€18 Million Question: Deutsche Bank London Traders And The Missing Bonus

Table of Contents

The Missing Bonus: A Detailed Breakdown

The €18 million bonus disappearance within Deutsche Bank's London operations wasn't a small oversight; it represents a significant chunk of the overall bonus pool allocated to its trading divisions. The incident came to light during [insert timeframe, e.g., the Q4 20XX bonus payout cycle], sparking immediate internal concern and launching a complex investigation. The traders involved primarily worked within [specify trading desk, e.g., the equities or derivatives trading teams], a department that, at the time, [mention the department’s performance: e.g., showed strong performance or experienced mixed results]. The precise circumstances surrounding the disappearance remain unclear, but several critical aspects need further clarification:

- The €18 Million: This substantial sum represents a significant portion of the total bonus pool, highlighting the scale of the issue.

- The Timeframe: The missing funds were discovered to be absent during [specify date range or period]. This timeframe is crucial in pinpointing potential culprits or revealing systemic weaknesses.

- Compromised Systems?: The investigation explored whether any internal systems responsible for bonus allocation and tracking were compromised or malfunctioning. This includes looking at potential vulnerabilities in the bank's accounting software and employee access controls.

Key Players and Potential Suspects

While protecting the privacy of individuals is paramount, understanding the roles of key players is vital to understanding the missing bonus situation. The investigation focused on [mention job titles, e.g., several senior traders, a managing director, and potentially compliance officers] within Deutsche Bank's London branch. These individuals were involved in different aspects of the bonus allocation process, from performance evaluations to final payment authorization.

Analyzing their respective roles reveals potential avenues of investigation:

- Trader Responsibilities: The traders' roles involved managing significant financial assets and generating profits for the bank. Their performance directly impacted their bonus allocation.

- Management Oversight: Senior managers held responsibility for overseeing the traders' activities and ensuring compliance with internal policies.

- Compliance Functions: Compliance officers played a critical role in validating the bonus payouts and adherence to regulatory requirements.

Potential motivations for such a substantial loss remain speculative, but possibilities include:

- Internal Fraud: Intentional misallocation or embezzlement of funds.

- Systemic Errors: Failures within the bank's internal control systems could have led to unintended discrepancies.

- External Factors: Although less likely, external cyberattacks or unauthorized access could theoretically be considered.

The Investigation and its Fallout

The investigation into the missing €18 million involved a multifaceted approach, including:

- Internal Audits: Deutsche Bank conducted thorough internal audits to examine its own systems and processes.

- External Investigations: Independent firms were likely engaged to conduct impartial investigations.

- Regulatory Scrutiny: The Financial Conduct Authority (FCA) and other relevant authorities may have launched their own investigations to ensure compliance with regulations.

The fallout from the incident has been significant:

- Reputational Damage: The event severely impacted Deutsche Bank's reputation, eroding trust among investors and customers.

- Stock Price Impact: The missing bonus likely contributed to fluctuations in Deutsche Bank's share price.

- Internal Control Reforms: The bank likely implemented stricter internal controls and revised its bonus allocation procedures.

- Legal and Regulatory Consequences: Depending on the investigation's findings, legal repercussions and regulatory penalties may have been imposed.

Lessons Learned and Future Implications

This incident served as a stark reminder of the importance of robust risk management within the financial sector. Deutsche Bank, and the industry as a whole, learned crucial lessons:

- Enhanced Internal Controls: Strengthening internal control systems, particularly those related to bonus allocation and financial tracking, is vital.

- Improved Transparency: Greater transparency in bonus structures and payment procedures would improve accountability and minimize the risk of such occurrences.

The broader implications extend beyond Deutsche Bank:

- Increased Regulatory Scrutiny: Expect increased regulatory scrutiny of bonus practices and financial reporting across the banking industry.

- Potential Legislative Changes: The incident may prompt calls for legislative changes concerning bonus payments and corporate governance.

- Shift in Public Perception: Public perception of the ethics within high-stakes finance may shift, demanding more responsible practices.

Conclusion: Unraveling the Mystery of the Deutsche Bank London Bonus

The disappearance of €18 million in bonuses from Deutsche Bank's London office remains a significant event within the financial world. This case, involving Deutsche Bank London traders and the missing bonus, highlights vulnerabilities within internal control systems and underscores the need for greater transparency and accountability. The investigation’s findings, while not yet fully public, underscore the importance of robust internal controls, ethical practices, and stringent regulatory oversight. We encourage readers to share their thoughts and insights on this evolving situation and to consult further information from reputable news sources and regulatory websites for a more comprehensive understanding of "Deutsche Bank London traders and the missing bonus."

Featured Posts

-

Deutsche Bank Analyse D Une Histoire Moderne Complexe

May 30, 2025

Deutsche Bank Analyse D Une Histoire Moderne Complexe

May 30, 2025 -

The Adult Autism Diagnosis Journey Challenges Support And Growth

May 30, 2025

The Adult Autism Diagnosis Journey Challenges Support And Growth

May 30, 2025 -

Djokovics Player Union A Legal Battle Against Tennis Governance

May 30, 2025

Djokovics Player Union A Legal Battle Against Tennis Governance

May 30, 2025 -

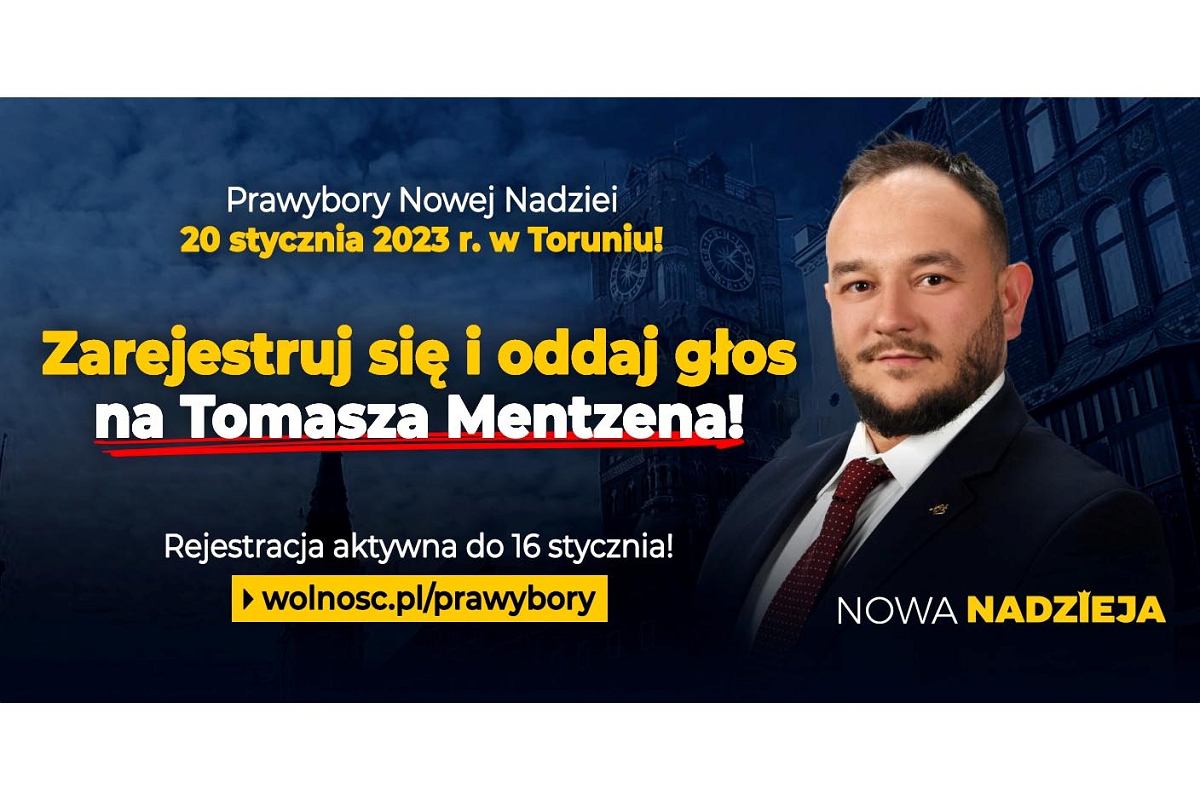

Analiza Kampanii Prezydenckiej Mentzena 2025

May 30, 2025

Analiza Kampanii Prezydenckiej Mentzena 2025

May 30, 2025 -

Epidemiya Kori V Mongolii Chto Proiskhodit I Kak Pomoch

May 30, 2025

Epidemiya Kori V Mongolii Chto Proiskhodit I Kak Pomoch

May 30, 2025