Dragon's Den And Beyond: Scaling Your Business After Investment

Table of Contents

Strategic Planning Post-Investment

Securing investment is a significant milestone, but it's also a pivotal moment to strategize for sustained growth. Without a well-defined plan, even the largest investment can be squandered. Effective business scaling requires foresight and a commitment to strategic planning.

Defining Clear Goals and Metrics

Setting measurable, achievable goals is paramount for tracking progress and demonstrating Return on Investment (ROI) to your investors. This transparency builds trust and ensures continued support.

- Develop a detailed business plan outlining short-term and long-term objectives. This plan should clearly articulate your vision for the next 12-24 months and beyond, outlining key milestones and anticipated growth metrics.

- Establish Key Performance Indicators (KPIs) to monitor progress. KPIs should be specific, measurable, achievable, relevant, and time-bound (SMART). Examples include customer acquisition cost (CAC), customer lifetime value (CLTV), monthly recurring revenue (MRR), and website traffic.

- Define success metrics aligned with investor expectations. Ensure your KPIs directly reflect the goals your investors outlined during the investment process. Regularly review these metrics to show progress and address any concerns.

- Regularly review and adjust the plan based on performance. The business landscape is constantly evolving. Regularly analyze your performance data, adapt your strategies accordingly, and ensure your plan remains a dynamic tool for growth, not a rigid document.

Building a Robust Team

Scaling a business requires more than just funding; it necessitates a strong, capable team. Your team is the engine driving your growth, and investing in it is crucial.

- Identify skill gaps and recruit talent strategically. As your business expands, you'll likely need expertise in areas you may currently lack. Focus on hiring individuals with complementary skills and experience to strengthen your team's capabilities.

- Delegate effectively and empower team members. Don't try to do everything yourself. Delegate responsibilities to competent individuals, empowering them to take ownership and make decisions.

- Foster a culture of collaboration and accountability. A strong team works collaboratively, sharing knowledge and supporting each other. Establish clear expectations and foster a culture of accountability to ensure everyone is contributing to the overall success.

- Invest in employee training and development. Continuously invest in the professional development of your team members. Providing training opportunities will enhance their skills and keep them engaged and motivated.

Effective Resource Allocation

With increased funding, comes the responsibility of managing resources wisely. Strategic allocation of investment funds is crucial for maximizing their impact and demonstrating responsible financial stewardship to your investors.

Managing Investment Funds Wisely

The efficient use of your investment capital is key to achieving sustainable growth. Don't squander your resources; prioritize strategic investments that deliver the highest return.

- Prioritize investments in key areas driving growth (e.g., marketing, technology, R&D). Focus your investment on areas that will directly impact your revenue generation and market expansion.

- Develop a detailed budget and monitor expenses closely. Maintain a clear budget that tracks all expenses and ensures you stay within your financial plan. Regular monitoring will prevent overspending and maintain financial health.

- Explore funding options beyond initial investment (e.g., bootstrapping, loans). Don't rely solely on your initial investment. Explore other funding options as needed to support your growth trajectory, including revenue-based financing, or seeking further investment rounds.

- Maintain transparent financial reporting to investors. Keep your investors informed about your financial performance. Regular financial reports demonstrate transparency and build trust, which is crucial for a continued positive relationship.

Optimizing Operations and Processes

As your business scales, operational efficiency becomes increasingly important. Streamlining processes will allow you to handle increased demand without sacrificing quality or customer satisfaction.

- Implement efficient workflow systems and technologies. Invest in tools and technologies that automate tasks and improve workflow efficiency. This can include Customer Relationship Management (CRM) systems, project management software, and automated marketing tools.

- Automate repetitive tasks to improve productivity. Identify tasks that can be automated to free up your team's time to focus on more strategic initiatives.

- Outsource non-core functions to focus on strategic initiatives. Outsourcing non-core functions, such as accounting or customer support, can free up your internal resources to focus on your core competencies and strategic growth initiatives.

- Continuously improve processes based on data and feedback. Regularly analyze your operational processes to identify areas for improvement. Gather feedback from your team and customers to inform your optimization efforts.

Marketing and Sales Strategies for Growth

Scaling your business requires a robust marketing and sales strategy to reach new customers and manage increased demand. A well-defined approach will ensure your growth is sustainable and profitable.

Expanding Market Reach

Reaching new customers is critical for sustained business growth. A multi-faceted approach is necessary to maximize your reach and penetrate new market segments.

- Develop a comprehensive marketing strategy targeting new customer segments. Identify new customer segments that align with your business and develop targeted marketing campaigns to reach them.

- Leverage digital marketing channels effectively (SEO, PPC, social media). Utilize various digital channels, such as search engine optimization (SEO), pay-per-click (PPC) advertising, and social media marketing, to reach your target audiences.

- Explore partnerships and collaborations to expand reach. Collaborate with other businesses or influencers to expand your reach and tap into new customer bases.

- Monitor marketing ROI and adjust strategies as needed. Regularly track your marketing ROI to ensure your investments are delivering results. Adjust your strategies based on performance data to maximize effectiveness.

Scaling Sales Operations

Managing increased sales volume effectively is essential to maintaining quality and customer satisfaction. Scalable sales operations are crucial for sustained growth.

- Implement a robust CRM system to manage customer relationships. A CRM system helps manage customer interactions, track sales progress, and improve customer satisfaction.

- Optimize sales processes to handle higher volumes. Streamline your sales processes to handle increased sales volume efficiently and effectively.

- Train sales teams on new products and services. Keep your sales team up-to-date on new products and services to ensure they can effectively sell them.

- Develop strong customer service strategies to retain customers. Excellent customer service is critical for retaining customers and building brand loyalty.

Maintaining Investor Relations

Maintaining a positive and transparent relationship with your investors is paramount for continued support and future funding rounds. Open communication and consistent updates are vital.

Regular Communication and Reporting

Transparent communication builds trust and fosters a strong investor-entrepreneur relationship. Regularly inform your investors of your progress and address any concerns proactively.

- Provide regular updates on progress against key metrics. Keep your investors informed about your progress towards achieving your goals. Provide regular reports on your KPIs.

- Share financial reports and key performance indicators. Regularly share your financial reports and KPIs to demonstrate transparency and accountability.

- Be proactive in addressing investor concerns. Address any investor concerns promptly and transparently to build and maintain trust.

- Foster open communication and build strong relationships. Maintain open lines of communication with your investors and nurture strong relationships based on mutual trust and respect.

Demonstrating ROI and Long-Term Value

Investors are ultimately interested in seeing a return on their investment. Consistently demonstrating the value of their contribution is critical for maintaining their support and securing future funding.

- Highlight key achievements and milestones. Regularly highlight your successes and milestones to show progress and demonstrate the value of the investment.

- Show clear progress towards long-term goals. Keep your investors updated on your progress towards achieving your long-term goals.

- Quantify the impact of investment on business growth. Quantify the positive impact of the investment on your business growth. Demonstrate how the funds have been used to drive growth and increase profitability.

- Emphasize sustainable growth strategies. Highlight your sustainable growth strategies to demonstrate your commitment to long-term success.

Conclusion

Successfully scaling your business after securing investment, whether from Dragon's Den or another source, requires careful planning, strategic resource allocation, and strong investor relations. By focusing on clear goals, building a robust team, and effectively managing resources, you can transform initial investment into sustainable long-term growth. Don’t let your Dragon's Den success fade—use this guide to propel your business to new heights. Continue learning and adapting your strategies to maximize your post-investment growth, and remember that consistent monitoring and reporting are crucial for your long-term success in scaling your business after investment. Don't hesitate to seek guidance from experienced mentors or business advisors as you navigate this exciting phase of your business journey. The journey beyond securing investment is challenging but also incredibly rewarding; with the right strategy and dedication, you can achieve explosive growth.

Featured Posts

-

Accompagnement Numerique Pour Thes Dansants Simplifiez Votre Organisation

May 02, 2025

Accompagnement Numerique Pour Thes Dansants Simplifiez Votre Organisation

May 02, 2025 -

Xrp Explained Uses Value And Future Potential

May 02, 2025

Xrp Explained Uses Value And Future Potential

May 02, 2025 -

Xrp Cryptocurrency Everything You Need To Know

May 02, 2025

Xrp Cryptocurrency Everything You Need To Know

May 02, 2025 -

Shh Rg Kb Tk Zyr Khnjr Ayksprys Ardw Ky Rpwrt Ka Jayzh

May 02, 2025

Shh Rg Kb Tk Zyr Khnjr Ayksprys Ardw Ky Rpwrt Ka Jayzh

May 02, 2025 -

Star Wars Shadow Of The Empire Dash Rendar Figure From Hasbro

May 02, 2025

Star Wars Shadow Of The Empire Dash Rendar Figure From Hasbro

May 02, 2025

Latest Posts

-

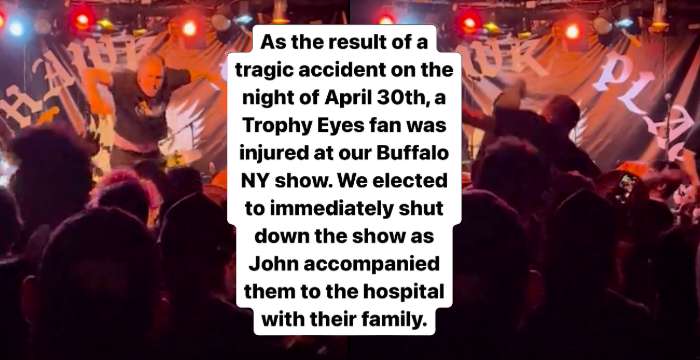

Cubs Pirates Game Fan Seriously Injured After Outfield Wall Fall

May 02, 2025

Cubs Pirates Game Fan Seriously Injured After Outfield Wall Fall

May 02, 2025 -

The Economic Fallout Of The Trade War Beijings Attempts At Concealment

May 02, 2025

The Economic Fallout Of The Trade War Beijings Attempts At Concealment

May 02, 2025 -

Rare Earth Minerals Ukraine And The U S Announce Key Economic Deal

May 02, 2025

Rare Earth Minerals Ukraine And The U S Announce Key Economic Deal

May 02, 2025 -

Syracuse Lacrosse Hazing 11 Players Turn Themselves In

May 02, 2025

Syracuse Lacrosse Hazing 11 Players Turn Themselves In

May 02, 2025 -

Fans Fall At Cubs Pirates Game Hospitalized After Outfield Wall Incident

May 02, 2025

Fans Fall At Cubs Pirates Game Hospitalized After Outfield Wall Incident

May 02, 2025