Dubai Holding Increases REIT IPO To $584 Million: Details And Implications

Table of Contents

H2: The Increased IPO Size: A Deeper Dive

H3: Original IPO Size vs. New Valuation: While the initial planned size of the Dubai Holding REIT IPO remains undisclosed publicly, the jump to $584 million represents a considerable upward revision. This substantial increase likely reflects a surge in investor interest fueled by the robust performance of the Dubai real estate market and the attractive nature of the REIT's underlying assets. The higher valuation indicates a stronger-than-anticipated market appetite and increased confidence in Dubai Holding's portfolio. The percentage increase, while unavailable without the original figure, signifies a significant vote of confidence from potential investors.

H3: Implications for Dubai Holding: This boosted IPO translates into substantial benefits for Dubai Holding. The increased capital injection will provide:

- Increased capital for future projects: Fueling expansion into new real estate ventures and potentially diversifying its portfolio further.

- Debt reduction and improved financial stability: Strengthening Dubai Holding's financial position and reducing its reliance on external financing.

- Enhanced investor confidence and market perception: Solidifying its reputation as a reliable and successful player in the Dubai real estate market, attracting further investment.

H3: Attracting International Investment: The enlarged IPO acts as a powerful magnet for international investors. Dubai's stable political climate, strong economic growth, and strategic geographic location make it an attractive destination for global capital. This increased IPO highlights the confidence in Dubai's long-term economic prospects and strengthens its position as a premier investment hub in the Middle East. The appeal extends beyond just the financial returns; it showcases Dubai as a stable and prosperous nation for long-term investment.

H2: Understanding the Dubai Holding REIT

H3: Asset Portfolio & Diversification: The Dubai Holding REIT boasts a diversified portfolio of high-quality assets, mitigating risk for investors. The portfolio includes a mix of:

- Residential properties: Catering to a wide range of demographics and price points.

- Commercial properties: Offering stable rental income streams from office spaces and retail outlets.

- Hospitality assets: Including hotels and serviced apartments, capitalizing on Dubai's thriving tourism sector.

This diversified approach ensures resilience against fluctuations within specific market segments.

H3: Expected Returns & Investment Strategy: While precise figures regarding projected returns aren't publicly available, investors are anticipating competitive returns aligned with similar REITs in the region. Dubai Holding's investment strategy likely emphasizes long-term value creation through strategic asset management and capital appreciation. Dividend payouts and specific growth projections are expected to be detailed in the IPO prospectus.

H3: Regulatory Approvals and Timeline: The success of the IPO hinges on securing the necessary regulatory approvals from relevant UAE authorities. The timeline for completion will depend on the pace of these approvals and the completion of all necessary documentation. Transparent communication regarding the regulatory process will be crucial in maintaining investor confidence.

H2: Implications for the Dubai Real Estate Market

H3: Market Sentiment & Investor Confidence: The substantially increased Dubai Holding REIT IPO injects a significant boost into investor confidence in the Dubai real estate market. This positive sentiment is likely to translate into increased property values and heightened investment activity across various segments of the market. The success of this IPO will serve as a benchmark for future real estate investment projects in the region.

H3: Competition and Market Dynamics: The successful completion of this large-scale IPO will inevitably impact the competitive landscape of the Dubai real estate market. Other developers may seek to emulate this success, leading to increased competition and possibly accelerating innovation within the sector. This competitive pressure could lead to improved offerings and potentially more attractive investment options for investors.

H3: Long-Term Growth Prospects: The increased IPO reinforces the long-term growth prospects of Dubai's real estate sector, aligning with the UAE's broader vision for economic diversification and sustainable development. This significant investment signals confidence in Dubai's future as a global hub for business and tourism, further enhancing its appeal to international investors and driving sustained growth within the real estate market.

3. Conclusion:

The dramatic increase in the Dubai Holding REIT IPO to $584 million underscores the robust health of the Dubai real estate market and the growing confidence of both domestic and international investors. This development is beneficial for Dubai Holding, strengthening its financial position and paving the way for future expansion. Moreover, it signifies a positive outlook for the entire Dubai real estate market, boosting investor confidence and fostering further growth. The diversified portfolio of the REIT and the expected returns make it an attractive investment opportunity.

Call to Action: Stay informed on the latest developments in the Dubai Holding REIT IPO and explore the potential investment opportunities. Learn more about this exciting development in the thriving Dubai real estate market today! [Link to Dubai Holding Website] [Link to Relevant Investment Platform]

Featured Posts

-

Biarritz Le Bo Cafe Une Nouvelle Page S Ecrit Avec Des Gerants Experimentes

May 20, 2025

Biarritz Le Bo Cafe Une Nouvelle Page S Ecrit Avec Des Gerants Experimentes

May 20, 2025 -

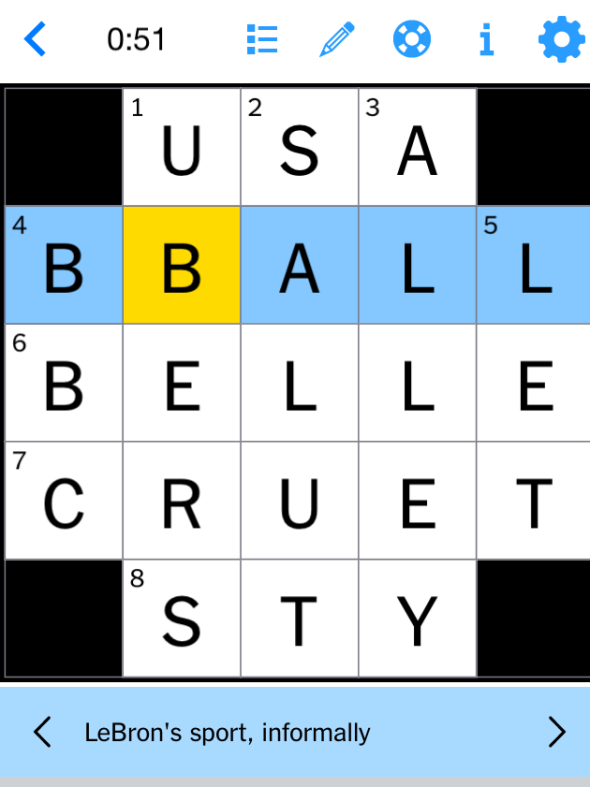

Solve The Nyt Mini Crossword Answers For March 18 2025

May 20, 2025

Solve The Nyt Mini Crossword Answers For March 18 2025

May 20, 2025 -

Amorims Masterstroke Analyzing Man Utds Latest Forward

May 20, 2025

Amorims Masterstroke Analyzing Man Utds Latest Forward

May 20, 2025 -

Glen Kamara Ja Teemu Pukki Vaihdossa Jacob Friisin Avauskokoonpano Paljastettu

May 20, 2025

Glen Kamara Ja Teemu Pukki Vaihdossa Jacob Friisin Avauskokoonpano Paljastettu

May 20, 2025 -

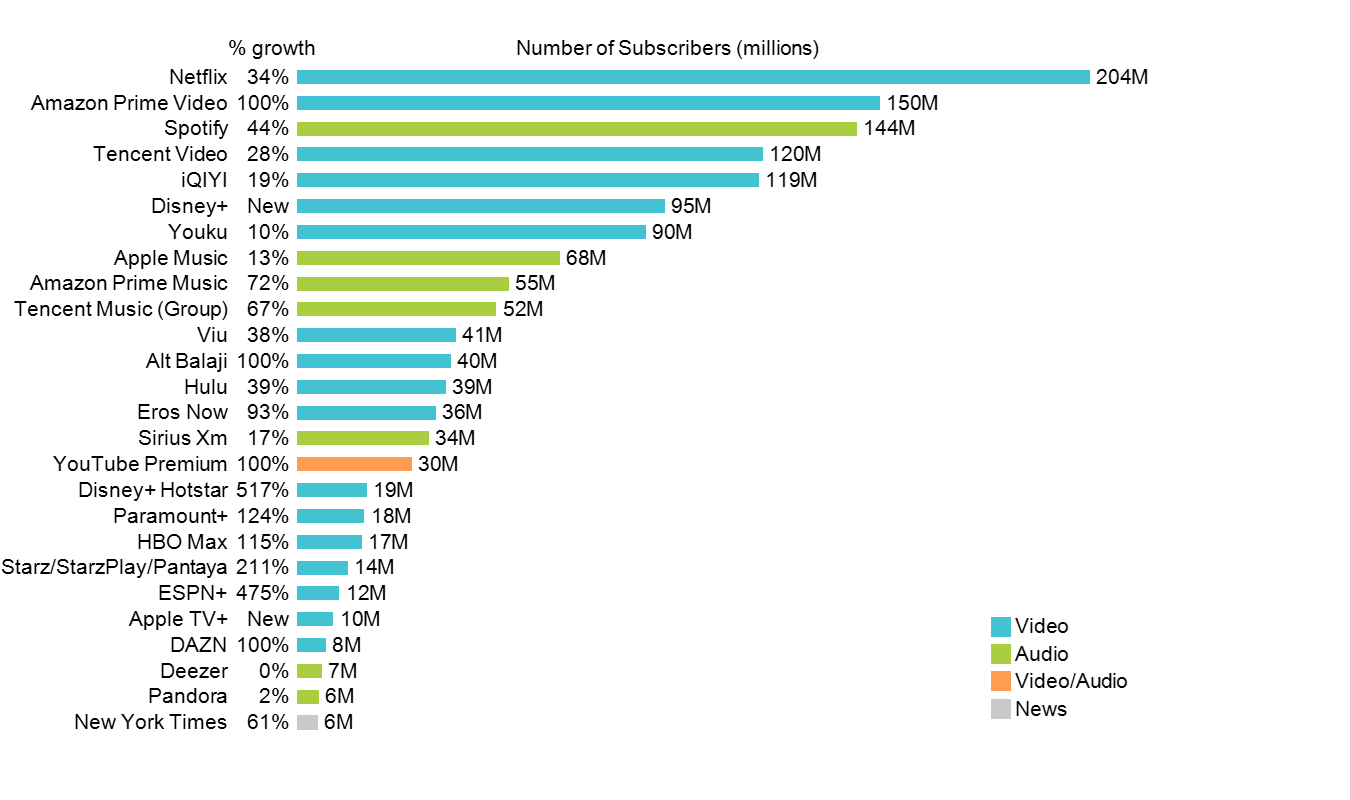

Experience Live Bundesliga Top Streaming Services Compared

May 20, 2025

Experience Live Bundesliga Top Streaming Services Compared

May 20, 2025

Latest Posts

-

Efimereyontes Giatroi Patra 10 Kai 11 Maioy Eyresi And Plirofories

May 20, 2025

Efimereyontes Giatroi Patra 10 Kai 11 Maioy Eyresi And Plirofories

May 20, 2025 -

I Los Antzeles Stoxeyei Ton Giakoymaki

May 20, 2025

I Los Antzeles Stoxeyei Ton Giakoymaki

May 20, 2025 -

Prokrisi Ston Teliko Champions League I Poreia Tis Kroyz Azoyl Me Ton Giakoymaki

May 20, 2025

Prokrisi Ston Teliko Champions League I Poreia Tis Kroyz Azoyl Me Ton Giakoymaki

May 20, 2025 -

Efimeries Giatron Patras 10 11 5 Pliris Lista

May 20, 2025

Efimeries Giatron Patras 10 11 5 Pliris Lista

May 20, 2025 -

Giakoymakis I Los Antzeles Kanei Kroysi

May 20, 2025

Giakoymakis I Los Antzeles Kanei Kroysi

May 20, 2025