Dubai Holding's REIT IPO: A $584 Million Investment Opportunity

Table of Contents

Understanding the Dubai Holding REIT IPO

What is a REIT?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate. REITs offer several benefits to investors, making them an attractive investment option.

- Definition of REIT: REITs are publicly traded companies that pool capital from multiple investors to invest in real estate. They are required to distribute a significant portion of their taxable income as dividends to shareholders.

- Tax Advantages: Many REITs enjoy favorable tax treatment, avoiding corporate income tax if they meet specific distribution requirements.

- Dividend Payouts: REITs are known for their relatively high dividend payouts, providing a regular stream of passive income for investors.

- Portfolio Diversification: Investing in a REIT allows for diversification within the real estate sector, reducing the risk associated with owning individual properties.

Dubai Holding's Portfolio

The Dubai Holding REIT IPO encompasses a diverse portfolio of prime real estate assets in Dubai. The specific properties included will be detailed in the official prospectus, but expect a mix of high-value properties strategically located across the emirate.

- Key Properties: The portfolio is expected to include a mix of residential, commercial, and potentially retail properties in key locations across Dubai, including potentially high-profile developments and established income-generating assets. The exact composition will be revealed closer to the IPO date.

- Estimated Value of Assets: The total value of the assets included in the REIT is estimated at $584 million, representing a substantial investment opportunity.

- Management Company Details: A reputable and experienced property management company will oversee the operation and management of the REIT's assets, ensuring efficient operations and maximizing returns for investors.

Investment Highlights

The Dubai Holding REIT IPO offers several compelling reasons for investors to consider participation.

- Expected ROI: While specific ROI projections will be outlined in the prospectus, the potential for attractive returns is high, given the strong growth trajectory of the Dubai real estate market.

- Dividend Yield Projections: Investors can anticipate a competitive dividend yield, providing a steady stream of passive income. The exact yield will be specified in the official IPO documentation.

- Potential for Capital Appreciation: Dubai's real estate market has historically demonstrated strong capital appreciation, suggesting the potential for significant long-term growth in the value of the REIT's underlying assets.

- Long-Term Growth Prospects: Dubai's ongoing infrastructural development, economic diversification, and sustained tourism growth all contribute to a positive outlook for the long-term growth of the Dubai real estate market.

Analyzing the Investment Risks

Investing in any asset class, including REITs, carries inherent risks. It's crucial to understand these risks before committing to the Dubai Holding REIT IPO.

Market Volatility

The real estate market is subject to cyclical fluctuations. Economic downturns, interest rate changes, and broader macroeconomic factors can all influence property values.

- Potential for Decreased Property Values: Market downturns can lead to a decrease in property values, impacting the REIT's net asset value and potentially reducing returns for investors.

- Interest Rate Risks: Changes in interest rates can affect borrowing costs for the REIT and potentially impact the overall profitability of the investment.

- Macroeconomic Factors: Global economic conditions, regional political stability, and specific events in Dubai can all influence the performance of the Dubai real estate market.

Due Diligence

Before investing in the Dubai Holding REIT IPO, thorough due diligence is essential.

- Reviewing the Prospectus Carefully: The prospectus contains crucial information about the REIT's assets, financial performance, risks, and management team. Review it carefully and seek clarification if necessary.

- Understanding the Management Team's Track Record: Assess the experience and expertise of the management team responsible for overseeing the REIT's operations.

- Assessing the Financial Health of the REIT: Analyze the REIT's financial statements and performance metrics to gauge its financial stability and future prospects.

Diversification

Diversifying your investment portfolio is crucial for mitigating risk.

- Not Putting All Your Eggs in One Basket: Don't concentrate your investments in a single asset class or geography.

- Allocating Investments Across Different Asset Classes: Spread your investments across various asset classes, such as stocks, bonds, and alternative investments, to reduce overall portfolio risk.

- Seeking Professional Financial Advice: Consult with a qualified financial advisor to discuss your investment goals, risk tolerance, and develop a suitable portfolio diversification strategy.

How to Participate in the Dubai Holding REIT IPO

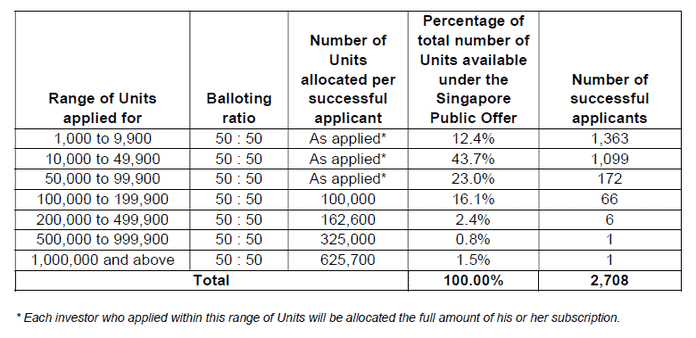

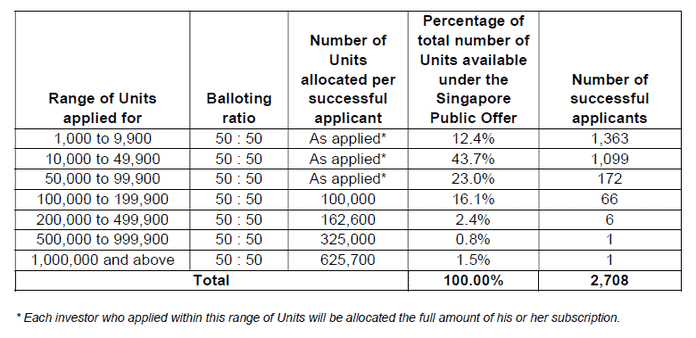

Participating in the Dubai Holding REIT IPO involves understanding the eligibility criteria and the application process.

Eligibility Criteria

Specific eligibility criteria for participation will be outlined in the IPO prospectus.

- Investment Minimums: There will likely be a minimum investment amount required to participate in the IPO.

- Application Process: The application process may involve submitting an application form, providing supporting documentation, and adhering to specified deadlines.

- Required Documentation: Be prepared to provide necessary identification documents, proof of address, and potentially other relevant documentation as specified by the IPO underwriters.

Investment Platforms

Investors can typically participate through various channels.

- Licensed Brokerage Firms: Many licensed brokerage firms will facilitate participation in the IPO.

- Online Investment Platforms: Some online investment platforms may offer access to the IPO.

- Direct Application: Depending on the IPO structure, direct application may be possible. Check the prospectus for details.

Seeking Professional Advice

Seeking guidance from a financial advisor is highly recommended.

- Importance of Personalized Financial Advice: A financial advisor can help you assess your investment goals, risk tolerance, and determine if the Dubai Holding REIT IPO aligns with your overall investment strategy.

- Risk Assessment: A financial advisor can help you understand and assess the risks associated with investing in the REIT.

- Portfolio Diversification Strategies: A professional can guide you in developing a well-diversified portfolio that incorporates the Dubai Holding REIT IPO appropriately.

Conclusion

The Dubai Holding REIT IPO offers a compelling investment opportunity with the potential for substantial returns in the Dubai Real Estate market, a noteworthy addition to your UAE Real Estate portfolio. However, investors should conduct thorough due diligence, understand the associated risks, and consider their own risk tolerance before committing funds. The potential for long-term growth in Dubai's real estate sector makes this a noteworthy investment, but careful consideration and possibly professional financial advice are crucial.

Call to Action: Don't miss out on this exciting opportunity to invest in Dubai's booming real estate market. Learn more about the Dubai Holding REIT IPO and make an informed investment decision today! Research the Dubai Holding REIT IPO and explore this $584 million investment opportunity.

Featured Posts

-

Tampoy Ston Gamo I Dynami Tis Deyteris Eykairias Martha

May 20, 2025

Tampoy Ston Gamo I Dynami Tis Deyteris Eykairias Martha

May 20, 2025 -

Avauskokoonpano Julkistettu Kamara Ja Pukki Vaihtopenkillae

May 20, 2025

Avauskokoonpano Julkistettu Kamara Ja Pukki Vaihtopenkillae

May 20, 2025 -

Us Typhon Missile System In The Philippines Alarming China

May 20, 2025

Us Typhon Missile System In The Philippines Alarming China

May 20, 2025 -

Hmrc Savings Debt A Guide For Thousands Of Unknowing Taxpayers

May 20, 2025

Hmrc Savings Debt A Guide For Thousands Of Unknowing Taxpayers

May 20, 2025 -

Le Meurtre De Federico Aramburu Deux Suspects D Extreme Droite Toujours Recherches

May 20, 2025

Le Meurtre De Federico Aramburu Deux Suspects D Extreme Droite Toujours Recherches

May 20, 2025

Latest Posts

-

Representatives Push To Recover 1 231 Billion From Oil And Gas Industry

May 20, 2025

Representatives Push To Recover 1 231 Billion From Oil And Gas Industry

May 20, 2025 -

Nvidia Ai

May 20, 2025

Nvidia Ai

May 20, 2025 -

1 231 Billion Recovery Sought From 28 Oil Companies Representatives Commitment

May 20, 2025

1 231 Billion Recovery Sought From 28 Oil Companies Representatives Commitment

May 20, 2025 -

It

May 20, 2025

It

May 20, 2025 -

82 Ai

May 20, 2025

82 Ai

May 20, 2025