EToro Revives IPO Plans, Targeting $500 Million Funding Round

Table of Contents

Keywords: eToro IPO, eToro funding, eToro initial public offering, social trading IPO, $500 million funding, eToro stock market debut, eToro investment, social trading platform

eToro, the leading social trading platform, is making headlines again with its renewed pursuit of an initial public offering (IPO). This ambitious move targets a significant $500 million funding round, marking a crucial step in the company's growth trajectory and potentially reshaping the landscape of the social trading industry. This article delves into the details of the eToro IPO, examining the potential implications for investors, the company itself, and the broader financial market.

eToro's Renewed Interest in an IPO

eToro's journey towards an IPO hasn't been without its challenges. Previous attempts faced hurdles, likely stemming from fluctuating market conditions and perhaps unmet investor expectations. However, the company appears to be better positioned now. The current market, while still volatile, presents a potentially more favorable environment for tech IPOs, particularly for companies with a demonstrably strong and growing user base like eToro.

- Improved Financial Performance: eToro has reportedly shown significant improvement in its financial performance since its previous IPO attempts. This improved profitability and revenue growth makes it a more attractive proposition for investors.

- Strengthened Brand and Market Position: eToro has significantly enhanced its brand recognition and solidified its position as a dominant player in the social trading sector. This increased market share and brand loyalty contribute to investor confidence.

- Strategic Partnerships and Moves: Strategic partnerships and acquisitions have likely played a role in bolstering eToro's appeal to potential investors. These moves demonstrate a clear growth strategy and increase the company's overall value proposition.

The $500 Million Funding Target and its Implications

The ambitious $500 million funding target speaks volumes about eToro's ambitious growth plans. This substantial capital injection will fuel several key initiatives:

-

Product Development: A significant portion of the funds will likely be allocated to enhancing the platform's features, improving user experience, and developing innovative trading tools to maintain a competitive edge.

-

Market Expansion: eToro may use the funds to expand its geographic reach, targeting new markets and user demographics globally. This global expansion could significantly increase its user base and revenue streams.

-

Strategic Acquisitions: Acquiring smaller, complementary companies within the fintech or social trading space could further strengthen eToro's position and broaden its service offerings.

-

Impact on User Base and Market Share: The influx of capital could lead to increased marketing efforts, potentially attracting a larger user base and further solidifying its market-leading position.

-

Competitive Landscape: The successful completion of the eToro IPO could significantly impact the competitive landscape, potentially triggering further investment in or consolidation within the social trading sector.

-

Pricing and Features: While it's difficult to predict with certainty, the additional funding might allow eToro to offer new features or adjust its pricing strategy to remain competitive or even expand its market reach further.

Timeline and Potential Challenges for the eToro IPO

The exact timeline for the eToro IPO remains unclear, subject to regulatory approvals and prevailing market conditions. Securing the necessary approvals from bodies like the SEC (in the US) and other relevant regulatory authorities will be crucial. However, the process is likely to involve several stages, including filing registration documents, undergoing due diligence, and finally, the public offering of shares.

- Regulatory Approvals: Navigating the regulatory landscape is a significant hurdle; delays or unexpected requirements could impact the timeline.

- Market Volatility: Unpredictable market conditions, including economic downturns or geopolitical events, could negatively impact investor sentiment and potentially delay or derail the IPO.

- Competitive Landscape: The actions of competitors, including new entrants or aggressive strategies from established players, could pose challenges for eToro during the IPO process and beyond.

Impact on Investors and the Social Trading Industry

A successful eToro IPO presents several significant implications:

- Increased Accessibility: The IPO could increase accessibility to the social trading market for retail investors, potentially democratizing access to investment opportunities previously limited to institutional investors.

- Valuation of Similar Platforms: The valuation achieved by eToro could influence the valuations of other social trading platforms, impacting future funding rounds and IPOs within the sector.

- Regulatory Oversight: The heightened attention on eToro following its IPO might spur increased regulatory scrutiny of the social trading industry as a whole.

Increased Investor Interest: The eToro IPO could spark increased interest from retail investors looking to participate in the growth of the social trading sector.

For existing eToro users, a successful IPO could translate to increased value for their potential investment in the company, particularly if they hold shares post-IPO.

Conclusion

eToro's revived IPO plans, aiming to secure $500 million in funding, represent a pivotal moment for the company and the social trading industry. While challenges remain, a successful IPO could significantly impact the competitive landscape, attract further investment into the sector, and increase accessibility for retail investors. The potential benefits are substantial, but careful consideration of market conditions and regulatory hurdles is crucial for eToro's success. Stay informed about the latest developments regarding the eToro IPO and its potential impact on the financial markets. Follow us for updates on the eToro initial public offering and the future of social trading. Learn more about eToro's investment strategies and how the eToro funding round might impact their services.

Featured Posts

-

Captain America Brave New World A Key Characters Absence And Its Impact On The Mcu

May 14, 2025

Captain America Brave New World A Key Characters Absence And Its Impact On The Mcu

May 14, 2025 -

The Judd Family A Docuseries Revealing Unseen Stories

May 14, 2025

The Judd Family A Docuseries Revealing Unseen Stories

May 14, 2025 -

Spanish Tv Sparks Debate Over Israels Eurovision Participation

May 14, 2025

Spanish Tv Sparks Debate Over Israels Eurovision Participation

May 14, 2025 -

Sabalenkas Hard Fought Victory Over Mertens At Madrid Open

May 14, 2025

Sabalenkas Hard Fought Victory Over Mertens At Madrid Open

May 14, 2025 -

How To Watch The Snow White Live Action Movie At Home

May 14, 2025

How To Watch The Snow White Live Action Movie At Home

May 14, 2025

Latest Posts

-

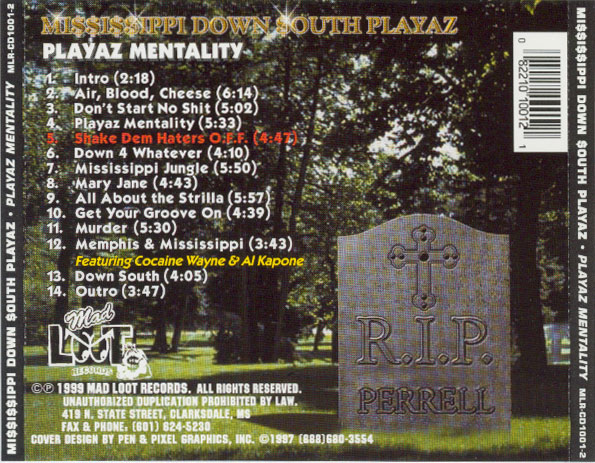

Dont Hate The Playaz Deconstructing The Slang And Its Origins

May 14, 2025

Dont Hate The Playaz Deconstructing The Slang And Its Origins

May 14, 2025 -

Exploring The Dont Hate The Playaz Phenomenon

May 14, 2025

Exploring The Dont Hate The Playaz Phenomenon

May 14, 2025 -

The Meaning And Impact Of Dont Hate The Playaz

May 14, 2025

The Meaning And Impact Of Dont Hate The Playaz

May 14, 2025 -

Understanding The Dont Hate The Playaz Mentality

May 14, 2025

Understanding The Dont Hate The Playaz Mentality

May 14, 2025 -

Dont Hate The Playaz Understanding The Culture

May 14, 2025

Dont Hate The Playaz Understanding The Culture

May 14, 2025