Dubai Holding REIT IPO: Size Boosted To $584 Million

Table of Contents

Increased IPO Size and its Significance

The initial IPO size was significantly smaller than the current $584 million figure, representing a substantial percentage increase. This upward revision reflects overwhelmingly positive market response and underscores the attractiveness of this investment opportunity. Several factors contributed to this impressive size increase:

-

Strong Investor Demand: The Dubai Holding REIT attracted significant interest from both domestic and international investors eager to participate in the growth of Dubai's thriving real estate sector.

-

Confidence in Dubai's Real Estate Market: Dubai's reputation as a global hub for business and tourism, coupled with its strong economic fundamentals, fuels investor confidence in the long-term prospects of its real estate market. This confidence is directly reflected in the increased IPO size.

-

Potential for High Returns: The underlying assets within the REIT offer a compelling value proposition, promising attractive dividend yields and potential for capital appreciation, making it an appealing investment for various investor profiles.

-

Increased investor interest from both domestic and international sources.

-

Positive outlook for Dubai's real estate sector.

-

Strong fundamentals of the underlying assets within the REIT.

-

Attractive dividend yield projections.

Dubai Holding REIT's Asset Portfolio and Investment Strategy

The Dubai Holding REIT boasts a diverse portfolio of high-quality properties strategically located across Dubai. The portfolio encompasses various property types, ensuring diversification and mitigating risk:

- Residential: Luxury apartments and villas in prime residential communities.

- Commercial: Grade-A office spaces in key business districts, offering strong rental yields.

- Hospitality: Hotels and serviced apartments catering to the growing tourism sector.

These assets are strategically located in prime areas across Dubai, including Downtown Dubai, Business Bay, and Jumeirah Beach Residence (JBR), ensuring high occupancy rates and strong rental income. The REIT's investment strategy focuses on long-term value creation through:

-

A diversified portfolio across different property types.

-

Strategic acquisitions of high-quality assets.

-

Active property management to maximize returns.

-

Sustainable investment practices and ESG considerations.

-

List of key properties and their locations (Specific details would be added here if available).

-

Growth potential of the portfolio through future acquisitions.

Implications for the Dubai Real Estate Market

The Dubai Holding REIT IPO has significant implications for the Dubai real estate market. The injection of substantial capital will:

- Increase liquidity in the Dubai real estate market. This influx of capital enhances market fluidity and provides more options for investors.

- Potentially drive higher property values. Increased investor confidence translates to higher demand, which can positively impact property valuations.

- Attract further foreign investment into Dubai's real estate sector. The success of this IPO could serve as a catalyst, attracting additional international capital.

- Contribute to the overall economic growth of Dubai. The increased investment activity stimulates economic growth and job creation.

Investment Opportunities and Risks

Participating in the Dubai Holding REIT IPO presents significant investment opportunities, including:

- Projected dividend yield: Investors can anticipate a consistent stream of income through attractive dividend payouts.

- Capital appreciation potential: The value of the REIT's underlying assets is expected to appreciate over time, offering potential for capital gains.

However, like any investment, there are inherent risks to consider:

- Market fluctuations: Changes in the overall market conditions can impact the value of REIT shares.

- Interest rate changes: Interest rate hikes can affect borrowing costs and potentially reduce profitability.

Therefore, it’s crucial to conduct thorough due diligence before investing. This includes:

- Thorough research on the REIT's financial statements and investment strategy.

- Understanding the associated risks.

- Seeking advice from qualified financial advisors. A professional financial advisor can help assess your risk tolerance and investment objectives.

Conclusion

The increased size of the Dubai Holding REIT IPO to $584 million reflects strong investor confidence in Dubai's real estate market and the potential for significant returns. This development is poised to have a positive impact on the Dubai real estate market, attracting further investment and contributing to economic growth. Explore the Dubai Holding REIT IPO opportunity today. Don't miss out on this exciting investment in Dubai's real estate market. Learn more about the $584 million Dubai Holding REIT IPO and secure your position. Investigate the Dubai Holding REIT IPO details now.

Featured Posts

-

The Us Missile Launcher And The Growing China Conflict

May 20, 2025

The Us Missile Launcher And The Growing China Conflict

May 20, 2025 -

Analyzing The D Wave Quantum Qbts Stock Dip On Thursday

May 20, 2025

Analyzing The D Wave Quantum Qbts Stock Dip On Thursday

May 20, 2025 -

Bbcs Ai Driven Agatha Christie Writing Course A New Learning Experience

May 20, 2025

Bbcs Ai Driven Agatha Christie Writing Course A New Learning Experience

May 20, 2025 -

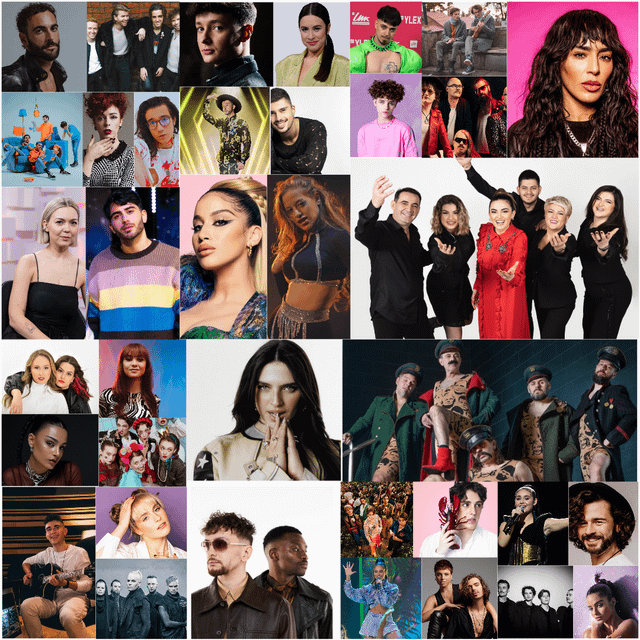

Meet The Eurovision Song Contest 2025 Artists A Complete Guide

May 20, 2025

Meet The Eurovision Song Contest 2025 Artists A Complete Guide

May 20, 2025 -

Understanding The Recent D Wave Quantum Qbts Stock Surge

May 20, 2025

Understanding The Recent D Wave Quantum Qbts Stock Surge

May 20, 2025

Latest Posts

-

Barry Ward Interview I Look Like A Cop

May 21, 2025

Barry Ward Interview I Look Like A Cop

May 21, 2025 -

Espn Insider Deciphering The Bruins Crucial Offseason Moves

May 21, 2025

Espn Insider Deciphering The Bruins Crucial Offseason Moves

May 21, 2025 -

Bruins Offseason Espn Highlights Key Decisions And Franchise Impact

May 21, 2025

Bruins Offseason Espn Highlights Key Decisions And Franchise Impact

May 21, 2025 -

Espn Uncovers The Key To The Bruins Transformative Offseason

May 21, 2025

Espn Uncovers The Key To The Bruins Transformative Offseason

May 21, 2025 -

Espns Bruins Offseason Analysis Key Franchise Altering Moves

May 21, 2025

Espns Bruins Offseason Analysis Key Franchise Altering Moves

May 21, 2025