraction. Recent PMI data has been exceptionally strong, significantly contributing to the Dow Jones's growth.

Specifically, the manufacturing PMI and services PMI have both reported figures consistently above 50, indicating robust activity across key sectors of the US economy.

- Positive PMI data from key sectors: The manufacturing sector shows strong order books and increased production, while the services sector is experiencing solid growth in areas like hospitality and technology.

- Robust economic activity and future growth: High PMI readings suggest a healthy economy with strong potential for continued growth, encouraging investors.

- Increased investor confidence and subsequent market gains: The positive economic outlook translates directly into increased investor confidence, leading to higher stock prices and boosting the Dow Jones.

Positive Investor Sentiment Boosts Dow Jones

Investor sentiment plays a pivotal role in shaping the Dow Jones's performance. Positive PMI results, coupled with other positive news, have significantly boosted investor confidence and risk appetite.

Positive PMI data reinforces a belief in strong economic fundamentals, influencing how investors view potential returns and risk. This heightened confidence leads to increased investment in the stock market.

- Positive news impacting investor sentiment: Strong corporate earnings reports, a stable geopolitical environment, and continued low unemployment rates have all contributed to a positive market sentiment.

- Institutional investors and their impact: Large institutional investors, with their significant capital, amplify market trends. Their confidence, further bolstered by the PMI data, significantly contributes to the Dow Jones's rise.

- Flow of investment capital: The influx of investment capital into the stock market, driven by optimistic forecasts fueled by PMI numbers, is a direct catalyst for the Dow Jones's steady climb.

Analyzing the Dow Jones's Future Trajectory Based on PMI

While the current outlook appears positive, it's crucial to maintain a cautious perspective. Several factors could impact the continued upward trend of the Dow Jones.

Maintaining a realistic outlook is crucial, and future market performance depends on several factors.

- Various scenarios based on future PMI readings: Continued strong PMI readings would likely sustain the positive trend; however, a decline could signal a potential market correction.

- Impact of potential external factors: Inflation, rising interest rates, and escalating geopolitical tensions could significantly influence investor sentiment and the Dow Jones's trajectory.

- Balanced perspective on the Dow Jones's future: While the current positive trend is encouraging, potential risks need to be considered when making investment decisions.

Dow Jones Steady Climb: A Look Ahead

In summary, strong PMI numbers are undeniably supporting the Dow Jones's steady climb, offering a positive economic outlook. However, potential external factors necessitate a cautious approach. Monitoring PMI data and other key economic indicators, such as inflation and interest rates, is crucial for understanding the Dow Jones's performance and making informed investment decisions.

To make wise investment choices, actively monitor the Dow Jones and track PMI data closely. Understanding the Dow Jones's performance requires staying updated on Dow Jones trends and the latest economic indicators. Continue to analyze the "Dow Jones Steady Climb" and its underlying factors for successful long-term investment strategies.

Featured Posts

-

Ai Stuwt Relx Groei Ondanks Zwakke Economie Vooruitzichten Tot 2025

May 24, 2025

Ai Stuwt Relx Groei Ondanks Zwakke Economie Vooruitzichten Tot 2025

May 24, 2025 -

Hamiltons Unfair Comments Draw Sharp Rebuke From Ferrari

May 24, 2025

Hamiltons Unfair Comments Draw Sharp Rebuke From Ferrari

May 24, 2025 -

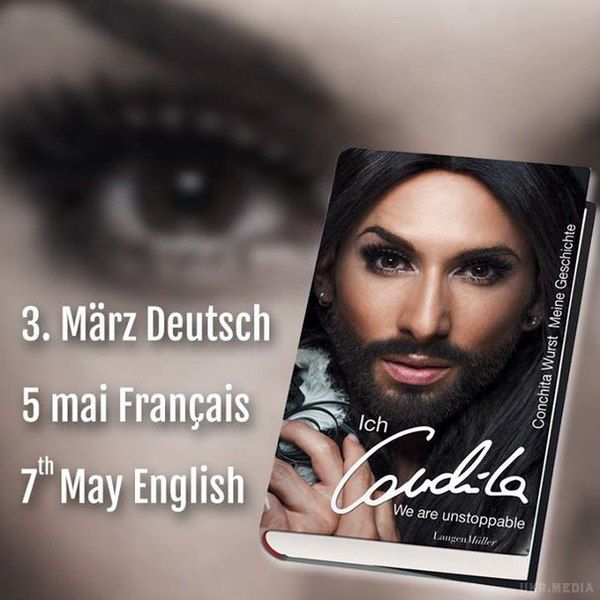

Konchita Vurst Pro Yevrobachennya 2025 Prognoz Na Chotirokh Peremozhtsiv

May 24, 2025

Konchita Vurst Pro Yevrobachennya 2025 Prognoz Na Chotirokh Peremozhtsiv

May 24, 2025 -

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Nav And Its Importance

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Nav And Its Importance

May 24, 2025

Latest Posts

-

Collaboration And Growth At The Forefront Best Of Bangladesh In Europe 2nd Edition

May 24, 2025

Collaboration And Growth At The Forefront Best Of Bangladesh In Europe 2nd Edition

May 24, 2025 -

Focusing On Collaboration And Growth The 2nd Best Of Bangladesh In Europe

May 24, 2025

Focusing On Collaboration And Growth The 2nd Best Of Bangladesh In Europe

May 24, 2025 -

Best Of Bangladesh In Europe 2024 Driving Collaboration And Growth

May 24, 2025

Best Of Bangladesh In Europe 2024 Driving Collaboration And Growth

May 24, 2025 -

Netherlands Hosts Major Bangladesh Event 1 500 Visitors Projected

May 24, 2025

Netherlands Hosts Major Bangladesh Event 1 500 Visitors Projected

May 24, 2025 -

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 24, 2025

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 24, 2025