EToro's $500 Million IPO Push: A Deep Dive Into The Resurrected Plans

Table of Contents

eToro's Past IPO Attempts and the Reasons for Failure

eToro's previous attempts at an IPO haven't been successful. While the company hasn't publicly disclosed specific reasons for these failures, industry analysts point to several contributing factors. Understanding these past challenges is crucial to assessing the likelihood of success in this new attempt.

-

Market conditions at the time of previous attempts: Previous attempts coincided with periods of economic uncertainty and decreased investor appetite for riskier investments, particularly in the volatile fintech sector. Negative market sentiment significantly impacted the attractiveness of eToro's IPO.

-

Internal challenges or strategic missteps: Some analysts suggest that internal challenges, perhaps related to scaling the business or refining its business model, may have played a role in the previous failures. A lack of clear market differentiation or a less-defined path to profitability could also have been contributing factors.

-

Regulatory hurdles: The regulatory landscape for online trading platforms is complex and constantly evolving. Navigating these regulations, particularly in different jurisdictions, can be a significant hurdle for companies aiming for an IPO. eToro may have faced challenges in meeting specific regulatory requirements in previous attempts.

-

Competition from established players: The online brokerage industry is fiercely competitive, with established players possessing significant market share and brand recognition. eToro's previous attempts may have struggled to differentiate itself sufficiently from established competitors.

Since its previous attempts, eToro has significantly evolved its business model. Key improvements include a broadened range of investment options beyond just stocks, including cryptocurrencies and CFDs, attracting a wider and more diverse user base. The platform has also enhanced its user experience and invested heavily in technological infrastructure, improving its overall operational efficiency. These improvements form a foundation for a potentially more successful IPO attempt.

The Current Market Landscape and its Impact on eToro's IPO Prospects

The current IPO market presents a mixed bag for eToro. While the fintech sector remains attractive to investors, the overall macroeconomic environment presents both opportunities and challenges.

-

Current investor appetite for fintech IPOs: Investor appetite for fintech IPOs is currently somewhat subdued compared to the peak of the previous bull market. This is partly due to higher interest rates and a general tightening of credit conditions. However, there's still significant interest in innovative fintech companies with proven business models and strong growth prospects.

-

Performance of similar companies that have recently gone public: The performance of similar companies that have recently gone public will heavily influence investor sentiment towards eToro's IPO. Successful IPOs and strong post-IPO performance would create a positive environment, whereas poor performance could lead to caution.

-

Macroeconomic factors influencing investor decisions: Global macroeconomic factors such as inflation, interest rate hikes, and geopolitical instability significantly impact investor risk appetite. A more stable macroeconomic environment would generally be more favorable to an IPO.

-

Potential for increased regulatory scrutiny: Increased regulatory scrutiny within the fintech sector represents a potential challenge. The stricter regulatory environment could affect eToro's valuation and its ability to meet regulatory requirements before and after the IPO.

Compared to previous attempts, the current market conditions present both advantages and disadvantages. While investor appetite may be less exuberant, eToro's enhanced business model and improved financial performance could counterbalance these factors.

eToro's Strategic Moves and Preparations for the IPO

eToro has undertaken several strategic initiatives to position itself for a successful IPO. These moves aim to showcase a robust and scalable business model to potential investors.

-

Financial performance improvements: eToro has reported significant improvements in its financial performance, demonstrating revenue growth and progress towards profitability. These improvements are crucial for attracting investor confidence.

-

Expansion into new markets and product offerings: Expanding into new geographic markets and offering a wider range of investment products has broadened eToro's user base and revenue streams. This diversification strengthens its resilience to market fluctuations.

-

Strengthening of its regulatory compliance: eToro has actively worked on strengthening its regulatory compliance across various jurisdictions. Demonstrating a strong compliance record will be vital to attract investors concerned about regulatory risks.

-

Key partnerships and collaborations: Strategic partnerships and collaborations with other fintech companies or financial institutions can enhance eToro's market presence and credibility.

eToro's financial projections and guidance related to the IPO will be closely scrutinized by potential investors. The company will need to demonstrate realistic yet ambitious growth targets to justify its valuation.

Key Investors and Their Role in the IPO

Identifying the key investors involved in eToro is crucial. These investors' influence can significantly shape the IPO's success. Their prior experience, industry connections, and investment strategies will impact the valuation and overall execution of the IPO. The valuation of eToro at the time of its IPO will be a crucial element in determining its success.

Potential Challenges and Risks Associated with the IPO

Despite eToro's preparations, several challenges and risks could impact the IPO's success.

-

Volatility in the stock market: Unexpected volatility in the stock market can negatively impact investor sentiment and the IPO's valuation.

-

Intense competition in the online brokerage industry: eToro faces intense competition from established players with greater resources and brand recognition.

-

Concerns about regulatory compliance and potential legal issues: Ongoing regulatory changes and potential legal challenges represent a significant risk.

-

Challenges in maintaining user growth and engagement: Sustaining user growth and engagement is crucial for long-term success, and any downturn could impact investor confidence.

eToro will need to address these challenges through robust risk management strategies, clear communication with investors, and a demonstrable commitment to regulatory compliance.

Conclusion

eToro's renewed push for a $500 million IPO marks a significant development in the fintech landscape. While past attempts faced challenges, the current market conditions and eToro's strategic moves suggest a potentially more favorable outcome. However, significant risks remain. The success of this eToro IPO will hinge on factors ranging from macroeconomic conditions to the company's ability to effectively manage its growth and navigate the complexities of the public markets.

Call to Action: Stay informed on the progress of eToro's IPO. Follow this space for updates on this crucial development and analysis of the implications of eToro's $500 million IPO push for the future of online trading and fintech investment. Learn more about the intricacies of eToro's IPO plans and their potential impact on the financial markets. Understanding the nuances of this eToro IPO will be key for any investor interested in the evolving fintech landscape.

Featured Posts

-

Find The Most Unique Restaurant In All Of New York State

May 14, 2025

Find The Most Unique Restaurant In All Of New York State

May 14, 2025 -

Ai Generated Poop Podcast Extracting Meaning From Repetitive Documents

May 14, 2025

Ai Generated Poop Podcast Extracting Meaning From Repetitive Documents

May 14, 2025 -

Hollyoaks Spoilers 9 Big Reveals Coming Next Week

May 14, 2025

Hollyoaks Spoilers 9 Big Reveals Coming Next Week

May 14, 2025 -

Daria Kasatkinas Australian Debut Wta Rankings And Celebration

May 14, 2025

Daria Kasatkinas Australian Debut Wta Rankings And Celebration

May 14, 2025 -

Eurovision Fans Feel The Pinch Swiss Francs Rise Dampens Festival Spirit

May 14, 2025

Eurovision Fans Feel The Pinch Swiss Francs Rise Dampens Festival Spirit

May 14, 2025

Latest Posts

-

A Star Studded Success Vince Vaughns New Netflix Drama Impresses

May 14, 2025

A Star Studded Success Vince Vaughns New Netflix Drama Impresses

May 14, 2025 -

Kupovina Novakovikh Patika Gde I Kako

May 14, 2025

Kupovina Novakovikh Patika Gde I Kako

May 14, 2025 -

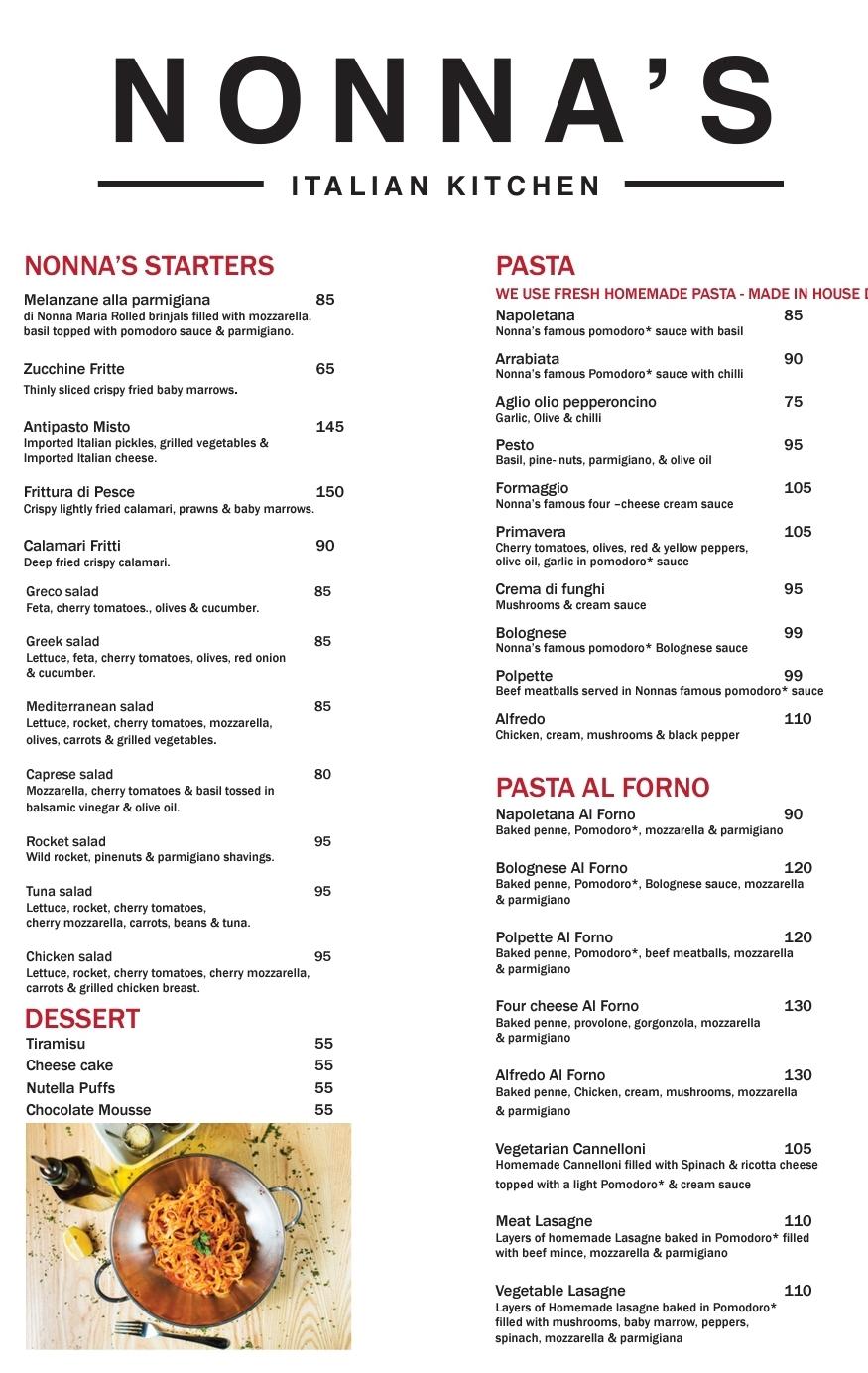

Nonnas Italian Kitchen Vince Vaughns New Restaurant Opens Its Doors

May 14, 2025

Nonnas Italian Kitchen Vince Vaughns New Restaurant Opens Its Doors

May 14, 2025 -

Vince Vaughns Latest Netflix Project A Hit With Viewers

May 14, 2025

Vince Vaughns Latest Netflix Project A Hit With Viewers

May 14, 2025 -

Zashto Su Novakove Patike Toliko Skupe

May 14, 2025

Zashto Su Novakove Patike Toliko Skupe

May 14, 2025