Dragon's Den: A Guide To Securing Investment

Table of Contents

Crafting Your Winning Pitch Deck

A strong pitch deck is crucial for securing any investment, mirroring the concise and impactful presentations seen on Dragon's Den. Investors, like the Dragons, are busy and need to quickly understand your business and its potential. Your deck should be clear, concise, and visually appealing.

The Problem & Solution

Clearly define the problem your business solves and present your innovative solution. This is your opportunity to showcase the market need and why your business is the answer.

- Concisely explain the market need: Don't bury the lead. Immediately highlight the pain point your business addresses. Use data to back up your claims.

- Highlight your unique selling proposition (USP): What makes your business different and better than the competition? What's your competitive advantage? This is key to differentiating yourself in a crowded marketplace.

- Demonstrate market research and validation: Show investors you've done your homework. Include market size estimates, target audience analysis, and any preliminary data that validates your business idea.

Market Analysis & Traction

Showcase your understanding of the market and demonstrate early traction (if any). Investors want to see that you've researched your market thoroughly and that there's a real demand for your product or service.

- Present market size and growth potential: Quantify the opportunity. How big is the market, and how fast is it growing? Show investors the potential for significant returns.

- Detail your target audience and marketing strategy: Who are you selling to? How will you reach them? A well-defined target audience and a clear marketing strategy are essential for success.

- Show evidence of early sales, users, or partnerships: Any early traction, even small successes, demonstrates validation and builds investor confidence. Include metrics like website traffic, user engagement, or early sales figures.

Financial Projections & Team

Present realistic financial projections and highlight the strength of your team. Investors need to see a clear path to profitability and a team capable of executing the plan.

- Include key financial metrics (revenue, expenses, profit): Present realistic projections for the next 3-5 years, demonstrating a clear path to profitability.

- Provide a clear funding request and use of funds: Be specific about how much funding you're seeking and exactly how you plan to use it. Transparency is crucial.

- Showcase team expertise and experience: Highlight the relevant skills and experience of your team members. A strong team increases investor confidence.

Mastering the Art of the Pitch

Delivering a compelling pitch is essential – learn from the best Dragon's Den pitches. Your pitch needs to be engaging, informative, and persuasive.

Storytelling & Passion

Engage investors emotionally with a captivating narrative. Your pitch should be more than just a presentation of facts and figures; it should tell a story.

- Craft a concise and memorable story: Keep it simple and focus on the key elements of your business. A compelling narrative will resonate with investors on an emotional level.

- Show your passion and belief in your vision: Investors invest in people as much as they invest in ideas. Let your passion shine through.

- Connect with investors on a personal level: Make a genuine connection with the investors. Show them that you're passionate about your business and that you're the right person to lead it.

Handling Tough Questions

Anticipate challenging questions and prepare thoughtful responses. The Dragons are known for their tough questioning. Be prepared for anything.

- Practice your pitch extensively: Rehearse your pitch until you can deliver it confidently and smoothly.

- Research potential investor questions: Anticipate the questions investors might ask and prepare thorough answers.

- Develop confident and clear answers: Be prepared to answer tough questions honestly and directly.

Negotiating the Deal

Be prepared to negotiate terms and conditions effectively. Securing investment is a negotiation, not just a presentation.

- Understand your company's valuation: Know the worth of your business. Research comparable companies and understand the factors that influence valuation.

- Know your walk-away point: Determine the minimum acceptable terms you're willing to accept.

- Be prepared to compromise: Negotiation involves give and take. Be willing to compromise on certain terms to reach a mutually beneficial agreement.

Finding the Right Investors

Identifying suitable investors for your business is crucial, like finding the right Dragon. Don't just target any investor; find those whose investment focus aligns with your business.

Investor Due Diligence

Research potential investors to ensure a good fit. Understanding their investment criteria is paramount.

- Analyze their investment portfolio and focus areas: Identify investors who have a history of investing in businesses similar to yours.

- Understand their investment criteria and preferences: What are their investment priorities? What stage of companies do they typically invest in?

- Network and build relationships with potential investors: Building relationships takes time and effort. Attend industry events, connect on LinkedIn, and reach out to investors directly.

Networking & Building Relationships

Attending industry events and connecting with investors is vital. Networking is essential for finding investors and securing funding.

- Attend relevant conferences and workshops: These events provide opportunities to meet potential investors and learn about the investment landscape.

- Join industry associations and networking groups: These groups provide access to a network of potential investors and industry professionals.

- Leverage online platforms like LinkedIn: LinkedIn is a powerful tool for connecting with potential investors and building relationships.

Securing Introductions

Warm introductions can significantly increase your chances of securing investment. A referral from a trusted source can make a big difference.

- Leverage your network to find introductions: Ask your contacts if they know any investors who might be interested in your business.

- Seek referrals from mentors, advisors, or industry professionals: These individuals often have connections to investors and can provide valuable introductions.

- Attend pitch competitions and investor events: These events provide opportunities to pitch your business to a large number of investors.

Conclusion

Securing investment, whether it's akin to a Dragon's Den success or a more traditional route, requires meticulous preparation, a compelling pitch, and a thorough understanding of the investment landscape. By mastering the art of pitching, crafting a persuasive narrative, and building strong relationships with potential investors, you can significantly improve your chances of securing funding for your venture. Don't be intimidated – start working on your Dragon's Den-worthy pitch today! Remember, thorough research and a well-structured plan are key to attracting the right Dragon's Den investment for your business. Start planning your Dragon's Den investment strategy now!

Featured Posts

-

Gaslucht Roden Vals Alarm

May 01, 2025

Gaslucht Roden Vals Alarm

May 01, 2025 -

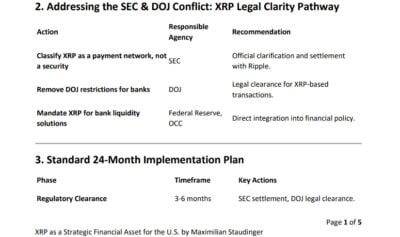

Ripple Xrp And The Sec Commodity Classification And Settlement Negotiations

May 01, 2025

Ripple Xrp And The Sec Commodity Classification And Settlement Negotiations

May 01, 2025 -

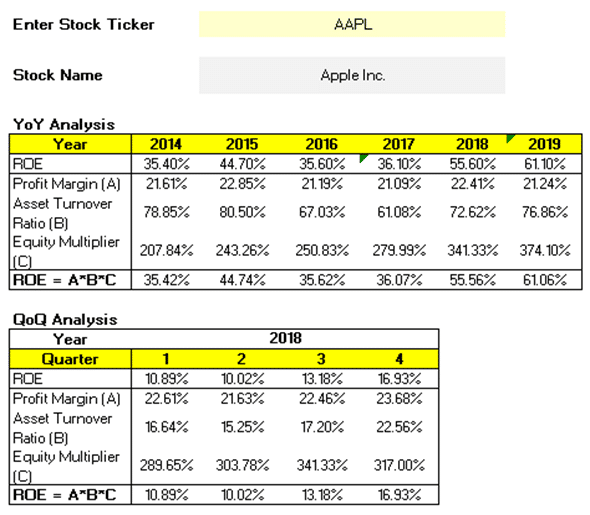

Analysis Duponts Performance In Frances Win Over Italy

May 01, 2025

Analysis Duponts Performance In Frances Win Over Italy

May 01, 2025 -

Dragon Den Against The Odds A Surprising Investment

May 01, 2025

Dragon Den Against The Odds A Surprising Investment

May 01, 2025 -

Rugby Six Nations Frances Victory Over Italy A Test For Ireland

May 01, 2025

Rugby Six Nations Frances Victory Over Italy A Test For Ireland

May 01, 2025

Latest Posts

-

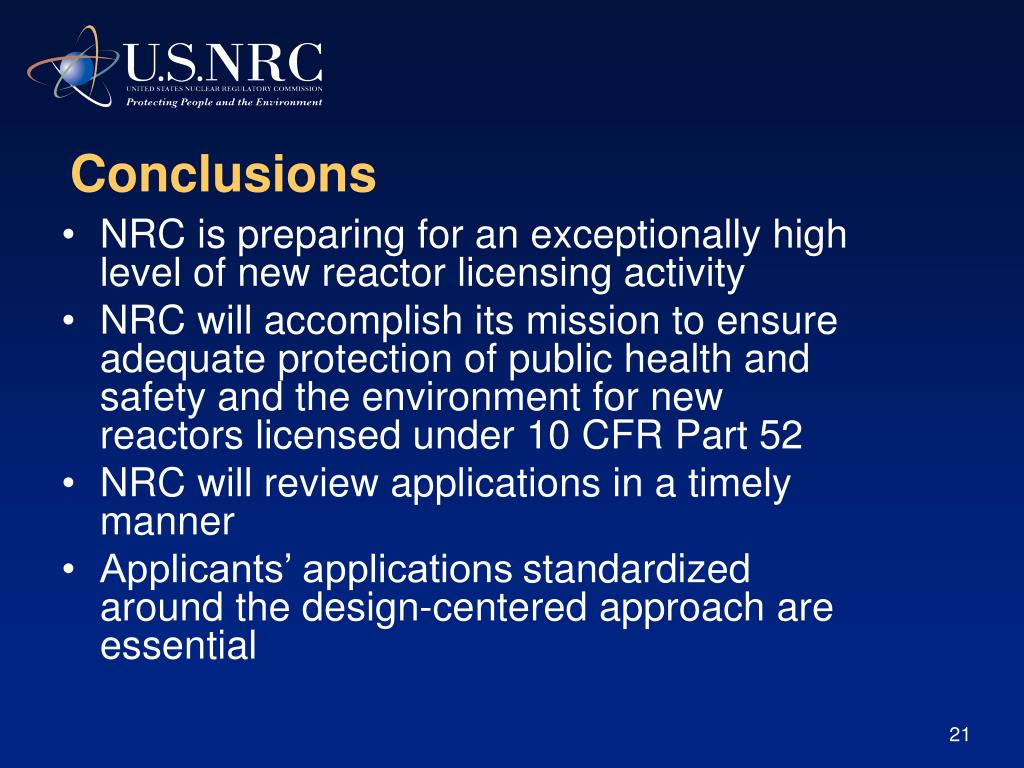

Successfully Upgrading Reactor Power Your Path Through Nrc Regulations

May 01, 2025

Successfully Upgrading Reactor Power Your Path Through Nrc Regulations

May 01, 2025 -

Robinson Nuclear Plants Safety Inspection Success License Renewal Possible Until 2050

May 01, 2025

Robinson Nuclear Plants Safety Inspection Success License Renewal Possible Until 2050

May 01, 2025 -

Nrc Health Achieves 1 Best In Klas For Healthcare Experience Management

May 01, 2025

Nrc Health Achieves 1 Best In Klas For Healthcare Experience Management

May 01, 2025 -

Planning A Reactor Power Uprate Navigating The Nrc Process

May 01, 2025

Planning A Reactor Power Uprate Navigating The Nrc Process

May 01, 2025 -

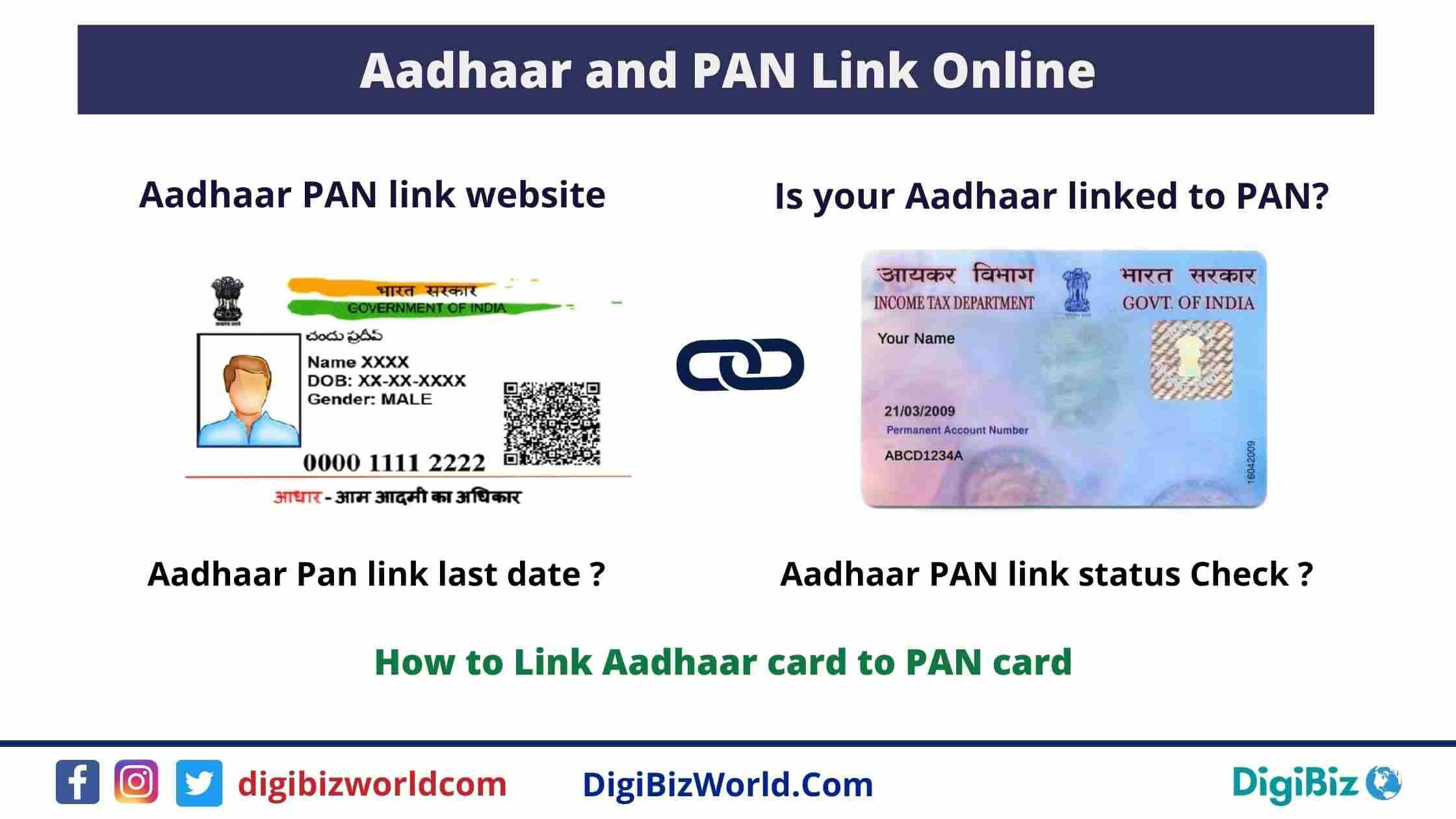

Assams Nrc Cms New Measures For Aadhaar Cardholders Outside The Register

May 01, 2025

Assams Nrc Cms New Measures For Aadhaar Cardholders Outside The Register

May 01, 2025